A payment gateway is an important technology in the payments world, which allows businesses to accept and process debit or credit card transactions, whether they are conducted online or in-person.

Although the term typically refers to the physical card readers we see in traditional stores, it also includes digital platforms utilised for online shopping. These gateways not only facilitate payments made with cards but have also evolved to support transactions through QR codes, Near Field Communication (NFC) technology, and even cryptocurrencies like Bitcoin.

How Does a Payment Gateway Work?

The payment gateway infrastructure serves as a middleman, securely transmitting transaction details between the customer, merchant, payment processor and financial institutions. It can be thought of as a digital conductor, meticulously guiding the transaction process to its secure and efficient destination.

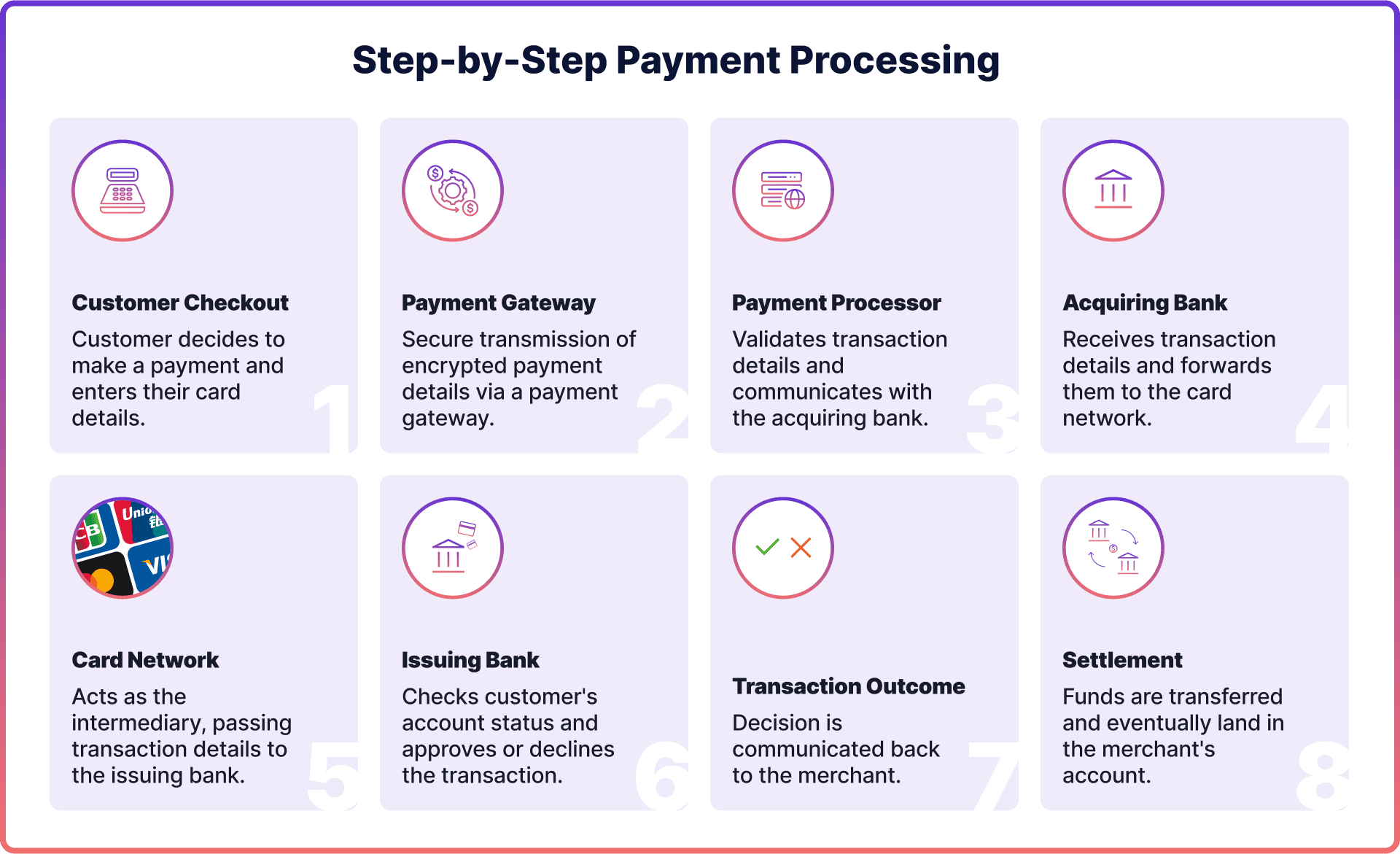

Here's a breakdown of how it works step-by-step:

- Customer Initiates Transaction: The customer places an order and submits it, either by swiping a card at a physical store or entering details online.

- Gateway Verification: The website or physical terminal directs the customer to the payment gateway, where they input their payment details. The gateway then verifies the customer's account balance.

- Payment Processor: After the payment gateway sends the transaction data, it is received by the payment processor. They verify and confirm the transaction details before reaching out to the acquiring bank associated with the business or merchant.

- Card Network: From there, the acquiring bank forwards the transaction information to a card network such as Visa or Mastercard. This card network then communicates with the issuing bank, which is responsible for providing credit cards to customers. The issuing bank conducts checks on factors like account status, available balance, and potential transaction risks.

- Bank's Response: The issuing bank checks for sufficient funds and any potential fraud. It then approves or declines the transaction.

- Completion: Once approved, the bank settles the payment with the payment gateway, which then finalises the transaction with the merchant.

Payment Gateway vs Payment Processor

Payment gateways and payment processors serve different functions in the transaction process. The payment gateway technology acts as a secure digital interface, collecting and encrypting customer payment information before transmitting it. It serves as the link between a merchant's website and the payment process.

On the other hand, a payment processor handles the movement of funds, connecting the customer's bank to the merchant account and facilitating money transfers. In simpler terms, while the gateway collects and sends payment data, the processor carries out the transaction by executing fund transfers.

Example of a Payment Gateway

Let's say there's a merchant who wants to sell products on an e-commerce platform. When a customer chooses an item and proceeds to checkout, they'll be asked to enter their credit or debit card information. That's where the payment gateway steps in. It securely captures and encrypts this data, ensuring it's transmitted safely to the appropriate financial institutions for approval.

Once approved, the transaction is completed, and the customer receives a confirmation. This seamless process, supported by robust security measures, demonstrates how crucial a payment gateway is in the digital commerce ecosystem.

What is Payment Gateway Integration?

Payment gateway integration is an essential step in setting up an e-commerce website or application. It involves establishing a secure connection between the e-commerce website and a payment gateway system. This connection allows for the safe capture, encryption, and transmission of customer payment information to the relevant financial institution for processing and authorisation.

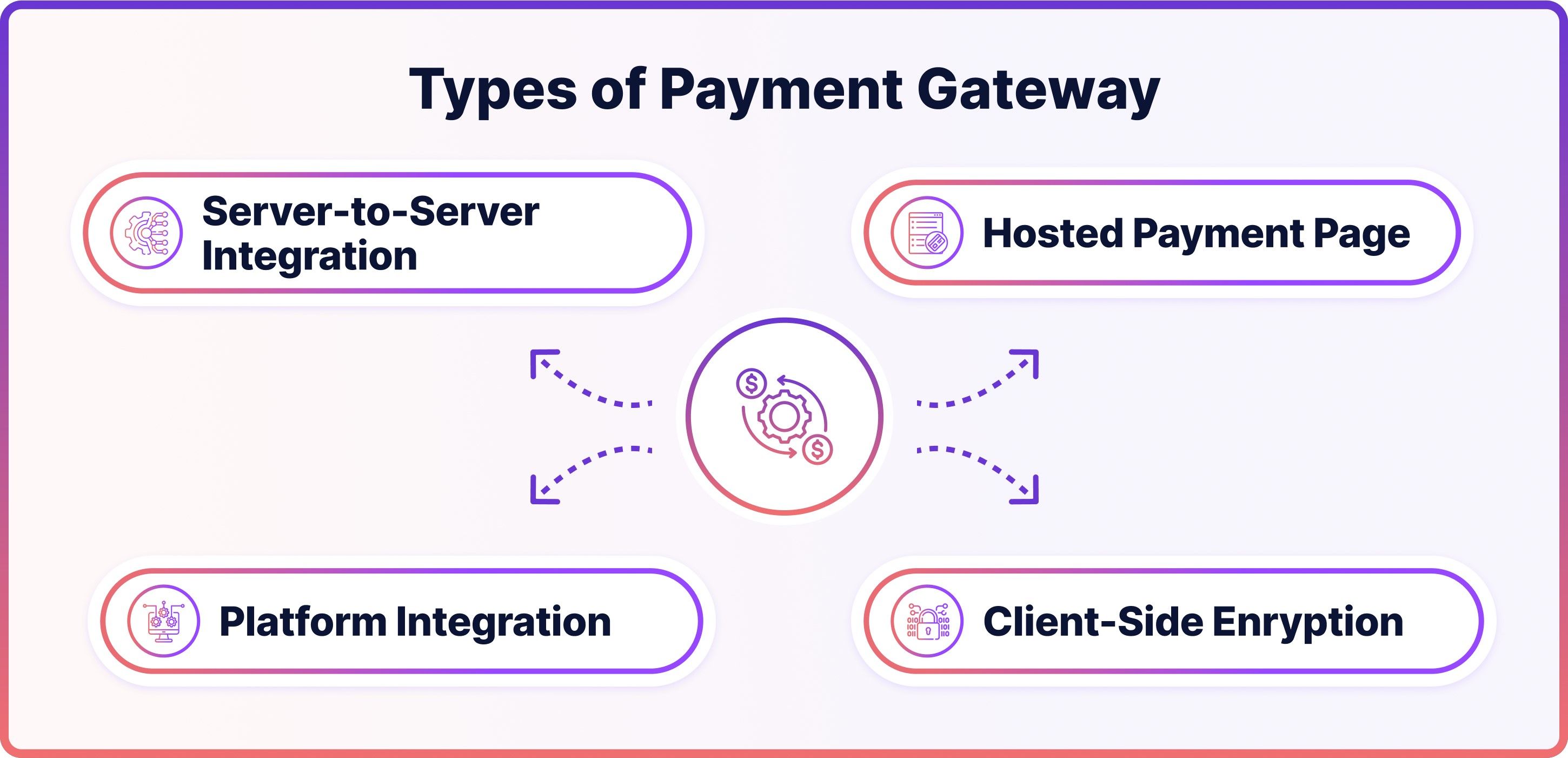

Types of Payment Gateway

There are several payment gateway methods available in the digital commerce landscape to meet different business needs. Here is an overview of some notable types.

Hosted Payment Page (Pre-built UI)

One popular type of payment gateway, particularly for businesses that prefer not to handle payment data directly, is the redirect method. When a customer chooses to make a payment, they are directed to the payment gateway's platform. Once the payment is made, they are then redirected back to the merchant's website. This method is favoured for its simplicity of integration and built-in security measures.

Server-to-Server Integration

Sometimes referred to as a direct gateway, this method enables customers to make transactions without being redirected away from the merchant's website. The payment data is securely transmitted from the merchant's server to the payment gateway's server. Although it provides a smooth and uninterrupted user experience, merchants need to implement strong security measures.

Client-Side Encryption

In this approach, the customer's payment information is first encrypted on their own device (usually in the browser). Only then is it transmitted to the server. This added security measure ensures that even if a hacker were to intercept the data during transmission, they would not be able to decrypt and access the actual payment details due to the strong encryption.

Platform Integration

Certain e-commerce platforms provide merchants with integrated payment gateways, streamlining the process. Instead of having to integrate a separate third-party gateway, merchants can take advantage of the platform's native payment gateway solution. This ensures compatibility and often provides access to negotiated transaction rates.

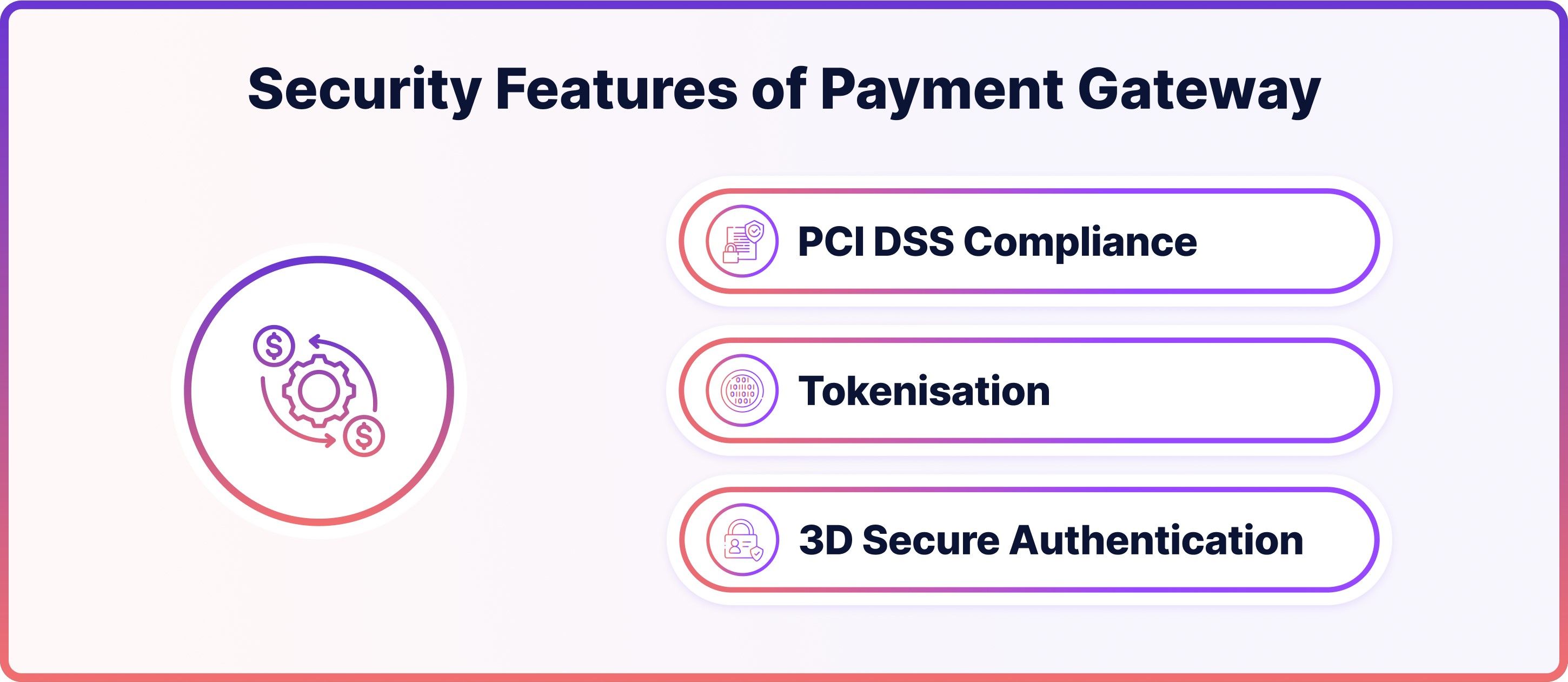

Security of a Payment Gateway Explained

In the world of digital commerce, ensuring secure transactions is of utmost importance. Below are security features that payment gateway processes would typically use to safeguard both merchants and customers.

PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a collection of security standards created to guarantee that companies accepting, processing, storing, or transmitting credit card information maintain a secure environment. Compliance with PCI DSS means that a payment gateway follows these rigorous standards to protect cardholder data from potential breaches.

Tokenisation

Tokenisation is a method used to protect sensitive data, like credit card numbers. It involves replacing the original data with a unique identifier or "token." If intercepted, this token is useless to malicious entities without a specific decryption key. By employing tokenisation, the actual payment details remain secure even if transaction data is compromised.

3D Secure Authentication

3D Secure is an extra security measure implemented for online credit and debit card transactions. It adds an additional step where cardholders are required to enter a password or a dynamic OTP (One-Time Password) during the online purchase process. This added layer of security helps to verify the identity of the legitimate cardholder, ensuring that the transaction is authorised by them.

How to Choose a Payment Gateway as a Merchant

Selecting the right payment gateway provider is crucial for merchants. Here are some considerations when choosing a service:

- Security: Ensure the gateway is PCI DSS compliant and offers features like tokenisation and 3D Secure authentication.

- Fees: Understand the transaction fees, monthly charges, and any hidden costs.

- Integration: Check how easily the gateway integrates with your existing e-commerce platform or website.

- Supported Payment Methods: Ensure the gateway supports a wide range of payment methods, catering to your customer preferences.

- Customer Support: Opt for gateways that offer robust customer support, ensuring smooth resolution of any issues.

By weighing these factors, merchants can select a payment gateway that aligns with their business needs and offers a seamless transaction experience for customers.

Payment Gateway with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for a secure payment gateway and seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What is a payment gateway in e-commerce?

In e-commerce, a payment gateway is a digital service that ensures the secure processing and authorisation of online transactions between customers and merchants. It acts as a facilitator, securely transmitting payment data to financial institutions or payment processors.

How to choose the best payment gateway for your business?

To choose the best payment gateway for your business, consider its security features, understand the associated fees, ensure easy integration with your platform, evaluate supported payment methods, and prioritise robust customer support.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each