As businesses shift online, e-commerce payments become crucial to developing an efficient digital strategy. In 2023, e-commerce made up over 19% of global retail sales, a trend set to rise to nearly a quarter by 2027, according to Statista.

However, understanding e-commerce payments can be tough. Businesses need to choose the right payment methods, ensure secure transactions, and follow industry rules. Here, we take a look at e-commerce payment processing, how to set it up, and the key factors to consider.

How Do E-Commerce Payments Work

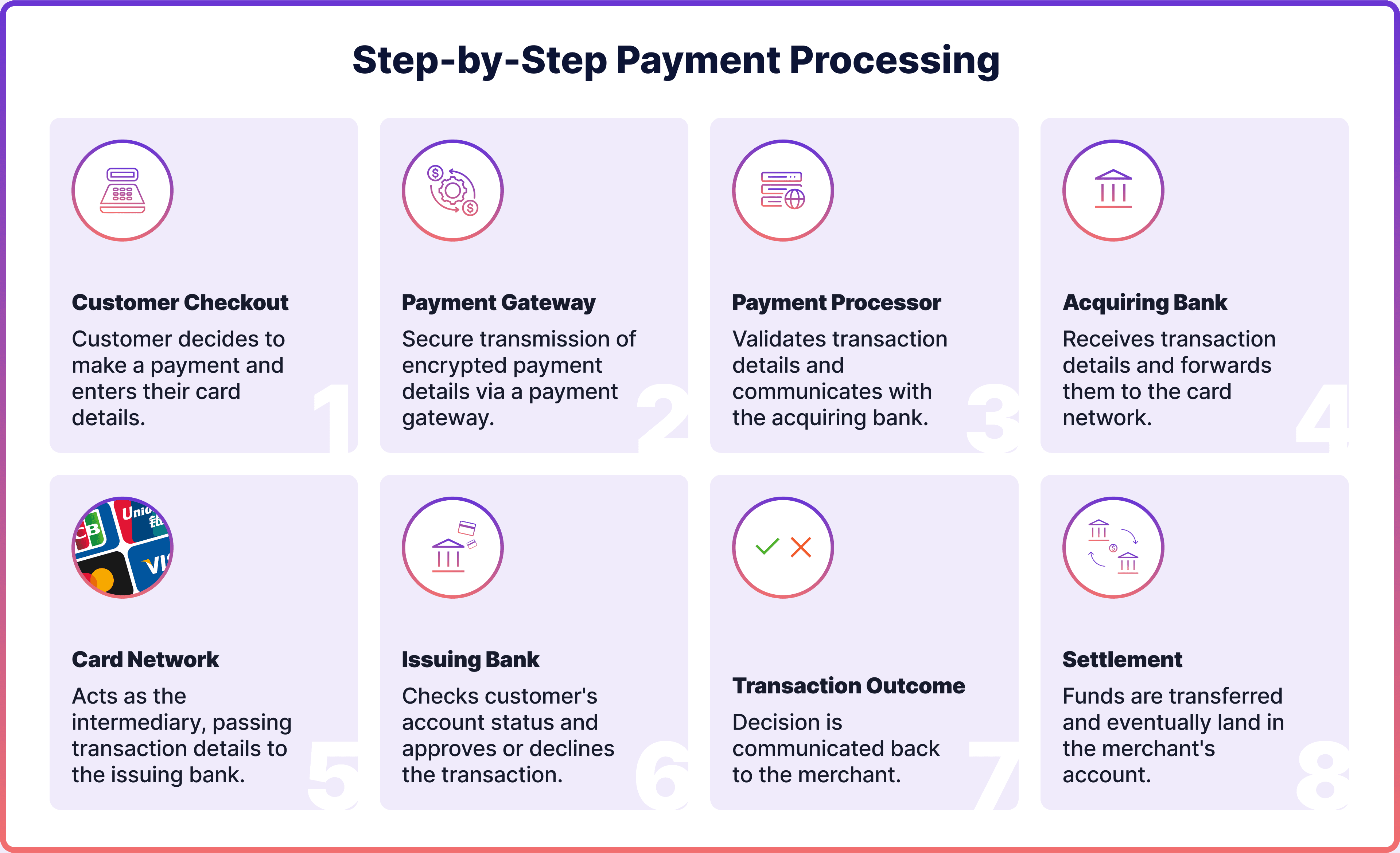

The electronic payment process in e-commerce involves several steps, from initiating a payment to finally settling it in the business's bank account. It’s crucial for enabling transactions between customers and businesses.

Payment Gateway

After the customer inputs their payment information, it gets securely transmitted to the payment gateway. This gateway is essential because it encrypts and securely sends the transaction data, including sensitive details like card numbers.

Payment Processor & Acquiring Bank

Once the payment gateway sends the transaction data, the payment processor receives it. They check and confirm the transaction details before contacting the acquiring bank linked to the e-commerce merchant account.

Card Network & Issuing Bank

Afterwards, the acquiring bank forwards the transaction details to a card network like Visa or Mastercard. The card network contacts the issuing bank, which verifies the account status and balance. Note that card networks aren't involved in open banking payments (Pay-by-Bank or Account-to-Account) since transactions occur directly between accounts.

Settlement

After reviewing the transaction, the issuing bank decides whether to approve or decline it. Approved transactions are collected by the merchant at the end of the day and sent to the payment processor for settlement.

What is an E-Commerce Payment Gateway?

As previously mentioned, a payment gateway is crucial for electronic commerce processing. It acts as a virtual card machine, collecting transaction data in a secure manner. Typically, payment gateway services are offered alongside e-commerce merchant processing, by the same provider. There are three main types of payment gateways, so it's important to choose the one that fits your e-commerce platform best.

Hosted Payment Gateway

Hosted payment gateways are also called redirect methods or third-party payment gateways. When customers pay, they are sent to the payment processor's site to put in their payment information. After the payment is processed, they are sent back to the seller's website.

Merchants tend to prefer this kind of e-commerce website payment gateway because it's convenient and secure. They don't have to process customer data by themselves. Setting it up is usually easy and it comes with security already in place.

Onsite (Self-hosted) Payment Gateway

With an on-site or self-hosted payment gateway, online sellers gather payment information right on their website. They then securely send this data from their own server to the payment gateway's server for processing.

Often referred to as a direct gateway, this method allows customers to stay on the e-commerce website without being redirected, making the user experience smooth. However, it might need the e-commerce merchant to have more technical skills and resources.

Offsite (API-hosted) Payment Gateway

By using Application Programming Interfaces (APIs), this type of gateway lets e-commerce merchants send payment information straight to the payment processor. This means no sensitive data is kept on the seller's servers. APIs are sets of rules that let different software systems communicate with each other. While the seller collects payment data on their platform, the actual processing happens elsewhere.

E-commerce Plugins

If you are using a popular e-commerce website to host your online store, some providers may offer plugins for seamless processing. For example, at Noda, we offer integration with the majority of popular e-commerce platforms such as WooCommerce, OpenCart, PrestaShop, Magento, and BigCommerce. Merchants who install the plugin can add a Noda button as a payment method on their website.

Popular E-Commerce Payment Methods

As a merchant, catering to your customers is of utmost importance. There are many payment options available for an e-commerce website, yet the key is meeting your clients’ needs.

Digital Wallets

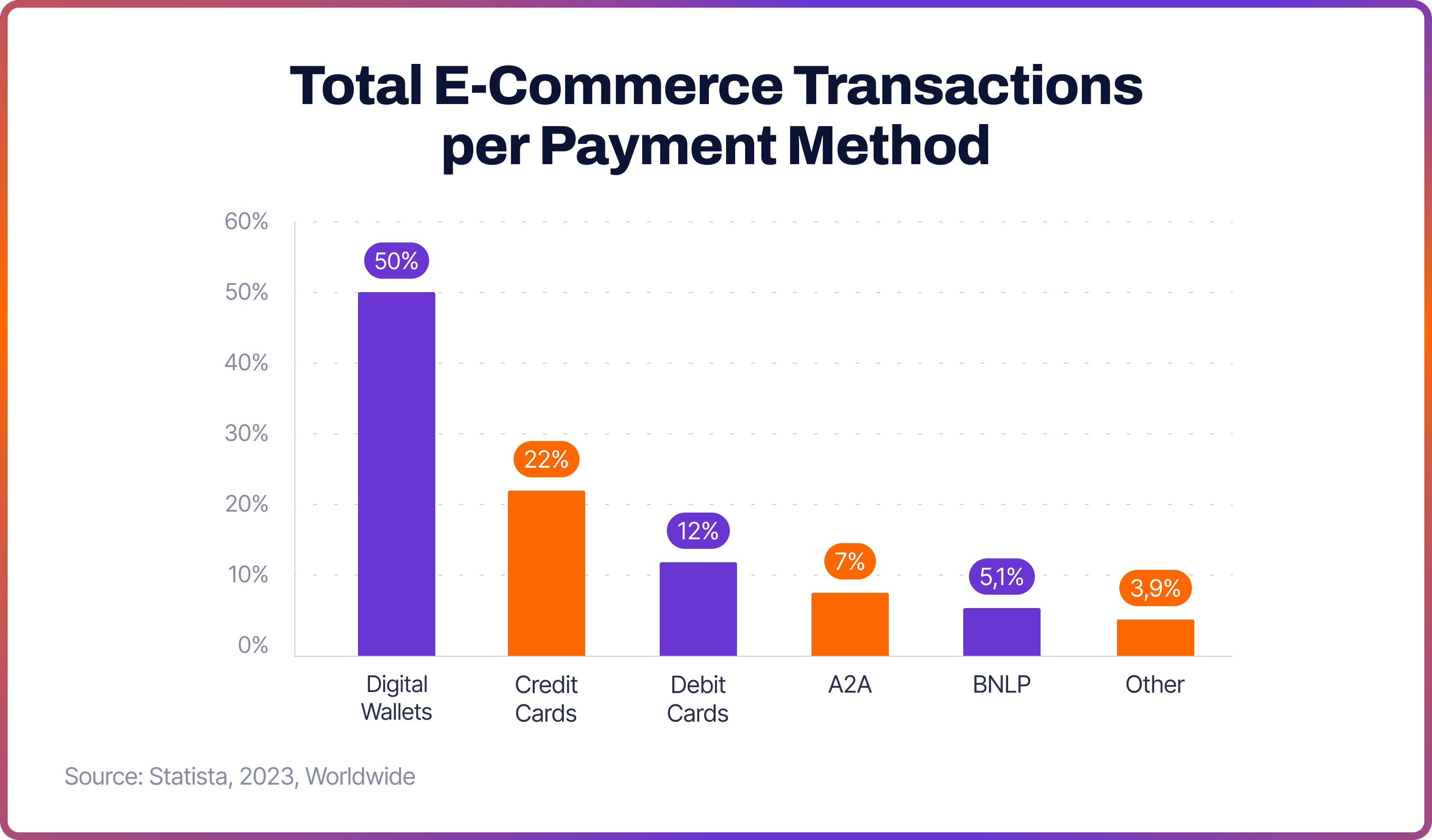

Digital wallets such as Google Pay, Apple Pay, PayPal, and others are now a leading trend in e-commerce payment processing. These web and mobile apps are favoured by customers globally and account for 50% of the value of transactions worldwide in 2023, according to Statista. It's essential to offer them as a payment option on your e-commerce platform.

Credit and Debit Cards

Physical cards issued by banks are a traditional payment method that still holds some momentum. Although consumers are largely switching to digital wallets, some still use credit card payments (22% of e-commerce transactions in 2023) and debit cards (12%) for e-commerce payments.

Account-to-Account (A2A)

This emerging payment method made up 7% of e-commerce transactions in 2023 and is associated with the growing adoption of open banking. Since 2018, the EU's PSD2 regulation required banks to share customer data with approved fintech companies using APIs. This secure way of sharing data fuelled direct account-to-account (A2A) payments, often called 'Pay-by-Bank'.

The A2A payment method has many advantages, like quick transfers and a smooth user experience. With pay-by-bank, customers don't have to enter their payment details manually; instead, they are redirected from the payment page to their trusted bank’s interface.

Buy Now Pay Later (BNLP)

BNPL is a payment option that lets customers buy items immediately and pay for them later. This allows them to buy without paying the full amount upfront instead of paying in instalments over time. BNPL's popularity has recently increased significantly, to 5.1% of all e-commerce transactions in 2023. For merchants, offering BNPL as a payment option is crucial to remaining competitive.

How to Set up Payment Processing for E-Commerce

Determine Your Strategy

First, set up your strategy. Consider your business needs and the payment features required. For example, look into your customers' preferred payment methods. Consider the types of payments they use, such as cards, digital wallets, or other options like BNPL.

Evaluate Technical Expertise

Next, assess the technical skills of your team. This is important because some types of payment gateways, such as self-hosted ones, require more technical knowledge for e-commerce payments integration.

Partner With a Payment Provider

If you choose a hosted or API-based payment gateway, you will need to work with a provider like Noda. Find an e-commerce payment solution that easily fits with your e-commerce platform and supports various currencies and payment methods, especially if you have international customers.

Pay attention to the UX provided by the e-commerce payment platform, as it greatly affects how your customers make payments. Security is also essential; ensure the provider meets industry standards like PCI DSS. Cost is another key factor to consider, including transaction fees, monthly fees, and any other related costs. Opt for a provider that offers a good balance of cost and functionality.

Test and Trial

When choosing a provider to process online payments, think about trying their services first. A demo or trial period can help you evaluate how well the platform works, how easy it is to use, and how reliable it is. Pay attention to the e-commerce payment process flow, how fast transactions are processed, and any problems that come up during the trial.

E-Commerce Payment Processing with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, e-commerce payment processing services, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

FAQs

What are the different types of payment systems for e-commerce?

There are three main types of payment systems for e-commerce: hosted payment gateways, onsite or self-hosted payment gateways, and offsite or API-hosted payment gateways. Hosted gateways redirect customers to the payment processor's site to enter their payment details. Onsite gateways process payments directly on the merchant's website, while offsite gateways use APIs to send payment details to the processor without storing sensitive data on the merchant's servers.

How does a payment gateway work in e-commerce?

In e-commerce, an e-commerce payment gateway solution collects and encrypts the customer's payment information and securely sends it to the payment processor. It acts like a virtual card machine that ensures the transaction data, including sensitive details like card numbers, is transmitted securely.

What are the best payment methods for selling online?

The best payment methods for selling online include popular digital wallets like Google Pay, Apple Pay, and PayPal. Credit and debit cards are still widely used, although digital wallets are gaining more traction. A2A transfers and BNLP options are also growing in popularity due to their convenience and ease of use.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each