Picture two different clients. The first buys from your business once and disappears within a month. The second client buys consistently, month after month, forming a lasting connection with your company that lasts decades.

The loyal customer who regularly engages and deeply values your brand is the one you aim to attract and keep. Thus, it's crucial to pinpoint these customers early on by estimating their lifetime value (LTV).

Yet there is a myriad of techniques – from cohort models to predicting customer lifetime value with machine learning – which one should businesses choose? Here, we take a look at lifetime value predictions and how open banking can benefit LTV.

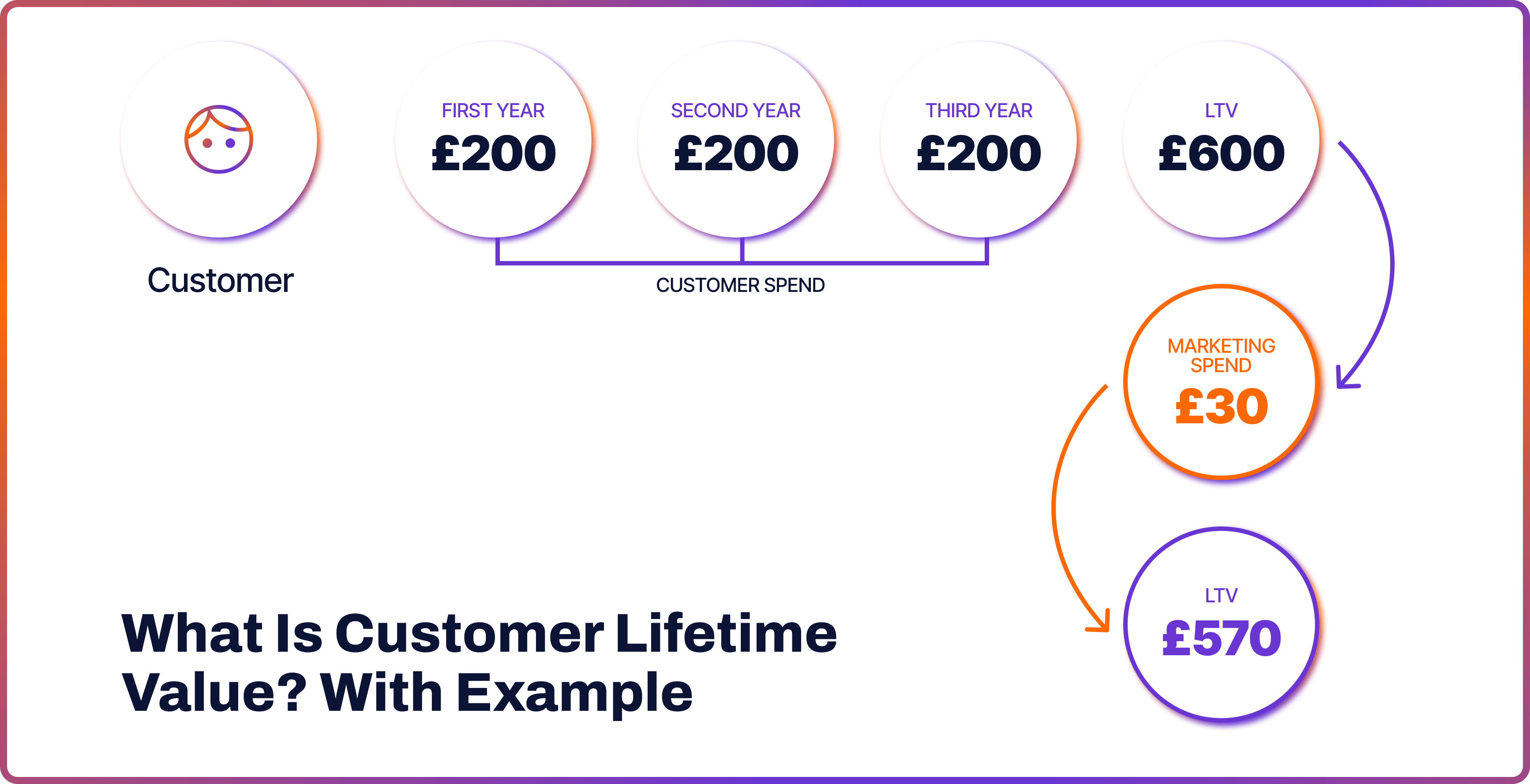

What Is Customer Lifetime Value? With Example

Customer LTV is the total value a client brings to your business long-term, over their entire relationship with your brand.

For example, if a customer spends £200 annually for a span of three years, their LTV would be £600. Yet, if acquiring this customer costs you £30 in marketing, their net LTV becomes £570. To calculate LTV, you have options like historical or predictive methods.

Historical LTV

For historic LTV, the process generally involves summing up all purchases made by an individual customer and dividing this total by their number of purchases. This reveals the customer's average purchase value. The higher the number, the greater the LTV for this customer.

You can calculate LTV yourself, but first, you'll need to gather specific values.

- Average Order Value (AOV): Total Sales Revenue / Total Number of Orders

- Gross Margin (GM): (Total Sales Revenue – Cost of Goods Sold) / Total Sales Revenue

- Churn Rate (CR) = (Number of Customers at End of Period – Number of Customers at Start of Period) / Number of Customers at Start of Period

- Customer Lifetime Period (1/CR) = 1 / Churn Rate

- Purchase Frequency (F) = Total Number of Orders / Total Number of Unique Customers

Then you can use these parameters for the following LTV formula:

LTV = AOV x F x GM x (1/CR)

Alternatively, you can use a business analytics platform that would perform the calculation for you.

Predicted Lifetime Value

Historic LTV is a valuable method, yet it doesn't consider changes in customer behaviour. That’s why predictive LTV prediction models may offer more precision. This approach requires more knowledge and time, involving algorithms for the calculation.

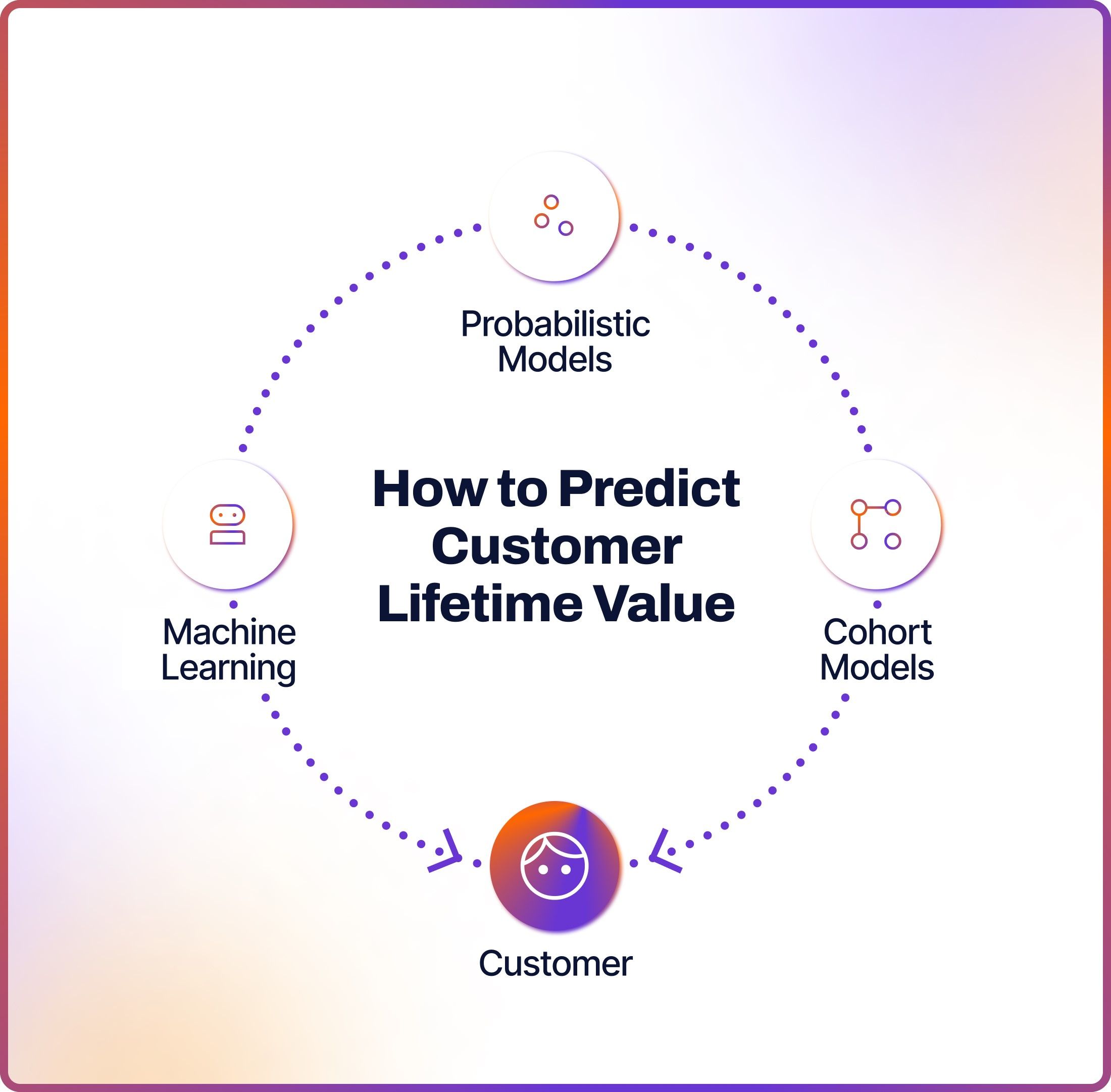

How to Predict Customer Lifetime Value

There are generally three approaches to LTV modelling: probabilistic, cohort and machine learning. All of them use data science to predict customer lifetime value.

Probabilistic Models

These models use patterns in past sales data to estimate how much and how often customers will buy in the future. Examples include BG/NDD and Gamma-Gamma.

Probabilistic models require historical transaction data by each customer to figure out how often they buy, how recent their last purchase was, and how much they spend on average. They look at differences in customers' buying habits and chances of churning. Some Python packages can simplify this complex modelling by providing built-in solutions.

Cohort Model

This method groups customers into cohorts based on shared characteristics like transaction start date or behavioural patterns. It assumes customers in a cohort exhibit similar spending patterns, which helps identify high LTV clients.

For example, to use this model effectively, you may want to segment clients based on their LTV and analyse their demographic and buying patterns. This could involve statistical methods like regression and classification models to identify variables that distinguish high-value clients. With this information, you can then target individuals with similar profiles under the assumption that they, too, will become high-value clients.

Machine Learning Models

These models conduct customer lifetime value prediction using machine learning. They use complex algorithms to detect patterns in customer data and forecast future behaviours. Essential steps include collecting and cleaning data, building and evaluating the model, and preprocessing the data for training.

Machine learning models often consider various data points, such as invoice details, product information, and customer demographics. These models can incorporate additional features like browsing data, email responses, and other customer metadata. They use a wide range of techniques, including feature engineering and normalisation, to prepare the data for effective prediction.

Benefits of LTV Prediction for Businesses

- Better Resource Allocation: Knowing the LTV helps businesses focus their resources on high-value customers, optimising marketing spend and resource distribution.

- Enhanced Customer Segmentation: Predicting LTV enables more accurate customer segmentation, allowing personalised marketing and improved customer relations.

- Increased Profitability: By focusing on customers with higher LTV, companies can boost their long-term profitability.

- Improved Product and Service Offerings: LTV insights can guide businesses in tailoring products to meet the needs of their most valuable clients.

- Strategic Decision Making: LTV prediction can guide strategic decisions, such as pricing, product development, and customer service.

How Open Banking Can Boost LTV

Open banking is the new financial framework based on data transparency. Previously, traditional banks held a monopoly over customer data. Open banking mandates them to share information with licensed third-party companies, provided consumer consent.

Banks share data through the use of application programming interfaces (APIs), which are sets of instructions acting like a software bridge. Meanwhile, authorised companies can create new innovative products based on the data. In Europe, open banking became a reality in 2018, when PSD2 was enforced.

One of the key advantages of open banking is that it boosts customer satisfaction through enhancing user experience. LTV is about maintaining long-term relationships with customers. A tried and true way to improve LTV is to invest in customer experience.

For example, open banking streamlines payments, removing the need for users to fill in their bank details manually. It also can aggregate multiple financial accounts into a single interface, simplifying user interaction. Therefore, a wider range of financial service integration results in customers who are less likely to look elsewhere.

Boost LTV with Noda Open Banking

Noda is an open banking provider that assists online merchants with payment processing, LTV forecasting, end-user KYC and UX optimisation. By integrating Noda into their online checkout, merchants can not only streamline payments experience for their customers, but get additional advanced insights into their spending behaviour and make accurate LTV predictions. This data can then be used in multiple ways, for example, to tailor marketing efforts, reaching out to those most likely to generate revenue.

Learn more about how you can unlock user insights with Noda Know Your Whales.

FAQs

What is customer lifetime value in marketing?

CLV is the total revenue a business can expect from a single customer throughout its entire relationship with the brand. For example, if a customer spends £200 annually for three years, their LTV would be £600. Yet, if acquiring this customer costs you £30 in marketing, their net LTV becomes £570.

What can digital marketers measure by using customer lifetime value?

They can use CLV to measure profitability, forecast revenue, guide budget allocation, and tailor marketing strategies. The loyal customer who regularly engages and deeply values your brand is the one you aim to attract and keep.

What is LTV in e-commerce?

LTV in e-commerce means the same as LTV in marketing - the predicted revenue a customer will bring to an online business over their entire relationship with the brand.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each