The way we pay has constantly evolved. From gold and paper money to bank cards and cryptocurrencies, modern consumers have many options in this age of rapid innovation.

The 21st century saw the rise of online banking, digital wallets, and mobile payments, offering greater convenience and security. Blockchain technology led to cryptocurrencies like Bitcoin. Open banking has also gained momentum, enabling instant account-to-account (A2A) transfers via application programming interfaces (APIs), bypassing traditional credit networks.

Consumer choices are wide, and they differ across regions and countries. Understanding payment preferences around the world can help merchants better connect with their target clientele.

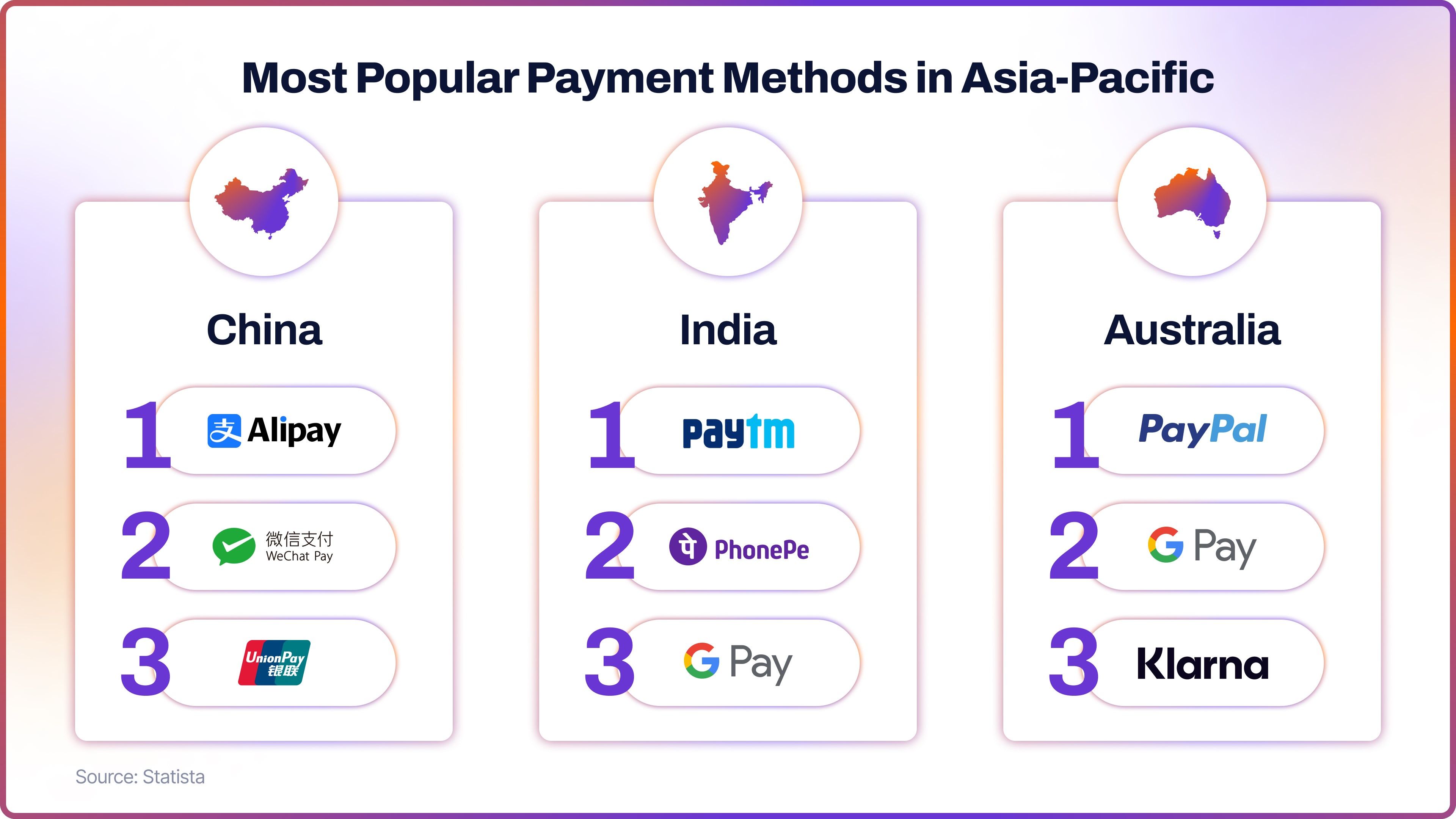

Most Popular Payment Methods in Asia-Pacific

In Asia Pacific, innovative payment methods are particularly popular. According to Statista, the region was leading the digital wallet adoption in 2023.

China

China is largely a cashless and cardless society, with most consumers paying via mobile phones. The leading digital wallets, Alipay, WeChat Pay, and UnionPay, dominate the market, according to Statista.

India

Although payment by cash is less common than before COVID-19, it’s still the most popular in-store payment method in India, according to Statista. Mobile wallets are expected to surpass in the long term. Wallets such as Paytm, PhonePe, and Google Pay are projected to gain millions of new users in India between 2020 and 2025.

Australia

As of March 2024, debit cards and online payment services such as PayPal, Google Pay, and Klarna, were the top choices for Australian online consumers. Meanwhile, in-store credit and debit cards remained dominant, making up over 70% of transaction volume.

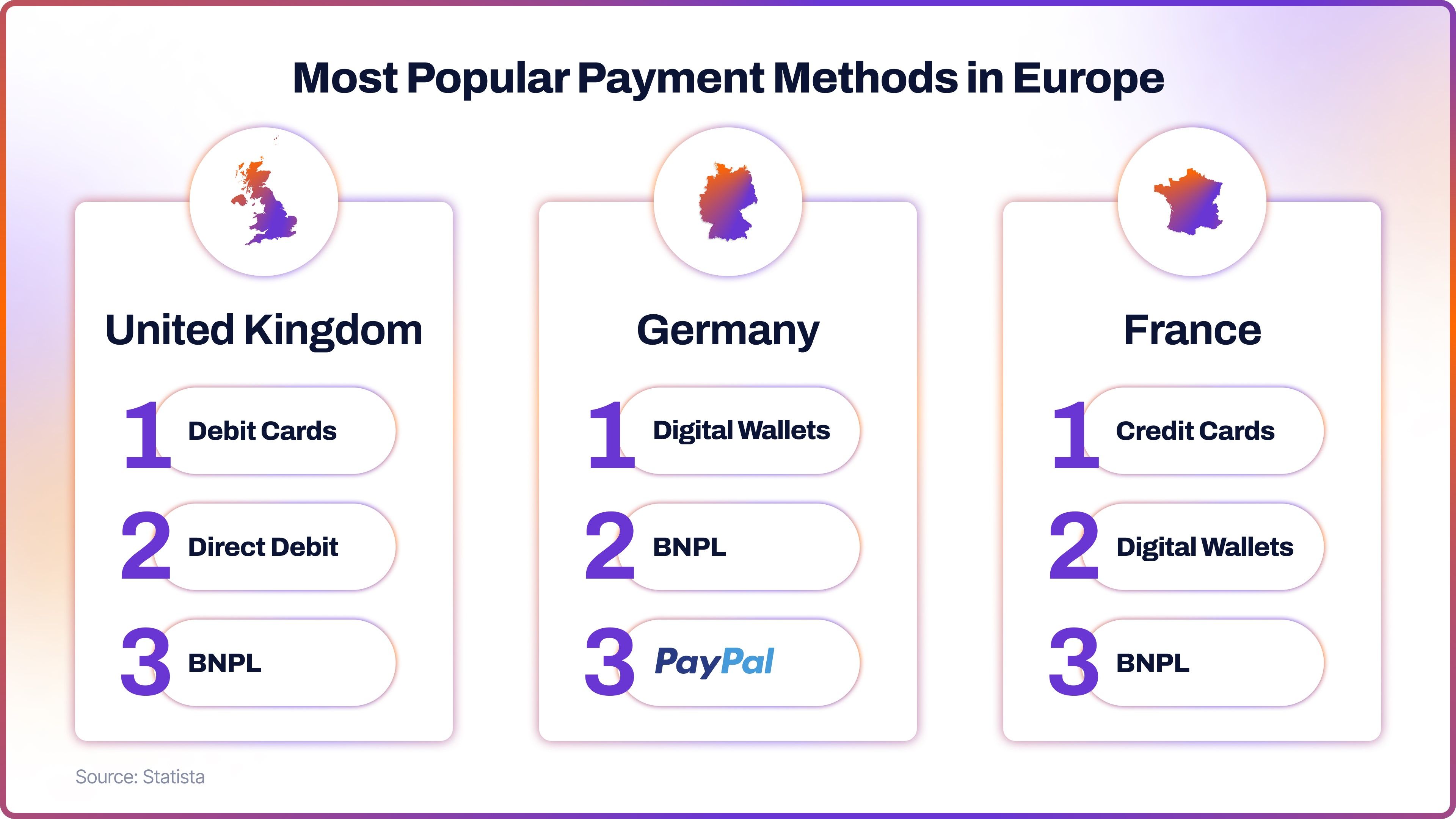

Most Popular Payment Methods in Europe

In Europe, digital wallets, too, are the most popular payment method, yet to a lesser extent than in Asia-Pacific. Digital wallets account for 30% of payments, followed by credit cards and A2A payments facilitated by open banking.

United Kingdom

As of March 2024, debit cards and direct debits were the top two choices among UK consumers for online payments. This was followed by online services such as digital wallets and Buy-Now-Pay-Later (BNLP). Meanwhile, for offline payments debit cards were the most popular, amounting to 47% of all transactions in 2022. The UK’s use of cash was one of the lowest globally.

Germany

In Germany, online payment services such as digital wallets and BNLP, and paying by invoice were the top survey answers by online consumers for March 2024. Meanwhile, a 2022 survey revealed that PayPal was the most popular online payment method, favoured by 46% of respondents. In-store, however, cash remained the most popular method, accounting for 40% of transactions in 2021. However, it’s been declining since 2017.

France

In line with other European countries, credit cards and online payment services (digital wallets, BNLP) were the top choices for French online consumers as of March 2024. Meanwhile, for in-store payments, a large majority involved debit and credit cards as of 2021. Combined, the two reached over 80% of all transactions.

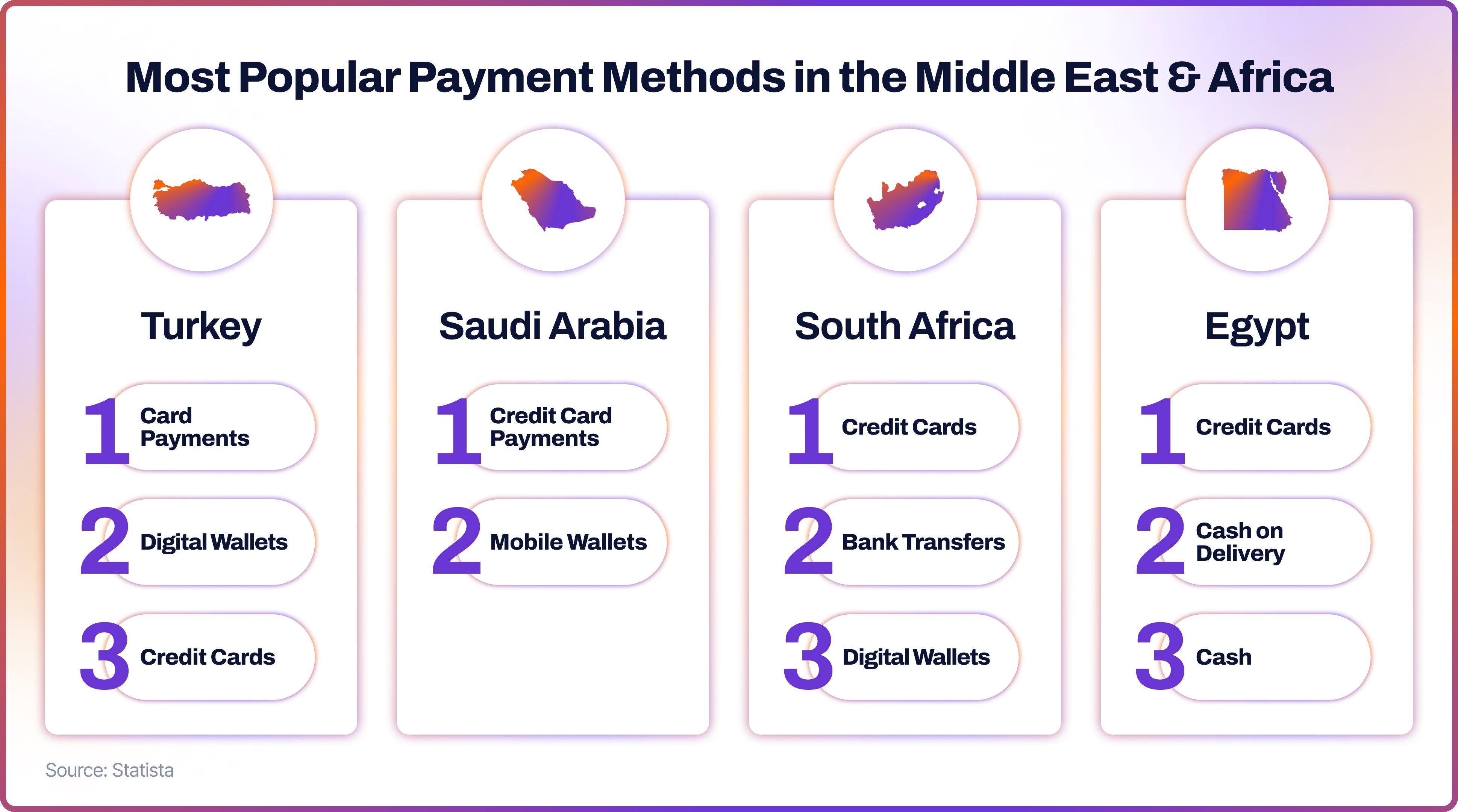

Most Popular Payment Methods in the Middle East & Africa

In the Middle East & Africa, credit cards were the most popular payment method at 24%, followed closely by digital wallets at 23%. Debit cards and A2A both amounted to 18% of payments.

Turkey

In 2023, card payments were the most prevalent choice in Turkey, making up 48% of al online transactions. Digital wallets were the next most popular, amounting to 16%. In-store, the most popular payment method was credit cards followed by cash transactions.

Saudi Arabia

In 2021, credit card payments were the most common online payment method with a share of 41%. The usage of cash is declining, as credit cards and mobile wallets are promoted in the country. Statista predicted that “cash will stop being the majority payment method in physical stores by 2025 as wallets like Saudi Telecom's STC Pay are expected to see an increasing user count.”

South Africa

As of January 2024, credit cards were used for 43% of e-commerce transactions in South Africa. Bank transfers were the second most popular, accounting for 22%, followed by digital wallets at 20%. In physical stores, debit and credit cards made up more than half of all transactions in 2021. Since COVID-19, debit cards and retailer financing have been on the rise.

Egypt

Credit cards and cash on delivery were the most popular choices by Egyptian consumers for online transactions in March 2023. The survey was conducted among 1,049 respondents. Meanwhile, cash and credit cards were the top answers for in-store payments.

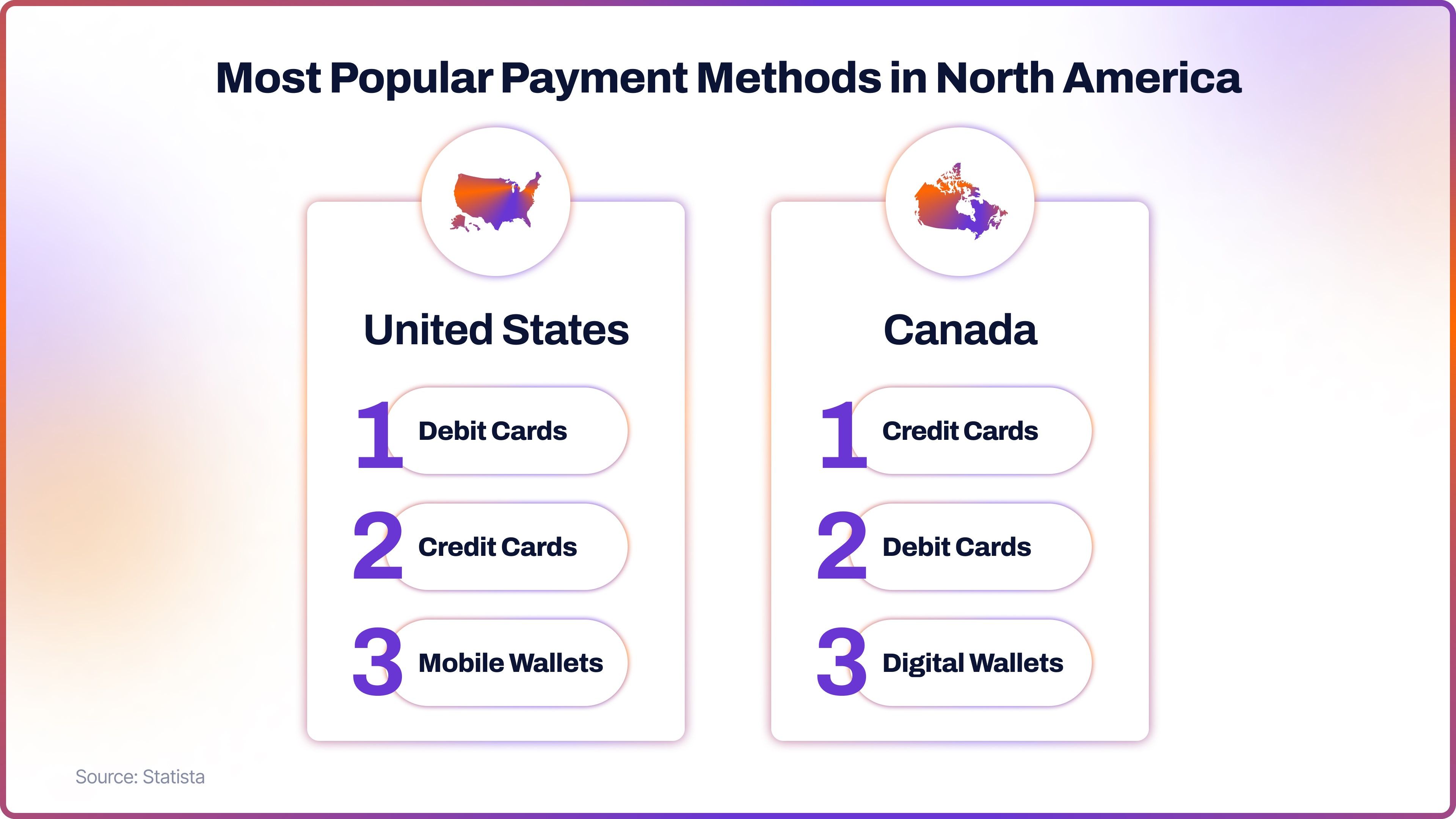

Most Popular Payment Methods in North America

In North America, similarly to Europe and Asia-Pacific, digital wallets are the new king. They amounted to 37% of all e-commerce transactions, followed by credit cards and debit cards. A2A were not as popular (at 5%), possibly due to the lack of open banking infrastructure in the region.

United States

Debit cards and credit cards were the most popular choices by US consumers for online transactions as of the March 2024 survey. Although not the most popular yet, BNLP payments are growing rapidly, 2022 data showed. Credit cards and mobile wallets dominate other payment options, which is likely related to “user experience”, according to Statista.

Canada

Credit cards were the most popular e-commerce payment method in 2022, although they are increasingly losing market share to digital wallets. BNLP is also gaining momentum, rising roughly 6% in terms of market share between 2020 and 2022. As of March 2024 survey, credit and debit cards were the most common answers. In physical stores, credit cards also remained the most used.

Most Popular Payment Methods in Latin America

In Latin America, credit cards were the most popular payment methods, amounting to 35% of e-commerce transactions. They were followed by digital wallets (21%) and A2A (20%).

Brazil

In 2023, 40% of online purchases were paid by credit or charge cards, while 16% were paid by digital wallets. Meanwhile, A2A is increasingly gaining traction, driven by the PIX open banking infrastructure in Brazil. In-store, credit cards and debit cards made up more than half of payments in 2021.

Mexico

Debit and credit cards were the most popular online payment methods in Mexico according to March 2024 consumer survey. Meanwhile, cash remained the most used option in physical stores, although its market share had decreased severely, according to 2017-2023 data.

Argentina

Similarly, the survey revealed debit and credit cards as the consumers’ choice for online transactions, as of March 2024. In store, consumers preferred debit cards and digital wallets. Mobile wallets, for example, saw their market share increase from 4% in 2017 to 12% in 2023. This is attributed to the growing adoption of Mercado Libre, Latin America’s biggest online marketplace, which offers offline, contactless payment options.

Open Banking Payments with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know