Cryptocurrencies and open banking emerged as innovative trends in finance. Both of them leverage the power of technology and adhere to the value of data transparency. Yet, how can the two complement each other?

Here, we take a look at open banking in the crypto industry, real-life examples of integration and what future trends may look like.

What Is Open Banking?

Open banking is a groundbreaking concept in finance. It mandates traditional banks to share data with licensed fintech companies, provided consumer consent. In Europe, open banking is a legal requirement under the PSD2 regulation enforced in 2018.

Previously, traditional banks held a monopoly over data. With open banking, fintechs can use it to build better, more personalised products. Open banking payments can streamline user experience so that customers don’t have to insert bank details manually. Another use case of open banking is apps that link multiple financial accounts into a single interface.

What Is Cryptocurrency?

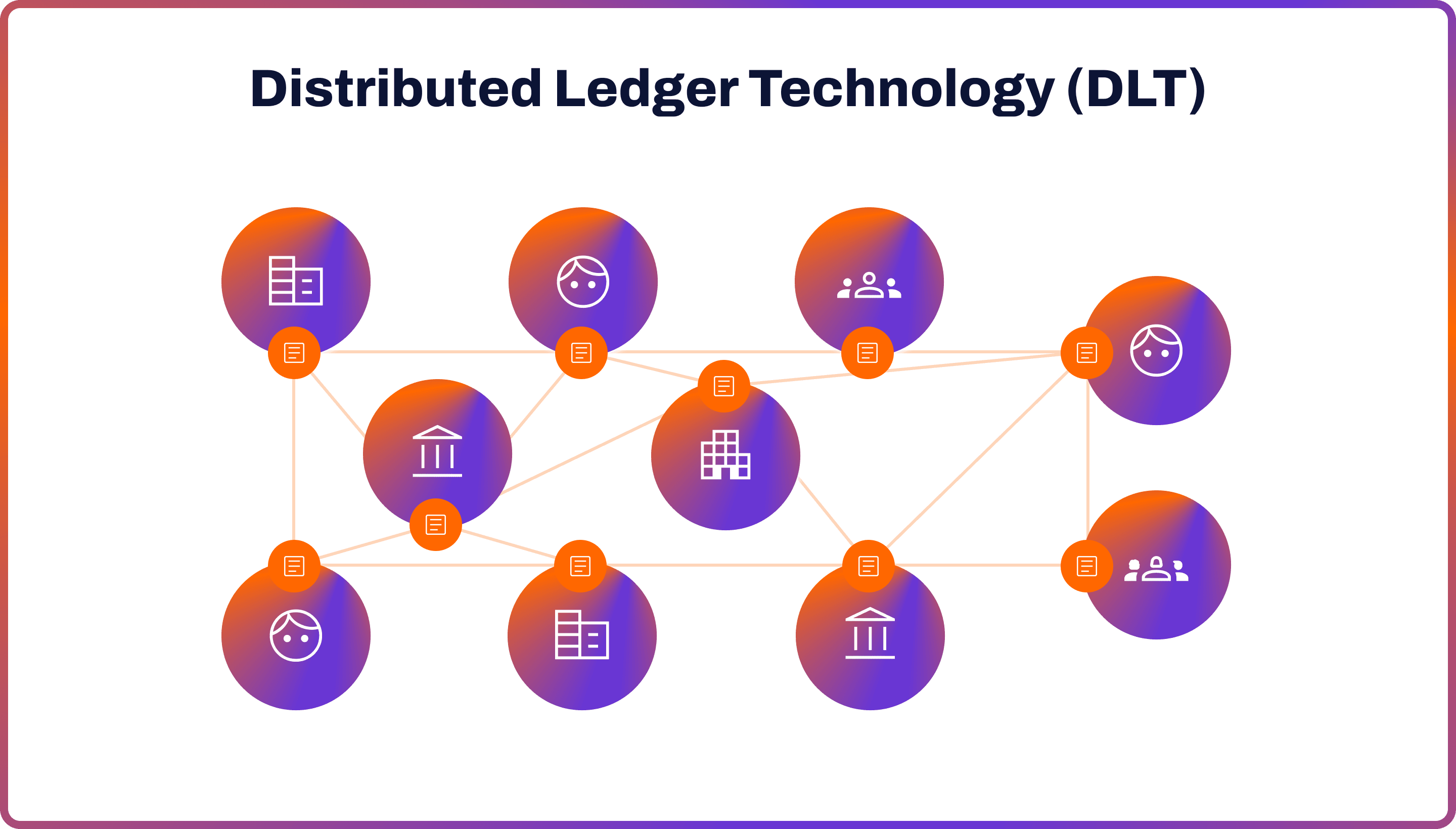

Cryptocurrency, or crypto, in simple terms, is digital decentralised money. It doesn’t involve any physical coins or notes. Yet what differentiates cryptocurrency from normal online transactions is that no authority controls it as it’s built on a distributed ledger technology (DLT).

The most well-known cryptocurrency is Bitcoin, but there are thousands of others, including Ethereum, Ripple, and Litecoin. Consumers and businesses use cryptos for a number of reasons: as investments, remittances, and means of exchange.

Transparency of Data

Blockchain technology and open banking both embrace a common philosophy: they aim to provide the simplest access to data and ensure information transparency.

The data exchange in the open banking system is run on application programming interfaces (APIs); they are sets of defined rules that enable different entities to communicate with each other. APIs function as a software bridge, enabling banks to share information with fintech companies securely.

Cryptocurrency is built on a blockchain, a distributed ledger that records all transactions across a network of computers. This system achieves transparency as it removes the necessity for a central authority.

How Crypto Can Use Open Banking

The power of open banking for crypto is in its ability to further streamline processes and enhance user experience. Open banking offers important features that can foster more innovation within the cryptocurrency ecosystem.

Account Deposits

To buy a cryptocurrency, a user first needs to transfer money to an exchange of their choice. This means that crypto accounts need to be topped up regularly.

Open banking can simplify this process, offering a quick and secure way of transferring funds.

Payment Initiation Service Provider (PISP) is one of the PSD2 licenses a fintech may obtain to access data from European banks. PISPs can also initiate payments on customers’ behalf.

PISPs, therefore, simplify payments and user experience as consumers no longer need to insert their card details. They can top up in just a few clicks.

Cryptocurrency Lending

Another way how open banking can enhance the crypto ecosystem is by streamlining lending. A cryptocurrency lending platform is a service where users can either lend their cryptocurrencies to earn interest or borrow cryptocurrencies by paying interest.

Some platforms may assess the borrower's creditworthiness. This is usually a lengthy process that involves analysing a borrower’s credit history and income. Yet open banking is posed to change this.

As open banking providers can aggregate financial data, they can instantly provide all the necessary information to lenders in just a few minutes. Open banking can streamline credit history checks, affordability and income verification for cryptocurrency lenders.

AML & KYC

Open banking can simplify fraud prevention and anti-money laundering (AML) processes, which are important for cryptocurrency compliance.

Know Your Customer (KYC) involves steps to verify that businesses or individuals are not engaged in unlawful activities. Open banking enables quick access to a client's complete transaction history, revealing payee details and transaction locations.

This streamlines the process of gathering user data, confirming wealth sources, offering transaction insights, and assessing risk levels. Furthermore, open banking eliminates the reliance on paper documents, which are less secure than digital versions.

Decentralised Finance (DeFI)

Decentralised Finance (DeFi) refers to financial companies that use blockchain to operate without central authorities like banks or governments. It's built on distributed ledgers, similar to cryptocurrencies, enabling various financial transactions, lending, borrowing, trading, investment, and insurance through smart contracts.

Like open banking, DeFi is about openness and accessibility. Open banking shares financial data with licensed fintech companies, while DeFi makes financial services openly accessible on the blockchain. Open banking could integrate with DeFi platforms, combining traditional finance's reliability and regulatory framework with the innovative, decentralised models of DeFi.

Integrating Crypto with Open Banking

Here are some real-life examples of how companies leverage the benefits of crypto using open banking:

- Coinbase: One of the largest cryptocurrency exchanges, Coinbase, has implemented open banking for its UK customers in 2022. This integration allows users to link their bank accounts directly for faster and more secure transactions.

- Revolut: While primarily a digital banking app, Revolut offers cryptocurrency trading features. It leverages open banking to provide seamless transitions between traditional and digital currencies.

- Gemini: Gemini, a cryptocurrency exchange and custodian, implemented open banking in 2022. The feature simplified the process of buying and selling cryptocurrencies by directly linking users' bank accounts.

Future of Crypto And Open Banking

The future of open banking and cryptocurrencies will depend heavily on the rise in adoption. Regulatory developments will also play a key role in shaping how the two technologies complement each other.

Increased Adoption

Consumer interest in both open banking and cryptocurrencies is expected to surge in the next decade. According to Juniper Research, the total value of open banking transactions will increase from $57bn in 2023 to an impressive $330bn by 2027 —a staggering growth rate of 479%.

Cryptocurrencies are anticipated to see increased mainstream adoption, too, with the global market projected to grow from $910.3m in 2021 to $1.9bn by 2028, according to Fortune Business Insights. As more businesses recognise the benefits of cryptocurrencies and open banking, more innovation and use cases within the space will follow.

Regulatory Evolution

Regulation will remain key in shaping how open banking and cryptocurrencies unfold globally. In Europe, PSD2 was crucial for the rollout of open banking. In 2024, the new regulation PSD3 will be finalised, promising higher API quality and stronger security features.

In 2023, the UK government announced plans for robust regulation of crypto asset activities, triggering a public consultation. The government plans to lay down formal legislation in 2024.

In Europe, the new MiCA cryptocurrency regulations will come into force in 2024, providing regulatory clarity for cryptocurrency businesses. MiCA sets guidelines for both crypto asset service providers (CASPs) and issuers of cryptocurrencies.

It mandates that issuers follow principles of disclosure and transparency, ensuring they provide comprehensive details about their crypto assets. CASPs are required to implement robust security protocols and comply with AML regulations.

Open Banking with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

How can open banking be used in blockchain?

Open banking streamlines secure and direct transfers of funds to cryptocurrency accounts. It simplifies processes like topping up crypto accounts and making payments quicker.

How does crypto affect open banking?

Cryptocurrency affects open banking by introducing a decentralised approach to financial transactions and data sharing. This allows for more innovative, efficient, and user-focused financial services, enhancing the capabilities of open banking.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know