We live in the age of big data. Today, data is more available than ever, offering vast amounts of information that are crucial for business decisions.

Open banking, enforced in Europe in 2018, is a legal framework based on data transparency. Before, traditional banks exclusively controlled customer data. Now, with customer permission, banks share information through application programming interfaces (APIs) with authorised fintech companies. This sharing enables fintechs to create tailored products for clients.

More data might seem equal to better data, but that's a misconception. In the open banking ecosystem, fintech companies are adept at leveraging data, but it's not merely the volume that's important. Quality of information plays the biggest role, as you can’t benefit from unrefined data only.

This is where data cleaning and enrichment come into play, and their implications are powerful. Coupled with open banking, they allow fintechs to go beyond raw transactions, transforming them into valuable insights. In this article, we take a look at this intersection and explore how to use data to enrich your business within the open banking ecosystem.

What Is Data Cleaning?

An essential step before data enrichment is data cleaning. Consider data as a resource similar to crude oil. Just as crude oil must be refined to be useful, raw data also requires processing. Data cleaning increases the accuracy and consistency of information, making it more reliable for further enrichment and analysis.

How Data Cleaning Process Works

The problem is that raw data is often cluttered. Reviewing raw transaction data, you might see repeated entries, complex text strings, and numbers that lack clear context. Only after the data cleaning process can this information be enriched and analysed.

Data cleaning in open banking would typically involve the following actions:

- Removing duplicated transactions

- Correcting errors

- Dealing with missing values

- Standardising formats

Benefits of data cleaning for open banking include improved data accuracy and reliability, which enhance the decision-making process in business.

What Is Data Enrichment?

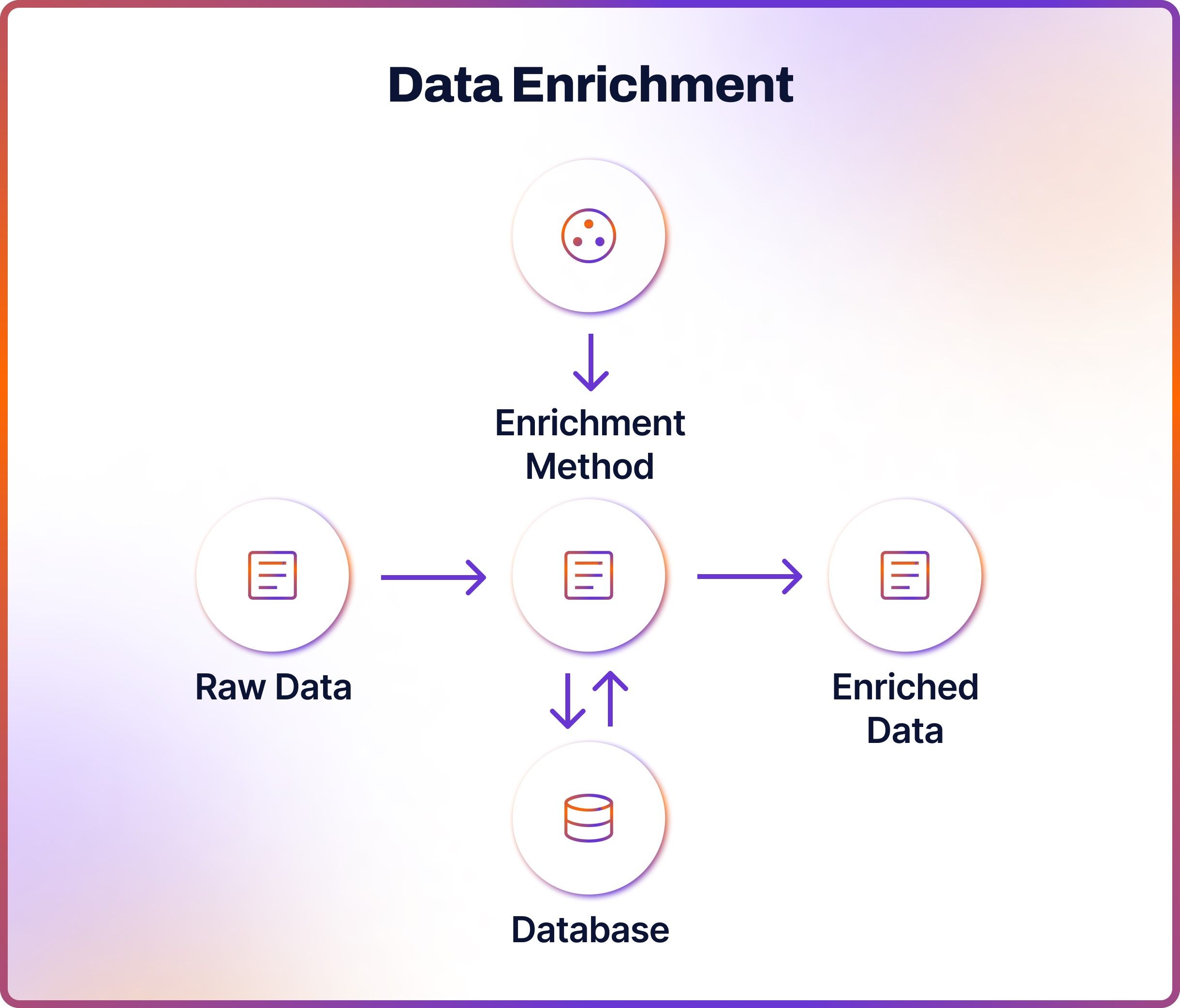

Data enrichment is a process of dealing with cleaned information to identify meaningful patterns. This is how companies transform data into a valuable asset.

Data enrichment involves enhancing, refining, and improving raw data by merging it with other datasets from external sources. The aim is to augment the original dataset with additional features or information. For example, data enrichment may involve:

- Adding new data from external sources

- Enhancing data with additional attributes

- Integrating data to provide a more comprehensive view

Categorising Data

Data enrichment may also involve sorting information into categories to create more value. Let’s continue our example of transaction data. Categorising each transaction can reveal the bigger financial picture.

Transaction categories based on B2C data enrichment can say a lot about spending habits, which can help companies develop more customised financial products. It's particularly valuable for personal finance tools, accounting, and business analytics.

Artificial Intelligence (AI) and Machine Learning (ML) can be used for further data analysis, creating actionable insights for business decision-making.

Data Enrichment in Open Banking

In the context of open banking, data enrichment and cleaning services means turning raw open banking data into useful information.

Transaction data enrichment offers various applications. When integrated with open banking, it can enhance your product range. Businesses can begin by identifying each transaction's main purpose using its description, amount, date, and related metadata.

And that’s just the beginning. Using open banking for data enrichment can reveal a customer's transaction locations and even evaluate the carbon footprint of their purchases. The opportunities are limitless.

For example, by combining open banking and data enrichment, lenders can easily obtain credit scores from banking data. Financial firms can turn raw transactions into clear streams of information, offering customers new insights into their financial habits.

Making decisions based on enriched financial data can benefit various businesses, including accounting platforms, lenders, personal finance managers, and traditional financial institutions. As more consumers use open banking products and services, these capabilities will continue to grow and improve.

Data Enrichment Use Cases

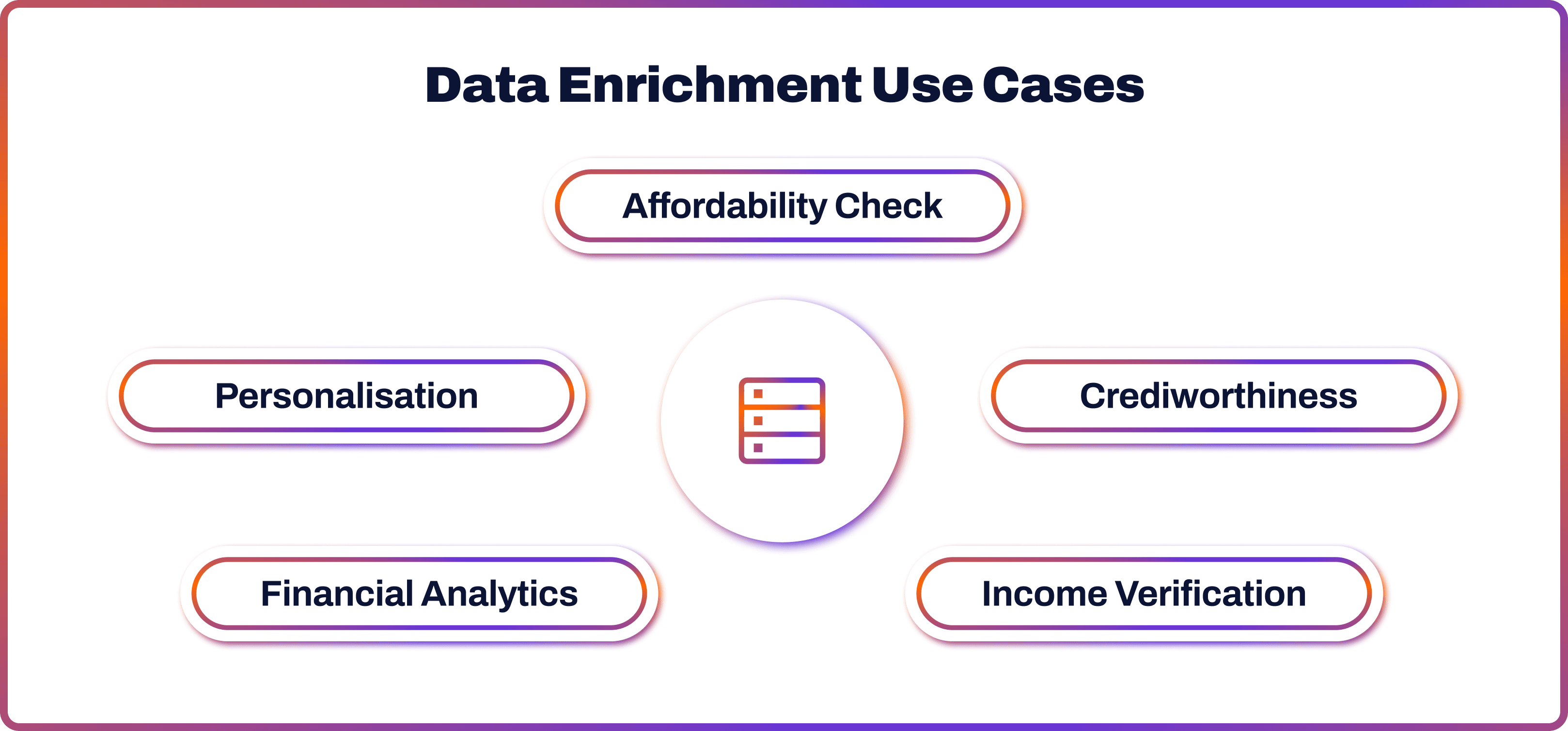

Below are some of the real-life use cases of fusing the open banking ecosystem with data enrichment. Each of them can be applied in numerous business sectors.

Affordability Check

For lenders in both consumer and business lending, understanding affordability is crucial. Assessing real affordability can be challenging with just a brief look at a borrower's financial situation. Data enrichment can enable lenders to review historical data, offering a detailed and precise view of affordability.

Creditworthiness

While affordability assesses if an applicant can manage a loan, creditworthiness evaluates the likelihood of repayment. Credit scores play a critical role in this decision. Yet, these scores overlook many people who are still working towards their financial health. Data enrichment gives lenders access to real-time insights, enabling them to make better-informed decisions.

Income Verification

Verifying income is central to the decision-making process in lending and renting. Traditionally, income verification has been time-consuming, relying on manually collecting payslips, tax returns and and account statements. This method requires significant time and resources and often results in unverifiable data prone to errors. However, combining data enrichment with open banking makes income verification instant, eliminating the need for piles of paper documents.

Financial Analytics

B2B data enrichment and open banking can enable businesses to predict their cash flow position based on prior balances and see balance trends across accounts. They can use further AI-based tools to analyse historical data and current market conditions. From predicting revenues to anticipating consumer behaviour, these tools have powerful implications when used in synergy.

Personalisation & Targeted Marketing

Open banking and data enrichment pave the way for customised products and services for consumers. By accessing enriched financial data, merchants can understand their financial habits more deeply, leading to personalised offerings.

For example, Noda’s Know Your Whale feature allows merchants to identify their next best-spending customers, be it gamers, frequent travellers or regular buyers in other categories. This data can be leveraged to provide improved recommendations, special offers and tailor marketing efforts, reaching out to those most likely to generate revenue.

Benefits of Data Enrichment in Open Banking

- Streamlined Decision-Making: By organising and enhancing data, enrichment processes enable quicker and better informed decision-making.

- Innovation: Insights from enriched data can inspire new products and services that target emerging customer needs and fill market voids.

- Customer Retention & Loyalty: Personalised services and products created through data enrichment can enhance customer satisfaction and encourage long-term client relationships.

- Cross-Selling Opportunities: With a better understanding of customer financial behaviours, companies can identify and offer additional, relevant products, increasing revenue per client.

- Predictive Analytics: Data enrichment enables analytics to forecast future financial trends. This helps in planning, risk management, and identifying new opportunities for both businesses and consumers.

- Customised Insights: Data enrichment turns raw open banking data into specific insights about customers' financial habits, enabling personalised product offerings that meet individual needs.

Open Banking with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting, and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment acceptance, or gain enriched data on your customers, Noda is your partner in growth.

FAQs

What does data cleaning mean for business growth?

Data cleaning means making data more accurate and reliable for businesses, which helps with better-informed decision-making and improved efficiency.

Is data cleaning important for businesses?

Yes, data cleaning is important for businesses. It ensures the quality of information and reduces errors. Data cleaning saves time and resources by avoiding the need to correct mistakes later.

Is data enrichment important for businesses?

Yes, data enrichment is important for businesses. It adds valuable insights to existing data, helps in creating personalised products and services, and improves customer understanding, which can drive innovation and competitive advantage.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each