The payments industry is undergoing a transformation. First, digital wallets took the sector by storm, surpassing credit and debit card usage worldwide. Now, new innovative payment methods, such as cryptocurrencies and Buy Now Pay Later (BNLP), are gaining momentum. What’s next, and where is the digital payment technology heading?

Here, we take a look at the key electronic payments industry forecasts, discovering future trends in consumer behaviour and growth.

What are Digital Payments?

In simple words, digital payments are transactions that are happening in the digital realm or online. They involve the transfer of money or digital currency between two parties. This can happen through digital wallets, apps, online platforms, credit and debit cards.

With the rise of e-commerce, digital payment innovation is essential for companies more than ever. They are not a luxury anymore, but a crucial prerequisite for building a successful business.

Digital Wallet Takeover

The ways people pay have evolved throughout history, from the first paper money introduced in China in 997 to the plastic cards in the 1960s and the invention of blockchain technology in 2008. In the 21st century, the digital payment revolution is taking the central stage.

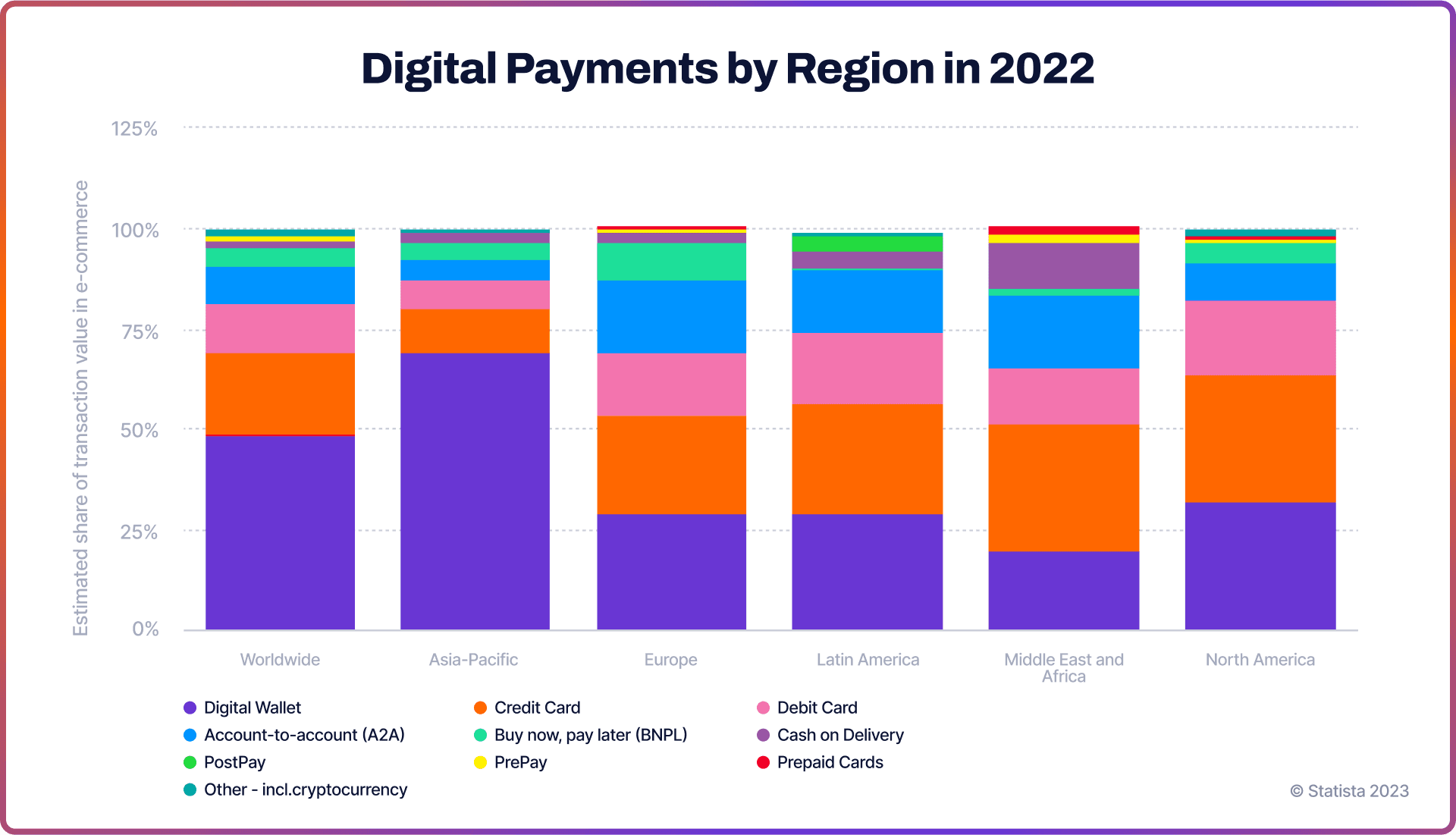

Digital wallets were the most used payment method worldwide in 2022, amounting to almost half of all e-commerce transactions, according to research by Statista. This digital payment trend is expected to accelerate in the future. A study from Juniper Research predicted that the total value of digital wallet transactions will surge from $9 trillion in 2023 to $16 trillion in 2028, amounting to 77% growth.

“This trend is driven by growth across both developed and developing markets, as the increased adoption of advanced services such as BNPL (Buy Now Pay Later), microloans, and personal financial management drive end-user engagement,” the study said.

Digital Payments by Country

- Asia-Pacific: The region has the strongest preference towards digital wallets worldwide, accounting for almost 70% of e-commerce payments in 2022. Notable brands like PhonePe in India and Alipay in China have become synonymous with digital transactions in the APAC region, according to Statista.

- Latin America: Digital wallets are poised for significant growth in Latin America, with Brazil leading the way. Platforms like Nubank and Mercado Pago from Argentina's e-commerce giant Mercado Libre are gaining traction.

- North America: The use of credit and debit cards still exceeds digital wallets in Northern America. Notable apps include PayPal and Venmo, Apple Pay and Google Pay.

- Europe: In Europe, too, credit and debit cards are still leading the way. Among popular digital wallets are Apple Pay, Google Pay and PayPal. Account-to-account (A2A) payments and BNLP are also quite significant in the region.

- Middle East and Africa: Credit cards are a dominant payment method, followed by digital wallets, A2A payments and debit cards. Cash on delivery is more common here than in other regions.

Digital Currencies

The rise of digital currencies is posed to be yet another macro trend in the future of the online payments industry, according to PwC research Payments 2025 & Beyond.

One vertical of this trend is Central Bank Digital Currencies (CBDC), which is the virtual form of the national currency. In the PwC survey, financial companies in Europe, the Middle East & Africa with more than $5bn in revenues cited CBDC-related disruptions among their top concerns. Meanwhile, according to the 2022 BIS survey, over 50% of the world’s central banks were conducting experiments or testing CBDC pilots, with the majority of work concentrated on retail CBDCs.

Another vertical is, of course, cryptocurrencies and blockchain technology. More businesses start accepting these digital coins as a payment method, and decentralised finance built on blockchain technology is getting traction too. Yet, cryptocurrencies are predicted to be a far smaller online payment market than CBDC-based transactions. According to Statista’s digital payment statistics, while crypto payments are expected to grow 17% annually until 2029, they will constitute to “less than one percent” of all e-commerce transactions.

Rise of Open Banking

Open banking practises are becoming increasingly adopted in Europe, Latin America and Asia Pacific regions. It is revolutionising the digital payments landscape by encouraging banks to share application programming interfaces (APIs) with third-party providers. The result is streamlined payments solutions and innovative financial products for consumers.

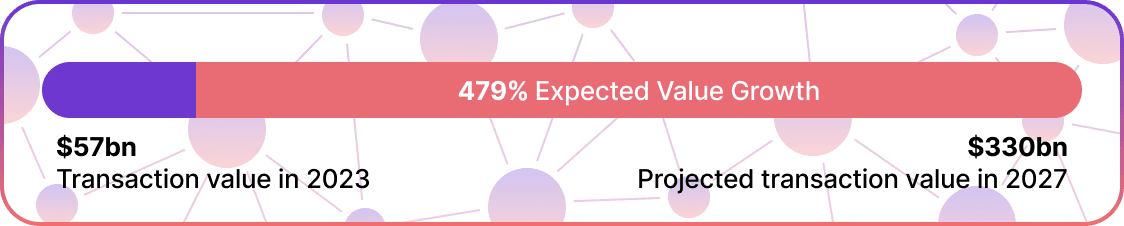

The trend is set to keep the momentum according to Juniper Research. The firm projected the total value of open banking transactions to increase from $56bn in 2023 to $330bn in 2027, a staggering growth rate of 479%.

According to another study conducted by Accenture in 2021, 76% of banks worldwide anticipate a customer adoption and usage surge of Open Banking APIs to increase by 50% or more between 2024 and 2026.

Financial Cybercrime

The shift to digital is not without its pitfalls. In 2020, amids the digitalisation brought about by the global pandemic, more than $1tn was lost due to cybercrime, according to a report by Sift. In 2023, the company found that account takeover attacks have risen by 354%, with fintechs hit especially hard.

The financial cybercrime was expected to be among the key macrotrends affecting payments industry’s future, according to PwC’s digital payments overview. “In our survey, security, compliance, and data-privacy risks and related issues were the top concern for banks, fintechs and asset managers in implementing a fully integrated technology strategy,” the research said.

Future of Digital Payments with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What is the country with the most digital payments?

According to the latest digital payments news, India was the country with the most digital payments in 2022. The country boasted 89.5 million digital transactions during the year, the data from MyGovIndia stated.

What are the key security features of digital payments?

Key security features of digital payments include encryption, tokenisation, two-factor authentication (2FA), biometric verification (such as fingerprints or facial recognition), and secure sockets layer (SSL) protocols. Additionally, anti-fraud algorithms and machine learning technologies are employed to detect and prevent suspicious activities and unauthorised transactions.

What are the most popular digital payment methods?

Digital wallets were the most used payment method worldwide in 2022, amounting to almost half of all e-commerce transactions, according to research by Statista. They were followed by credit and debit cards, and A2A transfers.

What are electronic payment systems?

Electronic payment systems facilitate the money transfer between two parties, such as a business and a customer, in the digital payments market. These systems cover various payment methods, including bank transfers, digital wallets, card and debit card transactions, and BNLP.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each