Digital payments are now the norm, making cash transactions obsolete. This change goes beyond being convenient; it shows how our digital environment is continuously growing.

The popularity of smartphones and online banking has led consumers to favour fast, secure, and personalised payment methods. Choices for cashless payments, including mobile wallets such as Apple Pay and Google Pay and account-to-account (A2A) payments enabled by open banking, continue to grow.

For businesses, a robust digital payment strategy is not just an option; it's essential. In this overview, we examine the key tactics merchants should consider and how a reliable payment provider can meet their needs.

What Is a Digital Payment Strategy?

A digital payment strategy is a plan for businesses to manage and facilitate electronic transactions efficiently. The strategy may include choosing appropriate payment platforms, integrating specific technology and adapting to the latest trends. An efficient digital payment strategy aims to enhance customer experience, increase transaction speed, and strengthen security.

Payment Processor & Payment Gateway

Businesses often use third-party payment processors and gateways to streamline transactions. A payment processor usually manages the transfer of funds from the customer’s account to the merchant’s wallet, ensuring smooth communication between their respective banks.

Meanwhile, a digital payment gateway is like a card reader in a retail store but online. It serves as a middleman, transferring payment data from the customer to the merchant.

The same service providers typically offer payment processing, gateway and other digital payment products. These service providers, like Noda, may also extend their services beyond the electronic payment process to reporting and analytics, assisting with security and compliance, and providing customer support.

Key Digital Payment Strategies

Let’s examine the six digital payment strategies merchants should consider when developing their approach. Each tactic should not be used in isolation but combined with other strategies tailored to achieve unique business goals.

Payment Methods

Electronic payments are now the status quo, replacing cash transactions. To stay current, merchants should offer a versatile range of payment methods to meet the needs of modern consumers. Among the most popular choices are digital wallets, accounting for 49% of all transactions in 2022. Alternative payment methods such as cryptocurrencies and Buy Now Pay Later (BNLP) are gaining momentum, too.

Open Banking Payments

Open banking, propelled by the EU's PSD2 regulation, mandated banks to share customer data with authorised fintech firms using application programming interfaces (APIs). This secure data sharing enables direct A2A payments, also known as "pay-by-bank."

As a digital payment strategy example, A2A offer a myriad of benefits: instant transfer of funds and seamless user experience (UX), just to name a few. Users bypass the need to manually input lengthy payment details, as open banking payment flow guides them between their online banking app and the payment gateway via app-to-app redirection. This process improves the customer experience and ensures merchants receive funds quickly.

Intuitive UX

Have you ever removed an app because it was too complicated? According to a PWC study, 32% of people would stop using a favourite brand after just one bad experience, expecting a seamless journey throughout.

Prioritising UX is vital for companies, including at the checkout process. Forrester Research discovered that a smooth UX design could boost conversion rates by up to 400%. Companies must ensure their payment gateways provide intuitive UX and straightforward payment processes to avoid cart abandonment.

Payment Security

With the shift to digital, cybercrime is on the rise, especially since the Covid-19 pandemic accelerated worldwide digital adoption. Cybercrime, including phishing, pharming, whaling, chargeback fraud, card testing, and identity theft, now poses a major threat to businesses globally.

Security must be a top priority in any digital payment strategy. Essential tools for merchants involve encryption, tokenisation, multi-factor authentication (MFA), biometric scans, anti-fraud monitoring, and routine audits. Adhering to PSD2 and PCI DSS standards is also crucial for compliance and safety.

Mobile Optimisation

The increasing use of smartphones is driving the rise in mobile payments. Since the introduction of the first iPhone in 2007, the number of smartphone users globally has reached 4.88 billion, covering more than 60.42% of the world's population.

In 2016, mobile traffic overtook desktop for the first time, signalling a major shift in the payment landscape. Nowadays, the majority of consumers use smartphones for online access, including activities such as online shopping. This means an efficient digital payment strategy must be optimised for mobile, whether it’s for browser-based checkout or in-app payments.

Data Analytics

Companies can use data to improve their payment strategy. Open banking, for example, allows for the secure sharing of customer data through APIs, personalising interactions and improving user experience. Access to this data helps businesses gain insights into customers' financial habits and preferences, allowing for tailored payment journeys.

Future of Digital Payments

The use of e-payments is rapidly increasing, and this trend is expected to continue. Research and Markets forecast a 16% annual growth rate in digital payments from 2023 to 2026. By 2026, it's estimated that the total number of non-cash transactions globally will almost double.

The growth of e-commerce makes digital payment innovation crucial for businesses today. Ignoring online payment options is not an option. Choosing a dependable provider is vital to leverage this trend.

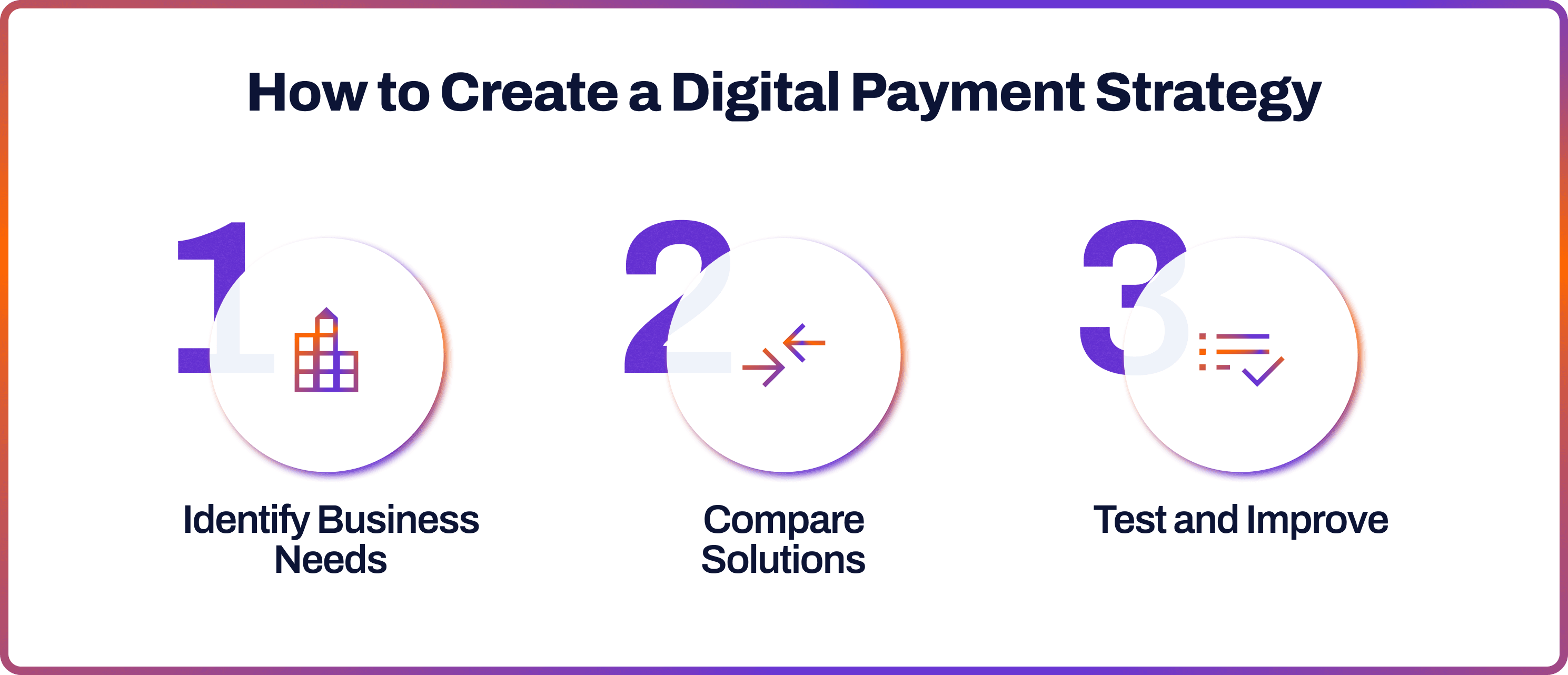

How to Create a Digital Payment Strategy

Step 1: Identify Your Needs

When devising a payment strategy, it’s crucial to assess your needs to tailor digital payments to your business model. For example, you can start by reviewing the following factors:

- Sales volume

- Average digital payments transaction value

- Payment channels

- Desired countries and currencies

- Desired payment methods

It’s essential to conduct research on your target market and their preferred payment options. Some demographics may choose traditional payment methods, like bank cards, while others may prefer innovative payment methods, like BNLP and digital wallets.

Step 2: Compare Payment Solutions

After determining your needs, review different payment systems and service providers that fit the brief. Make sure to check reviews, especially from businesses of the same type. Evaluate their product suite, pricing, integration capabilities and security standards. Ensure it’s a PCI DSS-compliant provider.

Step 3: Test and Improve

Once you've selected a list of providers that fit your business needs, reach out to their sales teams and try their services. Some payment companies may provide a trial period. Look for ease of use in the user experience and the level of customer support offered. Leverage payments data analytics and review your strategy regularly to make sure it’s optimised to consumer needs.

Instant Payments & Open Banking with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What are the main factors to consider when creating a digital payment strategy?

When creating a digital payment strategy, it's important to assess your payment needs, including sales volume, average transaction value, payment channels, desired countries and currencies, and preferred payment methods. Additionally, understanding your target market's preferred payment options is crucial.

How do you increase digital payments?

To boost digital payments, offer a variety of payment methods to meet modern consumer needs, optimise for mobile transactions, and ensure a smooth user experience. Leveraging data analytics to understand customer preferences and tailoring your payment journey can also increase digital payment adoption.

How do digital payments work?

Digital payments work by transferring funds electronically from a payer to a payee. This process often involves third-party payment processors and gateways that facilitate the movement of funds and ensure the secure exchange of information.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each