As the e-commerce sector grows, cybercriminals increasingly target digital payments. With more online transactions, hackers are stepping up their attempts to break through security defences.

Now more than ever, having robust payment security in e-commerce is essential. Here, we will cover the key features that help e-commerce businesses to protect their payments.

Cybercrime in E-Commerce

E-commerce cybercrime data reveals significant security risks for businesses. The MRC 2023 Global E-commerce Payments and Fraud report underlined the ongoing challenge of tackling these issues.

Nearly half of the merchants surveyed (46%) considered cutting down on fraud and chargebacks as their primary goal. Additionally, reducing operational costs associated with fraud became the main focus for 18% of merchants, a slight increase from 17% the previous year.

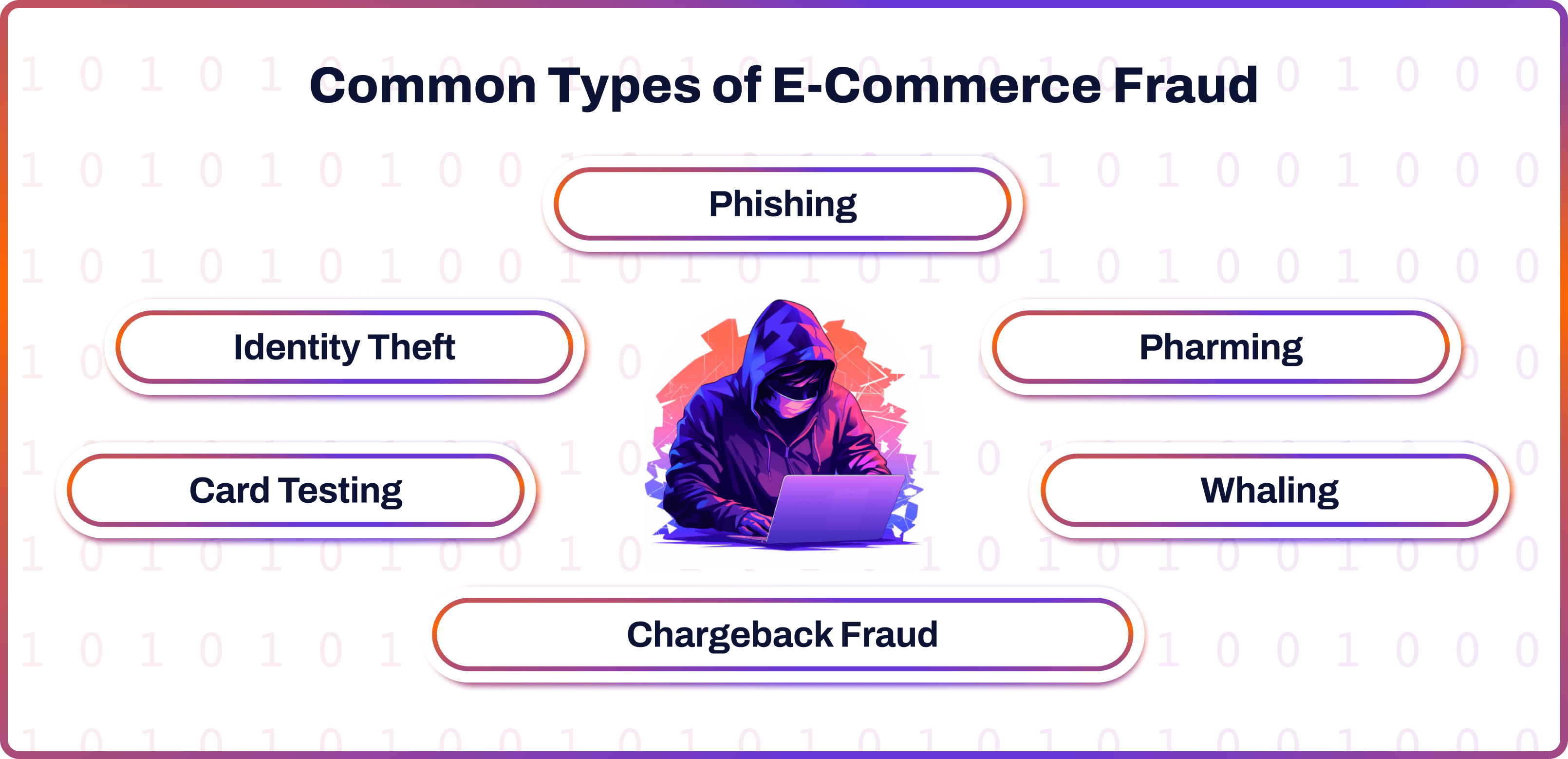

Common Types of E-Commerce Fraud

The report identified the most common types of e-commerce fraud, which stayed consistent over the past three years.

- Phishing: Involves tricking individuals into revealing personal information, like passwords or credit card numbers, through deceptive emails or websites.

- Pharming: A more technical scam that redirects users from legitimate to fraudulent websites to steal information.

- Whaling: Targets high-profile individuals, like company executives, to steal sensitive corporate information.

The MRC report revealed a notable rise in phishing, pharming, and whaling attacks for e-commerce businesses worldwide. Now, 43% of merchants reported falling victim to these frauds, an increase from 35% in the previous year. Other types of fraud included:

- Chargeback Fraud: Often referred to as ‘friendly fraud’, it’s when customers falsely dispute charges while retaining the goods. According to the report, 34% of merchants experienced this in 2023.

- Card Testing: This occurs when criminals use stolen card details to make small purchases on e-commerce websites. 33% of the merchants reported this type of fraud in 2023.

- Identity Theft: This type of fraud involves criminals stealing personal information to make unauthorised transactions or open accounts in someone else's name. 33% of the merchants reported this type of fraud, according to the report.

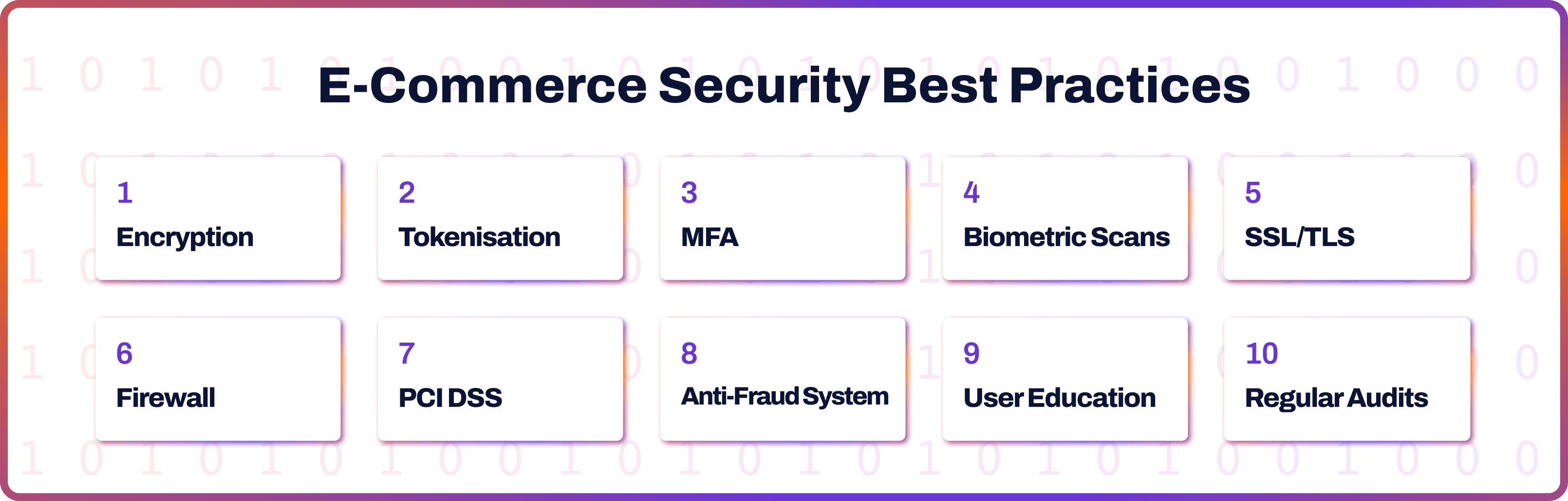

E-Commerce Security Best Practices

Secure e-commerce payments need essential functions like encryption, data protection, strong authentication and more. Let’s take a look at these tools in more detail.

Encryption

Encryption turns data into a coded format that can be decoded only with a specific key, ensuring only authorised individuals can access the information. Using algorithms, it changes readable data into a secure format to prevent cybercriminals from understanding it. Payment gateways use this method for website payment security to protect financial information during transactions.

Tokenisation

Tokenisation enhances online payment security by substituting sensitive details, such as card numbers, with a unique symbol or "token." This way, intercepted data is useless to hackers, safeguarding actual payment details. Unlike encryption, tokenisation doesn't allow for the original data to be recreated from the token, offering an extra layer of security.

Multi-Factor Authentication (MFA)

Multi-factor authentication (MFA) increases the security of e-commerce payments by requiring additional verification steps. Users must provide two or more verification types: knowledge (like a password), possession (such as a phone), and inherence (biometric data). In Europe, MFA is a legal requirement mandated by PSD2 in the form of Strong Customer Authentication (SCA).

Biometric Scans

Biometric scans are the next stage of the verification technology. They employ unique physical features such as fingerprints, voice, retina scans or facial recognition to verify a user’s identity. They are an extremely useful online transaction security tool, especially for defence against impersonation fraud.

SSL/ TLS

The Secure Sockets Layer (SSL) / Transport Layer Security (TLS) protocols use encryption to ensure online data privacy. These protocols are vital e-commerce security measures, as they safeguard customer information by encoding it, making it indecipherable to potential thieves. Without SSL/TLS, sensitive information like credit card details could be easily intercepted by cybercriminals.

Firewall

A firewall serves as a mechanism to guard network traffic. It inspects data coming in and going out based on specific security criteria. A firewall acts as a protective layer that keeps internal networks safe from external threats, blocking unauthorised access by cybercriminals.

PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) outlines security measures for businesses' handling of card information. It aims to secure the processing, storage, and transmission of card data, preventing fraud and data breaches.

Compliance with PCI DSS is crucial for e-commerce payment gateways, ensuring they have strong protections for cardholder information. It's vital to choose a provider that meets these standards.

Anti-Fraud System

An anti-fraud is an online payment protection system tool that monitors transactions in real time to spot and stop fraud. Payment providers often employ these payment security solutions. They evaluate multiple elements, like transaction size, card details, and IP address, using specific rules and algorithms. To improve detection accuracy, many of these systems use artificial intelligence (AI) and machine learning (ML) technology.

User Education

Educated users are the first line of defence. E-commerce companies can offer informational articles, tutorials and videos about cybersecurity on their websites. They can send newsletters or post on social media about safe online shopping and common scams. This would empower individuals to recognise and avoid cyberattacks.

Regular Security Audits

Companies should regularly review their security policies, user access controls, and data protection practices. This includes ensuring compliance with PCI DSS, the effectiveness of anti-fraud systems, and evaluating the integrity of encryption. Companies can also conduct vulnerability scans and tests to mitigate weaknesses. Regularly updating and patching software and training employees is also crucial.

Open Banking & Security for E-Commerce

Open banking emerged as an innovative trend in the world of payments. Previously, traditional banks held a monopoly over financial data. The new paradigm required the banks to share data with licensed fintech companies with customer permission. They do so securely via the application programming interfaces (API).

The data sharing was legally enforced in Europe in 2018 by the PSD2 regulation. In the payments landscape, open banking made account-to-account (A2A) payments faster and more efficient, as customers don’t need to enter card details manually.

Open banking payments can be a great solution for e-commerce security. They are designed to be safe, leveraging stringent standards like strong customer authentication and data protection laws. Plus, they are more secure than screen scrapping as the data is shared via APIs rather than from sharing login credentials with third parties.

Secure E-Commerce Payments with Noda

Secure e-commerce payments are crucial to protect both businesses and consumers. With cybercriminals increasingly targeting digital transactions, robust security measures help ensure payments remain safe.

Noda is a worldwide payment and open banking provider for instant business transactions. We offer a secure payment getaway, ensuring PCI DSS compliance, encryption and fraud prevention.

Noda operates in the EU and Canada, supporting a wide range of currencies for globally-minded clients. We offer partnerships for companies of all types and sizes, with scalable plans to fuel your business growth and meet your needs.

FAQs

How do you make secure payments online?

To make secure payments online, you can use encryption and secure payment gateways that comply with PCI DSS standards. You can utilise MFA and choose payment systems with fraud protection.

How do you secure your e-commerce website?

To ensure security for your e-commerce website, you can implement SSL/TLS encryption, enforce strong passwords, regularly update software, and comply with PCI DSS. Employ firewalls and conduct regular audits.

How do you make your e-commerce transaction secure?

You can make e-commerce transactions secure by choosing payment providers that offer encryption, tokenisation, and fraud detection systems. Ensure your e-commerce site security and educate customers on secure online shopping practices.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each