E-commerce, also known as electronic commerce, is the process of buying and selling goods and services online. It provides a digital marketplace where consumers can conveniently shop from their homes, offices, or while on the move. The continuous progress in technology and the widespread availability of the Internet have revolutionised business operations and changed how people shop.

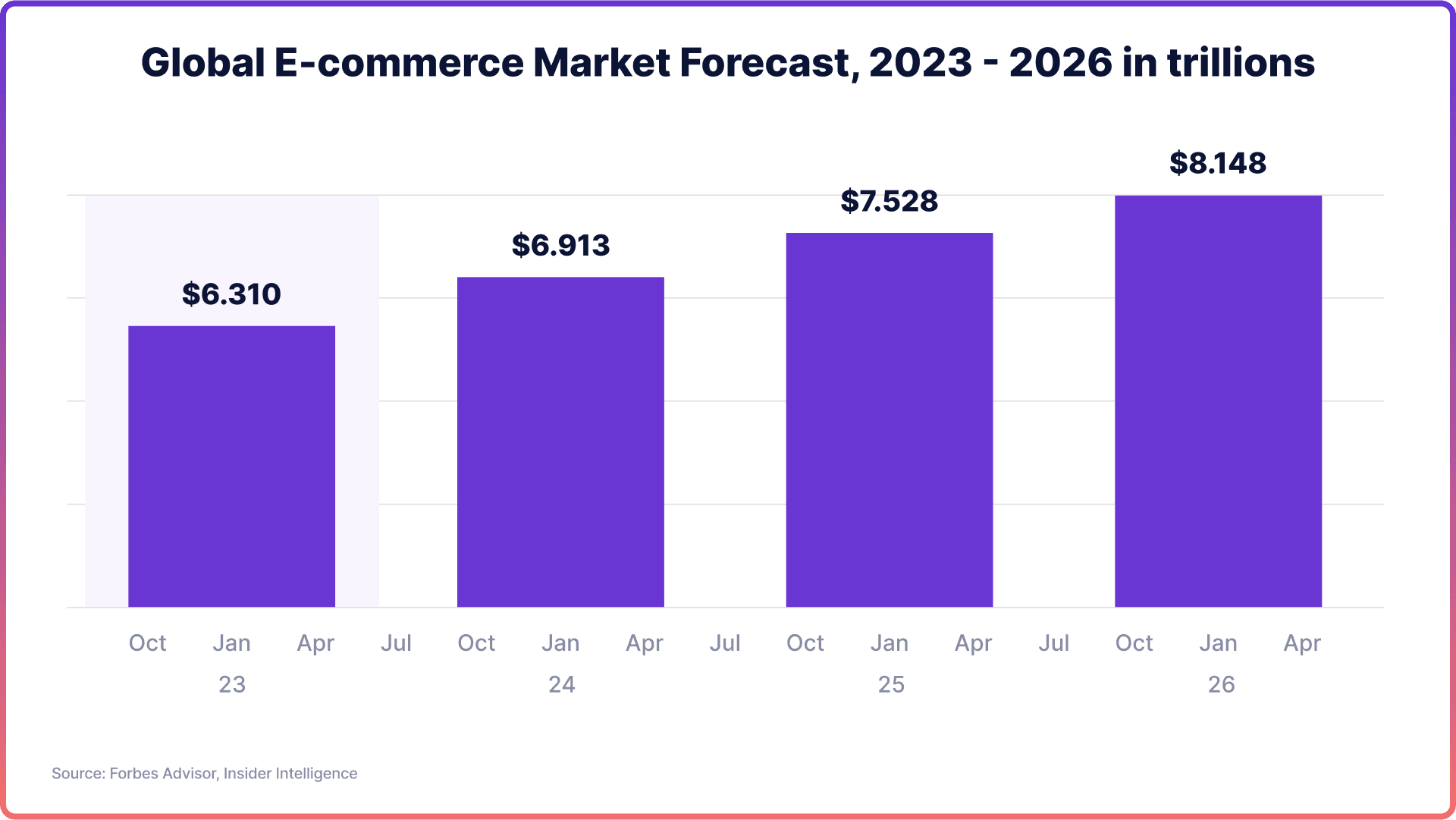

The e-commerce market has been growing rapidly in the last decade and is expected to accelerate further. According to data from Forbers Advisor, 20.8% of global retail purchases are forecast to take place online in 2023, with the market amounting to $6.3 trillion. By 2026, it’s expected to grow to $8.1 trillion with 24% of retail purchases happening online.

The move towards online shopping is not just a passing trend, but rather a radical change in how consumers behave. The convenience, wide range of options, and often competitive prices found on online platforms make e-commerce an enticing choice for both businesses and shoppers.

E-commerce Payment Methods

In the ever-expanding world of online shopping, understanding the diverse e-commerce payment solutions is crucial. These payment methods encompass the various ways in which customers can conveniently pay for goods and services while shopping online, catering to the different needs and preferences of online shoppers.

- Credit and Debit Cards: These remain the most common forms of online payment. They are widely accepted and offer convenience for both businesses and consumers.

- Digital Wallets: These are electronic devices or online services that allow individuals to make electronic transactions. Examples include Apple Pay and Google Wallet.

- Mobile Payments: Payments are made through mobile devices, often through a specific payment app.

- Buy Now, Pay Later (BNPL) Options: These services allow customers to purchase items immediately but defer the payment to a later date, often in instalments. Examples include Afterpay and Klarna.

- Cryptocurrency: Digital or virtual currencies that use cryptography for security, such as Bitcoin.

When choosing an e-commerce payment platform or provider as a business, it’s essential to check what payment methods they cover and whether it’s suitable for your target demographics. In the UK, for example, debit cards and digital wallets were the most popular online payment methods in 2023.

How Does an E-commerce Payment Work?

Although the ecommerce payment process may appear simple to customers, there is a complex system at work behind the scenes. Multiple entities are working seamlessly to ensure secure and efficient transactions.

- Payment Gateway: This software application serves as a secure intermediary between the online shop and the payment processor. It ensures that customer payment data is safely captured and transferred. It functions similarly to a physical point-of-sale terminal in a brick-and-mortar store.

- Payment Processor: This is a company that handles the transaction process on behalf of the buyer and seller. It plays a crucial role in verifying payment details, detecting fraud, and facilitating the transfer of funds between both parties' bank accounts. To authorise and settle payments, the payment processor communicates with the merchant's bank (merchant account) and the customer's bank (issuing bank).

- Merchant Account: This is a specialised bank account that enables businesses to accept payments, specifically credit and debit card transactions. When a transaction is approved, the funds are first deposited into the merchant account and then transferred to the business's main bank account.

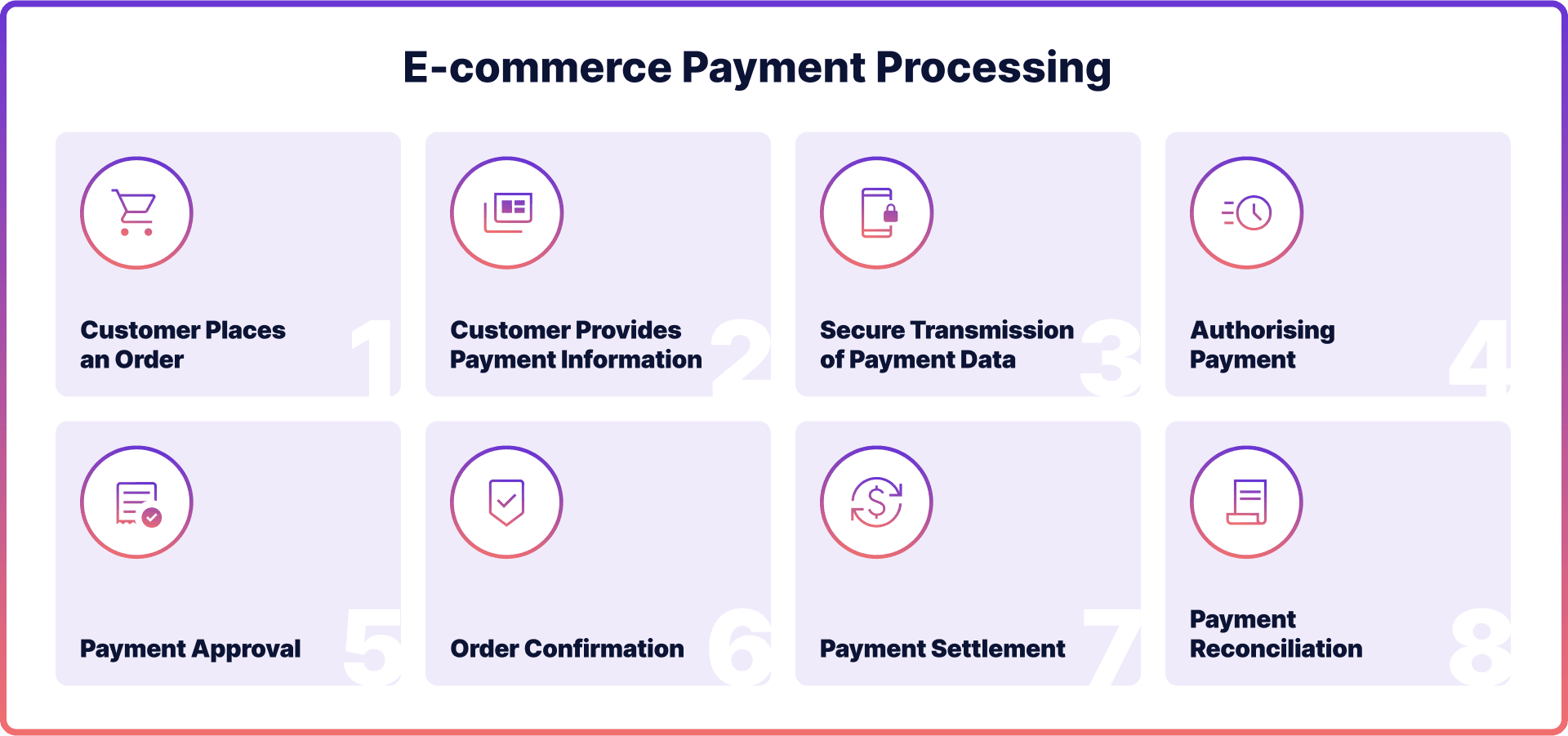

E-commerce Payment Processing

The process of e-commerce payment processing involves a structured series of steps.

- Customer Places an Order

The journey starts when a customer chooses the products or services they want, adds them to their cart, and decides to proceed with the purchase.

- Customer Provides Payment Information

During the checkout process, customers will be prompted to enter their payment details, such as credit card or debit card information. This data is entered into a secure interface provided by the payment gateway.

- Secure Transmission of Payment Data

To ensure the security of payment information, the payment gateway employs encryption techniques. This means that sensitive data, such as credit card numbers, is transformed into an unreadable format to protect it from potential hackers.

- Authorising Payment

Once your information is encrypted for e-commerce payment security, it is sent to the payment processor. The payment processor then reaches out to your bank or credit card issuer to confirm that the necessary funds are available and that the payment details provided are correct.

- Payment Approval

Once the payment details have been verified and it is confirmed that there are sufficient funds, the payment processor will send an approval message back to the payment gateway.

- Order Confirmation

Once the customer's order has been approved, the online store will send a confirmation e-mail or display a confirmation message on their website to confirm the order.

- Payment Settlement

Once the funds are approved, they are transferred from the customer's bank account to the merchant's bank account. The length of this process can vary, typically taking anywhere from a few hours up to a couple of days, depending on factors such as the chosen payment method and parties involved.

- Payment Reconciliation

Lastly, the online store verifies that the payment received matches the order amount, ensuring accurate financial record-keeping. This step is essential to maintain precise financial records.

Online Payments with Noda

Elevate your business with Noda’s online payments and open banking services. Drive increased sales and save valuable time through streamlined processes. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide e-commerce payment provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Unlock your business potential with Noda - your payments are our priority.

Final Thoughts

The world of online shopping is rapidly changing, thanks to advancements in technology and shifts in consumer behaviour. For businesses to successfully navigate different types of payment systems in e-commerce, it's crucial that they understand their complexities. From grasping the fundamentals of online selling to choosing trusted e-commerce payment services, companies must arm themselves with the right knowledge to provide smooth and secure transactions.

FAQs

What is a payment gateway in e-commerce?

In e-commerce, a payment gateway is a software application that safely collects and transfers payment information from an online store to the payment processor. This helps facilitate secure and seamless transactions on the website. When choosing a payment gateway solution for an e-commerce business, companies should conduct thorough research on their security methods and compliance.

What are alternative payment methods in e-commerce?

There are various alternative e-commerce website payment options available for businesses. These include digital wallets such as Apple Pay and Google Wallet, mobile payments, BNLP options like Afterpay and Klarna, as well as cryptocurrencies like Bitcoin.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each