Open banking has revolutionised the financial industry by enabling third-party developers to create applications and services around financial institutions. Open banking uses application programming interfaces (APIs), to grant account holders a wide array of options, from open data to private data. This network fosters increased accessibility and transparency in the realm of finance.

While the new paradigm challenges traditional banking and improves customer experience, open banking still faces numerous barriers such as under-developed regulation and security concerns. What is the future of open banking, and what are the latest adoption rate projections?

Origins of Open Banking

Europe, often referred to as the “cradle” of the open-banking market, saw the concept originate with its implementation of the Revised Payment Service Directive (PSD2) in 2016. This directive required banks to share their customer data with authorised third parties.

Over time, technology advanced, and APIs became the standard for seamless data sharing in the financial ecosystem, especially in Europe and the UK, which has played a significant role in driving the adoption and regulation of open banking alongside Europe. The UK has integrated European PSD2 and created the Open Banking Implementation Entity (OBIE), an open banking initiative that required nine of the UK’s biggest banks to share their data.

According to the June 2022 Open Banking Impact Report, the adoption of open banking in the UK has increased to an estimated 10-11% of digitally-enabled consumers. This shows significant growth from March 2021 when the percentage stood at 6-7%.

Many countries have followed Europe’s regulatory-driven approach. Europe, as the primary region for Open Banking, led by the UK, is projected to maintain dominance in transaction numbers for several years. Following Europe, the Asia-Pacific region also demonstrates some adoption of Open Banking, albeit with a significant difference in adoption rates between the two regions.

Four Scenarios for Open Banking Future

Evaluating how open banking trends may develop in future, consultancy firm Kearney forecasted four possible scenarios, extending from minor changes to a complete transformation of the landscape.

- Business as usual: In this scenario, banks maintain their dominant position by utilising their extensive resources and customer base to stave off competition from fintech companies.

- New normal: This scenario predicts a disruptive shift where fintech take the lead while banks assume the role of open banking infrastructure providers.

- Shared market: In this scenario, Kearney foresees a more balanced outcome, with both banks and fintechs coexisting and sharing the market space.

- Back to the past: This scenario forecasts a regression that occurs within open banking as traditional banking practices regain prominence.

The trajectory that the industry will take towards any of these scenarios remains to be seen. However, it is unequivocally clear that the forces of regulatory governance and customer adoption will serve as the compass, guiding the evolution of the global open banking strategy.

Regulation to Shape the Future

Regulation will play a vital role in shaping the rollout of open banking around the world and the future of financial services. In Europe, the PSD2 regulatory framework and Australia's Consumer Data Right (CDR) have been crucial in guiding the financial industry into sharing of data.

In the latest open banking news, the European Commission put forward the Third Payment Services Directive (PSD3) to advance open banking in June 2023. This directive has multiple aims: improving security and consumer protection, fostering innovation and competition, standardising regulations across Europe, and endorsing sustainable payment methods like instant payments and digital currencies. Before implementation, PSD3 must gain approval from both the European Parliament and the Council of the EU.

In the US, the Consumer Financial Protection Bureau (CFPB), which empowers individuals by facilitating data access, is developing regulations. These aim to promote competition, remove barriers, and safeguard financial privacy. Supported by authority granted by Congress in 2010, the CFPB plans to present proposals in 2023 and finalise rules by 2024. CFPB director Rohit Chopra stressed the importance of avoiding excessive control and leveraging established market standards to establish a unified open banking system.

In other regions, regulations are also being developed. In late 2022, The Central Bank of Saudi Arabia (SAMA) launched a new open banking lab. This lab aims to provide a technical testing environment for the development of upcoming open banking services scheduled for launch in the first quarter of 2023.

In contrast, other nations like Singapore are adopting an industry-led approach. The Monetary Authority of Singapore (MAS) has introduced the API Exchange (APIX), a global platform that promotes open banking and supports cross-border financial innovation. Launched in 2018, APIX acts as a bridge between financial institutions and fintech firms by facilitating collaborations through APIs.

Rising Consumer Demand

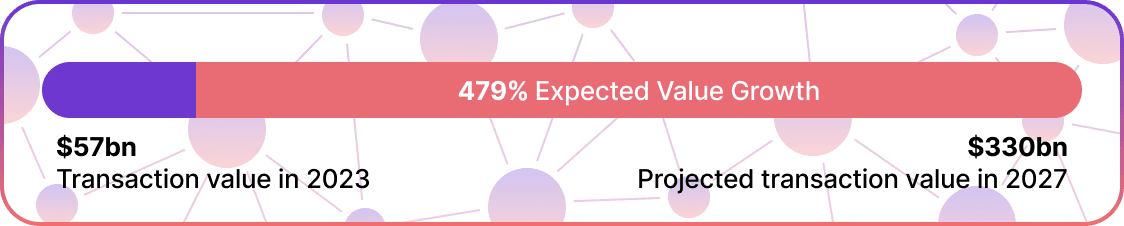

Consumer interest in open banking is set to surge in the coming years. According to open banking statistics by Juniper Research, a remarkable spike in the total value of transactions is expected.

The firm projects an increase from $57 billion in 2023 to an impressive $330 billion by 2027 in open banking transactions —a staggering growth rate of 479%.

According to another study conducted by Accenture in 2021, 76% of banks worldwide anticipate a customer adoption and usage surge of Open Banking APIs to increase by 50% or more between 2024 and 2026.

The rise in consumer demand for open banking can be attributed to various factors. Firstly, open banking provides a more personalised and convenient banking experience by integrating different financial services into a single platform. This enables consumers to efficiently manage their finances.

Secondly, open banking fosters competition among financial service providers, resulting in improved products and services for consumers. It facilitates the emergence of new business models and services like peer-to-peer lending and financial management apps, which offer added value to consumers.

Security to Remain Key Concern

There are numerous benefits of open banking, but it also raises concerns about data security and privacy.

Why may open banking pose these concerns? When financial data is shared with multiple parties, the risk of data breaches and fraud inevitably increases. Therefore, ensuring strong security measures and building trust among consumers are critical for the future of the open banking technology.

Banks and fintech companies must take advantage of advanced security technologies and practices, such as encryption, multi-factor authentication, and secure APIs. These measures aim to safeguard customer data effectively.

The issue of security holds particular relevance within the realm of open banking due to the sensitive nature of financial data. Fraud emerges as a critical topic that warrants further discussion, considering open banking's potential to significantly mitigate it in comparison to traditional card-based systems.

Final Thoughts

Open banking solutions have the potential to revolutionise the financial services industry. It aims to drive innovation, improve customer experience, and foster healthy competition. Open banking promotes financial inclusion that the industry has never seen before.

Yet achieving a fully functional ecosystem comes with its fair share of challenges. These include navigating regulatory hurdles, addressing security concerns, and prioritising consumer education.

Collaboration among banks, fintech, regulators, and other stakeholders will play a crucial role in unlocking the full potential of open banking opportunities as we move forward. The future of open banking holds immense promise and witnessing its unfolding is truly exciting.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each