Key takeaways:

|

To stay competitive in the digital era, businesses must prioritise their payment processing systems and strategies. The global digital payments industry is extensive, with a projected total transaction value of $9.46 trillion by 2023, as reported by Statista. By 2027, this figure is expected to reach an impressive $14.78 trillion.

This emphasises the significance for businesses of all sizes to have effective and dependable payment solutions. In this article, we will explore how to select a merchant service provider that can best meet your business requirements.

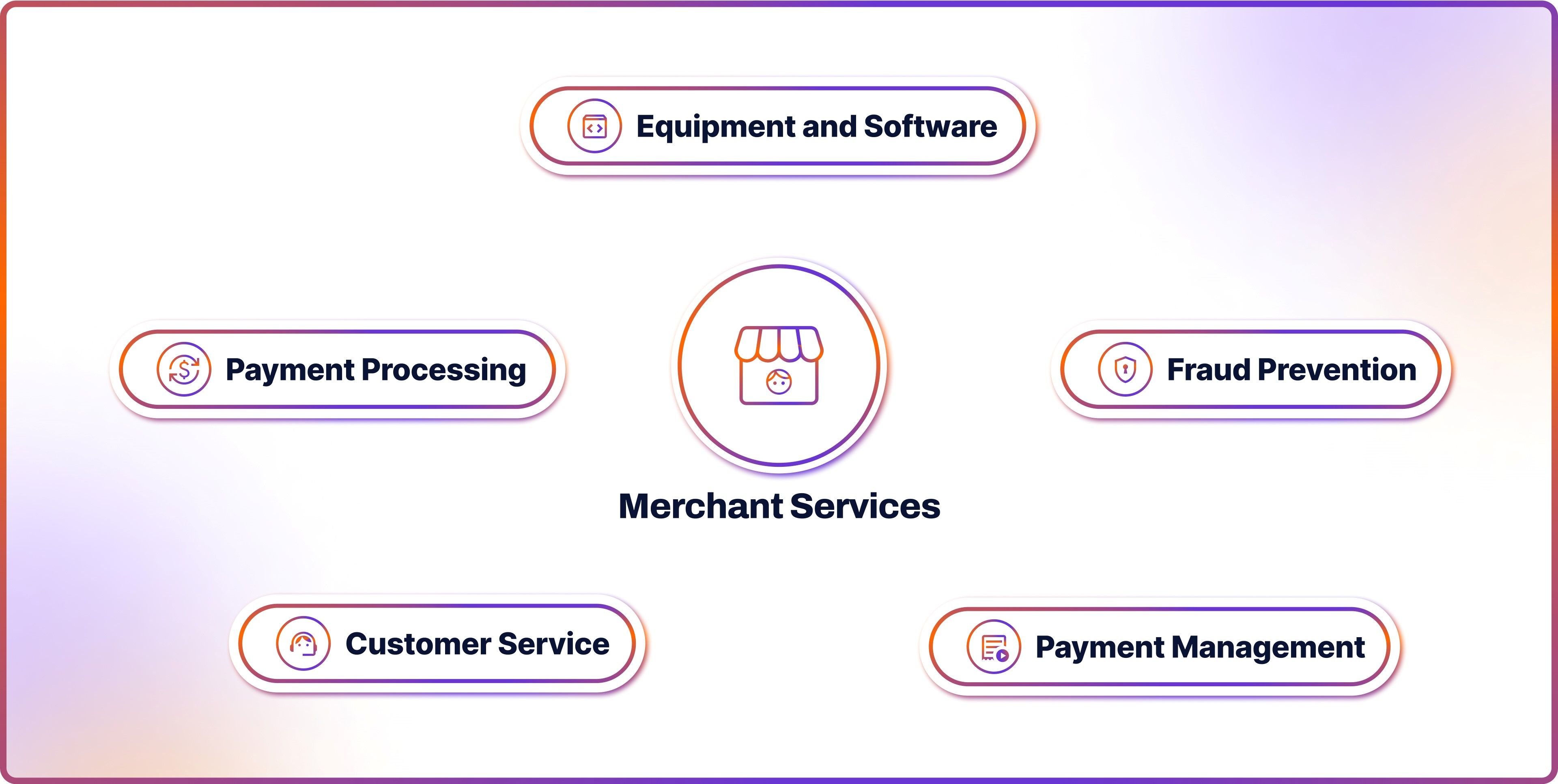

What are Merchant Services?

Merchant services encompass a variety of financial solutions that facilitate businesses in accepting and processing electronic payments. This includes handling credit and debit card transactions and facilitating online and mobile payments.

Online merchant service providers typically would handle transactions, implement fraud prevention measures, and provide customer support. They also offer equipment and software like point-of-sale (POS) systems and card readers to help businesses effectively process various payment methods.

What is a Merchant Service Provider?

A secure merchant service provider acts as an intermediary between businesses, customers and financial institutions, ensuring payments are processed securely and efficiently. Modern providers offer integrated solutions that cover merchant accounts, payment gateways, reporting, fraud tools and APIs for seamless integration. Security and compliance are fundamental aspects of these services, with leading providers adhering to PCI DSS, GDPR and PSD2 regulations and employing fraud prevention measures such as encryption and tokenisation.

These services also help reduce chargebacks, improve authorisation rates and provide detailed reporting that supports better business decisions. Whether you operate online, in-store or through mobile apps, the right provider will tailor its services to fit your business model.

Online merchant service providers deliver customised solutions designed to support the specific needs of different types of businesses. For instance, retail businesses often require integrated point of sale systems that combine payment processing with inventory tracking and customer loyalty programmes.

Software as a Service companies and subscription-based businesses typically depend on recurring billing systems and virtual terminals, which allow for automated payment collection, invoice management and the secure handling of stored customer payment information.

Businesses in higher risk sectors such as travel or gaming need advanced fraud prevention tools, chargeback handling, and identity verification measures like Know Your Customer and Anti Money Laundering compliance to mitigate operational risk. Across all these industries, merchant service providers also offer payment gateways, support for multiple currencies, analytics tools and customer service to help ensure reliable performance and adherence to PCI and other regulatory standards.

Merchant Account Providers vs Payment Service Providers

A common point of confusion is the difference between merchant processing account providers and payment service providers. While both enable businesses to accept electronic payments, they serve different needs.

Feature | Merchant Account Provider | Payment Service Provider (PSP) |

| Account Type | Dedicated merchant account | Shared aggregated account |

| Onboarding | Thorough vetting, risk assessment | Rapid onboarding, minimal checks |

| Fee Structure | Lower fees for high volume | Flat fees, higher at scale |

| Customisation | Bespoke solutions, greater flexibility | Standardised, off-the-shelf |

| Best Suited For | High-volume or high-risk, enterprise | Start-ups, SMEs, eCommerce |

Merchant accounts are generally favoured by established or higher-risk businesses that process large volumes or require greater customisation. Payment service providers, by contrast, are popular with start-ups and small businesses due to faster onboarding and simplicity, though they typically come with higher costs and fewer bespoke options.

What To Consider Before Choosing A Merchant Service Provider

The first step in selecting the right provider is understanding your business’s payment requirements. Consider whether you need support for online, mobile or in-person transactions, and think carefully about the payment methods your customers prefer, whether cards, bank transfers, mobile wallets or open banking. It is also important to reflect on whether your business model involves recurring payments or cross-border sales.

Cost is another critical factor. While transaction fees often take centre stage, it is essential to look at the total cost of ownership, including merchant discount rates, interchange fees, monthly charges, set-up costs, fraud management fees and any additional charges for compliance or currency conversion. Transparent pricing with no hidden fees will protect your margins and support long-term growth.

Compliance and security should never be compromised. Your chosen provider must have a proven track record in handling regulatory obligations, protecting sensitive data and mitigating risks such as fraud and chargebacks. Strong security features and adherence to regulatory standards provide not just protection but peace of mind.

Integration with your existing systems should also be seamless. Whether you use specific eCommerce platforms, accounting software or customer management tools, your payment processing should complement these technologies to streamline your operations. The ease of integration will impact not only operational efficiency but also the customer experience.

Reporting and analytics capabilities can deliver significant value, providing insights into customer behaviour, transaction trends and sales performance. The ability to monitor and analyse this data helps inform better strategic decisions and refine your business processes for improved outcomes.

Scalability is a key consideration, particularly for businesses with growth ambitions. A good provider will support your expansion into new markets, handle increased transaction volumes and adapt to evolving payment technologies, offering the flexibility required as your business evolves.

Before making a final decision, testing the services through demos or trial periods can reveal important details about ease of use, platform stability, transaction speed and the quality of customer support.

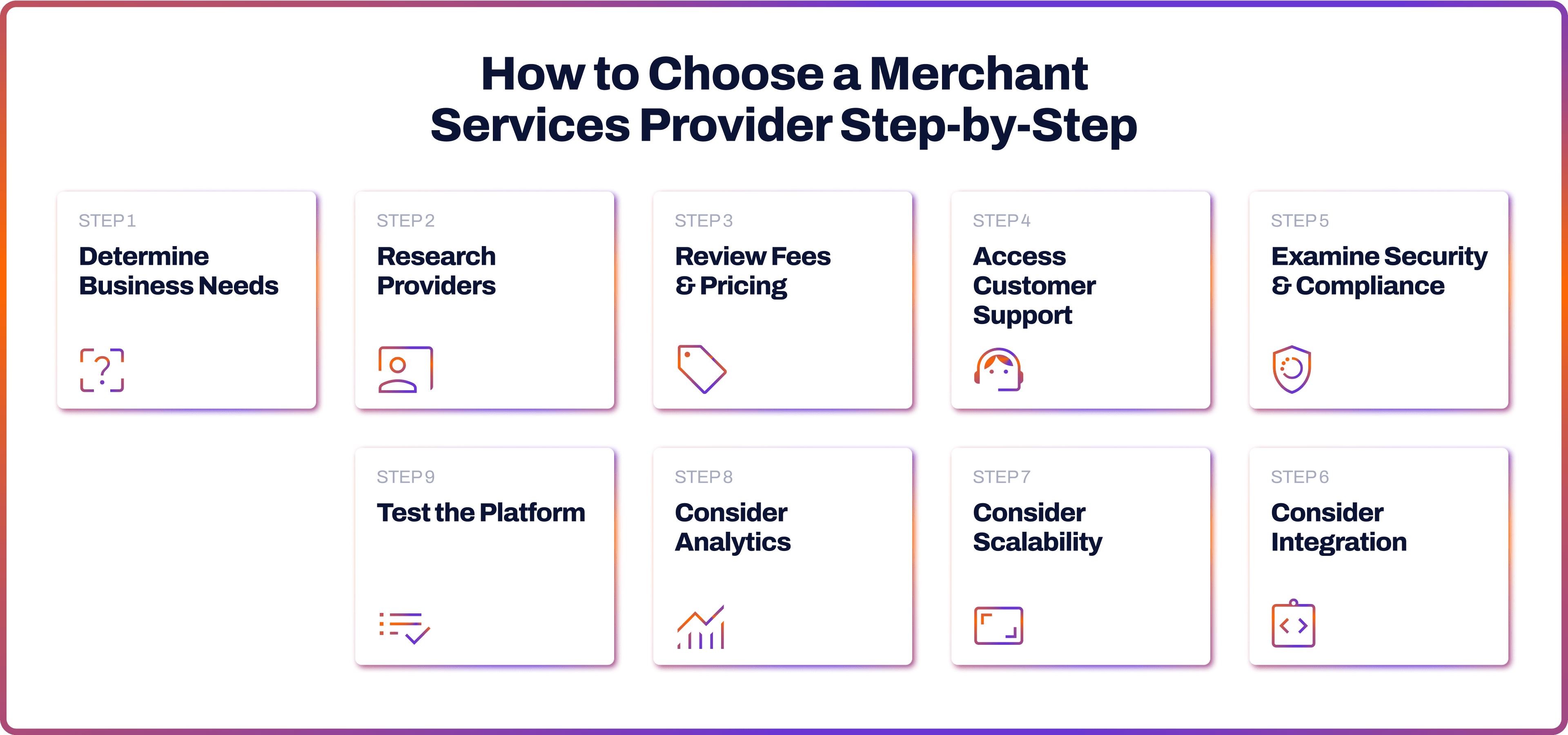

How to Choose a Merchant Services Provider in Step-by-Step

Step 1: Determine Business Needs

- Estimate your monthly transaction volume and average order value to guide pricing suitability.

- Define your key payment channels: in-store, mobile, e-commerce, or recurring billing.

- Decide on the payment methods that you will need for your e-commerce business.

Step 2: Research Providers

- Check third-party reviews and feedback from businesses similar to yours.

- Prioritise providers experienced in your specific industry or risk category.

Step 3: Review Fees & Pricing

- Compare all charges: transaction fees, monthly costs, set-up fees, equipment hire, and compliance costs.

- Look for clear, transparent pricing with no hidden charges.

Step 4: Access Customer Support

- Confirm if customer service is available during your operating hours and if they are available within your country and able to communicate in the language used by your business.

- Look for 24/7 support, live chat, or a dedicated account manager.

Step 5: Examine Security & Compliance

- Ensure PCI DSS compliance and robust fraud tools like encryption, tokenisation, and 3D Secure.

- Check for features like chargeback protection, KYC, and AML processes if operating in high-risk sectors.

Step 6: Test the Platform

- Request a demo or trial to evaluate ease of use, payment speed, and reliability.

- Use the trial to observe how well support teams respond to real issues.

Step 7: Consider Analytics

- Look for reporting tools that include real-time dashboards, refund tracking, and exportable transaction data.

- Make sure the analytics suit your business model, whether retail, SaaS, or subscription.

Step 8: Consider Scalability

- Ensure support for international expansion, multiple currencies, and onboarding of new sales channels.

- Ask whether the platform can adapt to increasing volume and new verticals.

Step 9: Consider Integration

- Confirm compatibility with platforms like Shopify, WooCommerce, accounting tools, and CRM systems.

- Look for available APIs, plugins, and developer support resources.

Online Payments for Modern Businesses with Noda

Noda offers a comprehensive solution for modern businesses looking to streamline payment processing. Our platform offers open banking solutions, underpinned by cutting-edge technology and a deep understanding of compliance. From secure transaction processing and fraud protection to AI-powered financial analytics and customer-friendly verification tools, Noda is designed to support businesses in growing with confidence.

Why Choose Noda as a Merchant Service Provider?

1. Broad connectivity

Connect to over 2,000 banks across more than 28 countries in Europe and beyond through a single integration.

2. Extremely low transaction fees

Fees start from just 0.1% per transaction, a fraction of typical card charges. Pass these savings on to your customers or increase your profit margins.

3. Instant account-to-account settlement

Receive funds within seconds instead of days. There are no card networks or processing delays, just fast and secure payouts through open banking technology.

4. Plug and play integration

Get started within minutes using plugins for WooCommerce, Magento, Prestashop and OpenCart, or use our flexible API for a custom integration experience.

5. No code payment tools

Generate payment links and QR codes instantly. Accept bank payments both online and in person without needing a developer.

6. Personalised support

Benefit from a dedicated account manager who understands your market, ensures a seamless onboarding process and provides responsive, expert support.

Ready to get started? Book your demo with Noda today.

FAQs

How do I create a merchant account with Noda?

First, you should be onboarded with Noda. Simply fill out the form, and our sales team will contact you shortly. During the onboarding, you will have the option to request Noda’s merchant account. Noda’s support team will be there to help you setting up.

Do I need a merchant service provider?

You'll need a reliable merchant service provider if your business wants to accept electronic payments, like credit and debit card transactions. They'll handle the secure and efficient processing of payments, which is important for improving customer convenience and possibly boosting sales.

Why does a business need merchant services?

Businesses rely on merchant services to ensure secure and efficient electronic payment transactions. They enable the acceptance of various payment options, such as credit cards, debit cards, and digital wallets.

What should I look for in a merchant service provider?

Look for providers that prioritise security and comply with industry standards. You'll also want to find one with transparent and reasonable fee structures and reliable customer support. Integration capabilities with your existing systems and scalability to accommodate business growth are also key considerations. Additionally, take into account their reputation for providing secure, efficient payment processing solutions by checking reviews from other users.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each