In the ever-evolving world of Software as a Service (SaaS), businesses rely heavily on recurring revenue streams, often facilitated through subscription models. The success of these models hinges on a seamless and dependable payment processing mechanism. Selecting the right SaaS billing software is not simply a procedural choice but a strategic one that guarantees consistent cash flow and heightened customer satisfaction.

What is SaaS Payment Processing?

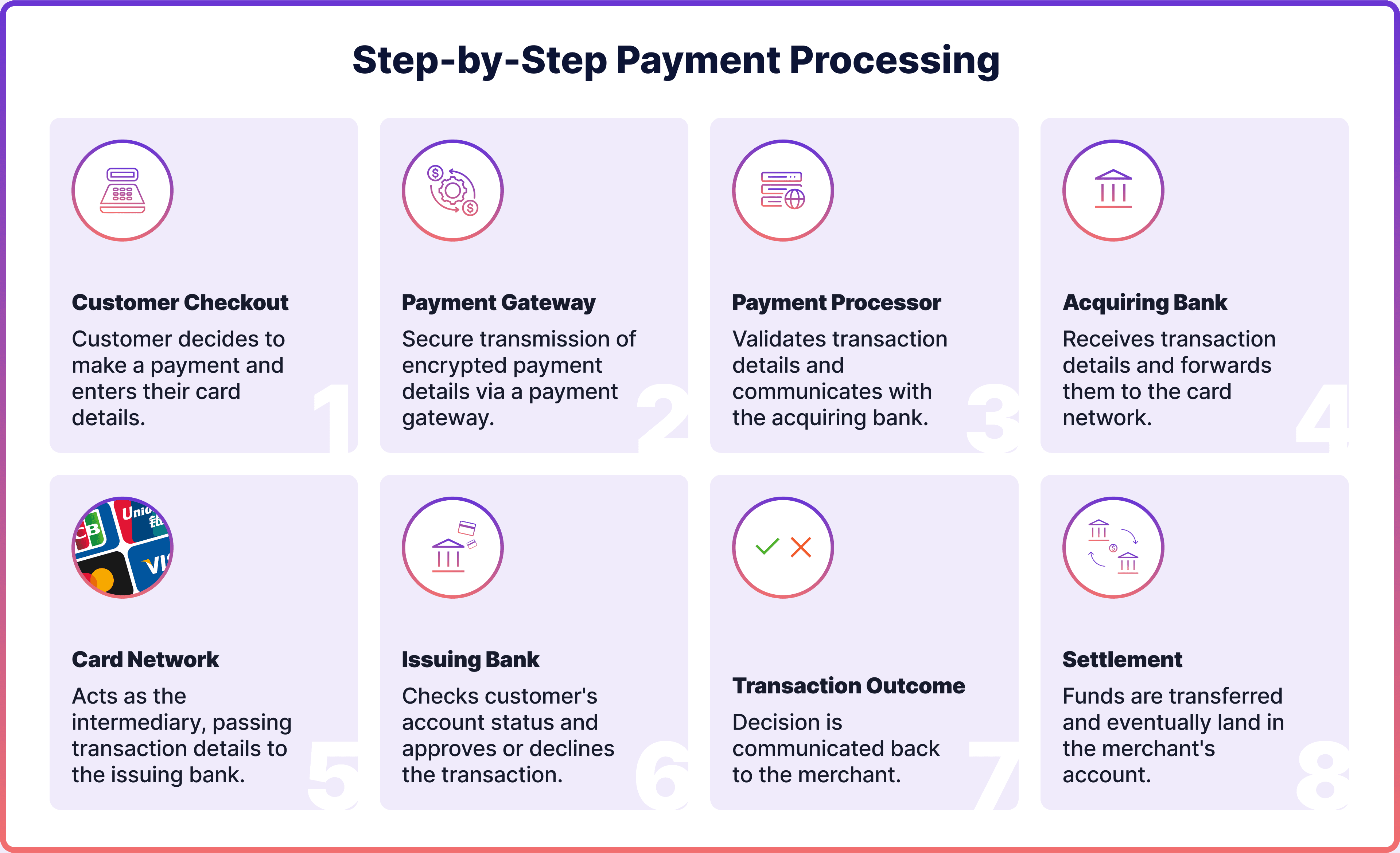

Payment processing is essential for enabling transactions between customers and businesses. It involves several steps, ranging from the initiation of a payment to its ultimate settlement in the business's bank account. However, the SaaS landscape introduces added complexity to this process due to its recurring revenue model.

How do SaaS Payments Work?

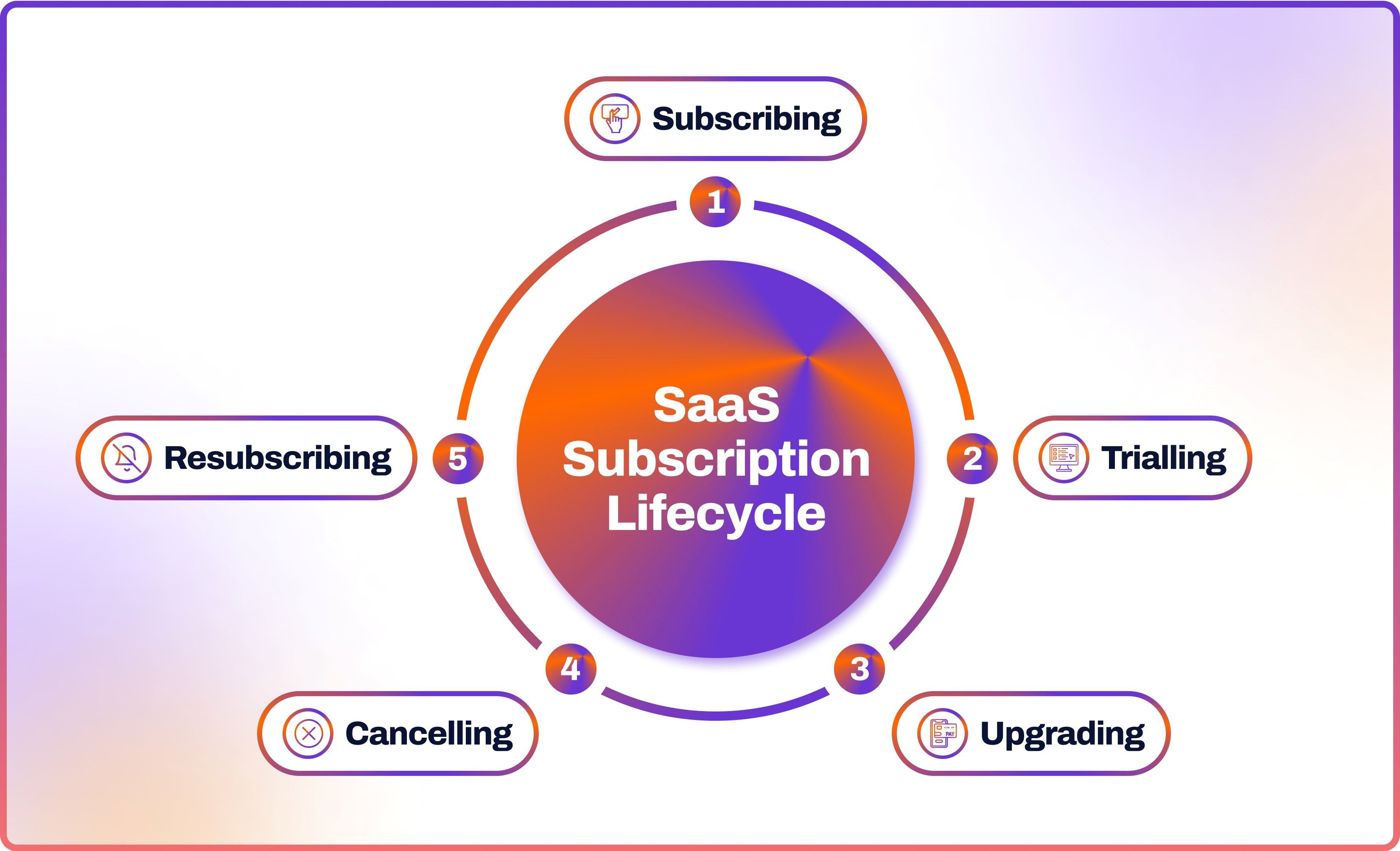

SaaS businesses rely on subscription cycles, meaning that customers are billed regularly, either monthly, quarterly, or annually. This recurring revenue structure is a defining factor in the understanding of the SaaS industry. Managing these subscription cycles involves intricacies such as ensuring timely payments and handling payment failures to maintain the predictability of revenue.

Having a reliable SaaS payments solution (not to be confused with a SaaS payment gateway) goes beyond just enabling SaaS transactions. It involves effectively managing the entire customer subscription lifecycle. This means ensuring that payments are consistently collected on time and addressing failed SaaS payments in a way that minimises customer churn. Additionally, it may offer valuable analytics to monitor and optimise the payment processes, resulting in a steady and predictable stream of revenue.

SaaS Payment Processor vs. SaaS Payment Gateway

A payment gateway is a technology that helps merchants and customers securely process online transactions. It serves as a bridge, transmitting payment information from the customer to the payment processor.

Within the SaaS ecosystem, both payment gateway and payment processor play important and interconnected roles. However, they have distinct functions. A payment gateway for SaaS primarily focuses on authorising and securing transactions, ensuring that payment details are transmitted securely between all parties involved.

In contrast, a payment processor or payment provider offers a wider array of services. Along with handling transaction authorisations like a gateway, it takes care of the complete payment lifecycle. This involves establishing payment schedules for recurring billing for SaaS, managing subscription cycles, handling chargebacks and refunds, and providing analytics and reporting functionalities to track payment performance.

SaaS Challenges in Payment Processing

Implementing a smooth payment processing system in a SaaS environment can be filled with various challenges. These obstacles have the potential to greatly affect the revenue cycle and customer satisfaction if not handled effectively. Let's explore some common issues and their consequences.

Invoicing and Billing

In the SaaS model, invoicing and billing are ongoing tasks that require precision and promptness. The difficulty lies in generating precise invoices that accurately reflect usage, discounts, and any additional fees. Additionally, the billing system must be capable of accommodating various billing cycles, prorations, and plan changes, which can quickly become intricate.

Limited Payment Methods

Customers around the world have different payment preferences. Offering a limited selection of payment options can discourage potential customers and even lead to losing existing ones. It is essential for SaaS platforms to provide a range of payment methods, such as credit cards, digital wallets, and bank transfers, in order to accommodate a wider audience.

Security

When dealing with sensitive financial information, it is imperative to prioritise strong security measures. The risk of data breaches and fraudulent activities looms constantly, necessitating strict adherence to security standards such as PCI-DSS and the utilisation of advanced encryption techniques. These precautions are vital in establishing trust and protecting against potential harm to finances and reputation.

Customer Churn

When payments fail due to expired credit cards or insufficient funds, it can lead to involuntary churn. An effective payment processing system should be equipped to handle these situations with grace, either by attempting retries or promptly notifying customers to update their payment information.

Lack of Integration

A fragmented payment processing system that lacks integration with other business tools can result in operational inefficiencies and inconsistencies in data. It is crucial to have seamless integration between the SaaS payment provider, accounting software, and CRM in order to streamline operations and maintain a unified view of customer data.

How to Choose a SaaS Payment Provider

When looking for a reliable SaaS payment system, it is important to find the solution that best suits your business. This will not only ensure seamless financial operations but also enhance the overall customer experience.

Here are some key features to consider during your search for the ultimate SaaS payment platform.

- Security: The payment platform should have robust security measures in place to protect sensitive customer data and prevent fraudulent activities.

- Customer Experience: Look for a user-friendly interface that enables customers to easily manage their subscriptions, view their billing history, and make payments seamlessly.

- Streamlined Billing: Automating billing cycles ensures invoices are generated accurately and delivered on time. Ideally, the provider would have flexible billing options that accommodate various pricing models and discount structures.

- Accounting and Reconciliation: Consider integration with accounting systems, which would automate the reconciliation process. It would update financial records in real-time to accurately reflect payments, refunds, and chargebacks.

- Seamless Integration: Integration with your existing infrastructure outside accounting is important too. Consider integration with your CRM systems and other business tools.

- Security and Fraud Prevention: Prioritise security for your customers by choosing platforms that adhere to industry-standard security protocols such as PCI-DSS and have implemented advanced mechanisms to detect and prevent unauthorised transactions.

- Scaling Options: Consider a payment solution that can handle your business growth seamlessly, ensuring smooth operations even with a high volume of transactions. Other features to consider include support for international transactions, offering multi-currency and multi-language capabilities to cater to a global customer base.

- Analytics and Reporting: Robust reporting tools that allow you to analyse important financial metrics such as revenue and churn rate can be beneficial. With real-time analytics, you can closely monitor payment performance and customer behaviour for timely decision-making.

- Pricing: The fee structure should be clear and transparent, with no hidden charges. Look for a platform that offers competitive pricing while also considering your business's budgetary constraints.

SaaS Payments with Noda

Elevate your SaaS business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. We offer instant payments, branded payment links, financial analytics, valuable user insights and much more. Our platform uses cutting-edge AI and machine-learning technologies.

FAQs

What are the benefits of SaaS payment processing?

Payment processing for SaaS enables smooth transactions in subscription-based models, guaranteeing a consistent income stream for businesses. It automates billing cycles, handles various payment methods, and efficiently manages subscription modifications. Additionally, it can offer valuable analytics to track payment performance, contributing to revenue optimisation and improving customer satisfaction.

How do you choose a SaaS payment provider?

When selecting a payment provider for your SaaS, it's important to consider a few key features. First, look for a provider that offers efficient billing processes, ensuring smooth and timely transactions. Security and fraud protection are also crucial aspects to prioritise, as you want to safeguard both your business and your customers' sensitive information. Integration with your existing infrastructure is another factor to consider, as seamless compatibility will make management easier. Additionally, make sure the payment provider supports a variety of payment methods to accommodate different customer preferences. Assess the quality of their customer support services and verify if they offer robust reporting and analytics capabilities, allowing you to gain insights into transaction data effectively. Furthermore, scalability is vital in choosing a reliable provider. Ensure they have solutions that can grow alongside your business needs without complications.

What is SaaS billing?

SaaS billing is the practice of charging customers for the services they receive on a regular basis, such as monthly, quarterly, or annually, in a SaaS business model. It involves managing subscription cycles, handling various pricing levels, and ensuring prompt payment collection. Efficient SaaS billing systems automate these tasks, provide transparent communication to customers about their billing status, and seamlessly integrate with other business tools for smooth operations.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know