Open banking has taken travel payments by storm and offers many applications in the sector. From payment facilitation to enriched data analytics, open banking has the potential to be a powerful tool for travel companies of all sizes.

Here, we examine how to choose the best open banking provider for a travel business, including the key benefits and factors to consider.

What Is Open Banking?

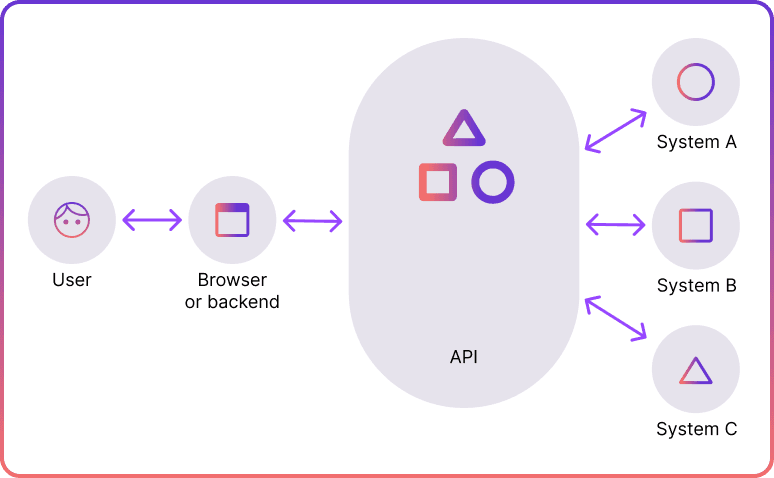

Open banking, under the EU's PSD2 regulation, requires banks to share customer data with authorised fintech firms. Previously, banks held a monopoly over customer data. The process is strictly regulated and needs explicit permission from customers to share their information.

Open banking relies on Application Programming Interfaces (APIs) for different software systems to communicate. Banks securely exchange data using APIs. This approach has sparked financial innovation, resulting in better products and a more seamless user experience.

A2A Payments

A major feature of open banking is account-to-account (A2A) payments, also known as "pay-by-bank." Open banking providers would need a Payment Initiation Service Provider (PISP) license to enable A2A payments under PSD2.

With A2A, customers can authorise payments directly through their bank, avoiding the need to enter lengthy payment information manually. The open banking process would guide users from their online banking app to the merchant’s site via app-to-app redirection. This leads to improved UX and immediate access to funds for the sellers.

Data Tools

Previously, bringing various bank accounts into one platform used screen scraping, a practice which posed security risks. Open banking solved this issue by requiring the use of APIs, increasing both security and ease of use.

In Europe, licensed Account Information Service Providers (AISPs) can consolidate information from various accounts into one place using APIs. Redirecting users between apps enhances the UX while ensuring data security. AISPs offer services from basic data collection to advanced data analytics, providing valuable customer insights and verification tools.

How Open Banking Can Help Travel Businesses

The travel sector is highly competitive. To succeed, companies need a robust digital presence. According to the Hilton’s Trends Global Survey, 80% of global travellers surveyed feel it’s essential to be able to book their trips entirely online, with 86% of Millennials and 83% of Gen Zers leading the charge. Therefore, travel businesses with a global focus need fast and convenient online cross-border payments supporting various currencies and payment options.

Meanwhile, many travel merchants struggle with payment issues, such as expensive card fees, slow settlements, delayed refunds, and inconvenient payment processes. Open banking platforms offer a range of solutions to these challenges.

Cutting Costs

Open banking payments providers offer lower transaction fees, a critical advantage as the travel industry recovers from the coronavirus impact. Traditional travel-related payment methods no longer offer the same savings potential. A2A payments through open banking bypass expensive card fees by directly transferring money from the consumer's bank to the merchant's account quickly.

Instant Settlement

Slow settlements are a well-known issue for travel merchants. Conventional payment methods, such as cards and BACS, can take up to three days to clear, affecting cash flow. Furthermore, travel merchants frequently experience longer settlement periods due to card processors holding larger rolling reserves.

In contrast, A2A payments are deposited into merchants’ accounts almost instantly. This allows travel businesses to accurately track their cash flow in real-time and improve their reconciliation processes.

Higher Conversions

In the modern, fast-paced world, speed is crucial. Customers want immediate results, and any delay or problem in their experience can drive them to a competitor. According to the Hilton’s survey, 76% of global travellers said they look for travel apps that reduce the friction and stress of travel, and this applies to the payment journey, too.

Open banking simplifies the payment UX by eliminating steps such as manually entering card details. Payments are made securely through their banking app or online banking with just a few clicks, removing cart abandonment.

Personalisation

Open banking provides access to extensive data, allowing travel companies to study customer habits and understand their preferences better. With AISP insights, they can offer more customised products and services. Analysing this data helps travel merchants create experiences that match specific customer needs.

How to Choose an Open Banking Provider for a Travel Business

Let’s take a look at the key factors and steps to consider when choosing an open banking service provider as a travel merchant.

Determine Your Needs

When selecting an open banking solution for a travel business, it is crucial to determine your specific needs. For example, do you need AISP or PISP services? Do you want to integrate A2A payments or enrich data analytics? It’s also key to evaluate the budget you are willing to spend.

Research Potential Providers

Begin with trusted sources for suggestions and check online reviews. Create a list of possible providers, then assess their reputation and experience in helping businesses like yours. It's crucial to pick a provider with a proven track record in your field.

Review Fees & Pricing

Providers might charge different fees, like transaction, monthly, setup fees, and equipment rental costs. It's important to assess and compare these to find the provider that offers the most cost-effective and clear pricing for your travel company.

Access Customer Support

Reliable customer support is essential for solving payment issues promptly and reducing disruptions in your travel operations. Choose an open banking provider known for excellent customer service.

Examine Security & Compliance

Security of payments and compliance with regulators should always come as the first priority. Some of the key tools to watch out for are encryption, tokenisation, anti-fraud systems, real-time transaction monitoring and multi-factor authentication. In terms of compliance, PSD2 and PCI DSS are the two benchmarks to keep in mind.

Consider Reporting & Analytics Tools

Some open banking software for a travel business may offer data analytics and reporting tools. At Noda, for example, we offer AI-driven financial analytics. These tools provide valuable insights into your sales performance, customer behaviour, and payment trends.

Consider Scalability

New travel business owners should look for a provider that can easily accommodate their startup's growth and evolution. This is crucial for maintaining smooth operations as the business expands. At Noda, for example, we provide scalable plans to fuel business growth.

Test and Trial

When choosing an open banking provider often, it may be worth testing their services beforehand. A demo or trial period lets you evaluate the platform's functionality, ease of use, and reliability. Pay attention to how user-friendly it is, how quickly transactions are processed, and note any problems you encounter during this test phase.

Key Benefits of Open Banking for Travel

- Reduced Transaction Fees: Open banking enables direct A2A transfers, avoiding high card processing fees and helping travel businesses save on costs.

- Faster Payment Processing: Open banking enables real-time transactions, improving cash flow and financial management for travel operators.

- Better UX: Open banking streamlines the checkout process, offering a quicker and more secure way for customers to pay without manually entering card details.

- Data-Driven Insights: AISP providers can offer travel businesses valuable insights into customer spending habits, enabling more targeted and personalised services.

- Strong Security: Open banking uses APIs for data sharing, which is more secure than the screen-scrapping practice. In Europe, open banking is highly secure and is regulated by PSD2.

Open Banking Payments with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What are the main advantages of open baking for travel business?

Open banking offers travel businesses reduced transaction fees by allowing direct A2A transfers and faster payment processing. It also improves user experience and provides data-driven insights for personalised services.

What are the key factors to consider when choosing an open banking provider for your travel company?

When selecting an open banking provider, consider their service range (AISP or PISP), fees, customer support quality, security measures, compliance with regulations, and the scalability of their services. Evaluating their experience and reputation in the travel sector is crucial.

What problems is open banking solving for travel?

Open banking addresses high card fees, slow settlements, delayed refunds, and cumbersome payment processes for travel companies, making transactions more cost-effective, quick, and user-friendly.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each