Open banking has the power to revolutionise how we manage our money – but is it safe and what are the potential dangers?

What do consumers and businesses need to know about open banking in order to make a judgement as to whether it will be beneficial to them?

Here we look at how companies are using open banking data, the risks that need to be considered, and what is being done to increase security standards.

What is open banking?

Let’s start with an overview. Open banking involves consumers and businesses giving regulated third-party providers access to their payment account data.

This can enable them to look after – and move – money easily, whether the aim is to send payments, build up savings, or manage it more effectively.

The concept of open banking is made possible by what is known as an API, which stands for application programming interface.

An API is a set of rules that enable software applications to communicate with each other so that data can be shared within and across organisations.

For example, when a customer wants to make a purchase online, they’ll be prompted to choose how this transaction will be completed. This relies on APIs to happen.

Benefits of open banking

The open banking regulations that have been introduced over the past decade have increased levels of competition across the industry – and that’s good news for everyone.

It means that not only are such organisations more transparent in their offerings, but consumers can manage their money in far more flexible ways.

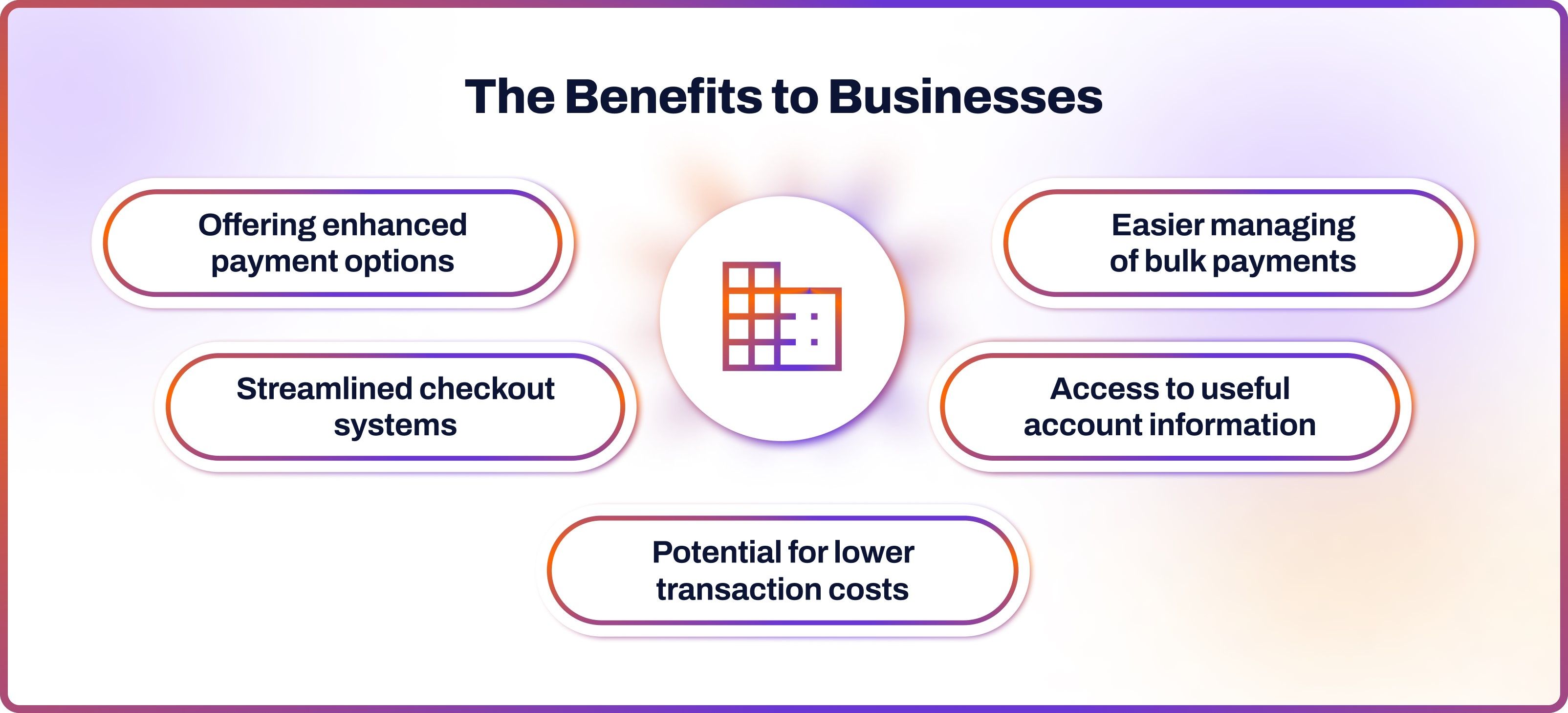

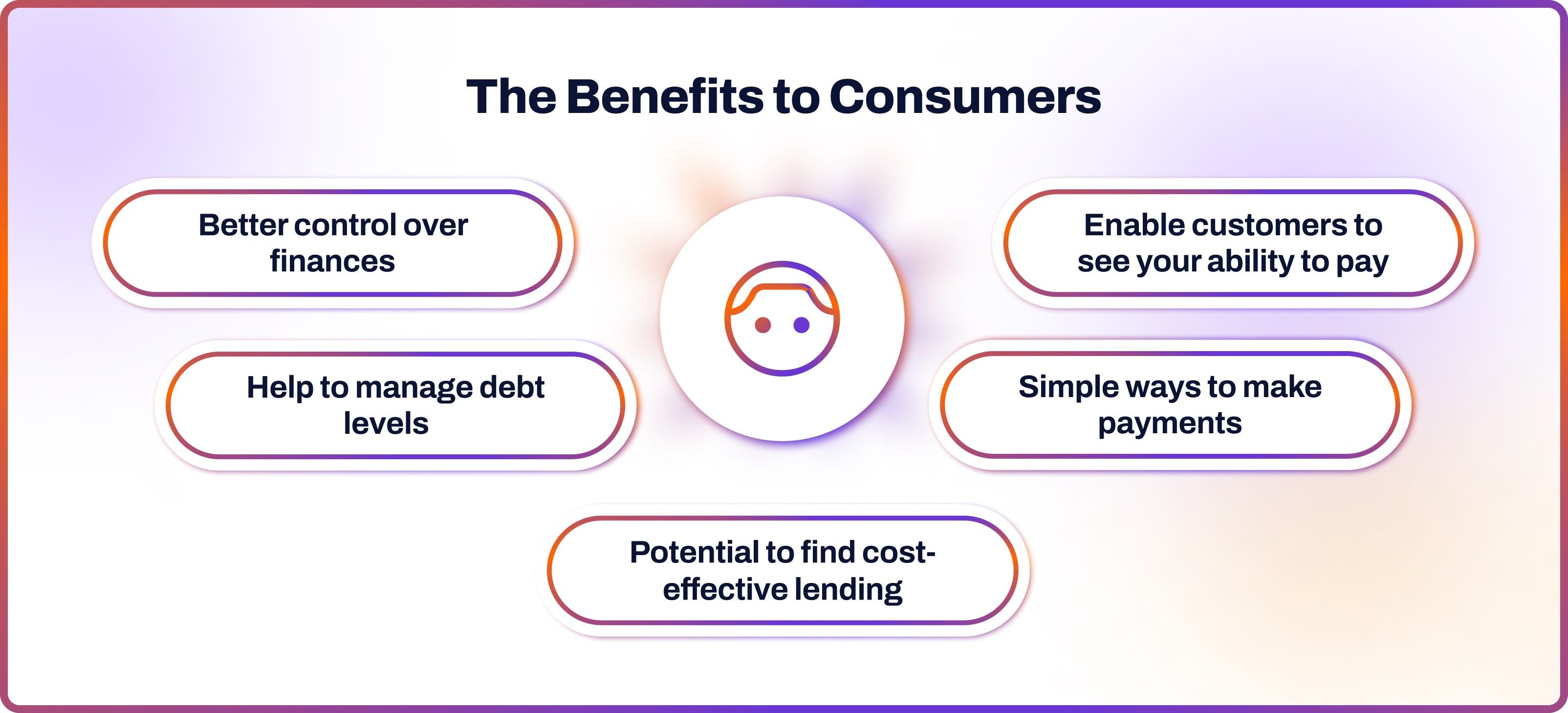

Here are some of the areas in which businesses and consumers could potentially benefit from the rise in open banking opportunities.

Boom in popularity

It’s for all those benefits listed above that open banking has become so popular over the last few years…and it’s a trend that’s expected to continue.

More than seven million consumers and businesses in the UK are using open banking-enabled products and services, according to UK regulators.

The report noted that open banking payments had more than doubled from 25 million in 2021 to more than 68 million in 2022.

“Open banking helps users make better-informed decisions and improves access to financial services,” it stated.

Of course, open banking isn’t just attractive to law-abiding individuals. It’s also of great interest to fraudsters looking to separate people from their money.

Therefore, the main question is: how safe is open banking? Do the benefits outweigh any negatives and what can everyone do to stay safe?

Is open banking safe?

Anything to do with the transferring of money is bound to make people nervous, especially when significant sums are being moved.

The issue of open banking and security was recently raised by Helen Charlton, chair of the financial service consumer panel at the UK’s Financial Conduct Authority.

“Open banking data is highly valuable to criminals, and therefore consumers are exposed to significant harm if firms do not protect their data securely.”

She also explored how this could happen.

“Open banking vastly increases the types of personal data, volume of data, and number of data pathways, therefore increasing the likelihood of data theft or loss,” she added.

Open banking security, therefore, is a crucial issue because no one wants to willingly put their hard-earned money at risk from criminals.

How to keep safe?

Consumers, therefore, will want to know: is open banking safe? The answer is that open banking is safe as long as you are using authorised and trustworthy payment providers.

In the UK, for example, you can check the register of listed firms on the website of the Financial Conduct Authority to find reputable businesses.

In Europe, authorised firms must appear in the public register of a particular country’s regulator, although you can also check with the European Securities and Markets Authority.

Never consider giving permission – or any information – to firms that aren’t regulated as that is just asking for trouble. When it comes to your money, it pays to be cautious.

Of course, there are always going to be potential problems. For example, even the longest established, regulated firms can fall victim to cyber-attacks.

How do I know it’s safe?

The reason why open banking is safe, according to the payments industry, is that regulated providers use rigorously tested software to secure data.

This means you won’t have to give access to your bank login details and password to anyone other than your actual bank. If you’re asked for this data, then something is wrong.

Users are also in charge of what information they choose to share – and for how long such permission is granted.

As long as you stay on top of these permissions then you’ll improve your chances of having a positive experience with open banking.

Businesses in the European Union will also be bound by privacy laws. The General Data Protection Regulation (GDPR) imposes rules on anyone involved in collecting data.

This includes hitting organisations that violate its privacy and security standards with harsh fines. These financial penalties can run into the tens of millions of euros.

Other tips on staying safe

It always makes sense to stay vigilant and not rely 100% on the bank or payment provider to keep you completely safe from fraudsters.

Therefore, pay close attention to your bank account so that you can act immediately if something doesn’t look right or a payment has appeared that you don’t recognise.

The same rules that are followed to keep you safe online should also be applied to the world of open banking. Consumers ignore this advice at their own peril.

The first step is to take a moment to think before parting with your money or data and then challenge yourself as to whether it could be fake. If you’re concerned, check with your bank.

Conclusion

So, what is the conclusion? Is open banking safe? The world of open banking is safe as long as you only use authorised, regulated companies in your particular jurisdiction.

These firms will have needed to comply with rigorous background checks by a regulator to ensure their way of operating was acceptable.

FAQs

Is open banking more secure?

It all depends on the individual bank or payment provider. As long as you stick to regulated organisations then you should be safe. However, if you end up signing up with an unauthorised firm, your money could be at risk.

Why is open banking secure?

The industry argues that open banking is secure because it uses rigorously tested software and security systems. They also point to the fact that firms are regulated so it’s easy for businesses and customers to find out if they are legitimate.

How does regulation help protect open banking customers?

Regulation plays a crucial role in the safety of open banking customers as it lists authorised firms and gives them set procedures that they need to follow. The fact regulators are constantly looking at the various protocols in place should give them a degree of comfort.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each