Mobile payments are gaining the upper hand in the market. The new consumer favourites mobile wallets like ApplePay and GooglePay are now among the world's most widely used payment methods. Hence, when it comes to e-commerce, businesses that undermine the importance of mobile payments will fall by the wayside.

Here, we take a look at the mobile payment revolution and the exciting trends it’s bringing forward for merchants.

What are Mobile Payments?

Mobile payments are exactly what they sound like: payments executed via a mobile device. This could be either a smartphone or a tablet. Mobile payments allow for a cashless and cardless payment experience, making it easier and faster for consumers.

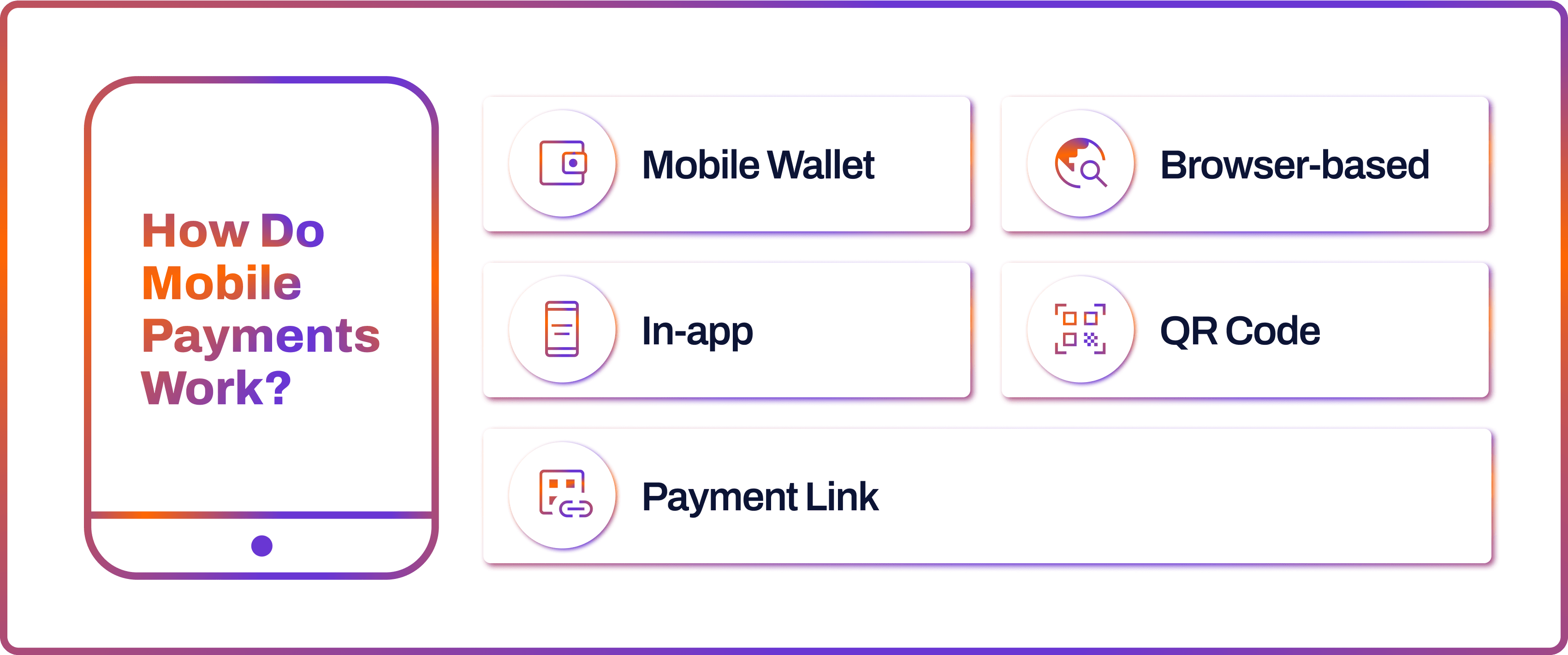

How Do Mobile Payments Work?

There are different types of mobile payments and their corresponding mechanisms.

Mobile Wallet

The most straightforward option is to use a mobile wallet. These apps, like Apple Pay and Google Pay, allow users to store their debit or credit card within a mobile phone.

For an offline transaction, the consumer taps their phone at the terminal with their wallet application open. For an online transaction, they authorise the payment via the wallet’s app.

Browser-based

Browser-based transactions involve users shopping online via their smartphone or tablet. Customers can pay depending on what’s offered by a merchant, from digital wallets to Buy Now Pay Later (BNLP) or inserting details manually.

In-app

Often, consumers can buy goods or services directly via the merchant’s app. The payment options would vary depending on the app type and the methods offered by a merchant.

For example, they may have to insert their details manually or use a digital wallet. Alternatively, some operating systems like Apple’s iOS may offer to pay for app subscriptions directly via Apple ID.

QR Code

Another way of paying with a mobile device is through a quick response (QR) code. Consumers scan a QR code, which directs them to a payment page. This is a convenient option for both online and offline payments.

Payment Link

Merchants may also send a payment link as a mobile message, which works similarly to QR codes. After following the link, a consumer is directed to the payment page. Both QR codes and payment links will lead users to a browser-based transaction if they don’t offer a digital wallet as a payment method.

Mobile Contactless Payments vs Mobile Payments

Mobile contactless and mobile payments are often used interchangeably, yet they have different functionality.

Mobile payments are a much broader term that covers a variety of mobile payment methods, including digital wallets, QR code payments, payment links, in-app payments and mobile browser-based transactions.

Meanwhile, mobile contactless payments are a sub-category of mobile payments. They involve using a mobile wallet, like Apple Pay, to complete an offline transaction. This method uses Near Field Communication (NFC) technology to enable contactless data exchange between a smartphone and a payment terminal.

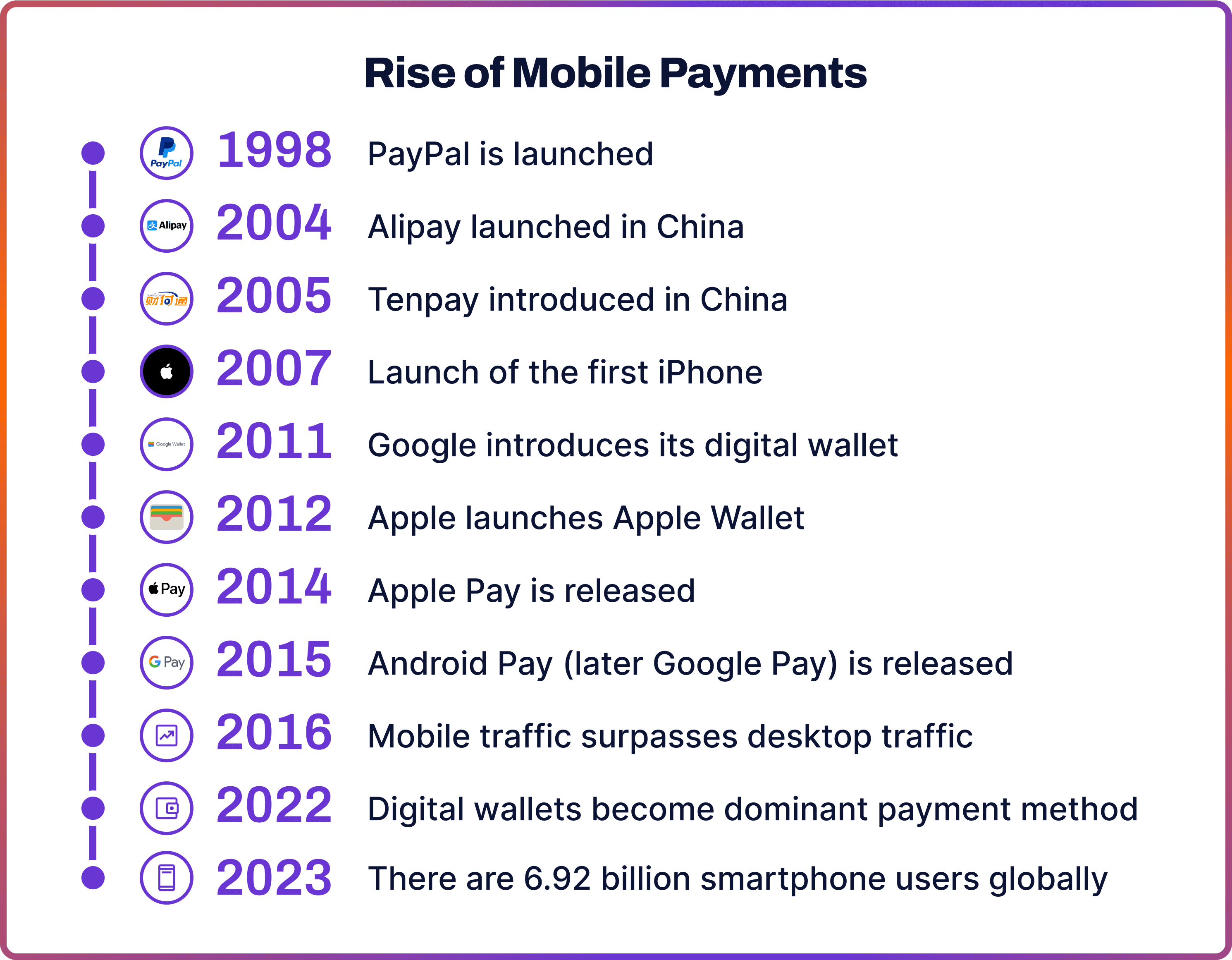

Rise of Mobile Payments

The growing adoption of smartphones continues to fuel mobile payments. Since the 2007 launch of the first iPhone, there are now 6.92 billion smartphone users worldwide. This amounts to over 85% of the global population.

In 2016, mobile traffic surpassed desktop for the first time, marking a significant turning point. Today, most people rely on smartphones for internet access and digital activities, including shopping.

These trends served as a fertile ground for the wide adoption today's most popular mobile wallets: Alipay, Tenpay, Apple Pay and Google Pay.

Apple Pay was released in 2014, allowing users to make payments using Apple devices, such as iPhone, iPad, Apple Watch and Macbook. Google Pay was released in 2015, initially named as Android Pay. It enabled contactless payments and in-app purchases. Google Pay was launched in 2018, combining the features of its predecessors and more.

Today, digital wallets are the dominant payment method worldwide, accounting for 49% of transactions in 2022.

Mobile Payments: Future Trends

It’s clear by now that mobile payments are here to stay. The emerging trends in mobile payments will significantly impact both consumers and merchants.

Mobile Wallets

As mentioned above, digital wallets are now dominating worldwide payments. Mobile wallets, like Apple Pay and Google Pay, are the sub-category that is driving the trend.

Amid the global pandemic and the strong preference for contactless payments, customers found mobile wallets more convenient. Between 2015 and 2020, mobile wallet adoption skyrocketed almost five-fold, from 0.4 to 2.3 billion, according to Merchant Machine.

The 2022 Statista report shows that mobile wallet penetration is especially strong in Asia. This is due to the high internet usage rate and the government’s push for a cashless society. In particular, China is the leading country in mobile payments, with the notable market players Alipay and Tenpay being established long before Apple Pay and Google Pay.

And the growth does not stop here. A study by TMR predicted that the mobile wallet market size will be worth $16.2 trillion by 2031. A separate study by Juniper Research predicted digital wallet transactions would rise from $9 trillion in 2023 to over $16 trillion in 2028, a surge of 77%.

For online merchants who still don’t offer mobile wallets as a payment method, now is the time to add them to your arsenal.

P2P

Another growing mobile payment industry trend is peer-to-peer (P2P) transactions. eMarketer predicted that mobile P2P payments will reach $1 trillion in transaction volume in 2023.

P2P payments occur between individuals through a mobile platform like Venmo or PayPal. They might not involve merchants, but they're still essential to how mobile payments are evolving.

The convenience of this payment method appeals to younger consumers. For example, GenZs are adopting mobile P2P transfers at a rapid pace. eMarketer predicted 80.4% of new users between 2023 and 2027 will come from this generation.

Cybersecurity

The growing market adoption means a corresponding rise in the risks of mobile payments. Phishing, pharming, card testing, identity theft, and first-party misuse are the most prevalent fraud attacks, according to the 2022 Cybersource report. As mobile payment trends evolve, the number and variety of cybercrime will likely increase.

Here, cybersecurity measures, which have become essential for merchants, come into force. For example, encryption standards such as SSL and TLS are mandated by the Payment Card Industry Data Security Standard (PCI DSS).

Multi-factor verification is another measure widely used in digital payments. Under European PSD2 regulation, multi-factor verification is legally required for some types of payments. Often, multi-factor verification is supported by biometric security such as fingerprints and facial recognition.

Open Banking

Open banking promises to elevate mobile payment technology. In open banking, traditional banks share data with licensed fintech companies through open application programming interfaces (APIs), provided consumer consent. This results in better, more personalised financial products for users.

Open banking can drive innovation in mobile payment solutions for merchants. For example, its functionality enhances user experience, lowers transaction costs and strengthens security. Open banking providers, like Noda, can offer various mobile payment systems for online merchants to accommodate their customers’ needs.

Mobile Payments with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What are the advantages of mobile payments?

The key benefit of mobile payments is their convenience for consumers. The global pandemic and the preference for contactless payments fueled the rise of mobile wallets such as Apple and Google Pay.

What are the main risks of using mobile payments?

As with any new payment technology, the rise of mobile payments will likely drive a corresponding surge in cyber fraud. Merchants must use efficient security measures to protect customers.

What are the most popular types of mobile payments?

The most popular type of mobile payment is mobile wallets such as Google Pay and Apple Pay. Between 2015 and 2020, mobile wallet adoption skyrocketed almost five-fold, from 0.4 to 2.3 billion, according to Merchant Machine.

What is the future of the mobile payments industry?

The mobile wallets will continue to grow in popularity. A study by TMR predicted that their market size will be worth $16.2 trillion by 2031. A separate study by Juniper Research predicted digital wallet transactions would rise from $9 trillion in 2023 to over $16 trillion in 2028, a surge of 77%.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each