Introduction

Planning to start or expand your online business into the UK? Your checkout page could make or break your success. You can pour cash into online ads and social media marketing, but if your checkout doesn’t offer the payment methods in UK that shoppers expect, the basket is abandoned in seconds.

British shoppers have strong preferences—ignore them, and carts get abandoned. Offer the most popular online payment methods UK, whether it is the familiar swipe of a card or the cutting-edge ease of open banking, and loyalty follows.

This guide dives into customer preferences and highlights why open banking—powered by solutions like Noda—is a game-changer for merchants looking to streamline online payment processing UK. Let’s help you make informed decisions to grow your business. Forget generic global advice; let’s explore what actually works in the UK right now—where nearly 97% of consumers are expected to shop online by 2029.

Key Takeaways

|

Why the UK Payment Systems Matter for Merchants

UK customers consistently prioritise speed, convenience and security when making payments. An average shopper now glides through checkout in seconds rather than typing 16-digit card numbers, combining lightning-fast convenience with bank-grade security baked into every tap or biometric check.

While traditional ways to pay remain widely used, modern methods deliver the frictionless experience shoppers expect. For younger consumers especially, the sheer convenience of online payment solutions UK offers a game-changer – imagine effortlessly paying utility bills or instantly splitting dinner costs with friends without ever needing to input card details, all with the robust security of instant bank transfers.

This shift in preferences is precisely why UK merchants must diversify their UK payment methods – offering just one or two methods risks alienating large segments of shoppers.

As more consumers become familiar with these options, merchants working with agile UK payment service providers can tap into this growing trend and offer an innovative and convenient checkout experience.

Six Top Online Payment Methods in UK 2026

For UK merchants aiming to capture this market, understanding core solutions that capture the market is vital. Below, we discuss a list of online payment methods UK in a bit of detail to see how they can fit into your business strategy and meet the needs of your UK customers effectively.

UK shoppers often juggle multiple payment methods in UK, so the usage figures for each payment method reflect the proportion of consumers who use or prefer each method, acknowledging that many regularly utilise more than one.

Debit and Credit Cards

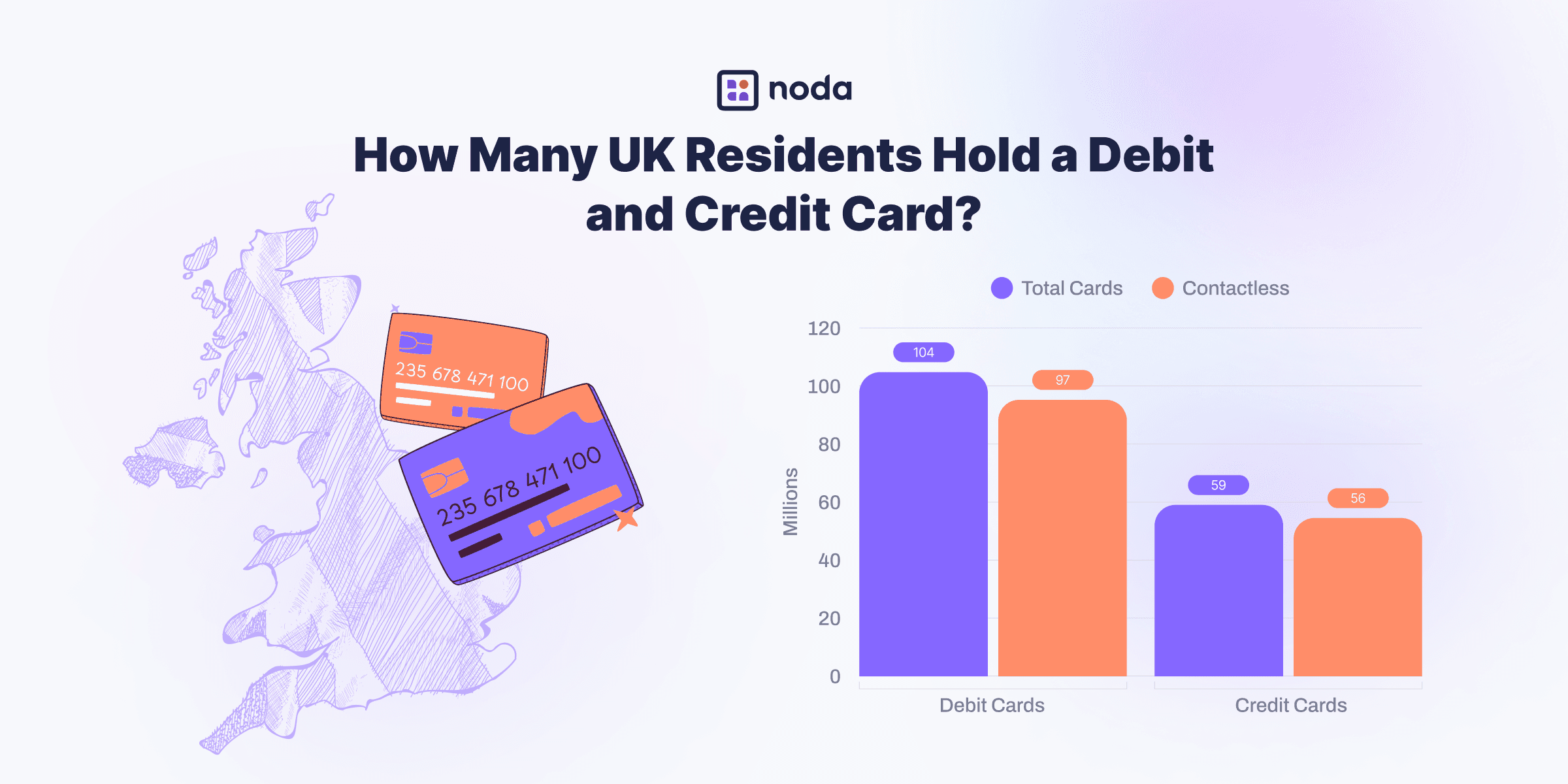

Debit and credit cards form the backbone of online payments in the UK, capturing the largest share with 65% of consumers using debit cards and 45% opting for credit cards. They deliver trusted, familiar experiences—debit for everyday buys, credit for higher-value or secured purchases.

In November 2025, UK cardholders made 2.3 billion debit card transactions, spending £66.7 billion. Credit cards saw 391 million transactions, boosted by contactless easel.

Considerations for UK merchants:

Card payment acceptance is essential and should include both debit and credit card options to maximise reach and customer trust.

Cost alert: Interchange fees (1.5-3.5%), chargeback fees + compliance costs that can swallow margins.

Practical merchant tip: Switching from standard card rails to open banking platform Noda drops your transaction fee—up to 80 % cheaper than the cost you’ll pay on Visa/Mastercard, with the added perks of instant settlement, PCI DSS compliance, zero chargebacks and plug-and-play plugins for WooCommerce, Magento, Prestashop, OpenCart and custom APIs.

Direct Debit

Direct debit is also widely used by 44% of UK online shoppers to make recurring payments, making it ideal for merchants seeking steady revenue from subscriptions or memberships in sectors like food & beverage, homeware, fitness, or SaaS platforms.

Direct Debit wins on two fronts; for customers, it gives shoppers bank-grade security. For merchants, it pulls funds via the Bacs system (three-day processing), bypassing card networks to avoid fees, locking in recurring revenue without forcing customers to re-authorise every payment.

Considerations for UK merchants:

If your business relies on subscriptions or recurring billing, failed payments and potential chargebacks can be costly — leading to lost revenue, increased admin burden, and strained customer relationships.

Risk: Without a proper retries system, failed payments can reduce your monthly revenue and harm retention metrics.

Practical merchant tip: Schedule automated retries with a two-day gap for failed payments along with SMS/email reminders.

Digital Wallets

With 48% consumer adoption, this payment method has become indispensable for modern UK merchants. The convenience factor cannot be overstated – customers can complete purchases with just a few taps. PayPal leads this space, followed closely by Apple Pay and Google Pay, which increasingly dominate mobile payments due to biometric authentication and simplified UX.

Considerations for UK merchants:

Digital wallets reduce checkout friction and increase mobile conversions. Make sure your payment setup supports the most popular options to keep abandonments low.

Buy Now, Pay Later (BNPL)

BNPL appeals to around 25% of consumers in the UK, primarily younger demographics seeking flexible payment terms without traditional credit checks.

With the market set to reach approximately US$58 billion by 2029, there were over 10 million BNPL users in the UK in 2025. For merchants, it is a valuable addition to their payment arsenal as it encourages larger basket sizes and higher conversion rates, but it is important to be aware of the evolving regulatory landscape surrounding BNPL in the UK (new 2026 FCA rules mandate affordability checks even for loans under £50.)

Considerations for UK merchants:

Average transaction fees for merchants range between 3–6%, making BNPL significantly more expensive than other UK payment methods. New regulations will require merchants to display the total cost upfront, in a clear and transparent manner. Additionally, it’s essential to ensure that their BNPL provider is—or will be—FCA-authorised under the upcoming compliance rules.

Cryptocurrencies

Still niche in the UK, but slowly gaining recognition. While adoption is low compared to other methods, crypto may offer value for international customers, privacy-minded buyers, or web3-native audiences.

Considerations for UK merchants:

If you target tech-savvy or global shoppers, consider offering crypto through a regulated gateway—it's best utilised as a supplementary option.

Bank Transfers / Instant Payments (Open Banking)

Bank transfers, widely embraced by UK shoppers and growing in popularity, deliver instant, secure payments via the Faster Payments System, at lower fees than card payments. This category, powered by open banking, offers merchants reliable settlement and customers a trusted alternative.

Open banking is transforming how payments are made online in the UK by enabling direct, bank-to-bank transactions. This method cuts out the middlemen — no need for cards or digital wallets — and streamlines the process to be quicker and more secure, while also keeping costs down.

Considerations for UK merchants:

Accepting bank transfers via Open Banking can reduce transaction fees and fraud risk, streamline reconciliation, and improve cash flow management. It’s an attractive complement to traditional card payments.

Practical merchant tip: Streamline your adoption of bank transfers by partnering with an open banking platform like Noda. You can also easily generate and send secure payment links to your consumers for quick online checkouts. Benefit from Noda’s built-in security (PCI DSS, encryption, and fraud prevention) so no additional cost is incurred.

How to Choose the Best UK Online Payment Solution for Your Business

Choosing the right payment solution depends on your business needs, transaction volume and customer expectations. The ideal system should balance cost-efficiency, transaction speed, and security while ensuring a smooth experience for both businesses and customers.

Business Need | Recommended Methods | Key Benefits |

| Quick checkouts | Cards, digital wallets, open banking | Fast, secure, wide acceptance, instant settlement |

| Recurring Payments | Direct debit, open banking (for VRP) | Automated billing, optimised collections |

| High-Value Sales | Bank transfers/open banking | No card limits, lower fees, instant settlement |

| Cross-Border Sales | Digital wallets, open banking, cryptocurrencies | Multi-currency support, minimal conversion fees, instant settlement |

| Mobile Sales | Digital wallets, BNPL | Seamless mobile checkout, higher conversion on mobile devices, enhanced security |

| Cost Optimisation | Open banking | Lower processing fees, no chargebacks, instant settlement |

FAQs

What steps should my business take to accept payments from UK customers?

To accept payments in the UK, your business should partner with reliable online payment providers UK like Noda, which supports widely used methods and give you access to all major banks in the UK. Noda also offers easy API integration, low fees (starting just at 0.1%), and compliance with UK regulations and security standards.

What is the most widely used payment method in the UK?

Debit cards remain the top choice for UK consumers, with over half of all transactions made using them. However, contactless payments and mobile wallets are becoming increasingly popular, especially among younger shoppers.

What are the common online payment methods used in the UK?

Alongside debit and credit cards, mobile wallets like PayPal and Apple Pay, direct debits, bank transfers, BNPL services, and open banking payments are preferred by online shoppers. Each caters to different customer needs, with open banking gaining traction for its low costs.

What’s the safest way to accept payments in the UK?

Utilising providers that offer advanced security features such as PCI compliance, fraud detection, and encrypted open banking payments helps ensure safe transactions. Choosing a payment partner like Noda offers best-in-class security aligned with UK standards.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each