Have you heard of PayFac? It’s become a familiar term in payment circles but many people still don’t understand exactly what it means.

PayFac stands for payment facilitator and refers to services that enable businesses to accept payments from customers in a variety of ways.

Here we explain the concept behind a PayFac – or payment facilitator – and whether or not this is the preferred route to go for your business.

The evolution of payment systems

Let’s start with the basics. Virtually any business operating today needs to embrace the concept of accepting payments through a variety of methods.

To be honest, it’s daft not to take a flexible approach. The world is changing at a rapid rate, so limiting the ways potential customers can interact with you is a mistake.

Go back 30 years and most businesses needed to establish close working relationships with their bank in order to accept VISA or MasterCard payments.

This wasn’t an easy task. It was pretty labour-intensive and annoying for firms who resented the extra layer of paperwork required to complete such a transaction.

However, times have changed. Technological improvements have revolutionised how businesses, card networks and acquiring banks can work together to provide effective payment integration.

Online businesses

Demands for a modern payment facilitation solution have grown louder over the past 20 years on the back of an explosion in alternative payment methods and solutions.

There are now millions of web-based businesses around the world. In fact, studies put the figure at between 12 and 24 million online stores.

Their emergence has introduced everyone to the concept of online payment systems that can cope with a rise in e-commerce payments.

What are online retail payment facilitation solutions?

Now that we’ve provided some context, let’s take a closer look at how online retail payment facilitation solutions are defined.

The term PayFac was originally defined by Visa and MasterCard to describe any entity that was officially doing business with the card brands, according to JP Morgan.

However, its use has now evolved to the point where a PayFac solution can refer to anything that involves the use of technology in the taking of payments.

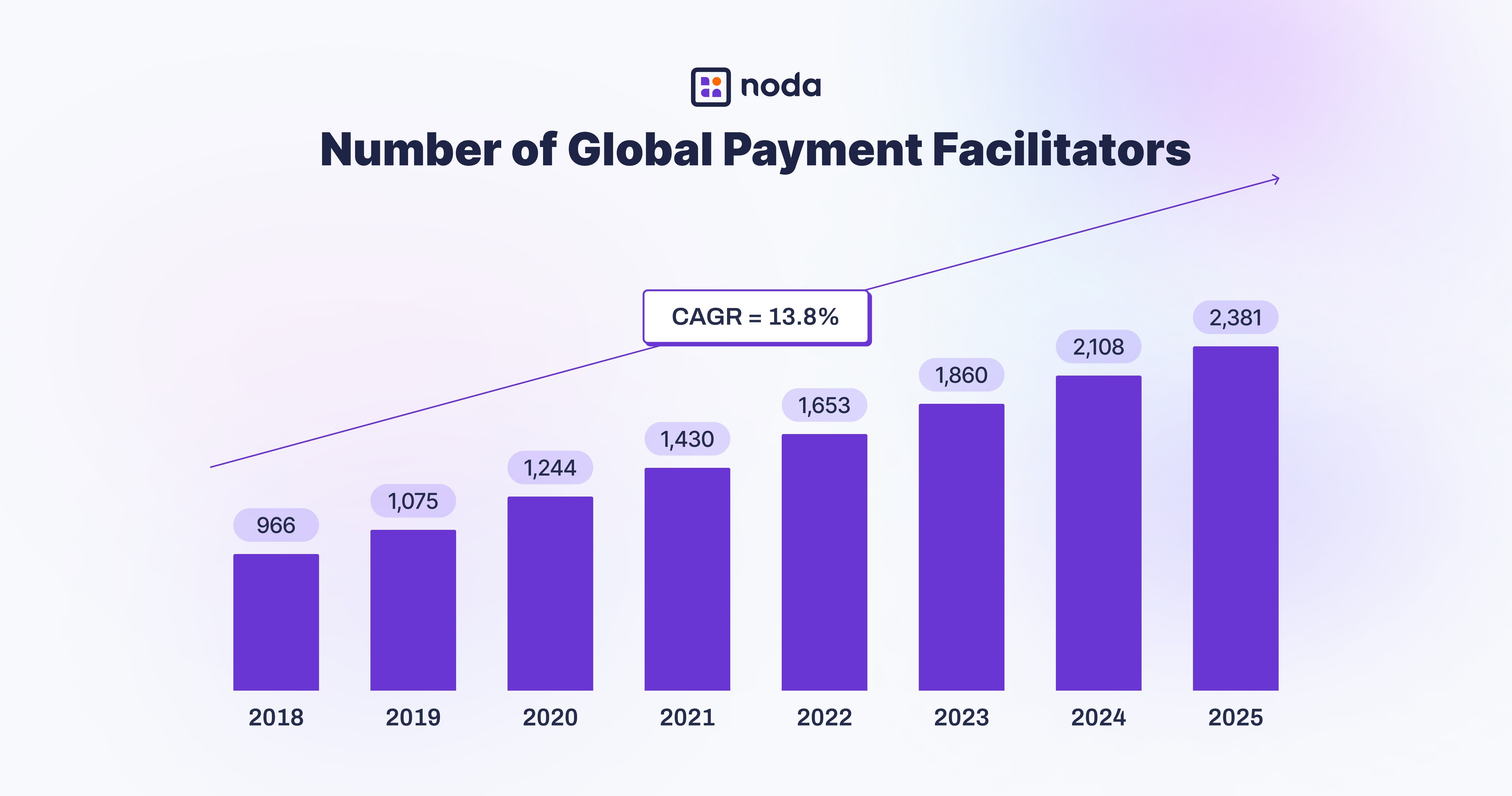

In fact, a report from Infinicept and AZ payments group suggested the number of payment facilitators would soar from 966 in 2018 to 2,380 by 2025.

The study also predicted the global GPV (gross payment volume) processed by payment facilitators is expected to exceed $4 trillion over the same time period.

“Such growth can be explained by an increased number of payment facilitators worldwide and an expansion of current payment facilitators’ customer bases,” it stated.

What do you need to know about the Payfac model?

Basically, there are different PayFac solutions. The more traditional version is when a business partners with an acquiring bank.

As an aside, an acquirer is an institution that processes credit or debit card payments on behalf of a merchant to enable their business to operate.

Of course, a more traditional payment facilitator model will require several systems to be build, developed and integrated.

However, an alternative option is for businesses to buy into a white-labelled PayFac platform that is already connected to an acquiring bank so requires less underwriting and processing elements.

These solutions can effectively be plugged into a company’s software and allow them to provide a clear payment acceptance procedure to customers.

This approach is often referred to as a payment facilitator as a service model and it’s one that we can expect to hear more about over the coming years.

Some of the benefits of this approach are:

- Ability to use your company’s branding throughout the process.

- Embedding payments processing into your overall solution.

- Receive help and support on issues such as compliance.

Benefits of becoming a payment facilitator

The interesting aspect is that there are tools available that enable businesses to become a payment facilitator by processing payments on behalf of customers.

They help to streamline payment processing, which includes automating underwriting and compliance, as well as providing settlement and reporting.

For those looking at how to become a payment facilitator, these are the key benefits of introducing a PayFac model into your business.

Saving time

Streamlined onboarding and processing can make the entire operation quick and efficient. This is an absolutely crucial aspect of a modern, web-focused business.

More revenue

Payment processing fees help boost revenue received. Opting to become a facilitator will create a new source of income through taking a percentage of sub-merchants’ transactions.

Better customer experience

A quick, efficient payment operation will benefit customers and encourage them to return. This will encourage them to be loyal – and that’s a definite bonus in a competitive environment.

Enhanced risk management

There’s the prospect of better compliance and risk management by having a system in place that is integrated properly and easy to use.

Which businesses are best suited to becoming payment facilitators?

There are plenty of businesses where online retail payment facilitation solutions are used. Here are some examples:

Booking platforms

There’s been a rise in sites that enable customers to book appointments or even holiday stays. A quick and easy way to take deposits will be particularly beneficial.

E-commerce operators

The internet is the go-to place for almost anything we want to buy these days – but the sheer number of options means it’s important for traders to offer effective solutions.

E-Learning platforms

Learning no longer has to take place in classrooms. The Covid-19 pandemic fast-tracked the use of e-learning capabilities and platforms such as Zoom.

Delivery software

Billions of parcels are delivered around the world every day – and this is one trend that’s unlikely to change any time soon. Specialist companies taking care of these deliveries can be paid in this way.

Is it right for you?

There are many factors to consider when you’re deciding whether to bring payments in-house, so this isn’t a decision that can be taken lightly.

Of course, to consider becoming a payment facilitation platform you will need to ensure you comply with the various legal and regulatory rules in your jurisdiction.

These are some key questions to consider:

- What are the benefits to your business of bringing payments in-house?

- How many different payment options do you want to offer customers?

- What are the cost implications?

- How can you future proof your offering?

Conclusion

The big question is: can online retail payment facilitation solutions take over? Well, the simple answer is that’s a possibility.

We have all become very comfortable with being taken through an online checkout and the importance of being able to make secure payments.

The benefits to businesses of being able to take payments in-house is likely to result in a rise in the number of PayFac platform services appearing over the next few years.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each