Today's customers expect more from businesses, and rightfully so, given the wide range of experiences they encounter. Customer Experience (CX) covers all customer actions when obtaining a product. It is an essential component of a successful business in an era where delivery matters as much as the offerings.

A seamless customer journey improves retention, increases lifetime value, fosters brand loyalty, and provides a competitive edge. Conversely, inefficient customer experiences yield negative results. With the growing preference for mobile apps and online services, digital journeys are crucial. Here, open banking steps in, with the potential to enhance CX.

What Is a Customer Journey?

A customer journey maps the complete customer experience across various interactions or touchpoints. This encompasses events before, during, and after they engage with a product or service. Examples include onboarding new customers, resolving technical issues, or upgrading a product.

Attending to full customer journeys can drive stronger business results, according to McKinsey research. For example, their survey revealed that “customer satisfaction with health insurance is 73% more likely when the entire journey works well than when only touchpoints do”.

The digital journey (or user experience, UX) includes all aspects of the CX that occur online or through a device, ranging from website or app navigation to online payments. Digital experiences are becoming more important for modern consumers. For example, in a financial services customer journey, digital wallets have become the most popular payment method worldwide.

What Is Open Banking?

Open banking is a framework built on the idea of data transparency. Traditionally, legacy banks held a monopoly over customer information. Yet, in open banking, they share data with licensed fintech companies, provided customers have consented. Fintech firms, in return, create innovative products and solutions tailored to enhance customer experience.

How Open Banking Works

Open banking was put into legislation with the European PSD2, enforced in 2018. It mandated European banks to open their application programming interfaces (APIs) to authorised third-party providers (TPPs). APIs are sets of defined rules that enable different entities to communicate with each other. They act as a software bridge, enabling the secure transfer of information in the open banking ecosystem.

To access the data banks provide, the fintech companies can obtain different TPP licenses under PSD2: PISP or AISP. PISP, or Payment Initiation Service Provider, can obtain read-only financial data and authorise consumer payments. PISPs eradicate the need for users to insert their payment details, ensuring a smooth customer experience.

AISPs, or Account Information Service Providers, on the other hand, can view customer information and aggregate multiple data sources into a single interface. Credit agencies or budgeting apps commonly use AISPs to access a comprehensive view of customers’ financial behaviour.

Open Banking Customer Experience: Use Cases

Open banking is a versatile tool, and so are the ways to utilise open banking to enhance CX.

Instant Payments

Open banking can simplify user experience for consumers. Using open banking APIs, providers like Noda can streamline transactions, sparing clients from manually entering payment details. Plus, integrating with Account-to-Account (A2A) payments technology, open banking can create a truly frictionless customer payment experience.

Account Aggregation

Open banking providers are behind the account aggregation necessary for tailored budgeting products. Customers no longer need to check multiple banking applications or websites. With the open banking functionality, they can now see all of their accounts within a single interface. This significantly improves their digital customer experience.

Personalisation

Open banking provides a wealth of data that businesses can use to understand their customers' behaviours. Such deep insights can enable businesses to create highly personalised products and services. By analysing this data, businesses can fine-tune their offerings to better match individual preferences, enhancing the overall customer experience.

Onboarding

For certain business types (like insurers or lenders), determining a client’s risk profile and verifying their income source is essential for onboarding. Open banking account aggregation can streamline credit history checks, affordability and income verification, Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. Clients no longer need to submit piles of paper documents as they can digitally share their financial data.

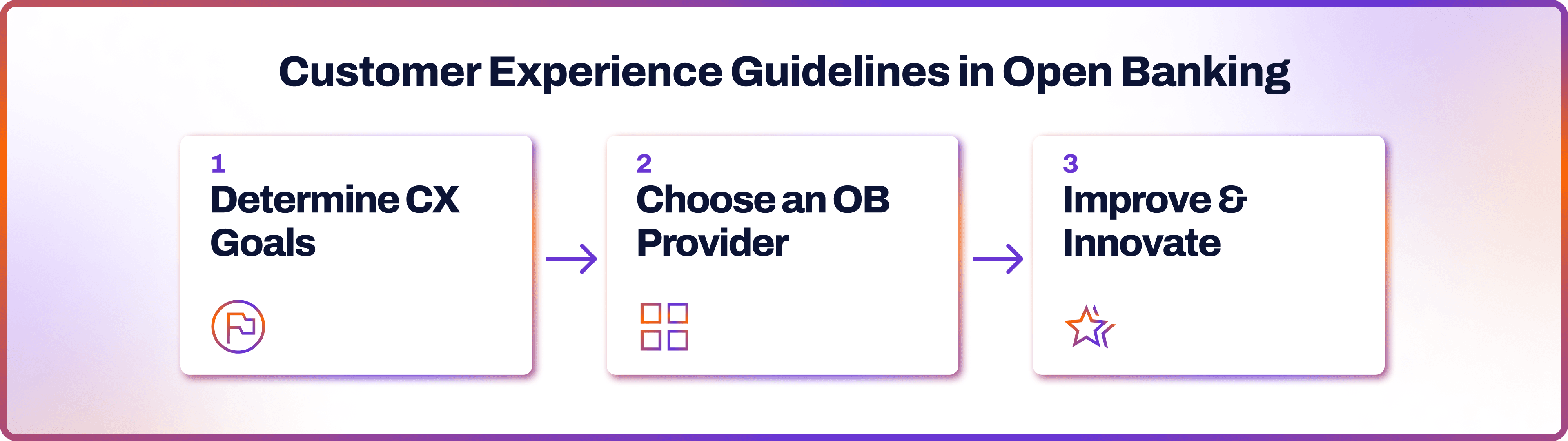

Customer Experience Guidelines in Open Banking

There are three key steps in transforming your customer experience through open banking integration.

Step 1: Determine CX Goals

Identify specific challenges in your current customer experience. Analyse areas where customer journey can be improved, such as payment processing, account management, or personalisation. Set clear, measurable goals for improving these aspects using open banking.

Step 2: Choose an Open Banking Provider

Select an open banking provider that aligns with your CX goals. Look for providers offering robust APIs and solutions that can seamlessly integrate with your existing systems. Ensure they have a strong track record in security, reliability, and regulatory compliance.

Step 3: Improve and Innovate

Continuously monitor the impact of open banking on CX and iterate based on customer feedback and evolving market trends. Stay agile and open to adopting new technologies as they emerge, ensuring your CX remains cutting-edge.

Benefits of Open Banking for Customer Experience

- Better Payment Experience: Open banking facilitates smoother and quicker transactions, removing the need to manually enter payment details.

- Financial Overview: It aggregates data from multiple bank accounts, helping customers to make more informed financial decisions.

- Data-Driven Personalisation: Open banking insightful analysis of customers’ behaviour, which leads to more personalised products.

- Simplified Processes: The sharing of data streamlines complex financial procedures such as verifying personal financial information, making onboarding applications more efficient.

From Open Banking to Open Finance

The shift towards customer-centric experience is clear, and it offers huge opportunities for open banking integration. Open finance is the next step on the open banking timeline, and it would require all financial institutions, not just banks, to share data with licensed providers. Open finance can bring an even more superior customer experience and innovation.

Open Banking Payments with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

How does open banking improve customer experience?

To improve customer experiences with open banking, businesses should focus on streamlining digital interactions and leveraging the data transparency it offers. By integrating open banking APIs, companies can simplify payment processes, offer personalised products, and enhance the overall customer journey for open banking, making it more efficient and user-friendly.

How does open banking affect customer experience?

Open banking positively affects customer experience by offering convenience and personalisation. It facilitates instant payments and supports customised financial services. This leads to a more seamless and integrated experience, meeting the modern consumer's expectations for efficiency and a tailored journey.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know