In the ever-evolving realm of finance, open banking is revolutionising business operations, unlocking growth and efficiency possibilities. But what exactly does open banking entail?

Open banking involves financial institutions securely sharing customer data with third-party providers through Application Programming Interfaces (APIs). This exchange occurs only with the customers’ consent, empowering them to retain control over their financial information while opening doors for businesses to explore new horizons.

Benefits of Open Banking for Businesses

Open banking is not merely a buzzword; it represents a significant transformation for businesses as it aims to enhance payment efficiency by reducing friction points while ensuring payment validity and security. A report by Open Banking Limited (OBL) revealed that the adoption of open banking technology is increasing among UK firms.

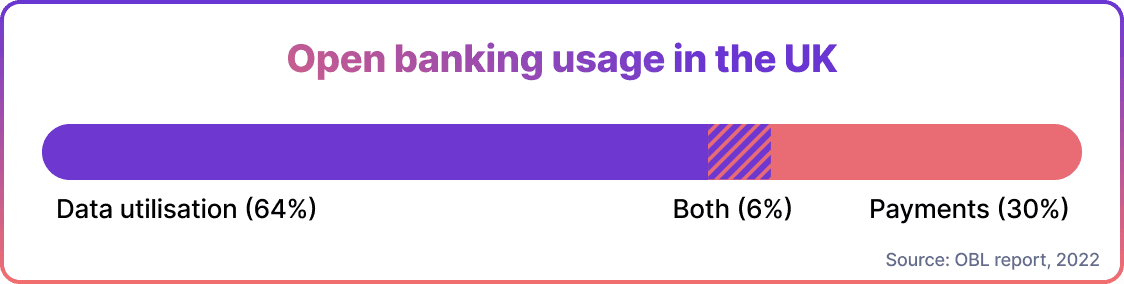

As of 2022, the business penetration rate reached 11%, slightly surpassing the retail sector's rate of 10%. There has been a significant reduction in the gap between these two sectors. In terms of open banking usage, data utilisation stood at 64%, followed by payments at 30%. Additionally, 6% of customers used both options. It is worth noting that business users lean more towards utilising data for their operations.

Let's explore some other open banking benefits for business:

- Higher conversion rates: Open banking simplifies the payment process, resulting in a better user experience and increased conversion rates. As a result, businesses witness more successful transactions and enjoy enhanced revenue.

- Higher acceptance rates: Transactions conducted through open banking boast an impressive success rate of over 95%. This reliability minimises the risk of transaction failures, ensuring a steady influx of income for businesses.

- Lower fees: Open banking offers a significant advantage by reducing transaction fees compared to traditional card payments. This cost-saving aspect proves especially beneficial for small businesses facing tight budget constraints.

- Funds settlement: It becomes faster with open banking, eliminating the waiting period associated with other payment methods. This improves cash flow and financial stability. Timely payments are crucial for businesses relying on uninterrupted operations.

- No chargebacks: Open banking transactions eliminate chargebacks, offering a valuable risk reduction for businesses. This safeguards businesses from potential financial setbacks commonly associated with chargebacks.

- Customer data: In the realm of customer understanding, open banking enables businesses to access and analyse vast amounts of customer data, allowing them to gain meaningful insights into their customers' needs and preferences.

- Streamlined administration: Open banking simplifies the process of gathering customer information, resulting in reduced administrative tasks and costs. This automated system allows businesses to allocate more time and resources towards their core operations, ultimately enhancing efficiency and productivity.

Open Banking for Small Businesses

Open banking holds significant potential for small to medium-sized enterprises (SMEs), according to the OBL report, which explored how open banking can help small businesses.

Improved financial decision-making emerges as a key advantage of open banking, with a significant number of small businesses attesting to its positive impact. These services offer valuable insights into business performance, resulting in enhanced decision-making and proficient management of late payments. The reported figures suggested widespread agreement (+73% net agreement) on the effectiveness of these provisions.

The OBL report also discovered compelling evidence showcasing the positive impact of open banking solutions on business operations. Specifically, they led to a 82% increase in overall efficiency, while also reducing internal costs by 48% and external costs by 53%.

The research highlighted the significance of open banking-powered cloud accounting for small businesses. It revealed that businesses of varying sizes were adopting cloud accounting services, with a higher rate among larger and more complex enterprises. A pilot study showed that 45% of respondents utilized cloud accounting services, which increased to 78% among businesses employing 5-9 individuals.

Open banking for different sectors

Open banking holds immense potential for various industries. Let’s explore how this transformative concept can help specific business types and sectors.

Retail and eCommerce

The retail industry has the opportunity to utilise open banking for improving the customer experience and minimizing financial risks for merchants.

By embracing open banking, retailers gain valuable insights into their customers' spending habits, enabling them to offer personalised services. Moreover, it provides flexible payment options, facilitating convenient purchases for customers and fostering recurring business.

Through seamless and secure payment processes, retailers can elevate their customer experience, resulting in enhanced loyalty and continued patronage.

Healthcare

Open banking has the potential to aid healthcare providers in securely managing patient financial data. It offers a streamlined payment process, reducing administrative tasks and providing real-time insights into internal transactions.

By automating payments, healthcare providers can prioritise patient care while gaining valuable financial management tools. Moreover, these real-time insights can empower them to make well-informed operational decisions.

Lenders

Open banking has the potential to enhance risk assessment by providing a holistic perspective on a consumer's financial well-being. Moreover, it can expedite loan processes and foster greater inclusivity within financial services.

As a result, lenders are empowered to offer improved loan terms and extend their reach to a wider customer base. By accessing comprehensive financial data, lenders can mitigate the likelihood of defaults and promote enhanced financial stability for their business.

Real Estate

Open banking has the potential to enhance property valuation and lending processes in the real estate industry. By providing real-time financial data, streamlining mortgage applications, and increasing transparency, open banking can empower real estate businesses to make well-informed decisions and offer exceptional services to their clients.

Moreover, through its efficient mortgage application process, open banking simplifies property purchases for consumers, ultimately bolstering the entire real estate market.

Insurance

By enabling streamlined claims processing, fostering healthy competition, and providing insurers with valuable data for risk-based pricing, open banking can significantly enhance the operations of insurance companies. This would in turn empower them to optimise their risk-management strategies and offer superior insurance products to customers.

With access to consumers' financial information, insurers can determine fair and precise insurance premiums based on individual risk profiles. As a result, this innovative system can promote fairness and accuracy in premium calculations.

Subscription-based

Open banking can help subscription-based businesses in reducing customer churn by facilitating regular payments directly from customers' bank accounts. Additionally, it offers the advantage of eliminating costly processing fees commonly associated with card transactions.

As a result, open banking provides subscription-based companies with opportunities to enhance revenue and foster customer retention. By ensuring consistent payment streams, open banking contributes to maintaining financial stability for these businesses.

Bottom Line

Open banking is more than just a trendy term; it has the ability to completely reshape the business landscape. By leveraging open banking's potential, companies can unlock fresh opportunities, enhance their operations, and provide superior services to customers.

This transformative force is here to stay, marking an exciting future for business owners. As open banking infrastructure continues to be embraced, we can anticipate a business world that is more efficient, transparent, and customer-centric. The possibilities of open banking are vast and still largely untapped.

FAQs

What is open banking for business?

Open banking for business involves financial institutions securely sharing customer data with third-party providers through APIs, with the customer's consent. This enables businesses to streamline operations, enhance efficiency, and unlock growth opportunities.

Which companies use open banking?

Companies across various sectors, including retail and eCommerce, healthcare, lending, real estate, insurance, and subscription-based businesses, are increasingly adopting open banking. The adoption is particularly notable among small to medium-sized enterprises (SMEs).

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each