Open banking can create a fruitful environment for startup companies. This new financial framework mandated traditional banks to open up customer data for access by licensed third-party providers. It has been a much-discussed pathway to financial services innovation for years.

Here, we take a look at how this technology works, its critical use cases and how open banking can help startup businesses.

What Is Open Banking?

The logic behind the success of open banking is clear. Banks have a wealth of financial information about people and businesses. This data has the potential for many innovative applications.

For example, banks can tailor customer experiences using their data on financial behaviours and transaction history. Yet, historically, large banks struggled to innovate quickly because of their rigid legacy systems.

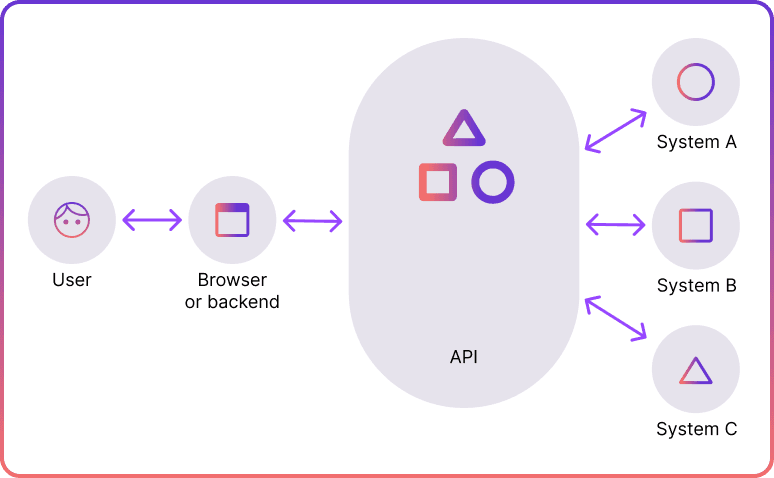

Open banking has boosted innovation in finance. it requires banks to open their application programming interfaces (APIs) to licensed third-party providers. APIs act as a software bridge enabling data sharing with approved fintech companies.

Banks share data with fintech companies only if consumers consent. In exchange, fintechs develop more innovative and tailored products for both individuals and businesses.

Open Banking for Startups in Europe

In Europe, startups benefit from a solid open banking legal framework in the form of PSD2. The directive was enacted in 2018 and mandated traditional banks to open their data APIs.

European fintech companies can obtain either Payment Initiation Service Provider (PISP) or Account Information Service Provider (AISP) licenses to access read-only customer data. PISP companies can initiate payments, while AISPs can aggregate data from different sources under a single interface.

In 2024, the upcoming PSD3 regulation draft will be finalised by the European Commission. It promises to introduce better API quality and stronger security measures into the open banking ecosystem.

Open Banking for Startups in Canada

In Canada, open banking is not available yet, but preparations are being made to implement the framework securely.

In 2018, Canada’s government initiated a review of open banking. In the 2023 fall economist statement, the authorities outlined the next steps in this process – the governance legislation is to be fully adapted by 2025.

“Open banking lead should be supported in this work through industry working groups that include balanced representation from banks, other prospective open banking participants and consumer representatives,” the government said.

Open Banking for Startups: Key Use Cases

As open banking is becoming more popular, use cases are spanning more sectors: lending, payments, and personal finance, just to name a few. Let’s take a look at the critical use cases of open banking technology for startup companies.

Business Lending

With the cost of living rising and inflation growing after the pandemic, many startups are facing pressure, particularly in getting funding.

Many startup owners, struggling with the slow and complex process of getting loans from traditional lenders, may resort to using expensive credit cards, overdrafts, or even personal loans to support their businesses.

Open banking offers a solution. By agreeing to share their transaction data, businesses allow potential lenders to access their real-time situation instead of basing the decision on the historical data.

Businesses have various options to use their open banking data, including embedded finance in accounting software, alternative lending platforms, marketplaces, brokers, and specialised business loan providers.

Startup Payment Processing with Open Banking

Payment processing issues can further complicate the challenges startups face in securing financing. For example, high fees for card payments can reduce profits, especially for businesses that have smaller transaction amounts.

Furthermore, offering only limited payment methods doesn't meet the evolving needs of a modern customer. They may prefer digital wallets or alternative online payment options instead of traditional bank cards. Plus, payment delays make it hard to cover operating costs and pay suppliers. This can hinder a startup’s growth.

According to Open Banking UK, in July 2023, open banking payments hit a record 11.4 million in the country, doubling the figure from July 2022. A significant factor behind this growth was the use of open banking for e-commerce payments.

Open banking payments are changing how customers shop online, offering a secure and smooth payment experience. Sellers can also verify payment receipts before sending out goods, adding trust to online transactions.

As big companies adopt open banking payments, startups can follow suit to attract more clients and expand their market share.

Financial Analytics & Forecasting

Sometimes, startups may struggle to understand their exact financial situation, making it challenging to manage cash flow, anticipate shortages, and work with accountants and analysts.

This issue can affect the accuracy of future earnings predictions, delay key decisions like asset investments, and reduce research and development efforts, all of which can restrict growth.

This can also hold true for tax calculations. Without real-time transaction data and the ability to share information with accountants, some companies may face unnecessary charges or miss out on tax benefits.

The June 2022 Open Banking Impact Report showed that the UK’s small businesses were more frequently using cloud accounting services powered by open banking. This helped them manage operations more effectively, gain better insights, improve efficiency, and save costs.

Operational Efficiency

Many startups get caught in cycles of manual, paper-based tasks that take a long time and are prone to mistakes. These tasks can keep employees from focusing on work that adds value.

Automating these tasks and optimising user experience can greatly help startups scale, which is often their goal. For example, using open banking, startups can adopt more efficient Account-to-Account (A2A) payments, removing the need for users to manually enter their card details. This also simplifies the checkout process, offering customers convenience and a quicker purchasing journey.

The same benefits apply to operational efficiency. By using tools that settle payments faster than traditional methods, startups can access vital funds sooner. They can shorten the gap between making a sale and getting paid, which boosts cash flow.

Open banking APIs can make accounting and financial management more efficient, too. They can automate matching transactions, manage bulk payments, and simplify bookkeeping.

Open Banking Benefits for Startups

- Funding Opportunities for Startups: Open banking allows startups to share real-time transaction data with potential lenders, improving chances of securing funding.

- Reduced Operating Costs: By automating financial tasks and leveraging efficient payment methods, startups can lower their operational expenses and improve profit margins.

- Faster Payment Processing: Startups can benefit from quicker settlements, enhancing cash flow by reducing the time between making a sale and receiving the payment.

- Improved Financial Management: Access to real-time data and automated bookkeeping through open banking APIs enables better financial forecasting and tax calculation.

- Better Customer Experience: Open banking enables personalisation and smoother payment experience, helping startups attract and retain clients.

- Strategic Decision-Making: With insights from open banking-powered analytics, startups can make informed decisions on product development, market expansion, and marketing strategy.

Open Banking & Payments with Noda

Noda is a worldwide payment solution and open banking API provider for seamless business transactions. From transaction management to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What are the main advantages of open banking for startups?

The main advantages of open banking are its power to uncover more funding opportunities, increase operational efficiency, and enhance customer experience.

How do I set up open banking for your startup?

Firstly, decide how you want to leverage the open banking technology. For example, if you want to integrate open banking payments into your startup, you need to find a reliable open banking provider. At Noda, we offer seamless business transactions through the power of open banking for companies of all types and sizes.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each