The Baltics are becoming the new fintech hub of Europe. The three countries often bracketed together - Estonia, Latvia and Lithuania - are boasting flourishing fintech sectors, with payments and lending taking the central stage.

Open banking is on the rise in the region, with Lithuania taking the central stage. Here, we take a look at the open banking infrastructure, regulation and ecosystems in each country and discuss the potential benefits this innovative trend can bring to the region.

Open Banking Regulation in the Baltics

Being part of the European Union, the Baltics' open banking regulation falls under the Payments Services Directive 2 (PSD2), enforced in 2018. PSD2 requires banks and account providers to share Application Programming Interfaces (API) data with third-party providers (TPPs) while obtaining consumer consent.

Furthermore, the Baltics are leveraging the ‘NextGenPSD2’ open finance framework developed by the Berlin Group, a Europen Standards Initiative.

In Lithuania, there was a separate public consultation on open banking in 2018. The council decided to establish the Open Banking Development Task Force, bringing together top experts in relevant areas. The APIs were completed in 2019.

Yet the journey doesn't end with PSD2. In June 2023, the European Commission released a draft legislation PSD3, which aims to advance open banking further and tackle issues like API quality. This new regulation will equip authorities with improved tools to assess the dedicated interfaces provided by banks and other financial institutions, driving progress in this area.

Open Banking in Lithuania, Latvia and Estonia: Overview

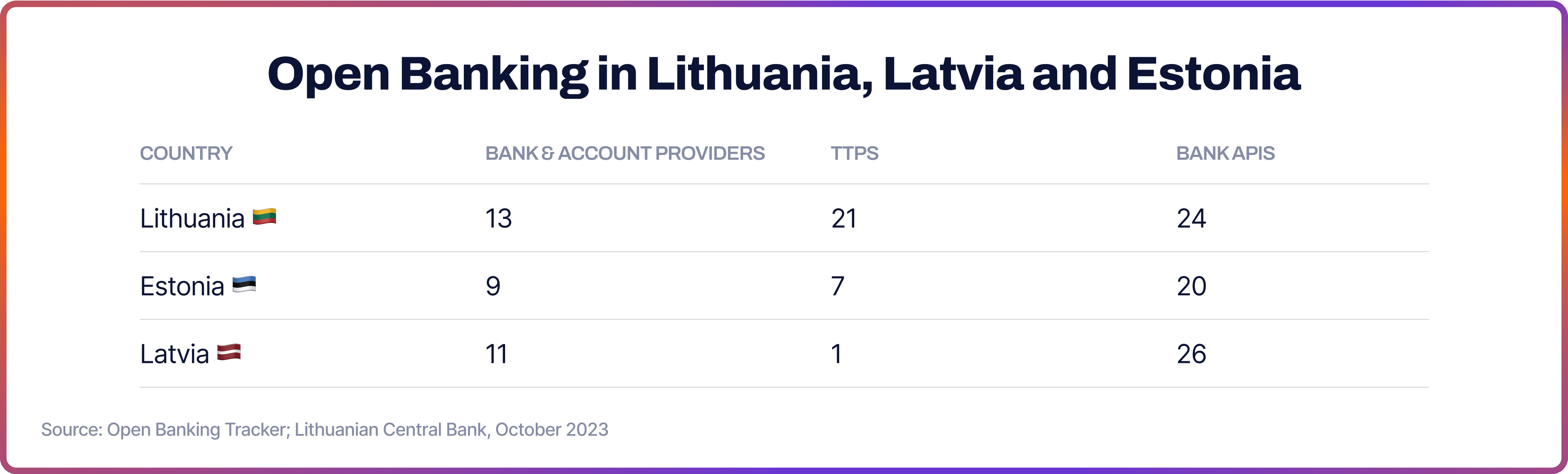

Below is the market adoption overview of open banking in the Baltic states. We can see that Lithuania is leading the way with the highest amount of account providers and TPPs.

Open Banking in Lithuania

Lithuania has positioned itself as the leading fintech hub in Europe, not without the support and initiative from its central bank. The country scored 7.5 in Yapily’s European League Table 2022 for open banking, taking fifth place after France.

“Lithuania’s open banking ecosystem is accelerating at pace,” the report said. “However, while the Lithuanian banks are generally very responsive to TPPs in the region, there is currently no consistent standards followed across the banks, and there can be periods of downtime.”

The Lithuanian Central Bank offers a register featuring APIs available in the domestic financial sector. These include 13 institutions as of October 2023. Among them are Lithuanian national banks, foreign bank branches, a credit union and fintechs such as Paysera and peer-to-peer lending platform Neo Finance.

According to the Open Banking Tracker, there are currently 24 Bank APIs and 21 TPPs regulated in Lithuania, which acquired licenses between 2012 and 2020. Meanwhile, the Lithuanian fintech landscape is flourishing. There were 263 fintech companies in the country at the end of 2022, according to Invest Lithuania.

Open Banking in Estonia

According to the Open Banking Tracker, the Estonian ecosystem boasts nine banks & account providers, seven TPPs, which are mostly payment fintechs, and 20 bank APIs. In the Yapily’s league table, the country scored 6.3, putting it at the lower end of the list.

“Estonia scores well in bank integration and API customer support,” the report said. “However, a lack of consistency across the largest banks and frequent periods of downtime can make it difficult for TPPs to integrate. Estonia should continue to focus on local regulatory oversight and API standardisation to accelerate its open banking ecosystem.”

Meanwhile, there is an increasing number of Estonians who prefer digital payments to physical plastic cards. Data from the Bank of Estonia showed that digital wallets, mobile phones, smartwatches and smart rings were used for 16.5% of card payments in Estonia in Q1 2023, which is almost double of 8.5% a year earlier. Statista estimated the online banking penetration in Estonia of 84.8% in 2023, suggesting a highly digitised society and many opportunities for open banking.

Open Banking in Latvia

According to the Open Banking Tracker as of October 2023, Latvian open banking architecture contained 11 banks & account providers, 26 bank APIs and one regulated TPP, Nordigen. In 2020, Nordigen was the first provider to offer a free European open banking API. In 2022, the company was acquired by GoCardless.

Among the banks and account providers within the Latvian open banking ecosystem are fintechs such as Revolut and Nordic groups such as SEB and Swedbank. The country scored 6 in the league table, putting it near the bottom of the list.

“For open banking to flourish in Latvia, the ecosystem will need to come together to tackle inconsistencies in the quality of bank integration and make the market more attractive for TPPs,” said the report. “Monitoring and enforcement will have a key role to play here as open banking continues to be regulated at the EU level, potentially limiting opportunities for innovation and adoption,” they added.

Meanwhile, digital payments in Latvia are booming and have long outpaced cash methods, according to the Payment Radar report by the Latvian central bank. Around 20% of Latvians now use mobile payments as their preferred method.

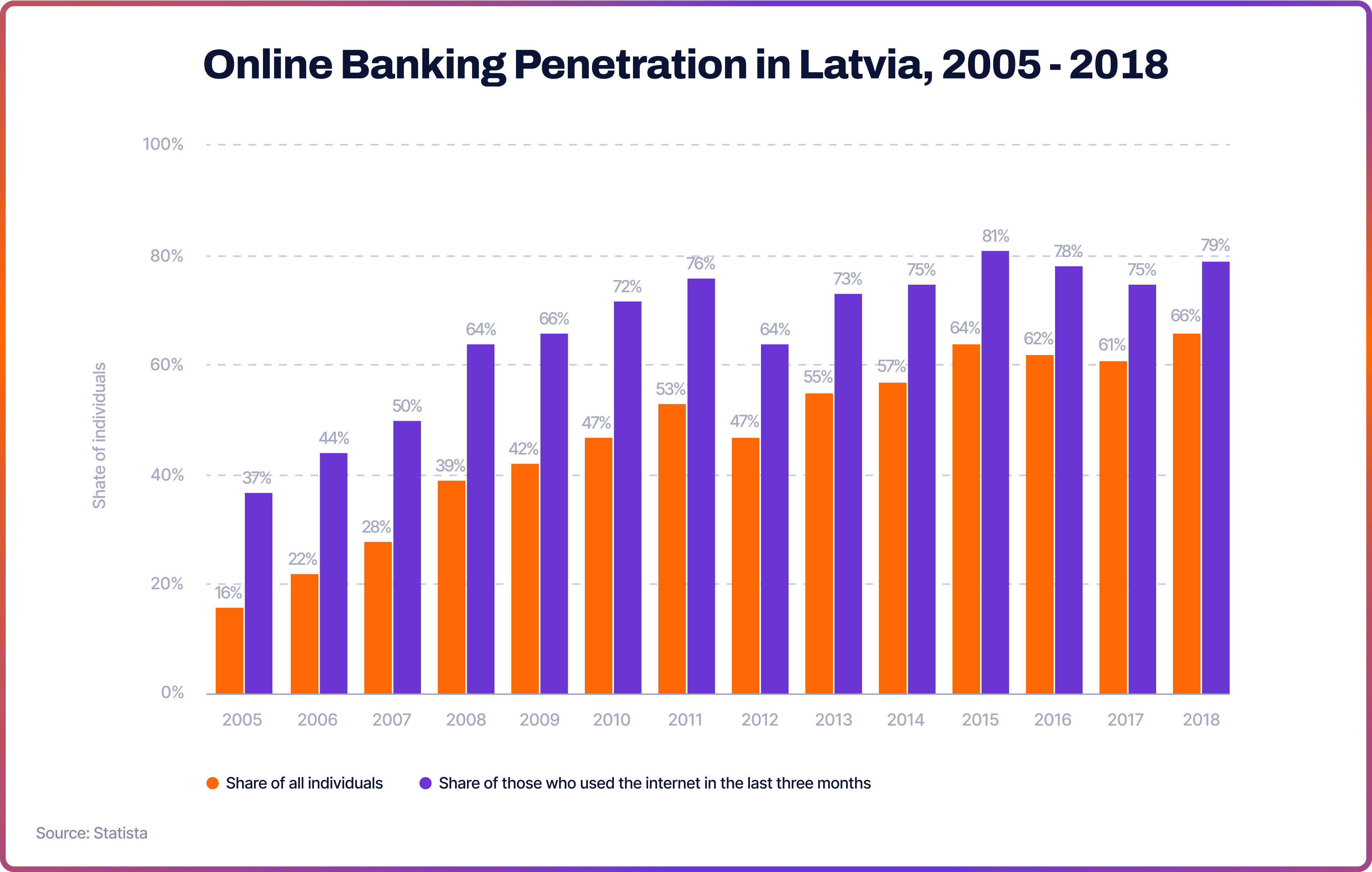

The online banking adoption in the country is too notably high. Data from Statista showed that 66% of all individuals used open banking in 2018. There are many opportunities when it comes to the development of open banking in the country, as Latvia is highly digitised.

Advantages of Open Banking in the Baltics

As we can see, open banking has been gaining traction in the Baltic region. Let’s take a look at its benefits. Open banking can bring a plethora of advantages, from financial innovation to economic growth.

Fintech Innovation

Open banking lowers the cost of innovation and allows fintech companies to gain a competitive advantage. The supportive regulatory environment, high digitalisation and a qualified professional talent pool in the Baltics are driving fintech innovation, resulting in better products for consumers.

Growing Ecosystem of Banking Software Providers

Countries like Lithuania have been growing their community of banking software providers in line with the development of open banking. These providers are crucial for enabling the digital capabilities required for banks and fintech companies to connect.

Emergence of Fintech Hubs

Open banking is contributing to the Baltic countries' emergence as significant fintech hubs in Europe. For example, Lithuania is rapidly emerging as a go-to jurisdiction for foreign fintech companies looking to set up an EU presence. This trend may contribute to the economic growth in the region.

Open Banking with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What is the future of open banking in Baltics?

The future of open banking in the Baltics will depend on many regional factors, such as their economies’ performance and central bank initiatives. The development of PSD3 regulation will likely influence the open banking development in the Baltics.

How do Baltic countries regulate open banking?

Being part of the European Union, the Baltics' open banking regulation falls under the Payments Services Directive 2 (PSD2) enforced in 2018. PSD2 requires banks and account providers to share API data with TPPs while obtaining consumer consent. Furthermore, the Baltics are leveraging the ‘NextGenPSD2’ open finance framework developed by the Berlin Group, a European Standards Initiative.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each