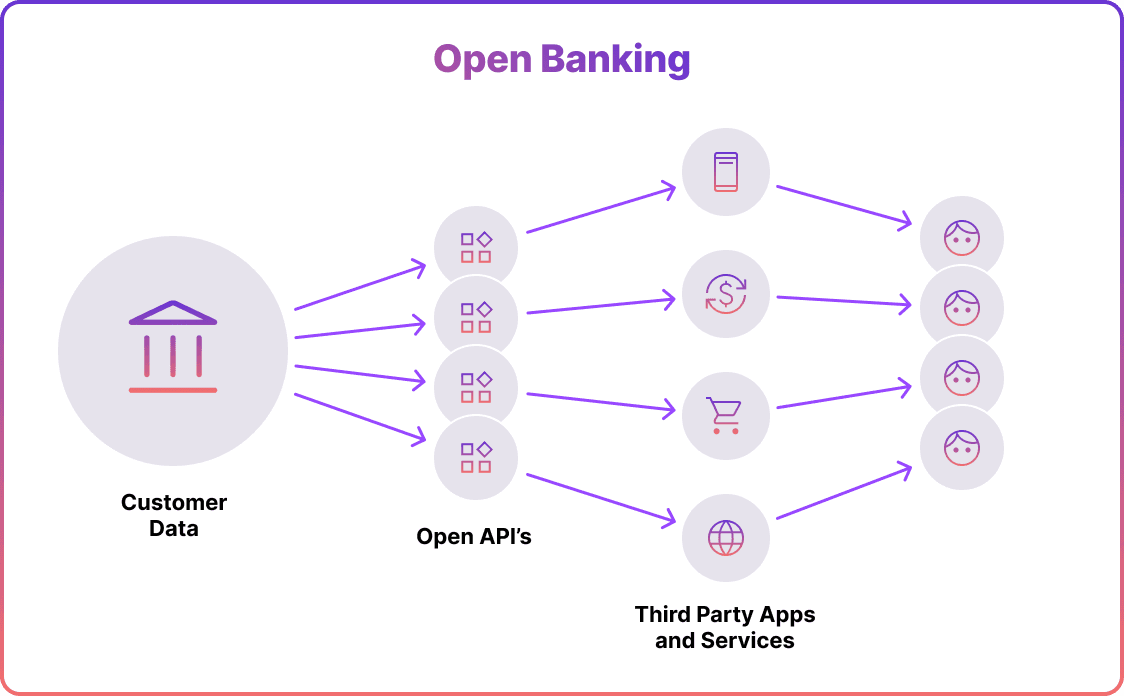

In today's technology-driven world, banking has evolved beyond traditional brick-and-mortar branches to the virtual sphere. The emergence of open banking technology – a paradigm shift where banks share user data with third-party developers via Application Programming Interfaces (APIs) – promises a more efficient, customer-centric model.

However, as this novel financial landscape evolves, so do the concerns about open banking security. Here we delve into the mechanisms behind this innovative technology, shedding light on open banking security standards and regulations.

How Open Banking Works

The heart of open banking is APIs, digital bridges enabling banks and third-party providers to interact and exchange data securely. By granting authorised third parties access to banking data, they can create a suite of financial services from personal finance management tools to more streamlined payment processes.

This sharing, however, doesn't mean customers relinquish control. In fact, quite the opposite is true. Banks and third-party providers are only permitted access to specific data that customers have expressly consented to share.

Open Banking Security Risks

As beneficial as open banking can be, it is not immune to potential security risks, especially due to extensive data sharing. Below are some of the key concerns surrounding open banking API security:

- Third-Party Risks: Opening up access to third parties introduces an element of risk. Any vulnerability in the third-party systems could potentially expose sensitive customer data.

- Fraud: With increased data sharing, there's an amplified risk of fraudulent activities. Cybercriminals may attempt to impersonate customers or even banks, to deceive and manipulate unsuspecting users into revealing sensitive information.

- Data Privacy: While regulations like GDPR exist, the sheer amount of data being shared across different platforms raises concerns about opening banking and data privacy. Ensuring all parties respect data privacy can be a challenge, especially considering that GDPR does not apply outside of Europe.

- Technical Risks: The reliance on APIs means that any malfunction, like system outages or integration errors, can impact the reliability of services.

Open Banking Security Explained

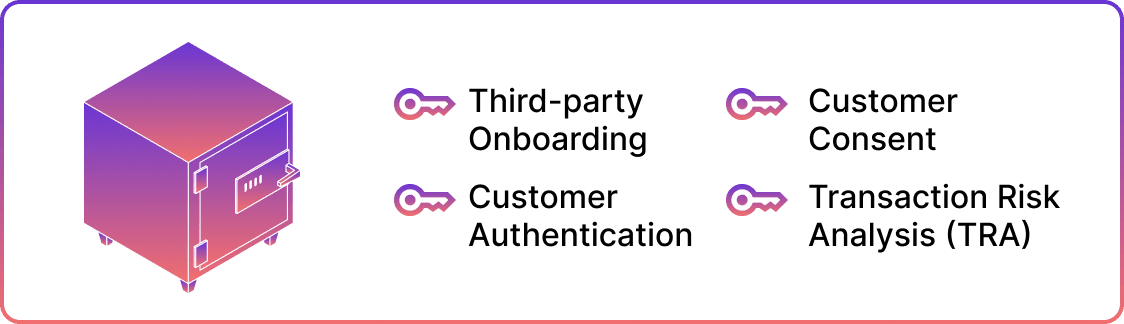

To counteract these security concerns and make open banking safe, the industry employs numerous measures from third-party onboarding to transaction risk analysis (TRA).

Third-Party Onboarding

The open banking ecosystem fosters collaboration between banks and third-party providers (TPPs), extending a more integrated and personalised banking experience to the customers. However, this collaboration also demands meticulous onboarding processes to maintain the security and integrity of customer data.

Before a TPP can access the open banking APIs, they must first subscribe, which involves a rigorous verification process. This process includes independent audits to validate that their systems and security controls meet the required standards set by financial regulators and government bodies. TPPs also need to demonstrate their compliance with regional data protection laws, like GDPR, and international banking regulations, like PSD2.

The onboarding process also ensures that TPPs maintain high standards of cybersecurity, have measures in place to detect and respond to security incidents, and commit to regular audits. This systematic third-party onboarding process is crucial in maintaining trust, security, and reliability in the open banking ecosystem.

Customer Consent & Authentication

Customer consent is paramount in open banking, putting customers in control of their data. This transparency promotes trust and ensures customers are aware of how their data is being used, stored, and regulated. Customers decide the level of sharing, duration, and purpose of their data usage.

But sharing sensitive information with third parties requires not just a customer's explicit consent but also robust authentication. Security measures here extend to employing KYC (Know Your Customer) processes for rigorous customer identification, preventing financial crime and money laundering.

Modern authentication techniques like multi-factor authentication (MFA) and biometrics add extra layers of security for fraud prevention.

Transaction Risk Analysis (TRA)

TRA is a sophisticated security measure integral to the open banking architecture. Essentially, TRA is a process that gauges the risk level associated with each transaction in real time. It scrutinises variables such as the transaction amount, the parties involved, the device used, and the transaction history.

When the risk level is identified as low, the TRA might allow consumers to bypass some authentication steps, simplifying their banking experience. However, if the risk level escalates, TRA triggers additional authentication measures, strengthening security during potential high-risk transactions. This fine-tuned balance between user experience and transaction security makes TRA a crucial element in the open banking security landscape.

Collaborative Approach

Collaborative intelligence plays a pivotal role in strengthening the security apparatus of open banking. In this shared ecosystem, banks, fintechs, and other TPPs work collectively, pooling together their resources, knowledge, and technical expertise to identify and neutralise potential threats.

This collaborative intelligence offers a more holistic view of the ecosystem’s security landscape, allowing for swift detection of anomalies, potential vulnerabilities, and irregular patterns in transactions. Furthermore, it extends to information sharing on new open banking and cybersecurity trends, threat intelligence, best practices, and emerging technologies.

Open Banking Regulations

Apart from the security measures employed by the businesses themselves, open banking companies operate under stringent regulations.

Financial regulators and government bodies create standards that all TPPs and banks must adhere to if they wish to participate in the open banking environment. Accessing open banking APIs is only possible if apps pass an independent audit that verifies their systems and security controls meet the required standards.

Moreover, regulations such as the European PSD2 and GDPR enforce equal rules for all participants, bolstering the security of open banking. These regulations promote data openness, transparency, and control, thereby gaining customer trust and compliance.

The UK, a major financial hub, has developed its own open banking system from the EU’s PSD2 principles, requiring the nine largest UK banks to create a common API standard, enhancing the interoperability and security of open banking.

Final Thoughts

In the realm of finance, open banking has emerged as the new norm, bridging banks with third-party developers through secure APIs to revolutionise the customer experience. However, as with every innovation, it also brings unique challenges, especially when it comes to security.

While the industry is fighting back with a suite of robust security measures, it's not a lone battle - banks, fintech, and other providers are banding together, pooling their knowledge and tech prowess to fend off potential threats. And let's not forget regulations like PSD2 and GDPR, ensuring the stage is fair and secure.

FAQs

Is open banking safe?

Open banking, when implemented correctly, can be a safe way to share financial data due to the stringent security measures and regulations in place. However, like any system involving data exchange, it is not immune to potential risks such as third-party vulnerabilities and fraud, which require continuous vigilance, robust security strategies, and regulatory compliance to mitigate.

How does open banking regulation protect customers?

Open banking regulations and the level of customer protection would vary from country to country. In the EU, for example, regulatory frameworks like PSD2 and GDPR ensure customers have control over their own data, while third-party providers must prove compliance through independent audits. Meanwhile, the UK has developed its own open banking system from the EU’s PSD2 principles, requiring the nine largest UK banks to create a common API standard.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants