In the fast-paced realm of fintech, two terms have emerged as influential forces for businesses and consumers: Open Banking vs Banking as a Service (BaaS). While both aim to transform our interactions with financial services, they serve different functions and provide unique advantages. Here, we seek to clarify these concepts and explore their impact on the modern business world.

What is Open Banking?

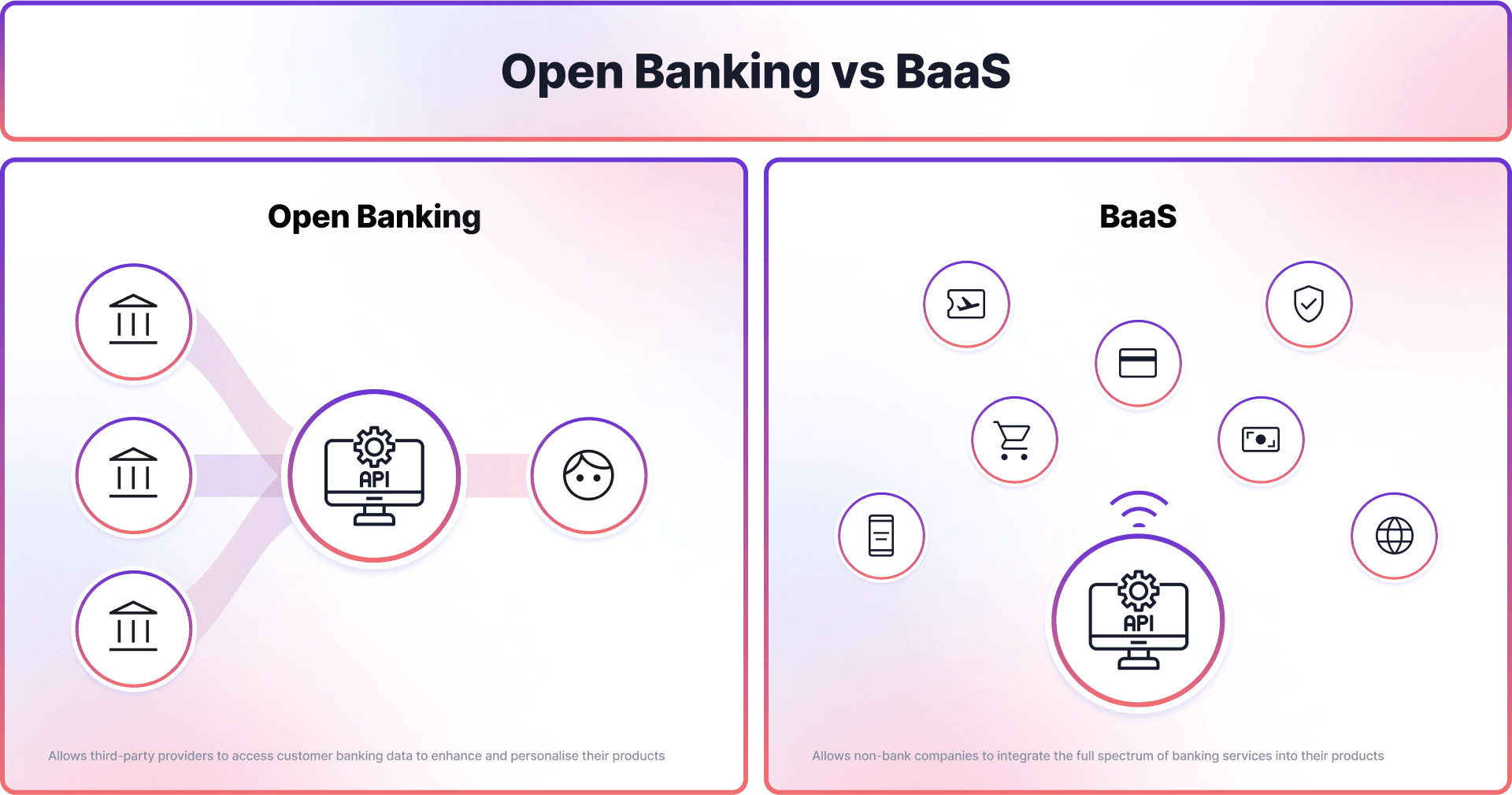

Open banking is a setting where, with customer consent, banks securely share their data with third-party providers using Application Programming Interfaces (APIs). This initiative aims to promote innovation, especially in creating high-quality personalised products for consumers, increase competition, and give consumers more control over their financial information.

At its core, Open Banking revolves around three main entities:

- Bank: Holds the customer's financial data and transactions

- Customer: The individual or business that owns the financial data and can give or not give consent to sharing their data

- Third-Party Provider (TPP): Entities that access the bank's data through APIs to offer value-added services to the customer

One of the most notable case studies for open banking is account aggregation. Consider a scenario where you have accounts with multiple banks. Instead of logging into each bank's app or website individually, open banking can enable you to use a single third-party app to access and oversee all your account information from these various banks. This could happen if they all securely share their API data with the third-party app.

APIs function as a connection between banks and third-party providers, facilitating the secure sharing of data while ensuring customer information is accessed only with explicit consent. With the help of APIs, TPPs can create innovative solutions that cater to users' financial behaviour and needs. These solutions range from personalised finance management tools to customised investment plans.

Key Benefits of Open Banking Explained

- Lower Fees: Open banking lets you bypass traditional card schemes with account-to-account payments, reducing transaction costs.

- Higher Conversion Rates: Seamless payment gateways can boost conversions and reduce cart abandonment.

- Instant Settlement: Rapid fund transfers and quick validation for cross-border payments.

- Personalisation: Access to consumer financial data allows tailored service offerings.

What is Banking as a Service (BaaS)?

Banking as a Service (BaaS) is a service model in the financial sector that falls under the umbrella of open banking. BaaS enables non-bank enterprises to provide banking services without acquiring a banking license. This is made possible by integrating the services of licensed banks into their products and platforms.

Implementing BaaS usually involves three key players:

- Traditional, Licensed Banks: These institutions possess the necessary licenses and infrastructure to offer banking services.

- Non-bank Enterprises/Fintechs: Companies that wish to offer banking services but lack the required licenses.

- BaaS Platform Provider: The intermediary that connects licensed banks with non-bank enterprises, facilitating banking services.

The main goal of BaaS is to expand banking services beyond traditional banks. BaaS achieves this by utilising APIs, enabling fintech companies and other non-banking organisations to seamlessly incorporate banking features like account management, payments, and lending into their platforms.

Digital wallets like PayPal are among the most prominent examples of BaaS revolutionising the financial landscape. These wallet applications, although not actual banks themselves, leverage the BaaS model to provide users with features like money transfers, bill payments, and even investment options.

Key Benefits of BaaS

- Rapid Market Entry: Fintechs can quickly launch financial products without a banking charter

- Cost Efficiency: BaaS allows fintech to offer banking services at a fraction of the traditional cost

- Innovation: Enables the creation of unique, tailored financial products and services

- Revenue Streams: Banks can monetise their infrastructure by partnering with fintech

- Consumer Reach: Expands access to financial services to underserved or niche markets

What’s the Difference Between Open Banking and BaaS?

Although both terms - open banking and BaaS - involve integrating banking services through APIs, the two have different purposes and distinct characteristics.

Open banking is a system that enables banks to share customer data with third-party providers through APIs. With the explicit consent of customers, they have control over when and with whom their data is shared. The goal of open banking is to make financial data more accessible and give customers the power to utilise services from other platforms besides their primary bank. For example, a budgeting app can access transaction data from a user's bank account through open banking, providing valuable financial insights.

BaaS, on the other hand, is a model where licensed banks collaborate with non-bank enterprises to integrate banking services into their products. This means that companies can offer specific banking services, such as mobile bank accounts or loans, without needing to obtain a banking license of their own. With BaaS, businesses can seamlessly integrate digital banking and payment services directly into their products, allowing customers to access these services through the business itself rather than through a traditional bank. For example, a shopping app could incorporate a built-in digital wallet or loan service provided by a BaaS provider.

BaaS vs Open Banking: Key Differences

- Extent of Integration: BaaS APIs have a broader scope, encompassing the entire lifecycle of an account, from its creation to retrieving transactions, balancing data, and even making payments. They play a role in both opening and closing accounts. In contrast, Open banking APIs are more limited, focusing mainly on retrieving data from a customer's account.

- Functionality: BaaS provides a comprehensive banking service, enabling fintechs to operate similarly to licensed banks. Open banking, however, serves as a bridge between banks and third-party services, allowing data sharing but not the full spectrum of banking operations.

- User Interaction: With BaaS, users typically interact with the third-party platform offering the banking service. In open banking, users primarily engage with their bank's channels, occasionally accessing their bank data via open banking APIs.

- Purpose: Open Banking is about offering specific banking features to customers, giving them more control over their data and broadening their access to financial services. BaaS, conversely, offers almost the entire banking package, allowing businesses to provide banking services without being banks themselves.

Open Banking with Noda

Elevate your business with Noda’s open banking solution. Drive increased sales and save valuable time through streamlined processes. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Unlock your business potential with Noda - your payments are our priority.

Final Thoughts

The financial industry is undergoing a transformation with the rise of open banking and BaaS. As we progress, combining these models could lead to a financial system that is more interconnected, efficient, and focused on the customer. It is up to businesses to utilise these innovations and stay competitive while meeting evolving customer demands.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each