Open finance is the next step beyond open banking – offering far more than instant transfers and basic customer data. But with new regulations and acronyms like FiDA, DUAA, and Smart Data flying around, it can be hard to understand what open finance actually means for your business.

This article breaks it all down – what open finance actually is, how it’s developing in the UK and EU, and why it matters for merchants right now.

Key Takeaways

- Open finance expands on open banking by including data from loans, pensions, insurance, investments, and more – giving a fuller view of a customer’s finances.

- The EU’s FiDA regulation will set the legal framework for open finance, with the final draft expected in 2025 and a phased rollout to follow.

- In the UK, the FCA and government are building the groundwork through the Smart Data initiative and the upcoming Data (Use and Access) Act 2025.

- Brazil is already leading the way, showing how open finance can boost competition, financial inclusion, and innovation through real-world results.

- For merchants, open finance means smarter payment options, faster credit decisions, and more personalised financial experiences – all powered by secure, consent-based data sharing.

What Is Open Finance?

Open finance refers to the emerging framework that will require financial companies – including banks, lenders, insurers, and investment firms – to share customer data securely with consent. With the customer’s permission, this data can be shared securely with licensed fintechs to create smarter, more personalised services.

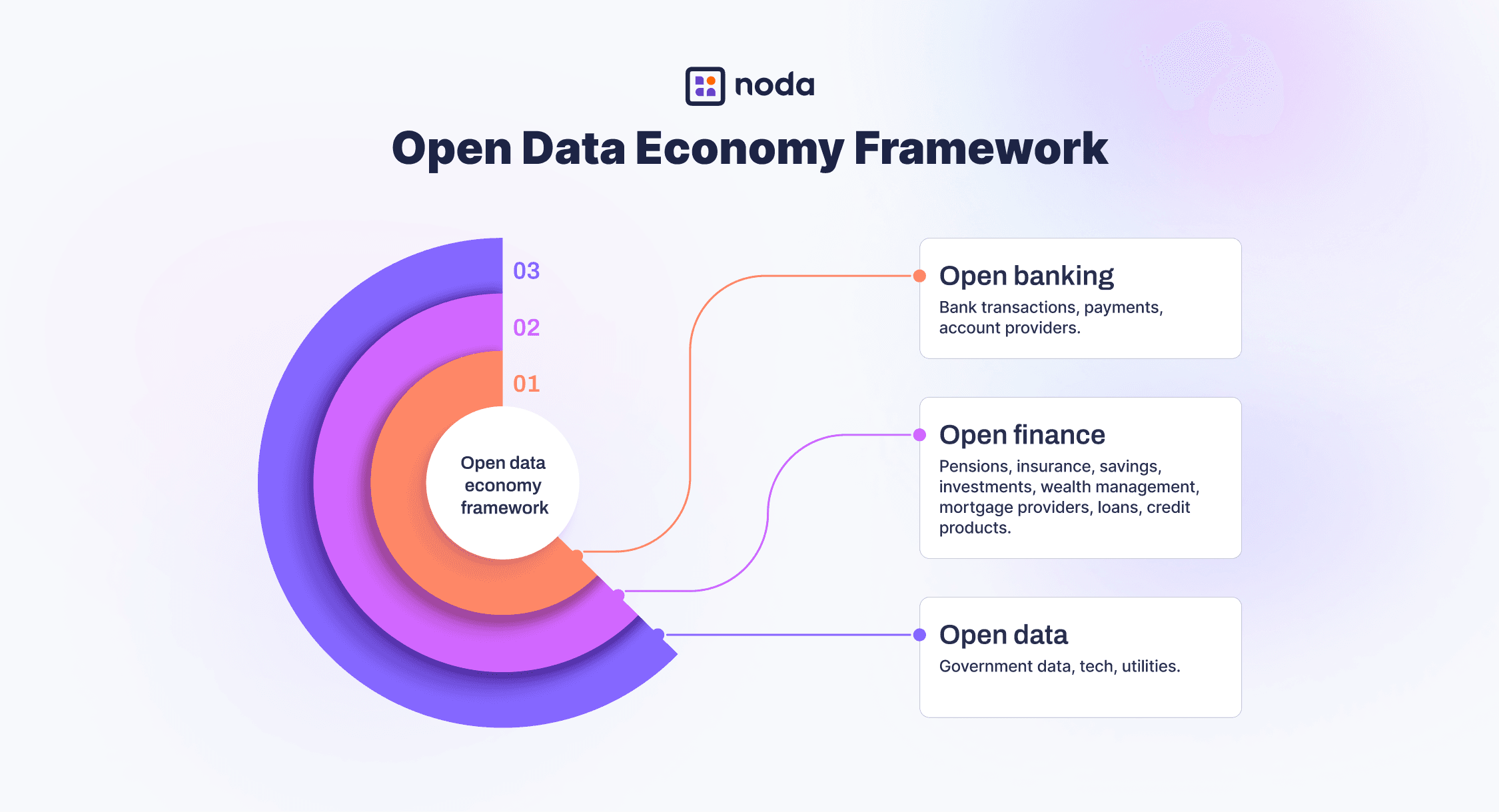

In essence, open finance is the next step after open banking, yet it’s much bigger in scope. It’s part of the bigger open data economy framework.

How Does Open Finance Work?

Open finance takes the same idea as open banking and extends it further. With open banking, banks securely share customer data with licensed fintechs through application programming interfaces (APIs), which are software connections, but only when the customer gives permission.

Open finance would expand this setup beyond banks, allowing other financial players like investment firms, insurers, pension funds, and mortgage providers to connect in the same way. Here’s how APIs work in this context:

- They act like a secure bridge between financial institutions and regulated and licensed fintech apps.

- They standardise communication, so different systems can “talk” to each other.

- They ensure data is shared only with customer consent and under strict regulations.

- They allow payments or data requests to happen instantly and safely.

Merchant takeaway: That means, instead of only seeing fragmented account and transaction data, merchants could access a customer’s broader financial picture through open finance.

Difference Between Open Banking and Open Finance

| Open banking | Open finance |

| Lets banks share customer accounts and transaction data (with consent). | Expands beyond banks to include pensions, insurance, mortgages, investments, and other financial service providers. |

| Focused mainly on payments and account information. | Provides a fuller financial picture across different services. |

| Already widely adopted in the UK and EU. Regulated via PSD2 in the EU; Open Banking Ltd in the UK. | Still emerging, with adoption and rules being developed. |

| Merchants can use it to accept pay-by-bank payments and see limited account data. | Merchants could use it to offer smarter payment options, reduce risk, and personalise services. |

Why Should Merchants Care about Open Finance?

Open finance is set to reshape how UK merchants handle payments and understand their customers. Building on open banking, it will connect data from loans, insurance, investments, and pensions, giving businesses access to a fuller financial picture. This can make transactions smoother, credit decisions faster, and payment experiences more tailored.

Why Wait for Open Finance? Start with Noda Today

At Noda, we’re already building what open finance promises. We combine the cost savings of open banking payments with the convenience of cards and digital wallets – all in one platform.

- 2,000+ banks across 28 countries (EU & UK) for pay-by-bank payments. Explore our bank coverage.

- All major payment methods covered: cards with smart routing, Apple Pay, Google Pay, and open banking.

- Lower costs: open banking transactions from just 0.1% per payment.

- Flexible integration: API, ready-made e-commerce plugins (WooCommerce, Magento, PrestaShop, OpenCart), payment links, and QR codes for offline payments.

- Instant payouts: better cash flow with real-time settlements.

- Dedicated account manager for smooth onboarding and fast support.

- 90-day free trial for SMBs.

Open finance is the future. With Noda, you don’t have to wait for it.

Open Finance Regulations Around the World

EU Open Finance: FiDA

Open finance hasn’t been adopted in the EU yet, but the legal groundwork is being put in place. The European Commission’s Financial Data Access Regulation (FiDA) – proposed in June 2023, and currently in draft – is designed to set the rules for the EU’s open finance.

Please note that FiDA is still under negotiation between the Council and Parliament, and final adoption is expected in 2025, with implementation likely beginning in 2026–2027.

The new regulation would cover these types of customer financial data:

- Loans and mortgages, including balances, conditions, and transactions (but not regular payment accounts).

- Savings and investments such as shares, insurance-based investments, crypto-assets, real estate, and the income they generate.

- Occupational pensions such as those built up in workplace pension schemes.

- Personal pensions linked to pan-European pension products.

- Non-life insurance such as property or car insurance (excluding health and sickness insurance).

- Creditworthiness data such as information gathered during loan applications or credit rating requests.

Under FiDA, like in PSD2, customers are in control of their financial data. Companies may access it only with clear permission, and they must explain exactly how they will use it. They cannot share the data without consent, and customers can withdraw permission anytime, free of charge.

With access to this broader pool of financial data, European fintechs could start building superapp-style platforms that bring banking, insurance, and investments together in one place.

For now, they might have the field mostly to themselves – FiDA is expected to keep Big Tech firms like Apple and Google out, at least initially, to avoid data monopolies. Still, that advantage may be temporary as Big Tech will likely push back through legal and diplomatic channels to gain access.

FiDA Timeline

The Council has agreed on its position, and the proposal is now being negotiated between the Parliament and the Council. The final regulation draft is expected in 2025, followed by a phased rollout.

UK Open Finance: Smart Data

In the UK, where open banking just reached 15 million active users, open finance is developing more slowly than in the EU.

However, the Financial Conduct Authority (FCA) plans to publish a roadmap within the next year as part of its new five-year strategy, including the key standards of open finance. The regulator aims to have the first Open Finance framework ready by 2027, beginning with small business lending to help companies access funding more easily.

The UK government is also laying the groundwork for a broader smart data economy through the upcoming Data (Use and Access) Act 2025 (DUAA). The law builds on open banking and open finance, aiming to make data sharing easier and more secure across sectors, and showing an inclination towards an open data economy. It will come into effect gradually, with full implementation expected by June 2026.

Marion King, Open Banking Limited (OBL) trustee, for OBL Smart Data Predictions report:

“The announcement of the [bill] signalled clear intent from the Government about the importance of building on open banking’s data sharing principles to deliver a smart data economy worth an estimated £10 billion over the next 10 years. The Bill will enable the introduction of the Secondary Legislation needed to establish the long-term regulatory framework for open banking, putting it on a commercially sustainable footing.”

Brazil: Pioneering Open Finance Framework

The world – including the EU and the UK – has plenty to learn from Brazil’s pioneering approach to open finance. By late 2022, Brazil had entered the final phase of its open finance rollout, which continues to expand through 2025.

Aristides Cavalcante, Head of Technology at the Central Bank of Brazil, explained in an interview for the Open Finance Index report, that the country’s open finance model is built on two key principles: reciprocity and interoperability.

“Open Finance will be successful in Brazil, due to three factors: a very broad scope for data sharing, a local willingness to share data and high-quality of the regulation provided by the Central Bank. Standardisation was also key for success in both user experience and APIs.”

By 2022, more than 5.2 million people in Brazil had active consent for data sharing, and API usage had soared to over 1 billion calls per month, according to Cavalcante.

Open Finance Use Cases

- Financial superapps: Open finance will give the opportunity to build apps that combine payments, credit, investments, insurance, and other services in one interface. Users don’t need five different apps – everything is under one roof.

- Better credit & lending offers: In Brazil, open finance is already helping lenders access richer data, which means they can offer loans with lower interest rates and fewer hurdles.

- Faster account opening: Companies can pull verified financial data from other providers (with consent) to speed up new customer registration.

- More tailored financial services & insurance pricing: With access to a fuller financial picture, insurers, investment firms, and other service providers can offer more tailored products (e.g. lower premiums, more precise risk assessments).

- More competitive & diversified financial ecosystem: Open finance lowers barriers to entry, letting new fintechs and non-traditional players compete against incumbents – good for innovation, bad for complacency.

AI and Future of Open Finance

Artificial intelligence (AI) – today’s biggest buzzword – is also making its way into open finance. The latest UK’s Open Banking Ltd discussion paper, a consultation that gathers feedback before finalising new policy ideas, puts AI at the centre of the sector’s future and invites key industry players to share their views.

The paper explores how AI can enhance open banking and open finance. It asks whether the cost and complexity of sharing data through APIs can be reduced, especially in legacy systems; whether the Open Banking Standard gives AI enough access to data to support new products; and whether AI can be used to create services entirely from scratch. It also invites suggestions on any other AI-related issues that should be considered.

FAQs

What is the difference between open banking and open finance?

Open banking lets banks share customer bank accounts and transaction data (with consent) through secure APIs. Open finance takes that idea further, as it includes a much wider range of financial data, such as pensions, insurance, investments, mortgages, and credit products.

What are open banking examples?

Examples of open banking include pay-by-bank payments, budgeting apps that connect to multiple bank accounts. These services use regulated APIs to access account data securely, with the customer’s permission.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each