The digital payment system in the Netherlands is evolving, but not in the way you might expect. While many countries rely on credit cards, Dutch consumers prefer bank-based transactions. Debit cards dominate in-store payments, while online banking, open banking and digital wallets are exploding in popularity.

To stay competitive, businesses must offer seamless, cash-free options. Open banking and digital wallets are growing, enabling faster, more secure transactions. Providing familiar, hassle-free methods builds trust and boosts conversions.

In this guide, we’ll break down the most popular Dutch payment options, examine the shift towards digital transactions, and highlight the best solutions for businesses and consumers.

The Shift in Dutch Payment Habits

Dutch payment habits are changing as digital transactions and mobile payments grow. Debit cards still lead in-store payments, but their share is falling from 60% in 2023 to 48% by 2027, while digital wallets rise from 18% to 35%.

Online spending is increasing and expected to reach €59.85 billion by 2027. Consumers now prefer faster, more seamless payment systems including real-time bank transfers and open banking solutions.

As digital payments become the norm, businesses must adopt a modern payment gateway that aligns with Dutch consumer preferences and supports seamless, real-time transactions.

Most Popular Payment Methods in the Netherlands

Consumer payment trends in the region are shaped by three key attributes: digital-first, bank-driven and mobile-friendly. With nearly universal banking access and a preference for instant transactions, businesses need to align with these expectations to keep customers moving through checkout.

Here’s a closer look at the payment methods most preferred by Dutch consumers:

Debit Cards and Credit Cards

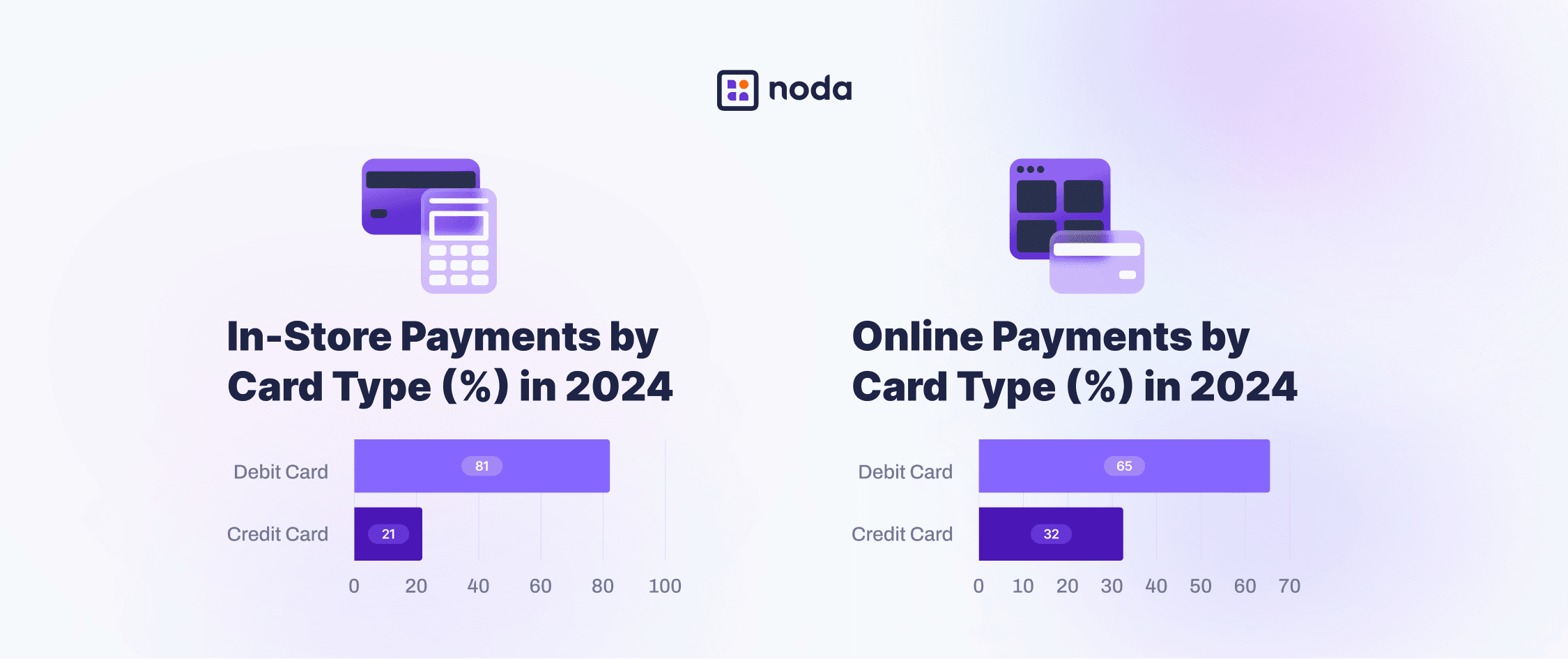

Debit cards are the default payment method for in-store purchases, with a 98.15% penetration rate. They are widely used for daily spending, including groceries, transport, dining and shopping.

Credit cards, on the other hand, are far less common, with a 37.45% penetration rate. Rather than everyday purchases, they are typically reserved for hotel bookings, car rentals and international online shopping.

Debit and credit card usage is expected to decline slightly, but they remain essential. By 2027, debit card payments at point-of-sale are projected to decrease to 48%, while credit card transactions will drop to 8%. Despite this shift, cards continue to be a dependable option for both local and international transactions.

Direct Bank Transfers

With 96.35% of consumers using online banking in the country, direct bank transfers are the most popular payment method for online transactions. They offer a fast, secure and familiar way to pay, making them essential for businesses operating in the digital space.

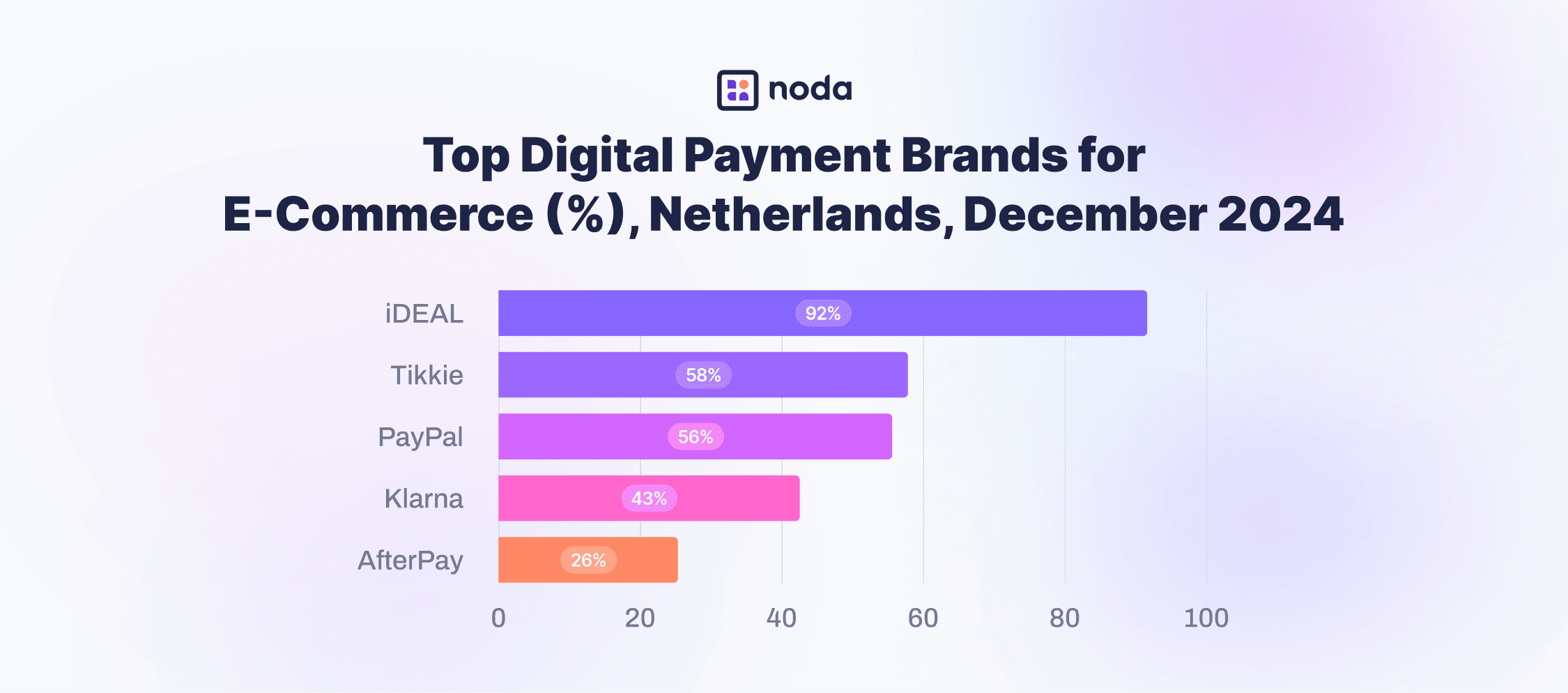

The leading real-time bank transfer system is iDEAL, responsible for 92% of e-commerce payments. It allows consumers to pay directly from their bank accounts through their banking apps, eliminating the need for credit cards.

Beyond iDEAL, real-time payments are growing rapidly. In 2023, 1.3 billion instant payments were processed, a number expected to triple by 2028. This signals a strong demand for fast, seamless bank transfers across different payment networks, including account-to-account (A2A) payments through open banking and instant transfers provided by major Dutch banks.

Digital Wallets

Digital wallets are becoming an essential part of payment systems, with more consumers shifting to mobile-friendly transactions. While debit cards still lead, mobile payments are rising due to tap-to-pay convenience and banking app integrations. By 2027, digital wallets will account for over a third of in-store transactions, up from 18% in 2023.

Digital wallets don’t replace bank transfers or debit cards, but they make mobile payments easier for shoppers. Businesses that integrate a payment gateway with real-time transfers and digital wallets will stay ahead, driving sales and building stronger customer loyalty in an increasingly cashless marketplace.

Buy Now, Pay Later (BNPL)

BNPL is also gaining popularity, allowing consumers to split payments without relying on traditional credit. In 2024, the market grew by 17%, reaching €11.26 billion in transactions. While not the most common way to pay, it’s a go-to option for those who want more flexibility at checkout.

Shoppers, especially in fashion and electronics, use BNPL to split costs into smaller payments, making purchases more manageable. For retailers, it can boost order values and attract budget-conscious customers, making it a valuable addition to checkout options.

Cryptocurrencies

While some online retailers accept cryptocurrencies like Bitcoin and Ethereum, they are not widely used for everyday transactions due to price volatility. Instead, most Dutch consumers hold crypto as an investment rather than a payment method.

In 2022, 14% of Dutch consumers owned cryptocurrency, but its use for actual purchases remains low. Businesses considering accepting crypto must ensure regulatory compliance, as the Dutch Central Bank (DNB) supervises crypto-asset service providers.

Open Banking

Open banking is changing the way payments work in the Netherlands and across Europe. Introduced under the PSD2 legislation, it allows certified third-party providers (TPPs) secure access to bank-held customer data, enabling faster, direct A2A transactions without needing cards or third-party payment processors.

As more consumers move away from traditional payment methods, A2A payments in the country are expected to reach 70% of domestic e-commerce transactions by 2027. Businesses that integrate real-time payments can reduce costs, improve cash flow and offer a smoother checkout experience.

The Future of Payments – Open Banking with Noda

Payments should be fast, flexible, and easy to manage. Noda’s Open Banking solution streamlines payment processing, user verification and checkout optimisation, so businesses can focus on growth – not transaction issues.

With over 2,000+ banking partners in 28 countries, we provide a scalable, multi-currency solution that keeps businesses ahead in a competitive market.

- Instant bank payments with real-time settlements for faster access to funds.

- Lower transaction fees by removing unnecessary intermediaries.

- Stronger security and compliance, including PSD2 protection and fraud prevention.

- Seamless integration with e-commerce plugins and API support for easy setup.

By simplifying payments and eliminating delays, Noda helps businesses enhance the checkout experience, reduce costs and scale effortlessly across markets.

Maximising Payment Flexibility for Customers

Offering the best payment methods ensures a seamless, efficient, and cost-effective checkout experience, helping businesses reduce cart abandonment and improve customer satisfaction. But as payments evolve, businesses need flexibility and scalability to stay ahead.

Having multiple payment options available – including real-time A2A transactions – gives customers the choice they expect. Noda’s Open Banking framework helps businesses integrate secure, real-time payments at lower costs, offering a smarter way to scale across markets.

Boost customer satisfaction with instant payments. Try Noda’s Open Banking today.

FAQs

How can I pay in the Netherlands?

Most payments are made through debit cards, online banking transfers, digital wallets and open banking payments. Contactless payments are widely accepted, and open banking is making payments faster and more seamless.

Which payment methods are used in the Netherlands?

The most common payment methods include debit cards, iDEAL bank transfers, digital wallets (Apple Pay, Google Pay) and Buy Now, Pay Later (BNPL) services like Klarna. Open Banking payments are also growing, offering businesses a faster and more secure way to process transactions.

Does the Netherlands use PayPal?

Yes, PayPal is available in the Netherlands and is commonly used for online shopping and international purchases, but it’s not as widely preferred as bank transfers or local payment options like iDEAL.

What is the iDEAL payment method in the Netherlands?

iDEAL is a bank transfer payment system that lets consumers pay directly from their bank accounts. It’s one of the most trusted and widely used online payment methods in the country. Learn more about iDEAL payments here.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each