In the rapidly evolving digital era, small businesses are always on the lookout for secure and efficient payment solutions to optimise their operations and improve customer satisfaction. With a wide array of choices at their disposal, it becomes vital for small business owners and executives to understand the landscape and make well-informed decisions that align with their unique business requirements.

Summary

|

What Are The Common Problems of Small Businesses?

Small businesses in the UK and continental Europe face a distinct set of challenges when it comes to accepting online payments. Integration difficulties are often the first hurdle. Adding a new payment solution to an existing setup can be technically complex, particularly without dedicated IT support. Many providers expect retailers to work with APIs or compatible ecommerce platforms, which can take significant time, effort and investment.

Another widespread issue is unclear or hidden fees. While some platforms appear to show transparent pricing, many use complicated structures that include fixed charges, variable rates, additional fees for certain payment types, and surprise costs for chargebacks or manual transfers. For business owners trying to understand the real cost of a payment, this lack of clarity is frustrating.

Delayed payouts are also problematic. Larger companies typically receive funds quickly, but smaller retailers may have to wait three to five working days or more to access their money. For businesses that rely on swift turnover or need to restock quickly, such delays can create serious cash flow issues.

Limited choice of payment options can cause customers to abandon purchases. Shoppers now expect to pay in the way that suits them best, whether by card, bank transfer, mobile wallet or instalment options. Managing several different providers to offer this range can become costly and complicated.

Security concerns and chargebacks present further difficulties. Small businesses are often more exposed to fraud, disputed payments and unauthorised transactions. While larger firms can afford internal teams to manage this, smaller ones are often left chasing unpaid invoices and covering losses themselves.

Lastly, lack of responsive support leaves many merchants feeling abandoned. In today’s round-the-clock business environment, problems with payments or platform errors need urgent attention. Without prompt and reliable customer support, minor technical issues can escalate into serious disruptions.

These challenges make it clear that small businesses need payment systems designed with their realities in mind. The ideal solution should be simple to set up, transparent in pricing, flexible in payment options, highly secure, and supported by a responsive, knowledgeable team.

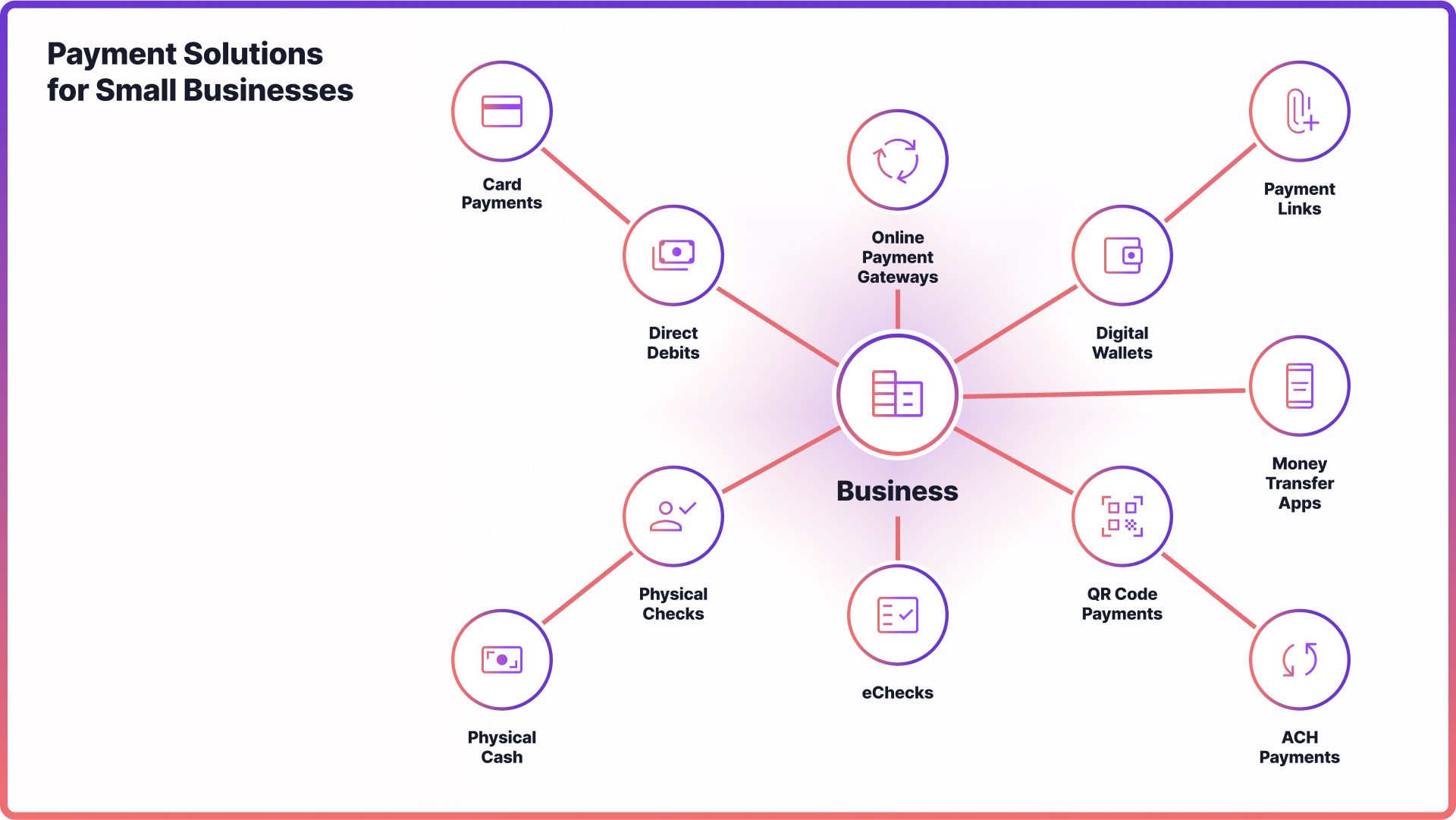

What Small Business Payment Methods Are Available?

Open banking

In recent years, open banking has emerged as the smartest and most efficient payment method for small businesses, allowing customers to pay directly from their bank accounts without entering card details or relying on third‑party intermediaries. Transactions settle in seconds rather than days, fees are typically a fraction of card processing costs and the risk of chargebacks is all but eliminated. This modern payment system in e‑commerce delivers a seamless, secure checkout experience that boosts conversion and cash flow.

Noda stands out as the supreme open banking platform for small businesses, offering instant account‑to‑account payments from over 2000 banks across 28+ countries Europe and beyond, plug‑and‑play integrations for popular shopping carts and ultra‑low fees from just 0.1% per transaction. By choosing Noda, merchants can reduce costs and provide customers with the speed and convenience they expect.

Card Payments

Card payments remain the most common method in the UK, offering ease and familiarity to customers, though fees and fraud risks must be considered. According to the 2024 UK British Retail Consortium (BRC) Payments Survey, an overwhelming majority of retail transactions, precisely 85%, were conducted using these cards.

Direct Debits

Ideal for recurring payments, direct debits automatically collect funds from customer bank accounts but may take several working days to clear.

Digital Wallets

Services like Apple Pay, Google Pay and PayPal enable fast, tap-and-go payments using smartphones, although they can carry higher charges.

Payment Links

Businesses can send secure payment links via email or SMS for quick online payments for small businesses without needing a website, though payment completion depends on customer action.

Money Transfer Apps

Apps like Wero or Revolut and similar tools are useful for instant peer-to-peer payments, particularly for freelancers or small service providers.

QR Code Payments

Customers scan a QR code to complete payments instantly, offering a contactless and simple experience for both sides.

Cash and Cheques

Though in decline, cash and cheques still play a role in specific sectors, especially where immediate liquidity or traditional methods are preferred.

Buy Now Pay Later (BNPL)

BNPL services allow customers to split payments over time, helping to boost sales and reduce friction at checkout, especially for higher-ticket items.

How to Choose the Right Payment Method for a Small Business?

Choosing the best payment gateway for a small business is essential for operating efficiently and supporting your e-commerce business’ growth. Several key factors should be considered when selecting the right solutions.

Firstly, understanding your business model is crucial. It is also important to consider customer demographics. Younger audiences are often more comfortable using QR codes or mobile money transfer apps, while older customers may still prefer more traditional methods such as credit and debit cards.

Cost plays a major role in the decision-making process. Each payment method comes with its own set of transaction fees and related charges, so evaluating the overall cost-effectiveness is vital. Liquidity needs must also be taken into account. If your business requires fast access to funds, then it is wise to choose payment options that provide rapid settlement, like instant bank payments.

Security remains a top priority for small business payment methods. The chosen payment methods should meet recognised industry standards and include strong protection against fraud. Lastly, integration should not be overlooked. Any new payment system should work seamlessly with your existing infrastructure to ensure smooth and efficient operations.

Top 7 Payment Options For Small Businesses

1. Noda

Noda is a modern open banking platform designed specifically for cost-conscious small businesses. It allows merchants to accept instant account-to-account payments from over 2,000 banks across Europe through a single integration. With ultra-low fees starting from 0.1%per transaction, plugins for platforms like WooCommerce and Magento, and a dedicated account manager, Noda is an excellent solution for businesses seeking affordable, scalable and secure online payment options.

2. Mollie

Mollie offers a user-friendly interface with broad multi-payment support, making it a great fit for small to medium-sized e-commerce businesses. It provides local payment options across Europe, supports major platforms like Shopify and Magento, and charges transparent pay-as-you-go rates. Mollie’s ease of use and flexible integrations make it ideal for merchants looking to offer customers a seamless checkout experience without lengthy setup processes.

3. GoCardless

GoCardless specialises in direct debit payments and is particularly well-suited to businesses with recurring billing needs, such as subscriptions or retainers. It offers lower transaction fees than card processing and automates the payment collection process, helping to reduce late payments. With integrations to platforms like Xero, QuickBooks and Salesforce, GoCardless is an effective option for service-based businesses and B2B invoicing.

4. SumUp

SumUp is primarily known for its point-of-sale hardware but also provides online payment solutions such as payment links, invoicing and a basic e-commerce store builder. It is especially useful for micro-businesses, mobile traders or retailers transitioning into online sales. SumUp’s straightforward fee structure and lack of monthly contracts make it a popular option for entrepreneurs seeking simplicity and reliability.

5. Square

Square offers a complete suite of payment tools, combining both in-store and online capabilities. It includes a free website builder, payment processing, inventory tracking and analytics. While it is most popular in the United States, its UK offering caters well to small businesses that want an all-in-one solution. However, its international reach is somewhat limited, which could restrict growth beyond local markets.

6. QuickBooks Payments

QuickBooks Payments is a built-in payment solution for users of QuickBooks accounting software, ideal for small businesses and freelancers who want to simplify how they get paid online. It lets you send invoices by email or text with a pay button included, so customers can pay instantly by card, bank transfer, PayPal or Apple Pay. Payments are deposited directly into your bank account and automatically matched to your records in QuickBooks, making reconciliation easy. While not a full ecommerce checkout tool, it can connect to platforms like Shopify or WooCommerce, allowing you to accept online payments and keep everything synced in one place. It is a strong choice if you already use QuickBooks and want to keep accounting and payments tightly linked.

7. WorldPay

WorldPay is a well-established provider of merchant services, offering a wide range of payment solutions including card processing, multi-currency support and recurring payments. It supports direct integration with major platforms such as Shopify and WooCommerce, providing branded or hosted payment pages, multi-currency support, Pay‑by‑Link, and advanced fraud management tools. While also present in point-of-sale environments, its online gateway and international reach make it a solid choice for businesses needing dependable, full-service e-commerce infrastructure with expert support.

Which Payment Methods Are Not A Good Fit For Small Businesses?

1. PayPal

PayPal is a well-known name in online payments, most often used by large companies. Its business solution enables quick setup, easy checkout, and access to global customers. PayPal supports cards, bank transfers and wallets, and its built-in buyer protection helps build trust. However, its high transaction fees make it an impractical choice for small businesses, positioning it as a better fit for companies that prioritise speed and reach over cost efficiency.

2. Klarna

Klarna is a buy-now-pay-later provider that enables small businesses to offer flexible payment terms to their customers, including interest-free instalments. This can help increase conversion rates and average order values, particularly in fashion, electronics and lifestyle sectors. Klarna is simple to integrate with most e-commerce platforms and also provides merchant protection against fraud and chargebacks. However, due to high transaction fees, it is one of the less preferable small business payment processing options.

3. Stripe

Stripe is a globally recognised payment platform known for its flexibility and customisation. It supports a wide range of payment methods including cards, bank transfers, wallets and buy-now-pay-later options. Stripe is particularly popular with developers and tech-savvy businesses, offering an extensive API, recurring billing tools and real-time reporting. It is an ideal choice for e-commerce companies operating across borders or those with subscription models.

Final Thoughts

In the dynamic world of commerce, the way businesses handle payments reflects their ability to adapt and prioritise customer needs. With a range of online payment processing for small businesses options available, from traditional methods like cash and checks to modern solutions like QR codes and money transfer apps, businesses have the opportunity to cater to diverse customer preferences.

For small businesses, finding the right balance between operational efficiency, cost-effectiveness, and customer convenience is vital. By staying informed and making strategic choices, businesses can streamline financial operations while enhancing the customer experience.

Why choose Noda as a Payment Option?

- Broad bank coverage

Accept payments from 2000+ banks in 28+ countries in Europe and beyond.

- Extremely low cost

Keep margins high with transaction costs starting around 0.1%, giving merchants a competitive pricing edge.

- Plug‑and‑play e‑commerce support

Get started quickly with Noda; ready-made modules work seamlessly with WooCommerce, Magento, PrestaShop and OpenCart. Opt for a custom solution with our flexible REST API.

- Multi‑rail payment flexibility

Blend open banking with card payments, Apple Pay, Google Pay, all through one streamlined integration.

- Onboarding & direct manager support

Access personal assistance, compliance guidance, and integration help from your dedicated manager so you’re not navigating PSD2 alone.

Contact Noda for a no-obligation demo. Our open banking experts will be happy to look into your unique business case.

FAQs

How can small businesses accept payments?

Small businesses have the flexibility to accept payments through a variety of methods. These include card payments, such as credit and debit cards, and options like Direct Debits. Online payments can be facilitated through digital wallets, e-commerce platforms, payment links, and even email invoices. Mobile payments have also become popular with the use of mobile wallets, money transfer apps, and QR code payments. Additionally, small businesses can still utilise traditional methods like physical cash and checks if preferred.

What are the best ways to accept payments for small businesses?

The most suitable payment methods for small businesses vary based on their unique business model and operational complexities. They can choose from a range of options, such as card payments, online payments facilitated by digital wallets or e-commerce platforms, mobile payments utilising QR codes or money transfer apps, and direct debits designed for recurring billing models.

How to choose a payment method for your small business?

When selecting a payment method for a small business, several factors must be taken into consideration. These include the business model, customer demographics, associated transaction fees, liquidity requirements, security concerns, and how well the payment method integrates with existing business systems. Achieving a balance between operational efficiency, cost-effectiveness, and customer convenience is crucial in making an informed decision.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each