Please note that the information about the companies in this article was sourced from their respective websites as of May 2025. This information may be subject to change.

A smooth payment system is essential for any business, but in healthcare, it’s even more important. Patients are often paying for high-value treatments, so payments need to be quick, simple, and secure, without adding extra stress to their visit.

In the UK, digital payments are expected to top £8 billion in 2025, but many businesses are still using outdated systems to take payments, making things slower and more complicated than they need to be.

This guide breaks down the most popular healthcare payment services, from card payments to Open Banking,so you can find the right fit for your practice.

The Unique Challenges of Taking Payments in Healthcare

Taking payments in healthcare isn’t like running a shop or a café. It’s personal, the amounts are often higher, and there’s a lot more at stake.

For one, healthcare payments can be high and sometimes unexpected. A private scan, a dental crown, or a course of physiotherapy can run into hundreds or even thousands of pounds. Patients need safe, flexible ways to pay, and they need to feel confident that their money is handled properly.

There’s also privacy to think about. In healthcare, you’re dealing with sensitive financial details, alongside personal medical information. Your payment system has to protect both, without making things awkward or complicated.

And then there’s trust. Patients trust you with their health, and that trust extends to how you handle their payments. If the process feels slow, clunky, or confusing, it can damage that trust. A smooth, secure system helps build confidence and keeps patients coming back.

Read: Payment Security Tools: A-Z Guide

Understanding Your Payment Options

Your patients are used to quick, easy ways to pay for everything else, whether they’re shopping online or booking a holiday. They expect the same speed and convenience when it comes to healthcare.

Today’s payment options go far beyond the old way of taking card payments at the reception desk. With modern healthcare payment processing tools, you can:

- Accept card payments in person or online

- Send payment links by email, text, or WhatsApp so patients can pay remotely

- Offer other options like Apple Pay, Google Pay, or Open Banking

- Generate invoices or link payments to your booking or patient management software

But it’s not just about convenience. A good healthcare payment processing solution also keeps sensitive data safe, reduces the risk of fraud, and makes sure your clinic follows important rules like GDPR and PCI DSS.

Pros and Cons of Each Payment Method

Method | Pros | Cons |

| Card Terminal | Familiar, fast for in-person use | High fees, fraud risk, and chargebacks |

| Payment Link | Great for remote billing | Requires internet access, extra steps |

| Open Banking | Low fees, no chargebacks, fast settlement | May not be familiar to all patients |

| QR Codes | Contactless, easy setup for clinics | Still new for many demographics |

| Direct Debit | Ideal for recurring treatments or packages | Slow to set up, less flexible upfront |

Let’s take a look at some of the most popular payment solutions for healthcare providers and see how they compare.

Noda

Noda is a new way to take payments that’s built for speed, savings, and simplicity. It uses Open Banking, which means your patients pay you directly from their bank account, no card networks or middlemen involved.

This can save you a lot of money. Noda’s fees start at just 0.1% per transaction—a huge difference compared to typical card fees of 1.5–3%. The payment lands in your account instantly, so you’re not waiting days for the money. If you’re taking in-person payments, you can also use QR codes, at just 20p per transaction in the UK, making it a cost-effective alternative to card terminals.

It’s also safer for clinics. Since Open Banking payments can’t be reversed, there’s no risk of chargebacks, which is a real relief when you’re dealing with high-value treatments like dental work, private scans, or physiotherapy packages.

Getting paid is easy, too. You can send a secure payment link by email, text, or WhatsApp, and your patient can pay in seconds. Noda is fully regulated by the FCA and designed with patient privacy in mind. It’s a smart option if you want a payment system that’s low-cost, fast, and simple for both your clinic and your patients.

You may also be interested in: Payment Links: Smooth Transactions for Modern Businesses

Stripe

Stripe is a big name in online payments and works well if you have a tech-savvy team or a developer who can set up your website or booking system to link with Stripe’s platform. It’s a good option if you want advanced features like custom checkout pages or automated invoices.

But for healthcare, Stripe can get expensive. Fees for card payments start around 1.5% in the UK but can go up to 3% or more for international payments. Stripe also sometimes treats healthcare as a higher-risk sector, which could mean higher fees or even frozen accounts in rare cases.

It’s a powerful option, but it might be more than you need if you want to keep costs down.

Square

Square is a payment system that can be a good fit for smaller clinics looking to start taking payments quickly. It’s simple to set up, with no long-term contracts or hidden fees. Square works both online and in person, allowing you to accept card payments, Apple Pay, Google Pay, or send payment links by email or text. It includes a basic dashboard for tracking payments and monitoring cash flow.

Fees start from 1.4% + 25p per transaction in the UK, which is competitive for smaller clinics but not as low as Open Banking options like Noda. While Square is widely used by small businesses, it does have fewer advanced features compared to other platforms.

Worldpay

Worldpay is one of the biggest names in payment processing, known for its strong security and support, which is helpful if you’re dealing with complex payment needs. But it does come with some downsides—fees can be higher than smaller providers, and they often require long-term contracts, which might not suit smaller clinics.

If you’re running a busy clinic or private hospital and need robust medical merchant services and a system that can handle lots of transactions, Worldpay might be a good fit. Payment Solutions for Healthcare.

Provider | Best For | Key Features | Fees | Any Drawbacks? |

| Noda | Clinics that want low fees and instant payments | Open Banking, direct bank transfers, no chargebacks, secure payment links, in-store QR code payments | From 0.1% per transaction | Patients who prefer traditional card terminals may need time to adjust. |

| Stripe | Tech-savvy clinics needing flexible features and multiple online payment methods | Card payments, Apple Pay, Google Pay, subscriptions, invoicing, card terminals | ~1.5–3% per transaction | Potential higher fees for healthcare |

| Square | Small clinics wanting a simple, easy setup | Online and in-person payments, payment links, card reader, basic dashboard | ~1.4% per transaction | Fewer advanced features; fees higher than Noda |

| Worldpay | Large clinics or hospitals with high transaction volumes | Card terminals, online payments, recurring billing, and multi-currency support | Varies; typically higher for small clinics | Long contracts, higher fees, not ideal for small practices |

How to Choose the Right Healthcare Payment Solution

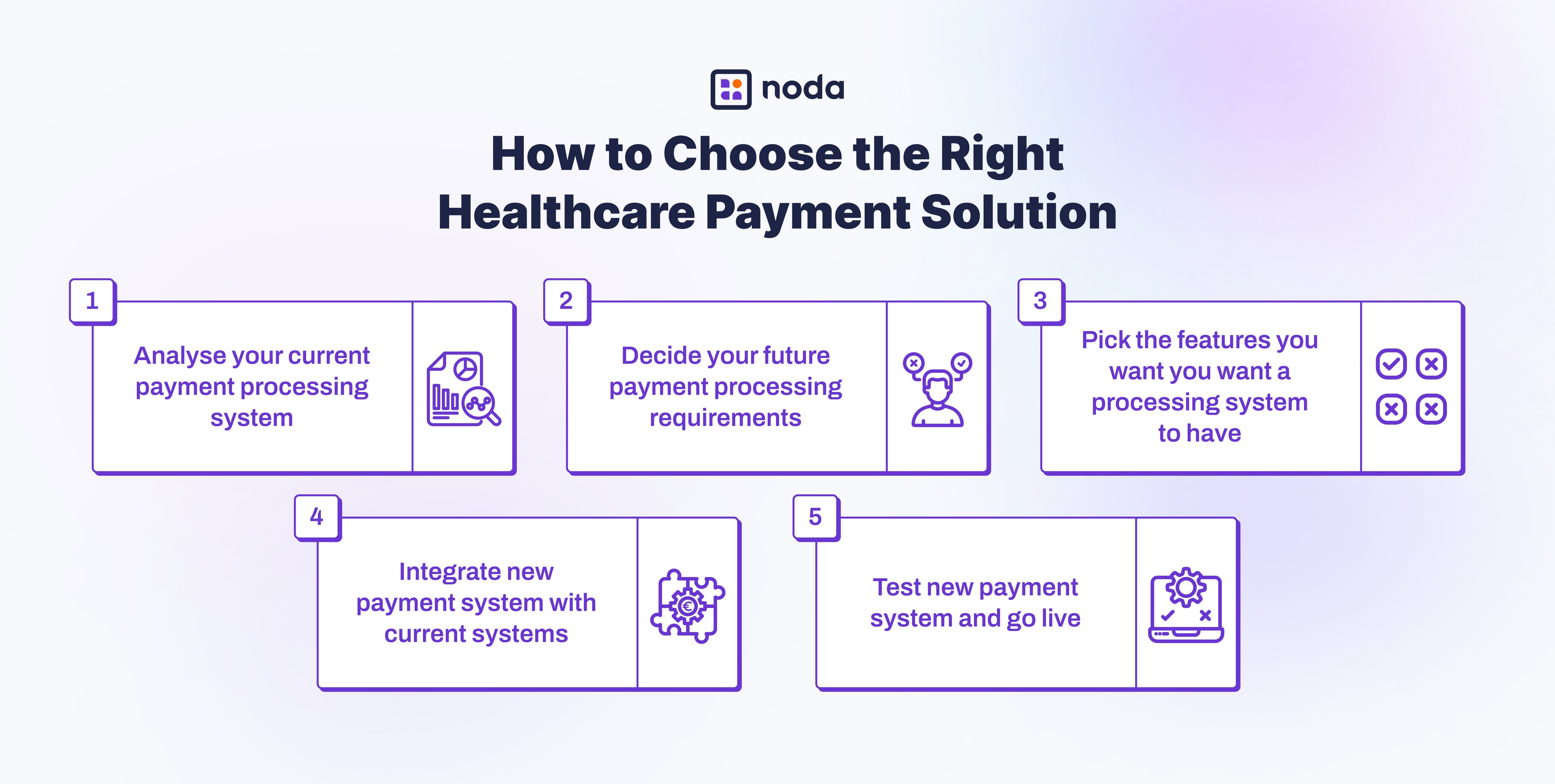

If you’re comparing providers, it helps to understand what kind of medical merchant account you actually need.

Start by reviewing what you already have. Are payments slow? Are there too many failed transactions? Do you wait days for the money to arrive? If so, it’s time for a change.

Next, think about what your clinic needs. Do you want a system that links with your booking software? Do you need fast payments, low fees, or simple invoices?

Always test a new system before you roll it out fully. Run a few trial payments, check the process, and make sure your team feels comfortable using it.

The right payment solution should save you time, cut costs, and make it easy for patients to pay, so you can focus on their care, not chasing invoices.

Keeping Healthcare Payments Secure and Compliant

Patients trust you with their health, and they expect the same care when handling their payment details.

The good news is that modern payment systems like Noda, Stripe, Square, and Worldpay handle security for you. They’re PCI DSS compliant, which means they follow strict global rules for keeping card details safe. Noda, which uses Open Banking, is also fully regulated by the FCA and protects payments with strong encryption.

For your clinic, there are a few simple steps to keep everything safe:

- Never store or write down card details.

- Always use secure payment links, checkout pages, or invoices from your payment provider.

- Keep payment and patient data separate. For example, write “Dental Treatment – £150” on an invoice, but never include sensitive medical details.

- Stick to GDPR rules when handling patient data. Only collect what you need, and keep it secure.

By following these basics, you can protect your patients and your clinic, and make sure payments are handled safely and securely every time.

Open Banking for Healthcare Payments

Open Banking is changing how people pay—and it’s a perfect fit for healthcare.

With Open Banking, patients pay you directly from their bank account. No cards, no apps, no middlemen. The payment goes straight from the patient’s bank to your clinic’s account, instantly.

For clinics, this means:

- No card fees eating into your margins.

- Instant payments—no waiting days for funds to clear.

- No chargebacks—because payments can’t be reversed like card transactions.

- Lower costs—Noda’s Open Banking payments start at just 0.1% per transaction. That’s a big saving compared to the 1.5–3% fees charged by most card processors.

Patients don’t need to sign up or download anything. You just send a secure payment link by email or text, they click it, choose their bank, and approve the payment in their banking app. Or, if they’re at your clinic, they can simply scan a QR code at the reception to pay instantly. It’s simple, fast, and safe.

For healthcare providers, Open Banking is especially useful for upfront payments, deposits, and high-value treatments like private scans, dental work, or physiotherapy packages, where card fees can really add up.

Ready to Take the Stress Out of Healthcare Payments?

With the right payment solution, you can spend less time chasing invoices and more time helping patients.

Noda’s Open Banking payments are fast, simple, and cost less, starting from just 0.1%.

Want to see how it works?

Book a demo today and take the first step towards easier, faster payments for your clinic.

FAQs

What is the cheapest way to take payments in a healthcare clinic?

If you want to reduce fees, Open Banking is currently the most affordable option for many clinics. A provider like Noda charges from as little as 0.1% per transaction or 20p for in-person QR code payments, compared to traditional card fees of 1.5–3%. For lower overheads and instant settlement, it’s one of the best value options on the market.

Can I accept card payments and Open Banking in the same system?

Yes, many providers—including Noda—allow you to offer both. Patients can pay using Open Banking links or scan QR codes in person, but if they prefer cards, you can also support traditional healthcare credit card processing online. It’s all about flexibility and giving your patients a choice.

How can I avoid chargebacks on healthcare payments?

Chargebacks are common in traditional medical merchant services, especially for high-cost treatments or missed appointments. With Open Banking, there are no chargebacks—once a patient approves a payment, it’s final. That makes it a safer option for clinics offering elective or cosmetic procedures where disputes can arise.

Do I need a card terminal if I use QR code payments in person?

Not necessarily. With QR codes, patients can scan the code using their smartphone and pay instantly through their bank—no card machine needed. This works especially well for reception desks or mobile practitioners and costs far less than traditional card terminals.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each