A payment gateway is a crucial tool in digital payments. It enables businesses to accept and manage online transactions. Think of a card reader in a retail store – an electronic payment gateway is exactly that, but online. It serves as an intermediary, securely transferring data from the customer to the merchant and their banks.

Digital payments have become a prime target for cybercriminals amid the rise in e-commerce. As online sales increase, so do the efforts of hackers to breach security measures. A study by JPMorgan Research in 2021 found that 71% of businesses surveyed experienced payment fraud, highlighting the growing challenge of cybersecurity.

Now more than ever, having a secure payment gateway is essential. Here, we will cover the key aspects of what makes a payment gateway secure, including its critical features and steps to choose a reliable provider that meets your business needs.

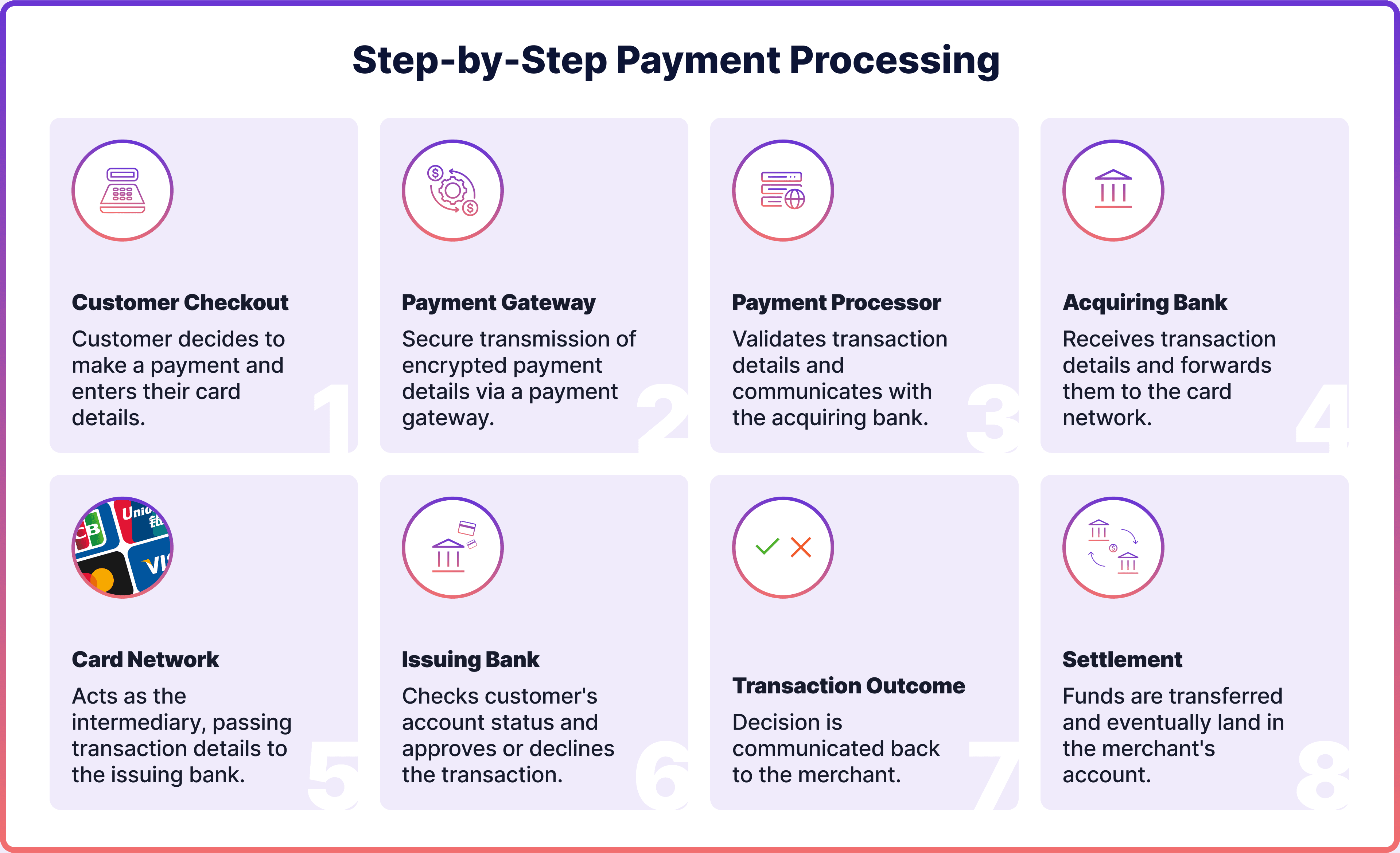

How Payment Gateway Works

The online payment process begins when a customer wants to make a website payment. They're directed to a payment gateway to input their details. The gateway moves the data to a payment processor, which confirms the details with the merchant's bank.

This information is then passed to the card network, like Visa or Mastercard, which contacts the customer's bank to check the transaction for issues like insufficient funds and fraud risk. If approved, the customer's bank settles the payment, completing the transaction.

Cybersecurity Risks

As mentioned above, cybersecurity risks have become extremely relevant to payment gateways due to the growth of online transactions. Some of the most common attacks linked to a payment gateway include phishing scams, identity theft and chargeback fraud.

- Phishing: The scam deceives individuals into disclosing sensitive information like login and payment details through fake emails or websites.

- Identity Theft: This type of fraud involves criminals stealing personal information to make unauthorised transactions or open accounts in someone else's name.

- Chargeback Fraud: Customers falsely dispute charges to get refunds while retaining the goods.

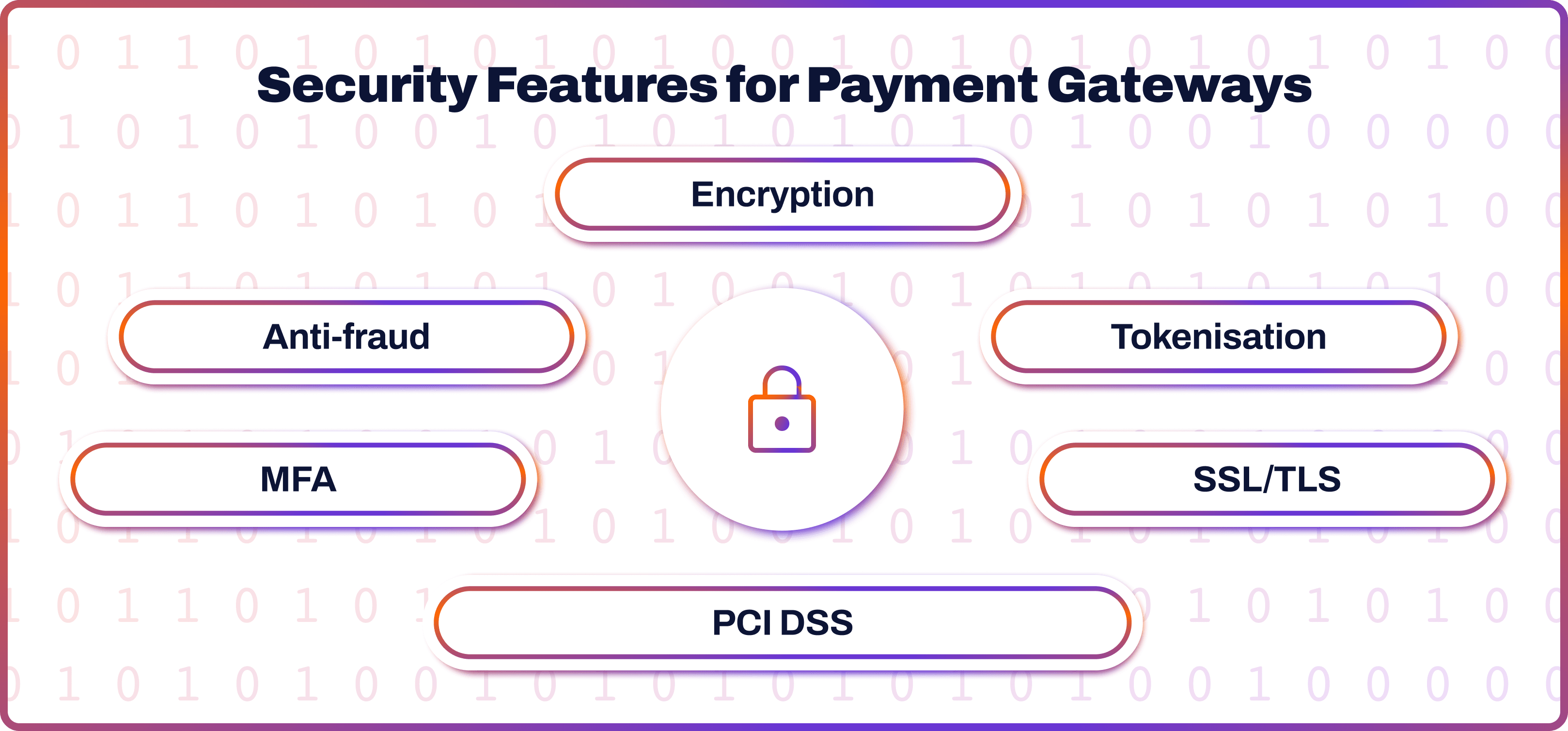

Security Features for Payment Gateways

A secure online payment gateway must provide essential features like authentication, encryption, routing, and notification. These mechanisms protect payments against fraud and identity theft.

A payment gateway with more security tools would ensure better protection for customers' data. Let’s take a look at the most popular payment security features in more detail.

Encryption

Encryption converts data into a complex code that can only be deciphered with a specific key. This ensures only authorised parties can access the information.

It works by using algorithms to transform clear, readable information into a format that cyber criminals can't understand. Payment gateways encrypt financial data before passing it further.

Tokenisation

Tokenisation secures online payments by replacing sensitive data, like credit card numbers, with a unique token. This means that even if the data gets intercepted, the token is useless to hackers, keeping the real payment information safe. It's a critical feature for a secure payment gateway.

While similar to encryption, tokenisation does not allow the original data to be reconstructed from the token. This adds an additional security layer.

SSL/TLS

The Secure Sockets Layer (SSL) / Transport Layer Security (TLS) protocols are an encryption-based technology that protects data privacy online. It secures information during transfer, ensuring safe sharing between a server and a customer’s web browser.

SSL/TLS are crucial for safe payment gateways, as they encrypt customer data, turning it into an unreadable format for anyone trying to steal it. Without these protocols, card details entered on a website could be captured by fraudsters.

PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) sets security guidelines for businesses payment card information. Its goal is to ensure the companies within this industry securely process, store, and transmit card data, protecting against breaches and fraud.

PCI DSS compliance ensures that a payment gateway meets strict security measures to safeguard cardholder information. It’s important to ensure your provider adheres to this standard.

Multi-factor Authentication

Multi-factor authentication (MFA) adds extra steps to the payment authentication process. It uses two or more factors to confirm users are who they claim to be. The MFA verification factors include:

- Knowledge: This could be something a user knows, like a password or an answer to a security question.

- Possession: This includes their devices like a laptop or a mobile phone.

- Inherence: This is something a user possesses inherently, like their biometric data.

Under European PSD2, Strong Customer Authentication (SCA), which is a form of MFA as it involves using two or more factors to authorise payments, is a legal requirement.

Anti-fraud System

An anti-fraud system is a sophisticated tool that scrutinises every transaction passing through a secure credit card payment gateway in real-time to detect and prevent fraud.

Modern anti-fraud systems analyse various factors, such as transaction amount, bank card, and IP address, to identify cybercrime. These systems have their unique sets of rules and algorithms. They often employ machine learning technology to enhance accuracy.

How to Choose a Secure Payment Gateway Provider

Choosing a secure payment processor and gateway provider that fits your business needs can significantly improve your payment flow. Here are the three essential steps:

- Define Requirements

Before selecting a payment gateway provider, consider what you need. Think about key security features, your budget, required payment methods, UX simplicity and how it will integrate with your system. This will help you find a provider that matches your unique business needs.

- Compare Providers

Now, it's time to evaluate different providers. Check their TrustPilot ratings, particularly reviews from companies in your industry. Create a comparison table with categories that reflect the features important to you.

- Test

Once you've narrowed down providers that meet your criteria, reach out to them for a demo. Many payment companies offer a trial period where you can test their services without financial commitment.

Future of Secure Payments

The adoption of digital payments is on the rise and is expected to grow significantly in the next years. According to Research and Markets, the sector could see a 16% compound annual growth rate between 2023 and 2026. The volume of electronic transactions globally will almost double, highlighting the rapid shift from cash.

The growth of e-commerce made cybersecurity a top priority. Selecting a secure payment gateway provider is crucial for expanding your business and establishing trust with your clients.

Secure Payments with Noda

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered.

Our platform uses cutting-edge AI and machine-learning technologies. We offer partnerships for companies of all types and sizes, with scalable plans to fuel your business growth and meet your needs.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each