Please note that the information about the companies in this article was sourced from their respective websites as of 21 January 2025. This information may be subject to change.

As Europe leads open banking adoption with 63.8 million users, merchants in the European market are increasingly looking to integrate open banking APIs into their operations to simplify transaction flow, reduce costs and offer a better payment experience to their customers.

However, if you're looking to integrate open banking technology into your business, it's crucial to choose the right partner that will help you stay ahead of trends and accelerate your business growth. This guide will explore the top 10 open banking API providers in Europe, helping you identify the ideal partner to align with your business goals.

What are Open Banking Providers?

Open banking providers are companies that integrate directly with bank APIs to enable secure access to financial services and data. These providers act as a bridge between banks and businesses, handling the complex technical integration and regulatory requirements needed to connect with banking systems.

For example, consider a travel agency that wants to offer customers the option to pay directly from their bank accounts. Instead of building complex banking connections themselves, they can simply integrate with an open banking provider like Noda. This allows their customers to securely authorise and complete payments at checkout, making the process faster than traditional payment methods like credit cards.

Beyond payments, open banking providers enable businesses to access and aggregate financial data for various purposes - from enhancing user verification processes to gaining customer insights for more personalised services. In the case of Noda, all of this is possible through a single, secure API integration.

A Closer Look at Top 10 Open Banking API Providers in Europe

Tink

Tink is a European open banking platform based in Stockholm, offering a range of financial services via APIs, including personal finance management, instant account verification, income verification and access to financial data. In addition to providing payment solutions such as pay-by-bank and recurring payments, Tink also offers data-driven tools that help businesses gain a detailed view of various aspects of their operations.

Currently, Tink is integrated with 3400 banks and financial institutions across Europe, and its expansion into the Baltic countries is still brand new. For this reason, the company doesn't have a date to start onboarding new merchants in this region.

One key consideration is that their services can be costly for early age startups and for small business owners (SBMs), as their pricing model is designed to target large companies.

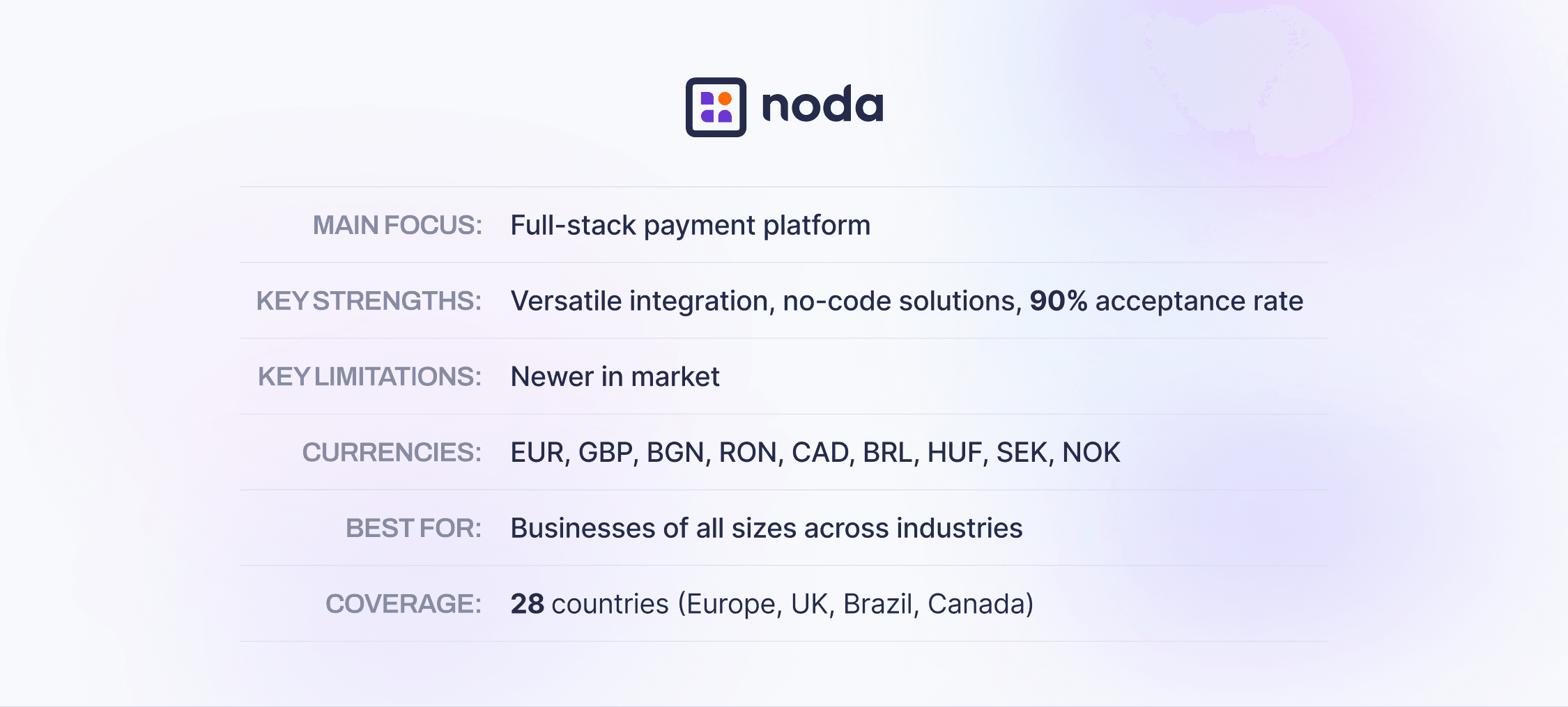

Noda

Noda is a London-based provider offering a full-stack payment platform that connects to over 2,000 banks across Europe, Brazil and Canada. The platform combines payment processing (open banking and card payments), customer data services, and no-code payment solutions, with a 90% acceptance rate across their banking network.

Noda serves a diverse range of industries including e-commerce, travel & tourism, SaaS, retail, marketplaces, educational platforms and online gaming. The company provides versatile solutions suited for businesses of all sizes, from large enterprises to smaller companies, with flexible integration options and customisable pricing plans.

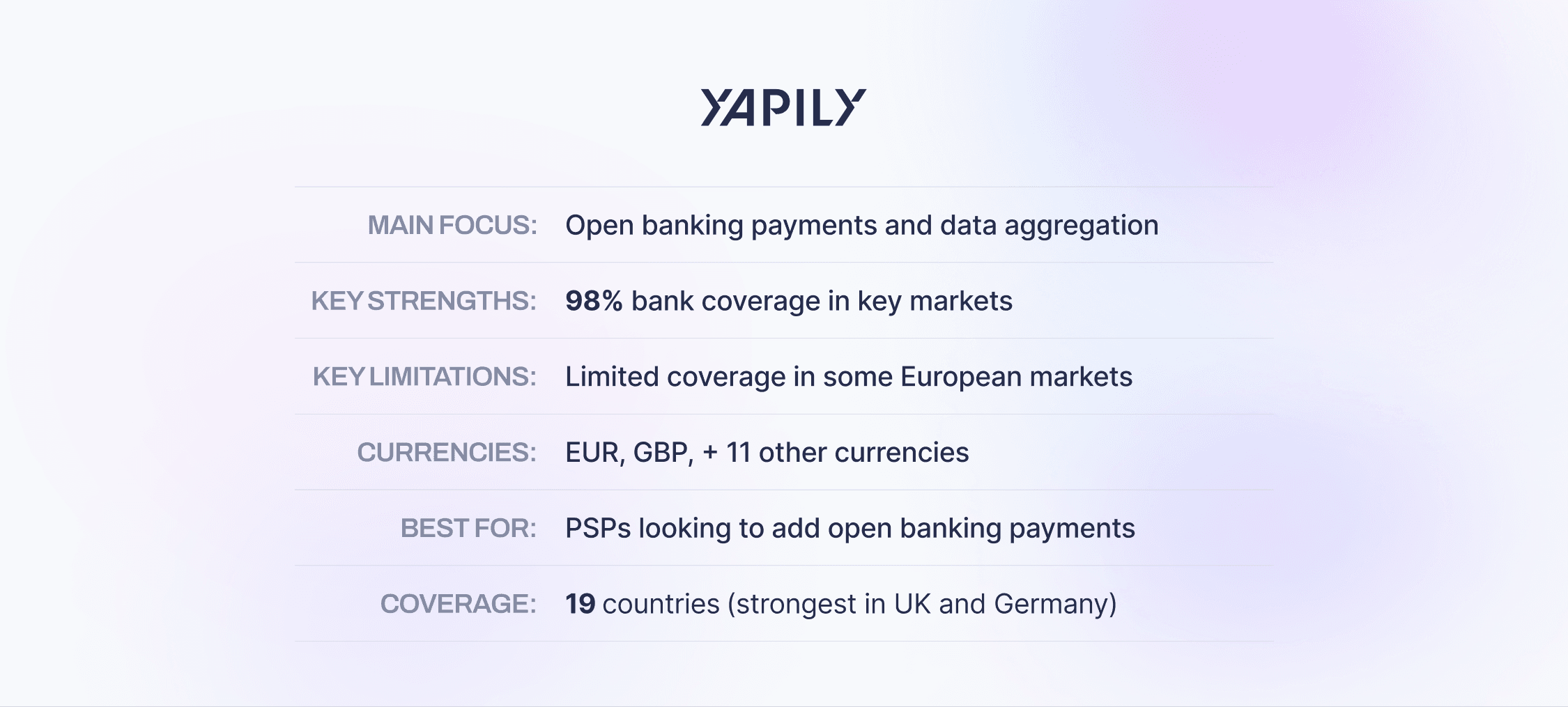

Yapily

Yapily allows businesses to access real-time financial data, connecting with 2000 banks across 19 countries. It offers particularly strong coverage in the UK and Germany, reaching approximately 98% of banks, while continuously expanding its reach across other European markets.

However, in the remaining 17 countries, such as Poland, coverage is less extensive. This partial coverage may limit options for users in those regions, compelling them to rely on alternatives like credit cards, PayPal or local payment methods.

As an API-first open banking provider, Yapily focuses on enabling businesses – such as payment service providers (PSPs), fintechs, and enterprises – to build their own financial products. Its technology supports both account-to-account payments and financial data access, allowing companies to integrate open banking seamlessly into their services. While Yapily is widely used for payment initiation, many businesses also leverage its data aggregation capabilities for financial insights, risk assessment, and customer verification.

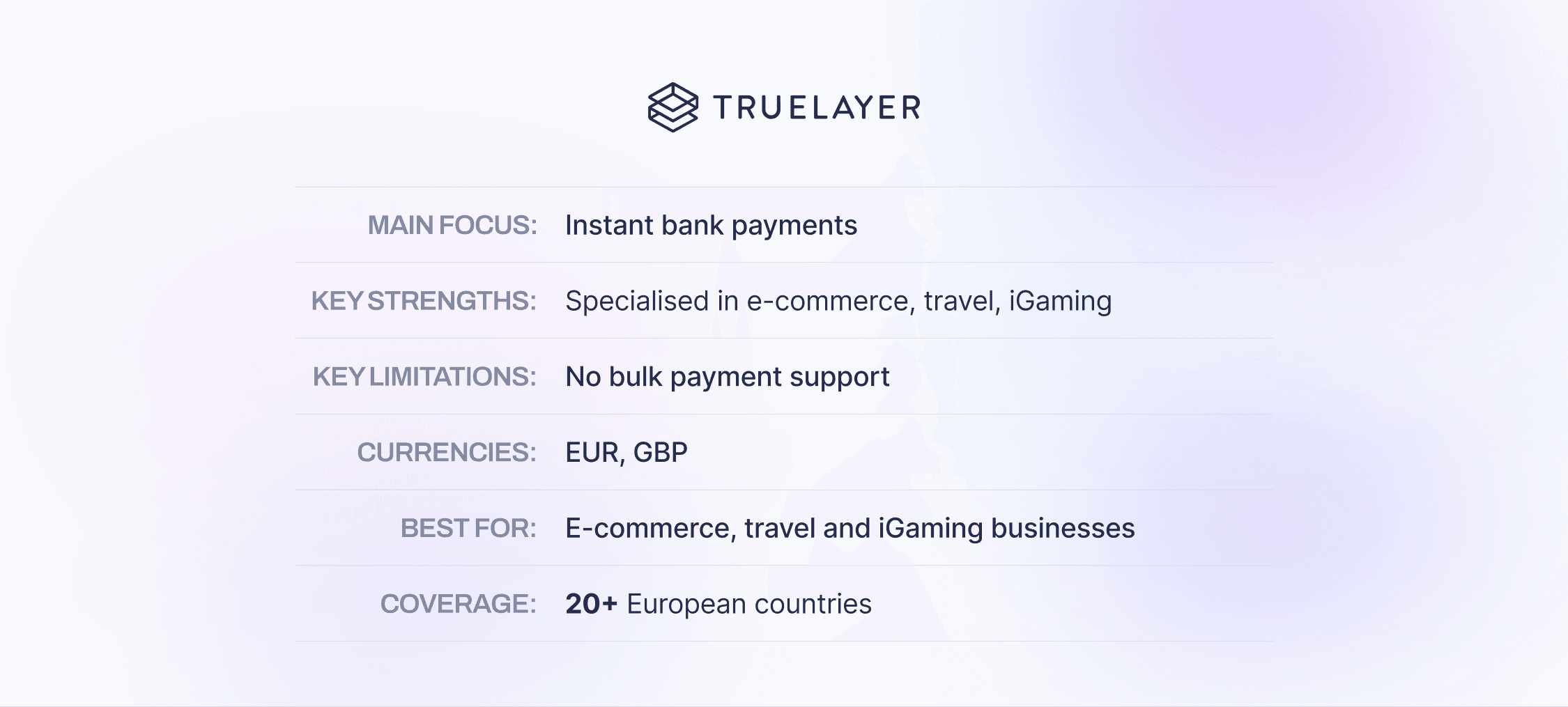

TrueLayer

TrueLayer is a UK-based provider of open banking solutions that specialises in facilitating instant bank payments for merchants, particularly in the European market. The company primarily serves three specific industries: e-commerce, travel and iGaming.

TrueLayer connects with 3,000 banks across Europe, providing secure access to banking data and single payment processing. The platform currently focuses on individual transactions rather than bulk payments, making it more suitable for businesses that process one-off payments.

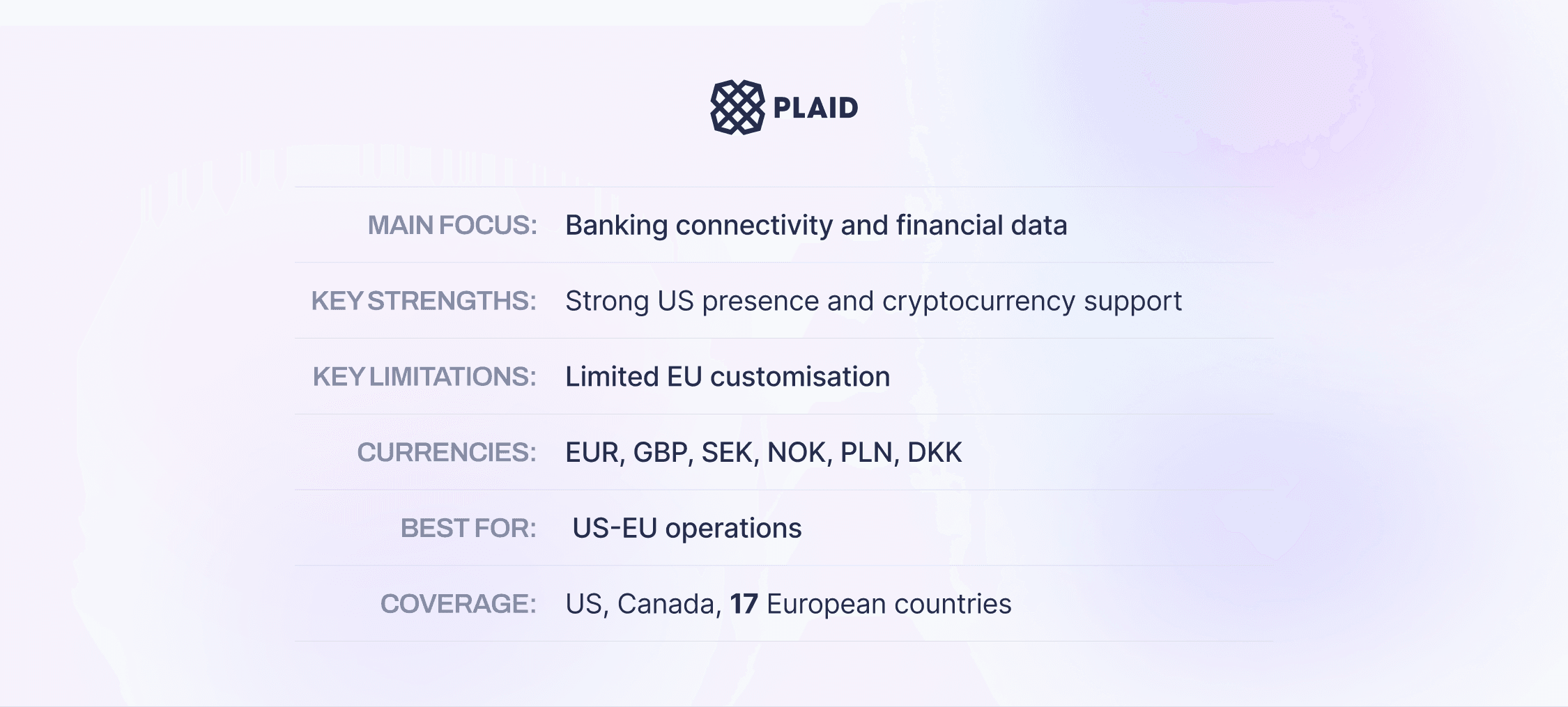

Plaid

Plaid is a San Francisco-based platform that enables businesses to connect to bank accounts, access financial data, and process payments through open banking. The company connects to over 2,000 European financial institutions, serving international merchants in the European market.

The platform offers standardised service plans for the EU and UK regions, with pricing and features tailored to their U.S. market focus. European merchants have access to their core banking connectivity services, though with more limited customisation options compared to their U.S. offerings.

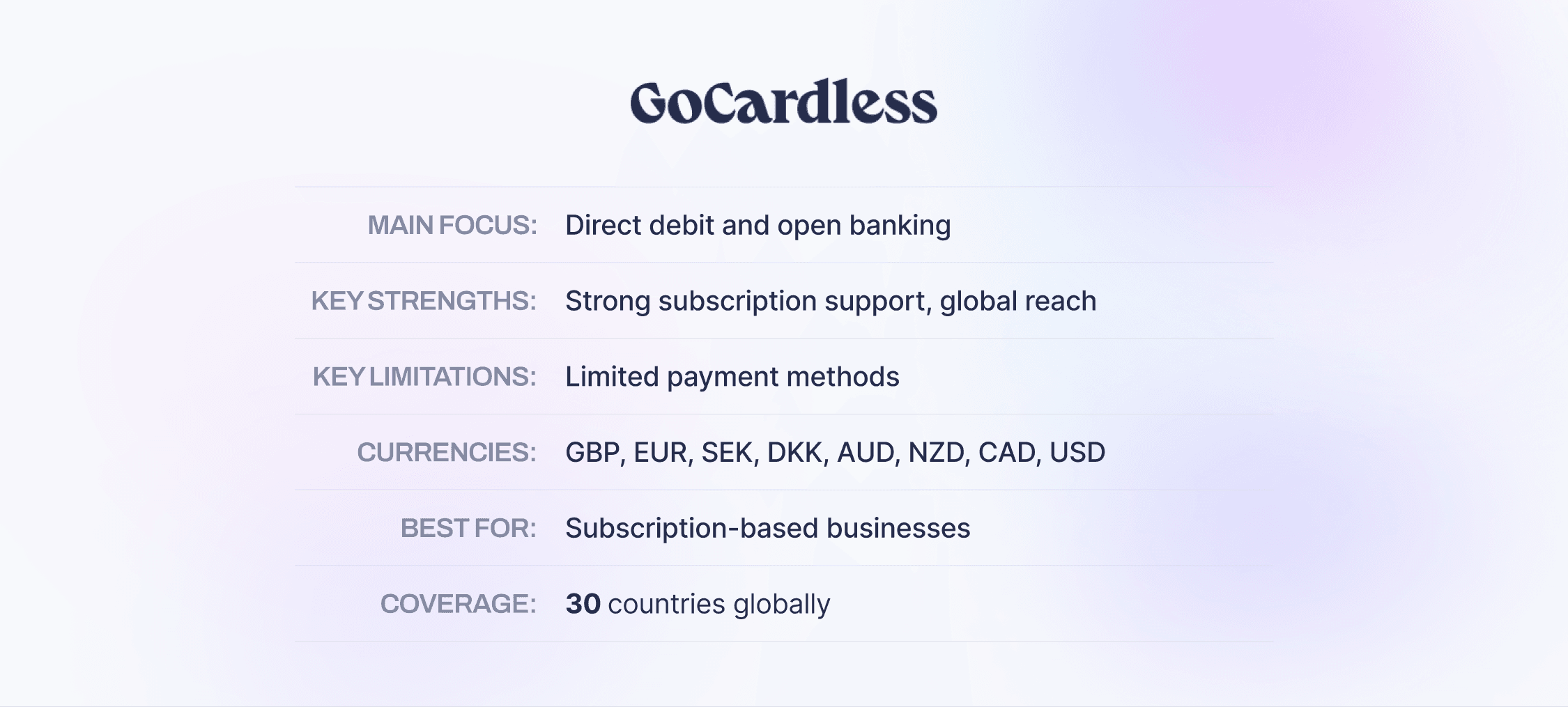

GoCardless

GoCardless, a London-based company, offers open banking solutions that enable instant payments and provide data products for businesses looking to get deeper insights into their operations. The platform's ability to automate payment processing through direct debit makes it highly suitable for subscription-based business models.

Operating in 30 countries across Europe, North America and Oceania, GoCardless provides significant flexibility for merchants to accept international payments, although transaction limits may vary by country. For merchants looking to integrate a broader array of payments with only one provider, GoCardless can present limitations since it focuses only on direct debit and pay-by-bank solutions.

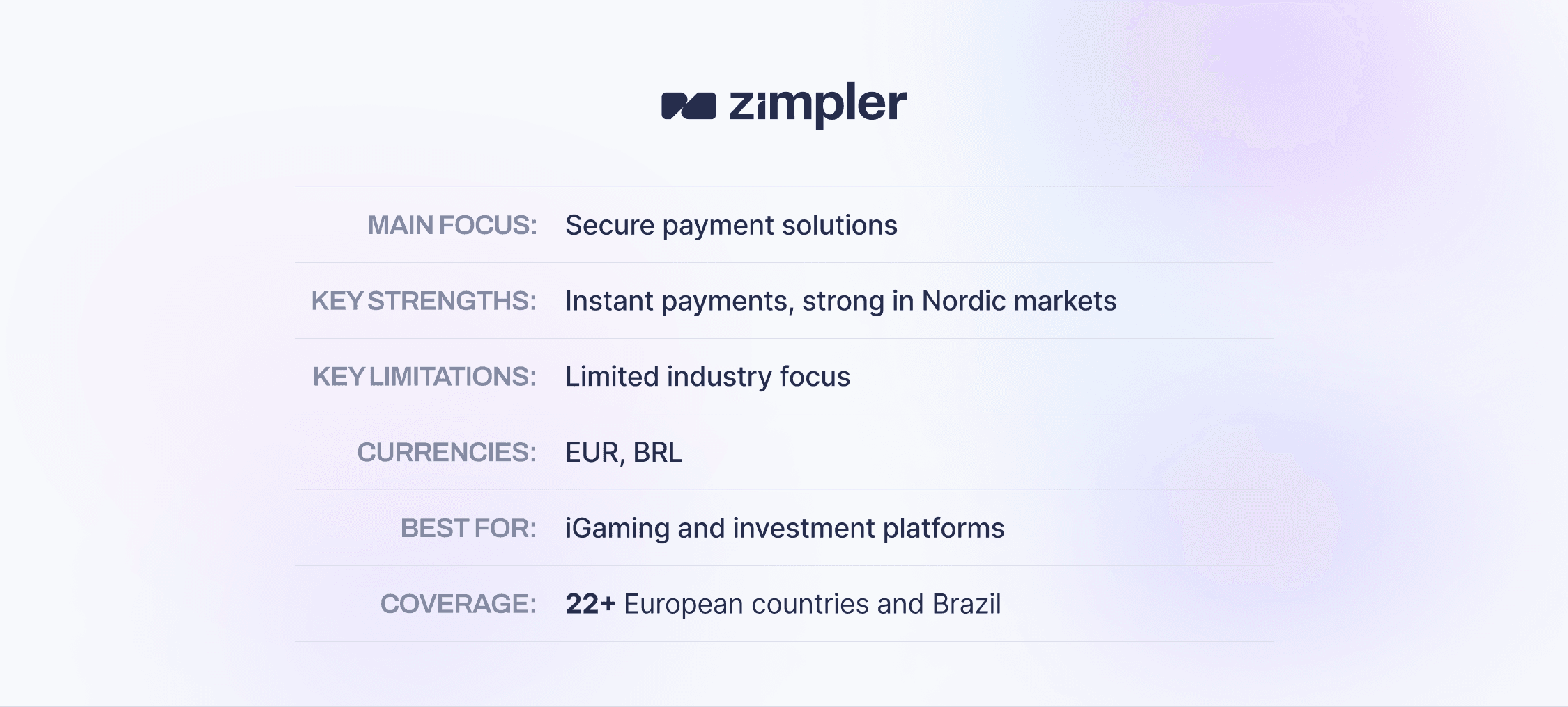

Zimpler

Zimpler, established in Sweden, is an open banking platform specialising in secure payment solutions across the Eurozone, the Baltics and Brazil. The company facilitates instant payments within Europe and Brazil. However, instant deposits and KYC services are only available in Brazil, Denmark, Estonia, Finland and Sweden.

Unlike Noda, which serves a diverse range of industries, Zimpler is predominantly focused on sectors like iGaming and investment platforms. This specialisation means that Zimpler may not provide the range of products and solutions required by marketplaces or SBMs in different industries.

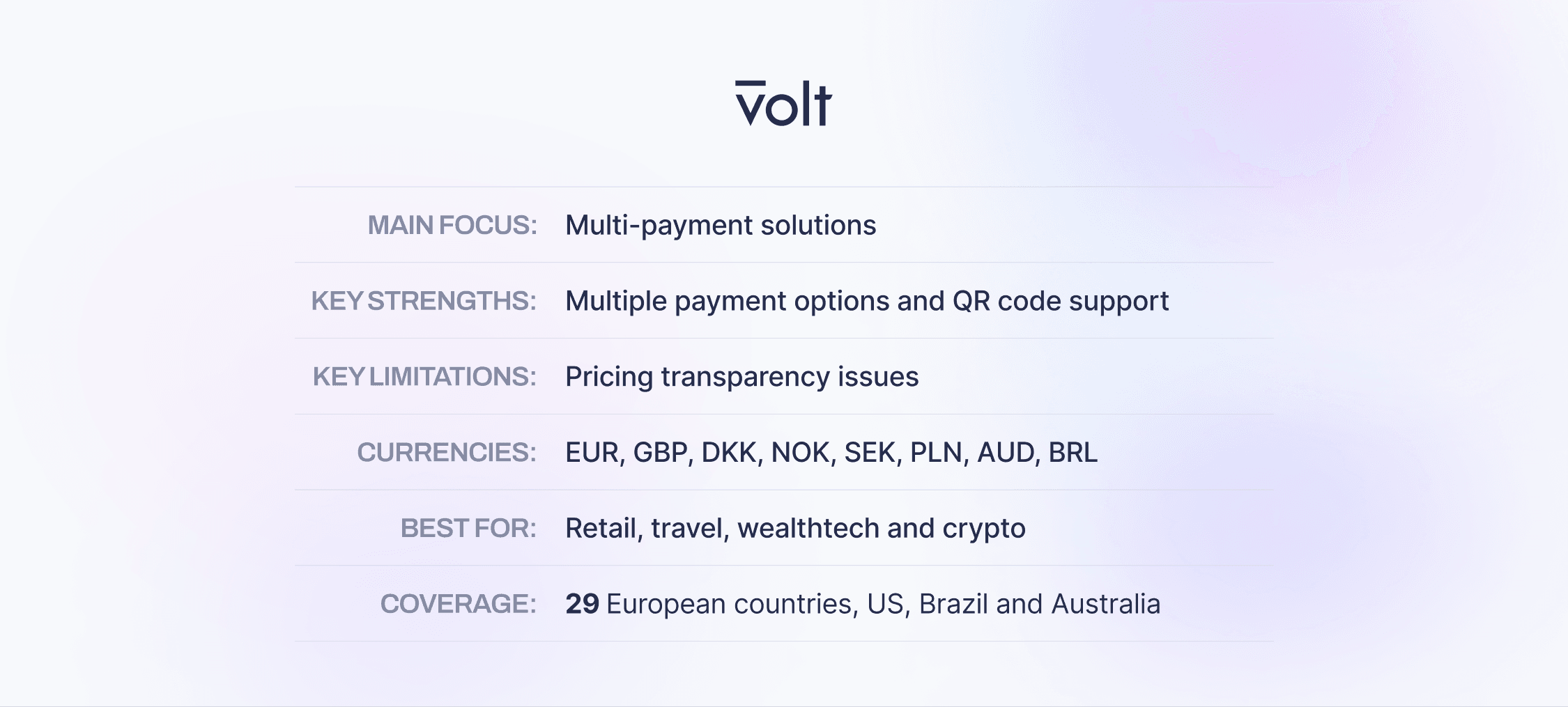

Volt

Founded in 2019, Volt is a company that offers open banking solutions for different companies and focusing on a few industries such as retail, travel, wealthtech, iGaming and crypto. Operating in 29 European countries, the US, Brazil and Australia, Volt process transactions across more than 5,000 banks in the UK and EU.

Volt provides other payment options including Pay by Bank, Pay by Link and QR code payments. Volt also supports international expansion with integration into Brazil's Pix and Australia’s PayTo systems. However, pricing details are not listed on their website and require direct contact with their sales team.

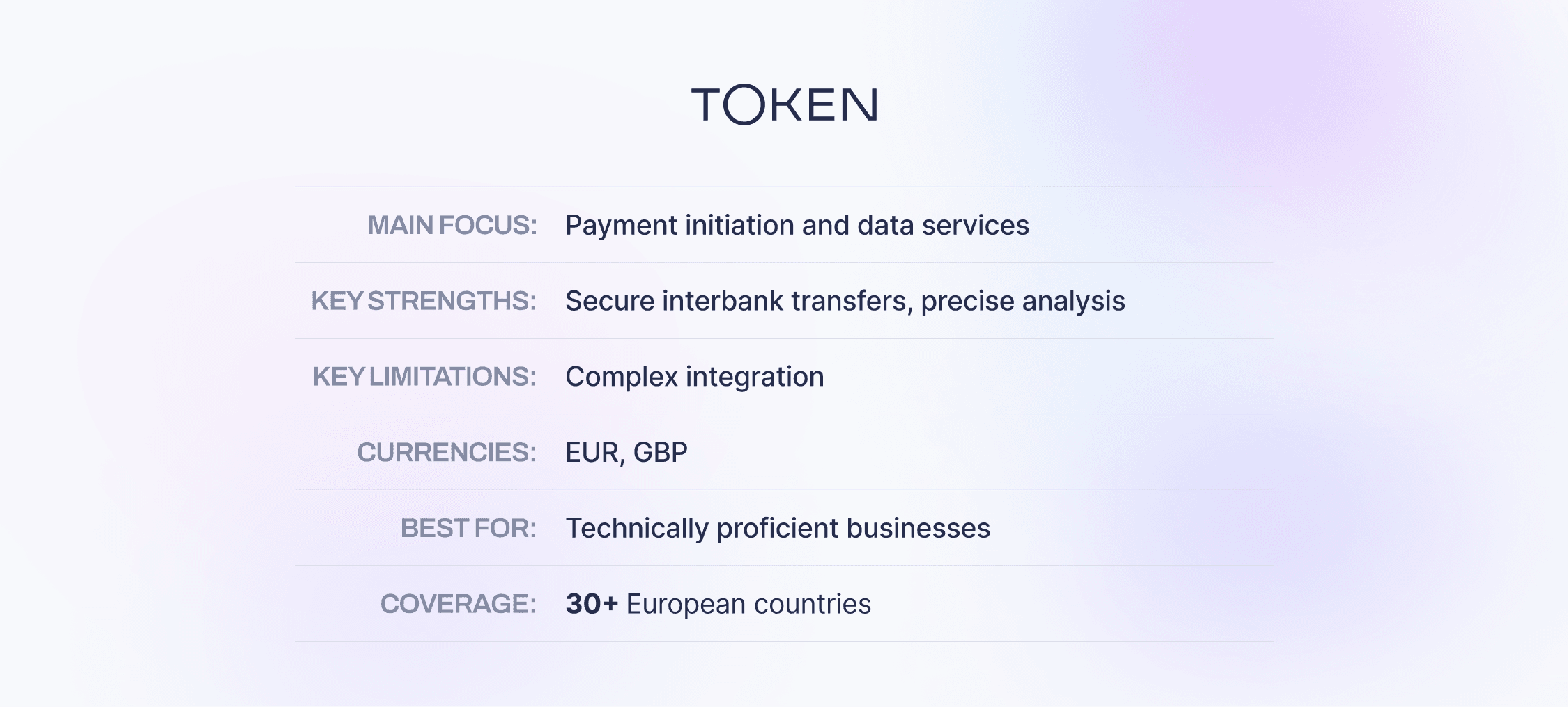

Token

Token is a company based in London, UK that offers a secure open banking platform that supports payment initiation and data services across approximately 21 European countries, including the Baltics. The company also promises to facilitate quick and secure interbank transfers, enhancing merchants' offerings with APIs that enable precise data analysis for improved customer experiences.

However, the integration process is where some businesses might stumble. Token's platform requires a certain level of technical expertise to implement. Unlike solutions like Noda, which caters to a broader audience with no-code payment pages, Token requires a higher level of technical proficiency to implement effectively, potentially limiting its accessibility for some merchants.

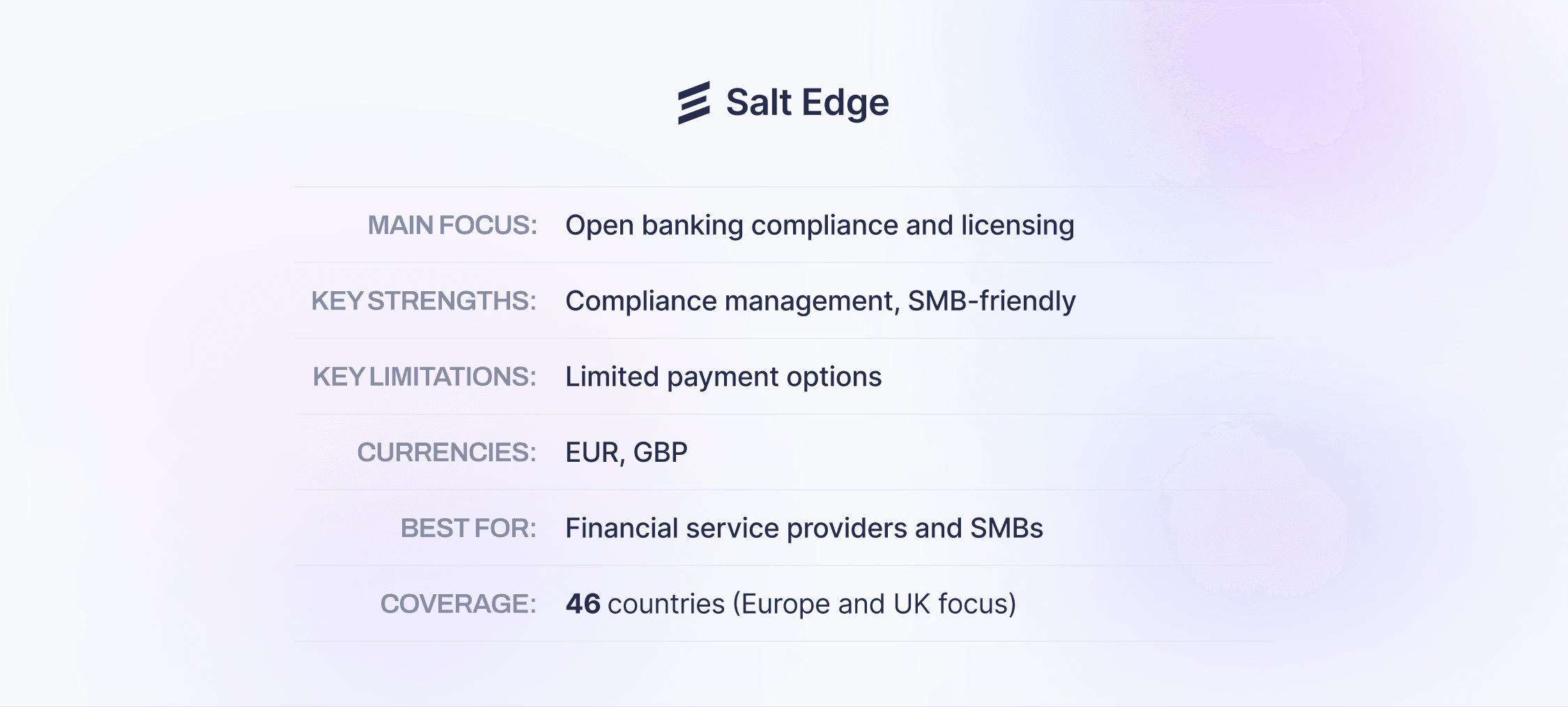

Salt Edge

Salt Edge, based in Canada, facilitates open banking payments across 2,000 European banks. While operating in 46 countries, their pay-by-bank services focus on Europe and the UK, serving industries from iGaming and travel to e-commerce and financial services.

The company specialises in managing open banking compliance and licensing requirements for financial service providers. This allows businesses, particularly small and medium-sized merchants, to offer bank payment solutions without obtaining their own banking licenses. Plans with their basic features starts from $500 per month, custom pricing plans are available through their sales team.

How to Choose the Best Open Banking Provider?

Selecting an open banking provider requires careful consideration of your business needs and growth plans. While all providers offer secure banking connections, they differ significantly in their capabilities, focus areas and geographic coverage.

Key considerations for your business:

- Data capabilities - from basic transaction data to advanced customer analytics

- Cost structure and pricing models

- Account aggregation and data sharing needs

- Payment method coverage beyond open banking

- Geographic reach, especially for international operations

The right provider should align with your specific requirements while being cost-effective. A comprehensive solution can eliminate the need to manage multiple providers and integrations, streamlining your payment operations and technical infrastructure.

Unlock Open Banking Benefits with Noda

Noda provides open banking and payment services with connections to over 2,000 banks across 28 countries. The platform offers customisable solutions for businesses of all sizes, combining payment processing, data insights and industry-specific features in a single integration.

For more information about implementing open banking payments for your business, contact Noda to discuss your specific requirements.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each