The Virtual International Bank Account Number (vIBAN) is a modern banking solution that offers businesses greater flexibility in managing international transactions. Unlike a traditional IBAN, which is associated with a physical bank account, a vIBAN is a virtual representation of an account.

Here we take a look at the meaning of a virtual IBAN in more detail, discuss its use cases and the key differences between an IBAN and a virtual IBAN.

Virtual IBAN vs IBAN

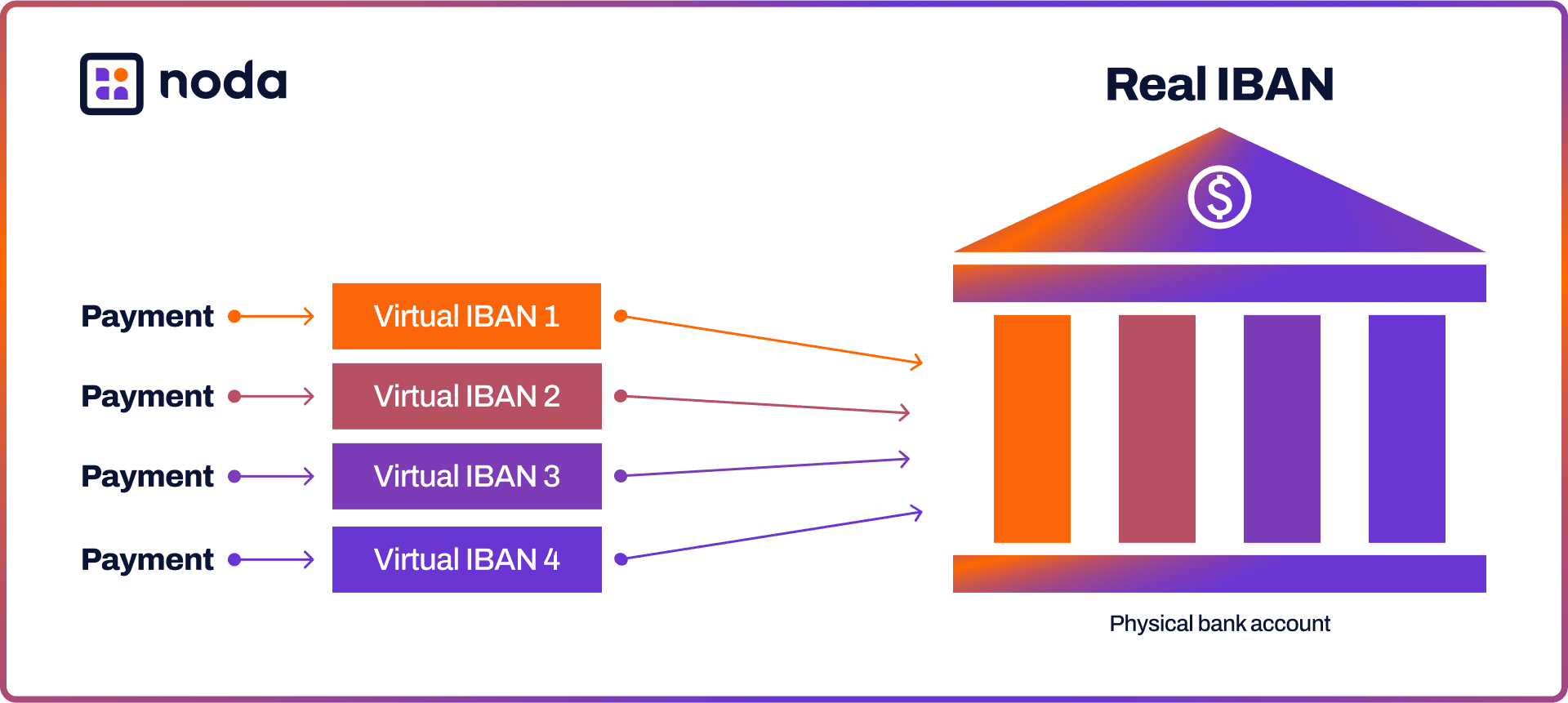

The vIBAN’s main purpose remains the same as an IBAN - to identify the sender and receiver during bank transfers. However, with a vIBAN, businesses can generate multiple IBANs connected to one bank account. This enables efficient fund segregation, transaction tracking, and simplified reconciliation, particularly for cross-border payments.

Virtual vs Physical

IBANs are important for international transactions as they represent a physical bank account. They ensure that funds are directed accurately to the intended recipient's account.

Virtual IBANs, on the other hand, are virtual representations of those accounts. They provide businesses with the ability to generate multiple IBAN numbers that are all linked to one main account.

Use Cases

IBANs are typically used for simple international transactions, where money is moved from one account to another.

On the other hand, virtual IBAN accounts are beneficial for businesses involved in cross-border trade or handling multiple currencies. They allow businesses to assign specific vIBANs for clients, projects, or departments, simplifying fund management and facilitating the monitoring of financial flows.

Security and Confidentiality

When it comes to IBANs, standard security measures are in place. An IBAN serves as a unique identifier for transactions.

In contrast, vIBANs provide even greater security by allowing businesses to share only the virtual IBAN with clients or partners. This helps keep the underlying physical account information confidential.

Efficiency and Cost

IBANs involve traditional banking processes, which might involve fees for international transactions.

On the other hand, vIBANs simplify the management of a physical account by offering a banking solution that supports multiple currencies and jurisdictions. This eliminates the need for maintaining numerous banking relationships, reducing complexity and costs.

IBAN vs SWIFT

IBAN and SWIFT play different roles in international banking. IBAN, which stands for International Bank Account Number, is a standardised format used to identify bank accounts in international transactions. It ensures that funds are routed accurately to the intended recipient's account.

On the other hand, SWIFT, short for Society for Worldwide Interbank Financial Telecommunication, is a global network that enables communication between banks for transaction processing. While IBAN focuses on account details, SWIFT deals with bank identification and communication.

How does a vIBAN work?

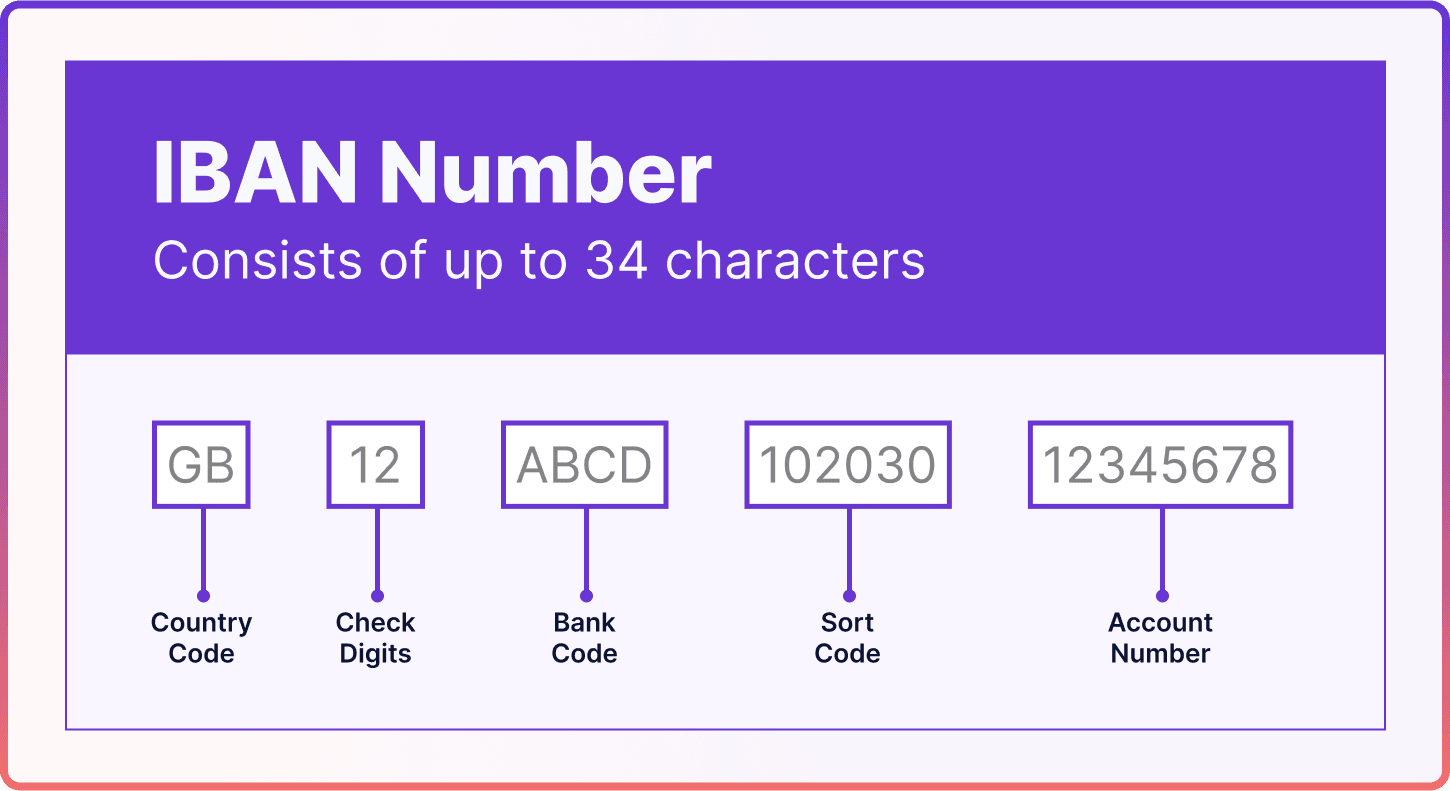

A vIBAN functions similarly to a regular IBAN but offers more flexibility. It serves as a virtual representation of an account, enabling businesses to create multiple IBANs connected to a single primary account. A virtual IBAN number typically follows this IBAN structure:

- Country Code: A two-letter code identifying the country where the bank account is held.

- Check Digit Code: Two digits ensure the accuracy of the IBAN by validating its integrity.

- Bank Identifier Code: Alphanumeric characters representing the bank's specific details.

- Sort Code: Often used in the UK, it identifies the bank's branch.

- Account Number: The unique number assigned to an account holder within that bank.

This structure guarantees that funds are directed correctly, whether the IBAN is virtual or linked to a physical account.

What are the Benefits of Virtual IBANS?

- Efficient Fund Management: Allows businesses to segregate funds based on clients, projects, or departments, streamlining cash flow operations.

- Multi-Currency Support: Facilitates cross-border payments by supporting multiple currencies without the need for separate physical accounts.

- Enhanced Security: Offers added confidentiality by allowing businesses to share only the vIBAN, keeping the underlying physical account details private.

- Cost Savings: Reduces account maintenance costs and offers efficient reconciliation, leading to overall financial savings.

- Scalability: Highly adaptable, allowing businesses to generate and manage multiple vIBANs as per evolving requirements.

vIBAN and Embedded Finance Explained

Embedded finance is the smooth integration of financial services into platforms, apps, or processes that are not inherently financial. Virtual IBAN providers play a crucial role in this integration.

The convenience of transaction management offered by vIBANs aligns perfectly with the goal of embedded finance – to provide seamless and frictionless financial experiences within existing user journeys, whether it's on e-commerce platforms, social media, or other digital platforms.

How to Use vIBANs in Business

There are multiple ways in which businesses can leverage virtual iBANs in their operations.

Global Expansion

Expanding into global markets can create financial complexities for companies. However, virtual IBANs offer a solution by enabling businesses to receive local payments, enhance cash flow, and eliminate the need for multiple bank accounts in each country.

E-commerce and Online Marketplaces

Managing payments across multiple platforms can be a complex task for online businesses and merchants. With virtual IBANs, they can easily track and identify incoming payments from different platforms, allowing for streamlined payment management and facilitating data analysis for informed decision-making.

Client Fund Management

Many industries, such as real estate, law, or travel, handle client funds on a regular basis. To ensure transparency and simplify the reconciliation of client transactions, virtual IBANs provide an efficient solution. With virtual IBANs, each client or project is assigned a unique identifier, making it easier to manage and track funds.

Currency Management

Managing multiple currencies can be a logistical headache for businesses. However, virtual IBANs offer a solution by allowing businesses to assign a unique identifier to each currency. This streamlines the process of receiving and converting funds, eliminating the need for separate accounts for each currency.

Accept Online Payments with Noda vIBAN

Noda is a leading provider of open banking solutions, offering businesses a simpler, faster, and more cost-effective way to handle payments. With coverage across over 2,000 banks in 28 countries, including the UK, EU, and beyond, Noda makes it easy for merchants to accept payments directly from customers’ bank accounts and enhance the user experience.

With open banking, you can say goodbye to expensive card fees, chargebacks, and long settlement times. Noda’s pay-by-bank method delivers instant payments, lower costs, and better protection against fraud.

You can use your existing merchant account or Noda virtual IBAN for payment collection and refunds in multiple currencies.

If you’re looking to simplify your online payments, talk to us today – we’re here to understand your unique business needs and answer any questions you may have.

FAQs

How can virtual IBANs help your business?

Virtual IBANs offer businesses increased flexibility in managing international transactions, making reconciliation more streamlined and providing support for multiple currencies. They simplify payment processes, particularly in e-commerce, enabling easier global expansion. Additionally, they enhance security by keeping underlying account details confidential, while also helping businesses efficiently manage client funds and reduce currency-related costs.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know