Tired of chasing invoices or dealing with clunky payment systems? Email payments via a payment link offer a faster, simpler way to collect money. Instead of chasing invoices or waiting on manual bank transfers, businesses can simply send an instant payment link straight to their customer’s inbox—and customers pay in just a few clicks.

It’s fast, secure, and works for just about any industry, whether you’re running an online store or a consulting business. In this article, we’ll break down how email payment links work, why they’re so effective, and how your business can start using them today.

What Is an Email Payment Link?

An email payment link is an email payment method that consists of a clickable link or button embedded within an email, directing customers to a secure payment page. Email payment links enables you to conveniently request payments from customers via email, ensuring high security and smooth UX.

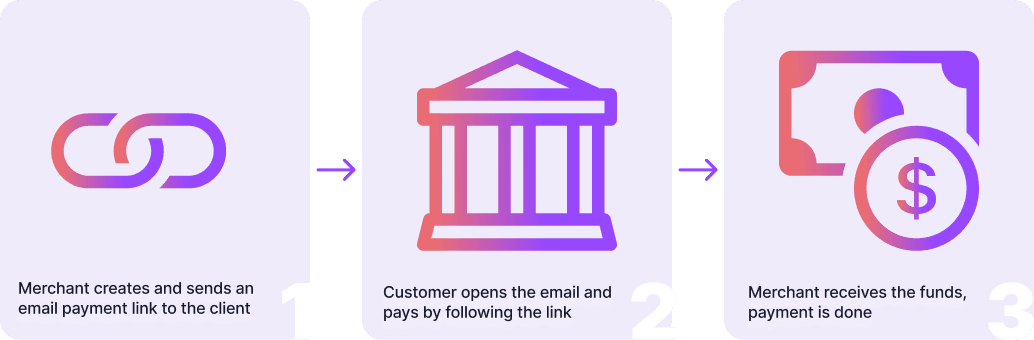

How Email Payment Links Work

You start by creating a payment link in your provider’s dashboard. This link takes your customer to a secure page where they can pay for your product or service. Then, you simply email it to them—with a quick summary of what they’re paying for and a clear Pay Now button.

When the customer gets the email, they click the button and land on a checkout page. There, they review the payment details and choose how to pay. They confirm the payment through email, and it goes through instantly. Both you and your customer get confirmation right away.

How to Pay by Email with Noda

With Noda, accepting email payments is quick and easy. Just generate a payment link—no setup, no code required. Your customer clicks the link, pays straight from their bank (via pay-by-bank), and you get the money instantly. You can send them to a simple checkout or use our no-code branded payment pages for a more polished feel.

Why Noda Built Payment Links on Open Banking

We made email payment links run on open banking (pay-by-bank) because it’s faster, safer, and cheaper than cards.

When a customer clicks your payment link, they are redirected to their trusted bank’s interface – on mobile or web. The money moves directly from their bank to yours—no middlemen.

Merchants benefit from lower processing fees and no chargebacks. Customers benefit from stronger security and seamless UX.

With Noda’s Open Banking solution you can connect to over 2,000 banks in 28 countries, accept multiple currencies, and process payments instantly.

Read: Why We Choose Open Banking

How to Create a Payment Link

- Set up an account

To begin a payment by email, you'll need to set up an account – in other words, onboard with the provider that offers the payment link feature. If you already have an account, simply log in.

At Noda, we offer a personal onboarding assistant for new merchants.

- Create a payment link

This is usually done via the provider’s dashboard. For example, at Noda creating a payment link only takes a few moments: enter price & currency, add payment details and press Generate. You’re all set!

- Send the payment link

First, review all the details. Then, proceed to email the payment link to your customer. They will receive an email containing their order details and a prominent "Pay" call-to-action button, inviting them to pay by email.

Benefits of Email Payment Link

Still on the fence about email payment links? Here’s why they’re a smart, flexible way to get paid faster.

Get Paid Fast—No Website or Card Reader Needed

With email payment links, you don’t need a fancy website, app, or payment terminal. Just create a link and send it straight to your customer’s inbox. It’s perfect for freelancers, retailers, and service providers who want a quick, no-fuss way to take payments—without the tech headaches.

More Sales, Less Drop-Off

The easier it is to pay, the more likely people are to follow through. Payment links create a smooth, one-click experience that gets customers from “I’m interested” to “paid” in seconds. No complex forms, no distractions—just more completed sales and fewer lost opportunities.

Fits Any Business, Any Setup

Whether you’re taking a deposit, a one-time payment, or billing regularly, payment links can flex to fit your needs. You can brand your payment page, customise the amount, and send the link via email.

Why Customers Love Email Payments via Link.

Email Payments via Link: Use Cases

Online email payments offer versatility and can be used by businesses across different industries. Let's take a look at some examples.

Online Stores

If you sell custom or made-to-order products, email payment links make checkout easy. Say you run a handmade jewellery shop—just send a link after confirming the order. Your customer pays in seconds. No website, no card reader needed.

Freelancers & Service Providers

Freelancers, consultants, and professionals can send payment links with their invoice. A graphic designer, for example, can finish a project, email the invoice with a link, and get paid right from the client’s inbox. No printing, no chasing.

Event Organisers

Running events? Use email payment links to confirm bookings. After someone signs up for your workshop or concert, send a link for the ticket fee. They pay online, get instant confirmation, and you avoid messy admin.

Software-as-a-Service (SaaS)

SaaS businesses can use email payment links to get paid for upgrades, or one-off services—fast. Let’s say a free trial ends. Instead of asking users to login and navigate a portal, just send a payment link. One click, and they’re on a secure checkout page. They confirm, and it’s done.

FAQs

How do I collect payment via email?

You can create an instant payment link, pop it into an email, and send it to your customer. They click, pay via email, and you're done. At Noda, we use open banking (pay-by-bank) for our payment links.

What is an email payment?

It's a payment made through a link sent in an email. Your customer clicks the link and pays online—quick and easy.

How does a payment link work?

A payment link sends customers to a secure checkout page. They review the details, pay, and both of you get instant confirmation.

How do I send a payment link?

Generate the link in your provider’s dashboard, double-check the details, and email it to your customer with a short message.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants