ACH bank transfers are an integral part of modern financial transactions, offering a secure and efficient method for businesses to manage their money. Here we take a look at the meaning of ACH bank transfer, its advantages, and how it compares to other money transfer methods.

What is ACH?

The Automated Clearing House (ACH) acts as a network responsible for coordinating electronic payments and automated money transfers. It enables seamless communication and fund transfers between financial institutions across the US.

Other regions supporting ACH payments include Canada, Mexico, the UK, Australia, European countries, Hong Kong, India and New Zealand.

What is ACH Bank Transfer?

The ACH bank transfer or payment is a convenient electronic bank-to-bank transfer carried out through the ACH network. It allows businesses and individuals to move funds directly from one bank account to another. This method finds widespread usage in direct deposit payrolls, customer payments, and supplier payments.

Types of ACH Transfers

- ACH credits represent transactions where funds are electronically transferred into a designated bank account. An illustrative case entails employers directly depositing payroll into the respective employees' bank accounts.

- ACH debits involve the transfer of funds from a bank account. For example, when a consumer arranges a recurring monthly payment for a utility bill, the utility company withdraws the necessary funds from the consumer's account each month.

How ACH Bank Transfer Works

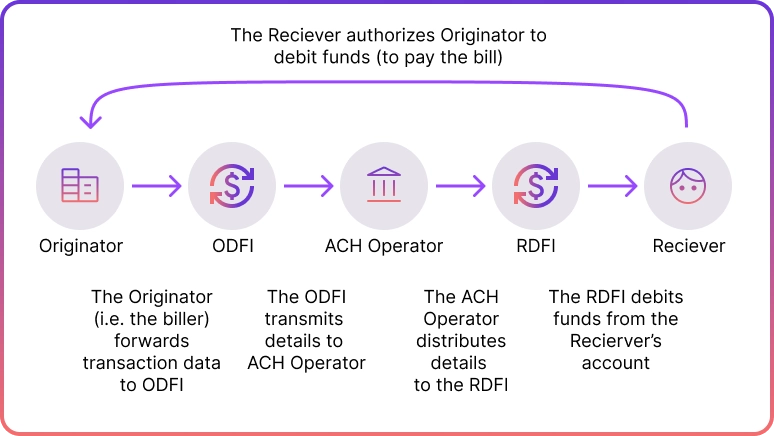

ACH bank transfers function by utilising a network that groups and processes requests on a set schedule. When an ACH transfer is initiated, the originating bank submits a request to the ACH network for transferring funds to the recipient's bank account.

The payment process starts when the sender, also known as the originator, submits a payment instruction to their bank, referred to as the Originating Depository Financial Institution (ODFI). Afterwards, the ODFI gathers all received requests within a specific timeframe and transmits them to the ACH network in batches.

The batches of payments in the ACH network are sorted and then sent to the Receiving Depository Financial Institution (RDFI) corresponding to each payment. Subsequently, the RDFI credits the receiver's account with the payment amount.

The processing time for ACH transfers can vary, ranging from a few hours to a few days based on the type of transfer. In general, ACH debit transactions are typically finalised within one business day. However, it may take up to two business days for ACH credit transactions to be fully processed.

ACH bank transfers have gained popularity due to their efficiency and reliability. They are widely utilised for various transactions, including direct deposits, bill payments, and B2B payments.

Wire Transfers vs ACH explained

ACH and wire transfers are two methods banks use to transfer money. However, they differ in terms of speed, cost, and use cases.

- Speed: Wire transfers are generally quicker than ACH transfers. Most wire transfers are completed within the same business day, whereas ACH transfers may take up to three business days.

- Cost: ACH transfers are generally cheaper than wire transfers, with ACH processing fees typically amounting to around 1% of the transaction. In contrast, receiving ACH payments is usually free. Wire transfer fees, however, can vary greatly depending on the bank and location, ranging from $0 to nearly $100.

- Use cases: ACH transfers are commonly used by businesses that handle bulk payments, like payroll or recurring bills. On the other hand, wire transfers are more suitable for one-time transactions involving large amounts of money that require swift processing, such as real estate deals or mergers and acquisitions.

Why Choose ACH for Business?

Choosing ACH for a business has several advantages:

- Cost-effectiveness: ACH transfers offer businesses a cost-effective solution as they tend to be cheaper than wire transfers.

- Security: In terms of security, ACH payments are regarded as more secure compared to wire transfers due to their utilisation of the NACHA, an independent organisation that operates ACH.

- Efficiency: ACH transfers offer businesses a more efficient payment solution when dealing with bulk transactions. This makes them an optimal choice for companies that process payments in large quantities.

- Flexibility: ACH transfers provide greater flexibility when it comes to resolving errors, issues, and disputes compared to wire transfers. This enhanced versatility allows for smoother transaction management and problem resolution.

Final Thoughts

In conclusion, ACH payments provide a secure, efficient, and cost-effective method for businesses to process payments. Whether employers need to pay their staff, suppliers require timely payment, or businesses receive customer payments, ACH transfers offer streamlined financial operations and savings.