The CMA (Competition and Markets Authority) is the regulatory body in the UK that focuses on promoting fair competition and safeguarding consumer interests in a rapidly changing business environment. It acts as a vigilant watchdog, ensuring businesses adhere to fair practices and consumers are treated fairly.

Here we take a look at the CMA meaning in more detail, including its history, functions and its role in promoting open banking in the UK.

Competition and Markets Authority Explained

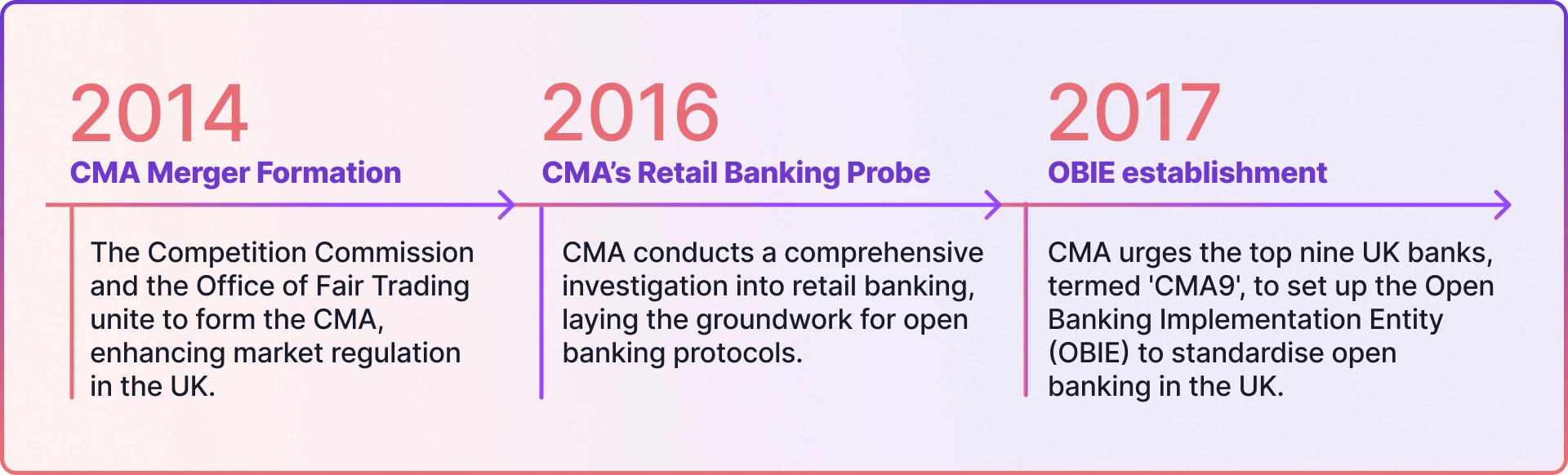

In 2014, the Competition Commission and the Office of Fair Trading joined forces to create the CMA (Competition and Markets Authority). This merger, which was carried out through the Enterprise and Regulatory Reform Act of 2013, aimed to enhance competition in the UK by establishing a single regulatory body that operates more efficiently.

The CMA has multiple responsibilities and plays various roles. Its main objective is to guarantee fair competition in markets and safeguard consumer rights. To achieve this, the organisation focuses on:

- Investigating mergers that might reduce competition.

- Taking action against businesses indulging in anti-competitive behaviour or cartels.

- Protecting consumers from unfair trading practices.

- Investigating entire markets if competition or consumer issues are suspected.

- Advising the government and other regulators on competition matters.

- Handling regulatory appeals related to issues like price controls.

The body operates as an independent organisation, separate from any government department. It is supervised by a board and headed by a Chief Executive and team of senior officials. In certain investigations, decisions are reached by impartial members of a CMA panel.

CMA and Open Banking

The CMA has been instrumental in establishing open banking protocols in the UK. Following its probe into retail banking in 2016, the regulator mandated the top nine UK banks, often termed 'CMA9', along with certain other financial entities, to introduce an open Application Programming Interface (API). This move enabled approved third-party providers (TPPs) to access data with customer consent.

To achieve this, the nine banks set up the Open Banking Implementation Entity (OBIE) in 2017, establishing the open banking standard in the UK. Its primary goal is to foster competition and create a uniform open banking system for easy account access.

Final Thoughts

The CMA plays a vital role in ensuring the UK market remains competitive and consumer-focused. Through vigilant oversight and proactive measures, they champion open banking and foster innovation to ensure consumers receive the best possible deals.

It is essential for business owners and executives to understand the CMA's role and directives to navigate the UK's competitive landscape and comply with market regulations.