A credit card is a rectangular piece of plastic or metal issued by financial institutions. It allows cardholders to borrow money in order to make purchases.

Unlike a debit card, which deducts funds directly from a bank account, a credit card enables users to borrow up to a specified limit. However, if the borrowed amount is not repaid in full by the due date, they will incur interest charges.

Here we take a look at the meaning of the credit card term and the process behind it in more detail.

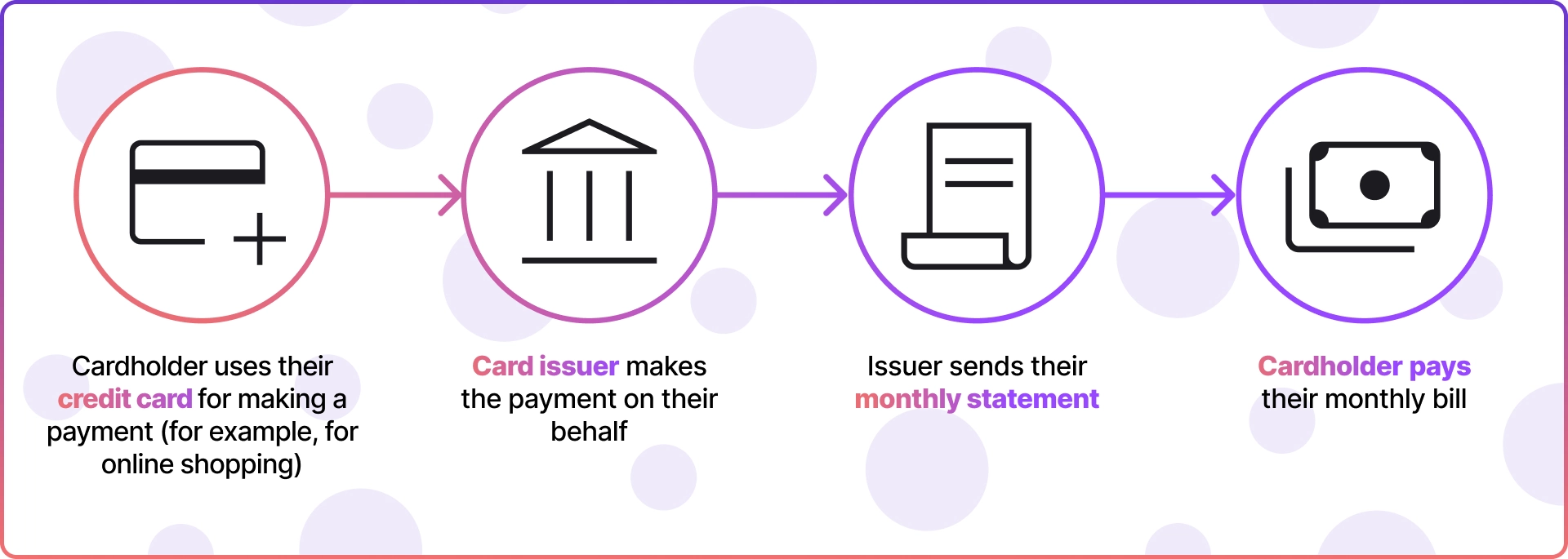

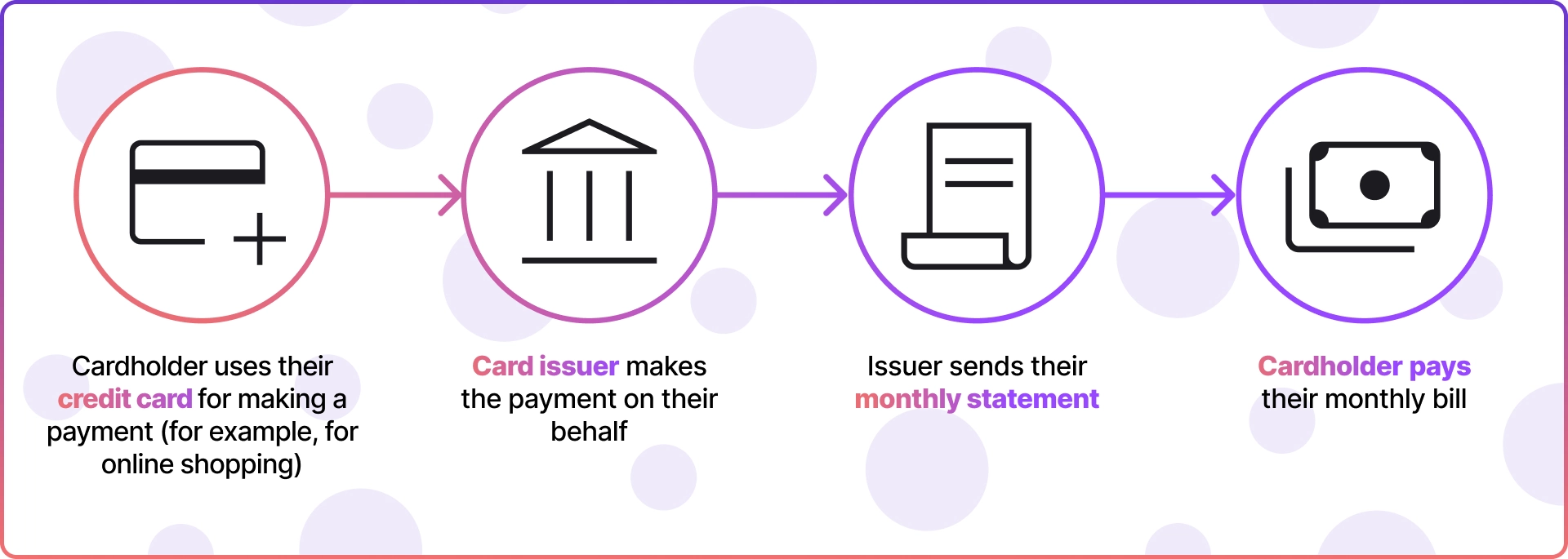

How Do Credit Cards Work?

When customers use a credit card, this means they borrow money up to a predetermined limit. Every purchase they make increases their account balance. At the end of a certain period, usually a month, they’ll receive a statement that lists all their transactions and the total amount they need to pay.

Credit Card Payment Processing

At its foundation, the credit card payment process involves multiple steps and entities, starting from when the customer swipes their card until the funds are settled into the merchant's account.

After a customer makes a purchase with their credit card, the transaction data is initially sent to either the acquiring bank or the merchant's bank via the payment gateway. From there, it is forwarded to the card network (such as Visa or Mastercard). The card network then directs this information to the issuing bank, which is responsible for providing the customer with their credit card.

After the customer submits their payment, the issuing bank reviews the transaction and determines whether to approve or decline it based on the customer's available credit. The decision is then communicated back through the card network to the acquiring bank and finally reaches the merchant's terminal.

It's important to recognize that all of these steps occur in a matter of seconds, ensuring that credit card transactions are both efficient and user-friendly. However, the actual process of settling funds and transferring payment to the merchant may take a few days.

Merchants can enhance the customer experience and ensure prompt access to funds by partnering with a reliable payment processor. This partnership can ensure a seamless, secure, and fast payment process.

Types of Credit Cards

- Purchase Credit Card: Standard cards used for everyday purchases.

- Credit Builder Card: Designed for those with poor or no credit history, helping them build a positive credit profile.

- Money Transfer Card: You can transfer money from a credit card to a bank account.

- Rewards Card: Offers incentives such as cash back, airline miles, or points for every purchase.

- Overseas Card: Designed for use abroad, often offering better exchange rates and lower foreign transaction fees.

Credit Card vs Debit Card

| Credit card | Debit card | |

|---|---|---|

| Source of funds | Borrowed from a bank | Directly from a bank account |

| Overdraft ability | Possible (with fees) | Limited, often with overdraft fees |

| Interest | Charged if balance not paid in full | Typically none |

| Building credit history | Yes, affects credit score | Typically doesn’t affect credit score |

| Rewards & Benefits | Often available | Less common |

| Usage limit | Credit limit set by issuer | Amount available in account |

| Fees | Annual fees, late payment, cash advance | Overdraft, ATM fees outside network |

| Cash withdrawals | Possible with higher interest rates | Common, often free from issuer’s ATMs |

Final Thoughts

When used responsibly, credit cards can be valuable financial tools. They provide payment flexibility, assist in establishing a healthy credit history, and offer various perks.

However, it's important to have a good grasp of their mechanisms to avoid getting caught in high interest rates or accumulating excessive debt. Recognising these intricacies can benefit both individuals' personal financial management and guide organisational financial strategies for business leaders. Plus, understanding credit card payment processing may benefit merchants whose clients use credit cards as their preferred method.

Please make sure to carefully review the terms and conditions related to your credit card and consult with a financial advisor whenever necessary.