Debit cards, also known as check cards or bank cards, enable consumers to purchase goods and services without carrying physical cash or checks. Debit cards play a crucial role in modern economy, enhancing convenience in speed of today’s payments system.

Here we take a look at the meaning of a debit card, how they work and what differentiates them from credit cards.

How Do Debit Cards Work?

At first glance, a debit card may look similar to a credit card, but its purpose and operations are different. Here is how it works:

- Account Linkage: The customer’s debit card is always connected to their checking account. The funds they can spend are determined by the balance in this account, not a credit limit.

- Immediate Deduction: Unlike credit cards, where customers borrow money and repay later, debit cards access funds they already possess. There's no debt incurred, and hence, no monthly minimum payments.

- Usage: Customers can use a debit card to withdraw cash from ATMs or make purchases, similar to credit cards. Some transactions might require a personal identification number (PIN), while others might not.

- Spending Limit: The amount customers can spend is limited to their checking account balance. Some debit cards also have daily purchase limits, ensuring they don't exceed a specific amount within a 24-hour period.

Credit Card vs Debit Card

| Credit card | Debit card | |

|---|---|---|

| Source of funds | Borrowed from a bank | Directly from a bank account |

| Overdraft ability | Possible (with fees) | Limited, often with overdraft fees |

| Interest | Charged if balance not paid in full | Typically none |

| Building credit history | Yes, affects credit score | Typically, doesn’t affect credit score |

| Rewards & Benefits | Often available | Less common |

| Usage limit | Credit limit set by issuer | Amount available in account |

| Fees | Annual fees, late payment, cash advance | Overdraft, ATM fees outside network |

| Cash withdrawals | Possible with higher interest rates | Common, often free from issuer’s ATMs |

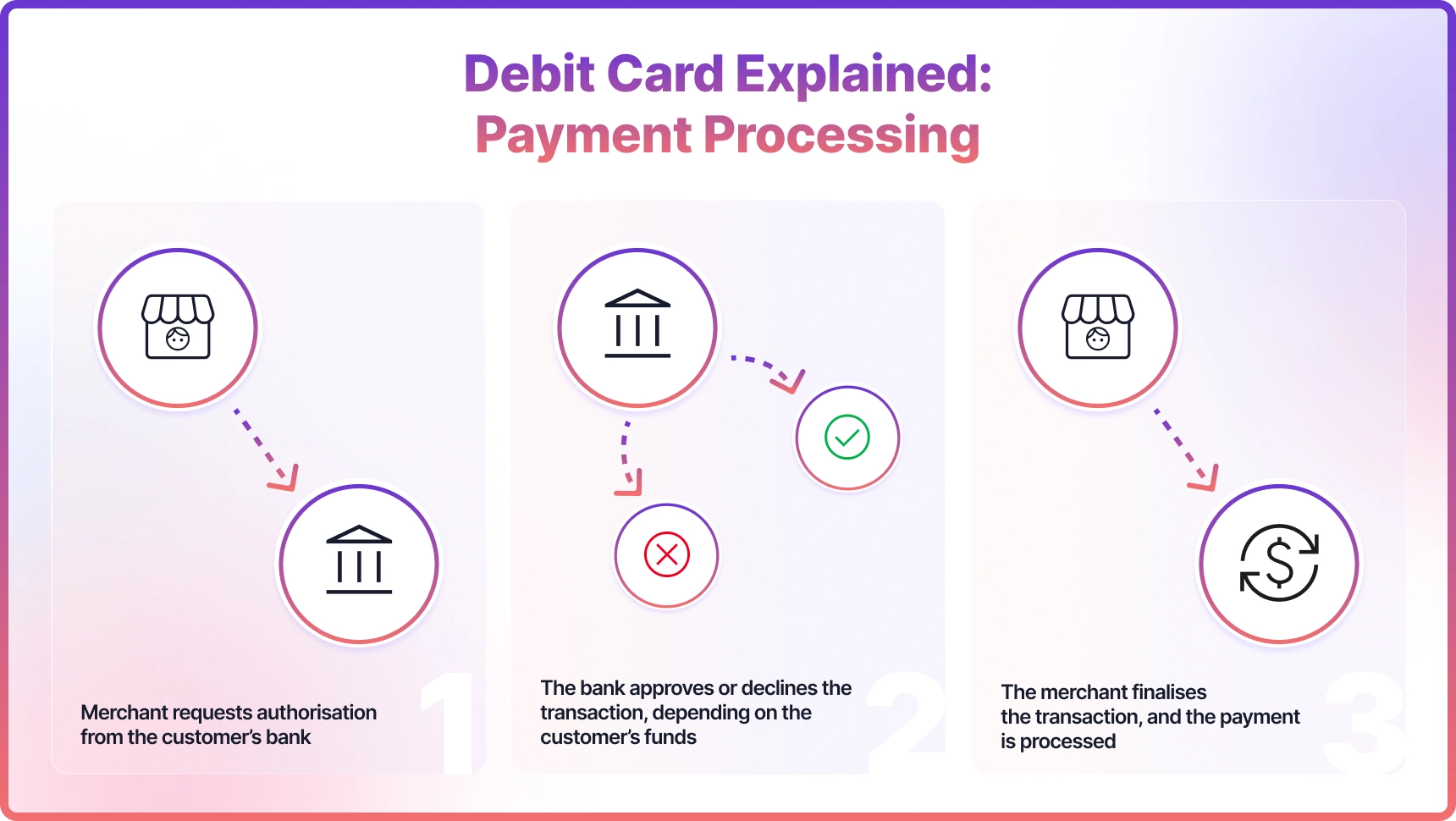

Debit Card Explained: Payment Processing

When a customer makes a purchase using a debit card:

- The merchant requests authorisation from the bank

- The bank checks if they have sufficient funds

- If funds are available, the transaction is approved, and the amount is set aside, marking it as "pending."

- The merchant then finalises the transaction, and the amount is deducted from the customer’s account.

It's essential to note that while some transactions are instantaneous, others might appear as pending for a while before being fully processed.

Final Thoughts

In the business world, having a thorough understanding of the tools and payment methods available to your customers is essential. Debit cards provide a great balance between convenience and control, allowing for efficient expense management. They act as a bridge between physical cash and credit, ensuring seamless transactions.