Financial data is an essential component of open banking as its sharing with third-party providers (TPPs) enables for more personalised banking experience. But what’s exactly the meaning of financial data, and what are its key use cases in the open banking realm?

What is Financial Data?

Financial data in the financial world captures a wide range of monetary transactions, balances, and financial activities conducted by individuals and businesses. This data plays a crucial role in making informed decisions, whether it's for personal investments, business expansions, or understanding market trends. Essentially, financial data provides valuable insights into an entity’s financial health, profitability, and growth potential.

Types of Financial Data

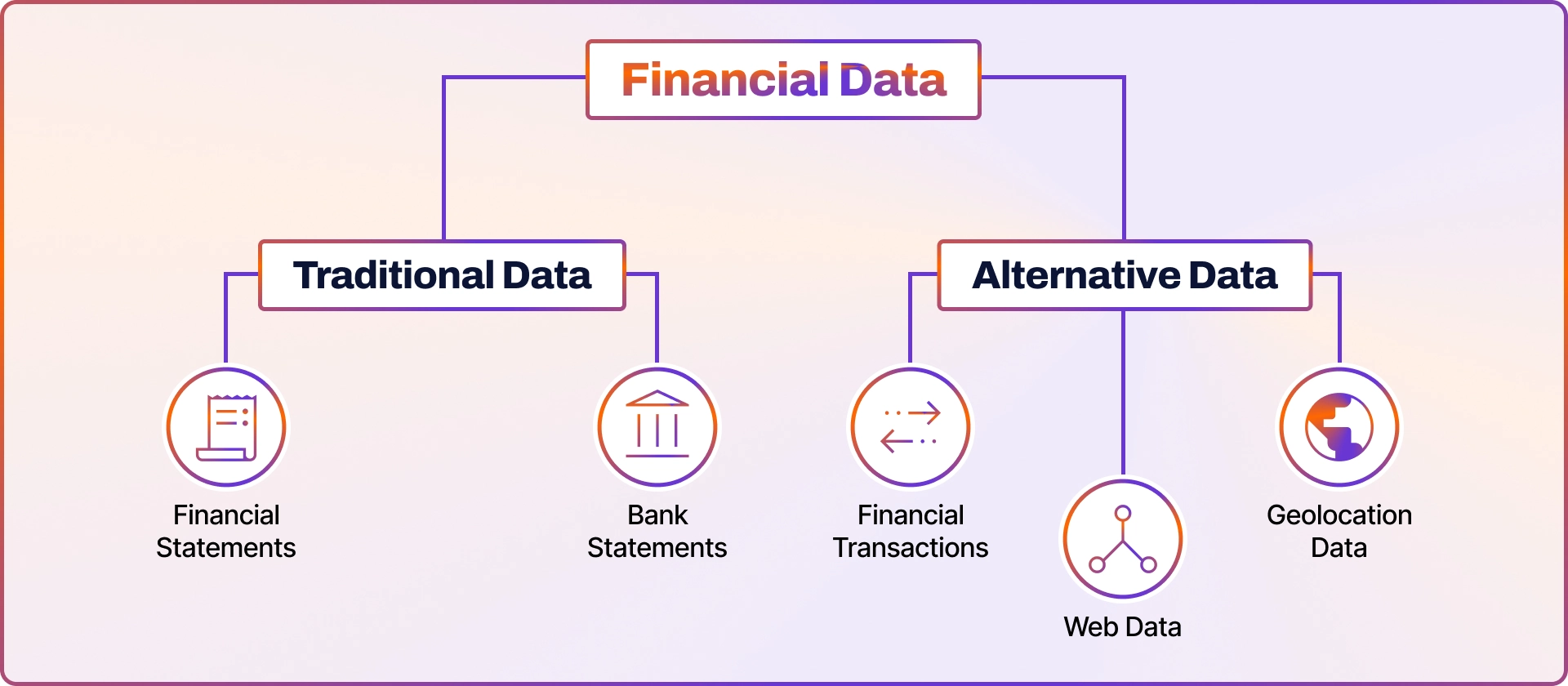

There are two major types of financial data: traditional and alternative.

Traditional Data

This is the kind of data that is more relevant in the world of investing, including:

- Bank statements: Bank statements provide a comprehensive record of all financial transactions that occur within a bank account, documenting an individual's or business's financial activities.

- Financial statements: These provide valuable information about a company's performance. They include balance sheets, income statements, and cash flow statements.

This type of data is often used by investors to evaluate the financial health of a company and make an informed decision on whether to buy, sell or hold its shares.

Alternative Data

Alternative data comes from non-traditional sources and is the type of data that is more relevant to open banking.

- Financial Transactions: This category encompasses information related to an individual’s or business’ spending. It can provide valuable insights into financial behaviours and spending habits.

- Web Data: This includes online activities like social media interactions, browsing habits, and online shopping behaviours. It provides valuable insights into an individual's or company's preferences and potential risks.

- Geolocation Data: This type of data covers information about the physical location of an individual or device. It is derived from devices such as smartphones or GPS systems. Geolocation data can provide valuable insights into patterns of movement and has the potential to predict future locations.

Financial Data in Open Banking

Open banking is transforming the way businesses engage with their financial data. By allowing banks to securely share consumers’ financial data with TPPs like fintech companies and other banks, provided consumer consent, open banking opens up a world of customised financial services. From personalised money management tools to specialised lending options, this new approach empowers businesses and offers consumers a more tailored banking experience.

At the core of open banking is the smooth and continuous sharing of financial data. This interconnected flow of information is what enables the customisation of products and services to meet each client's unique needs. The data shared through open banking varies based on regional regulations and the services provided. However, commonly shared financial data examples include:

- Account holder details (e.g., name, surname)

- Personal or company codes

- Residential or location addresses

- Merchant or activity codes

- Financial liabilities and account information

- Transaction codes

While the above list provides a general overview, the exact data shared always depends on active regulations and the specific services offered by TPPs.

When it comes to sharing financial data, security is of utmost importance. Developers and regulators in the open banking industry work together to ensure the highest levels of data protection. They follow standardised processes and adhere to regulations like PSD2 and GDPR.