Open Banking Implementation Entity (OBIE), currently known as Open Banking Limited, is the organisation in charge of establishing the UK's groundbreaking Open Banking Standard. Its goal is to foster competition, innovation, and transparency within the retail banking sector in the country.

Here, we take a look at the OBIE meaning in more detail, exploring its history, governance and role in the UK’s open banking landscape.

History of OBIE

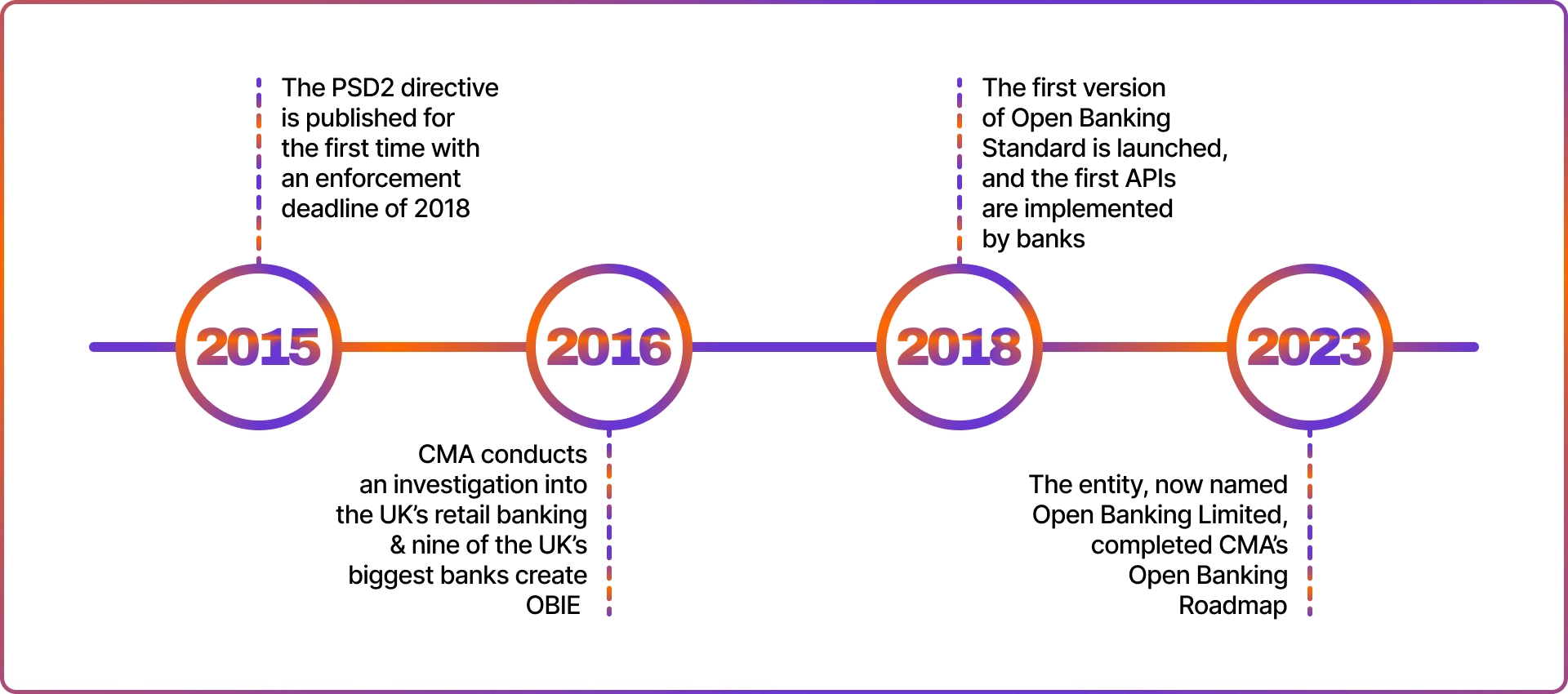

OBIE was established by the UK’s nine largest banks in 2016. The entity was founded as a result of the Retail Banking Market Investigation Order by the UK’s Competition and Markets Authority (CMA), which ordered UK banks to make their API data accessible to third-party providers (TPPs).

This order came about due to the implementation of the new open-banking legal framework, Payment Service Providers Directive (PSD2), across Europe. The UK took a proactive approach through OBIE, becoming a global leader in implementing and growing open banking initiatives.

The OBIE has since been renamed into Open Banking Limited, and In 2023, announced the completion of the CMA's Open Banking Roadmap on its fifth anniversary.

OBIE Governance & Role

OBIE's primary role is to design the framework and standards for open banking in the UK. It operates under a pro-competition mandate, ensuring that the infrastructure, guidelines, and ecosystem are conducive to innovation and consumer benefit.

The governance structure of OBIE is closely linked to the CMA. The two are intricately connected, with OBIE operating under the oversight and guidance of the CMA. The regulator plays a crucial role in guiding the strategic direction and budget of OBIE.

The entity collaborates with major banks, challenger banks, fintech companies, third-party providers, and consumer groups to achieve its objectives. As such, its responsibilities include:

- Standard Development: The development of the industry guidelines, such as Open Banking & API standards, which are then used by financial companies to employ open banking. This has sparked a fintech revival in the UK and served as inspiration for similar initiatives worldwide.

- Collaboration: OBIE collaborates with major banks, fintechs, and other stakeholders of the ecosystem to promote innovation and ensure smooth integration.

- Promoting Open Banking: Advocating for the benefits of open banking to consumers, businesses, and the broader financial industry.