Modern financial operations require more than basic payment processing. A Bank Transaction API (Application Programming Interface) not only facilitates core payment functions but also turns transaction data into valuable business insights. It offers real-time financial visibility, supports intelligent automation and empowers data-driven decision-making.

Today, most bank transaction APIs leverage open banking, a system that allows businesses to access bank financial data securely with user consent. By connecting banking systems and authorised third-party applications, open banking APIs have redefined how data is shared, prioritising security, compliance, and user control.

However, not all APIs are created equal. Many businesses face challenges such as:

- Using an API that is great for payments but does not provide detailed transaction insights

- Relying on a solution that lacks the coverage or scalability to meet your growing needs

- Being stuck with manual processes that are slow, time-consuming, and prone to errors

Noda’s API was specifically designed to address these challenges. It bridges the gap by combining transaction data access with payment capabilities, providing businesses with an all-in-one solution to handle financial workflows seamlessly.

To understand what makes a Bank Transaction API valuable, let’s explore how they work and why they matter for businesses today.

What is a Bank Transaction API?

A Bank Transaction API securely connects businesses to bank accounts with the account holder's consent. It enables seamless integration between banking systems and third-party application providers, acting as a bridge between your business systems and your customer banking data.

A Bank Transaction API provides access to:

- Transaction Processing: Enables businesses to accept payments and send payouts to their customers seamlessly.

- Transaction Histories: Details of past transactions, including amounts, dates, and descriptions.

- Account Balances: Real-time insights into available and total funds.

- Payment Statuses: Updates on pending or completed payments.

- Metadata: Additional details like transaction categories or payee information.

These APIs eliminate the inefficiencies of manual processes, reduce errors, and enable businesses to deliver better customer experiences.

How Does a Bank Transaction API Work?

A Bank Transaction API facilitates secure, targeted data exchange between your system and a bank’s database. Here’s how it works:

For Data Access:

- Data Requests: The API allows your system to specify the data it needs from the bank (e.g., account balances, or payment statuses).

- Authentication: User authorisation is required, often involving multi-factor authentication or consent-based protocols.

- Data Transfer: The bank retrieves the requested data and shares it in a machine-readable format.

- Integration and Automation: The data is processed within your system, enabling workflows such as KYC checks, reporting, and automated payments.

For Payments:

- Payment Initiation: Your system sends a payment request with the necessary details (amount, recipient, etc.).

- User Confirmation: The account holder authorises the payment through their bank.

- Processing: The bank validates and processes the transaction.

- Status Updates: Your system receives real-time updates on the payment status.

These APIs enable secure, real-time access to targeted data and payment processing, reducing operational inefficiencies like screen scraping and ensuring compliance with privacy standards.

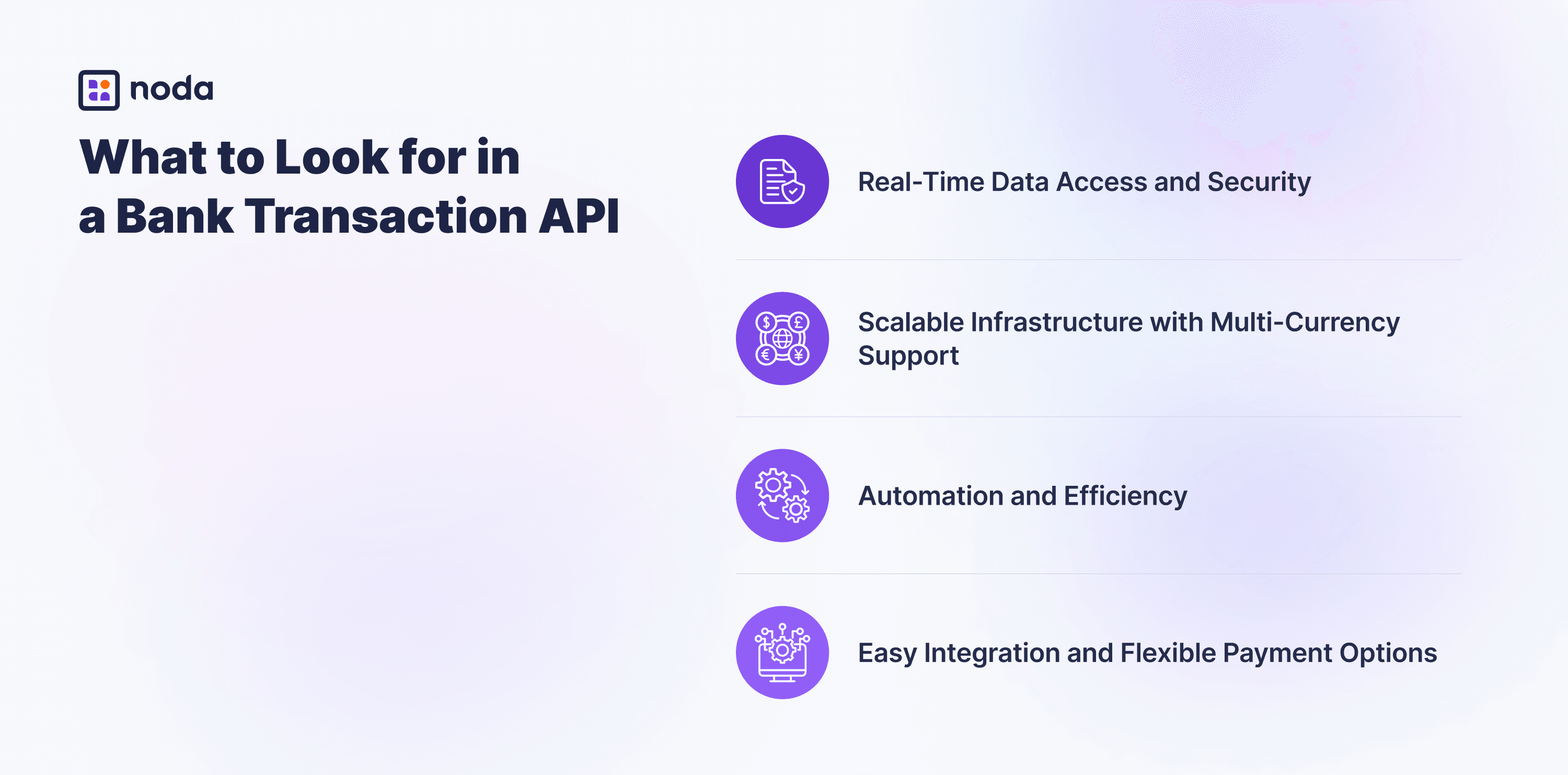

What Should You Look for in a Bank Transaction API?

Selecting the ideal bank transaction API can significantly reduce operational costs and enhance financial workflows. When assessing APIs, prioritise features that align with your business goals and operational requirements – including payment processing capabilities, integration flexibility and scalability potential.

By focusing on these core capabilities, you're investing in an API that delivers measurable business outcomes:

- Real-Time Data Access and Security: Real-time access to transaction histories, account balances, and payment statuses enables immediate fraud detection and instant payment verification. These features mitigate risk, enhance cash flow forecasting, and strengthen customer trust.

- Scalable Infrastructure with Multi-Currency Support: With scalable infrastructure, your business can seamlessly grow from processing hundreds to millions of transactions, supporting expansion into new markets. Multi-currency capabilities enable smooth cross-border payments while maintaining efficiency without the need for extensive modifications or additional integrations.

- Automation and Efficiency: Automation removes manual reconciliation and repetitive tasks, saving up to 15-20 hours of staff time weekly. By reducing reliance on manual processes, businesses can allocate resources to higher-value initiatives and reduce operational overhead.

- Easy Integration and Flexible Payment Options: Core payment features like instant account-to-account transfers, recurring payments, and refunds should align with your integration preferences. Flexible options, including APIs, no-code tools, and e-commerce plugins, ensure the API adapts to your specific workflows and growth strategy.

Noda’s Full Suite of APIs

Integrated financial tools are essential for businesses aiming to scale. Noda's unified API platform delivers all these capabilities, enabling businesses to handle payments, gain insights and scale operations through a single integration.

Let's explore how Noda's integrated API suite addresses each of these needs:

Open Banking API

Noda’s Open Banking API is built on the foundation of secure data sharing, providing businesses with access to user-approved financial information directly from our network of 2000+ partner banks. It enables businesses to:

- Retrieve transaction data, balances, and account details with user consent

- Facilitate real-time secure account-to-account payments

- Comply with regulations like GDPR and PSD2, ensuring data privacy and security

This API allows businesses to simplify financial operations by combining account verification, payment processing and transaction monitoring into a single integration – reducing development time, easing compliance and lowering operational costs linked to managing multiple banking connections.

Cards API

For businesses that handle card-based transactions, Noda’s Cards API simplifies the process by supporting both payments and payouts. This includes:

- Card Payments: Accept payments from credit and debit cards securely and at scale.

- Card Payouts: Manage refunds, reimbursements, or partner payouts seamlessly.

E-commerce platforms, subscription businesses and other organisations relying on card payments can benefit from a streamlined approach to handling transactions with reduced complexity.

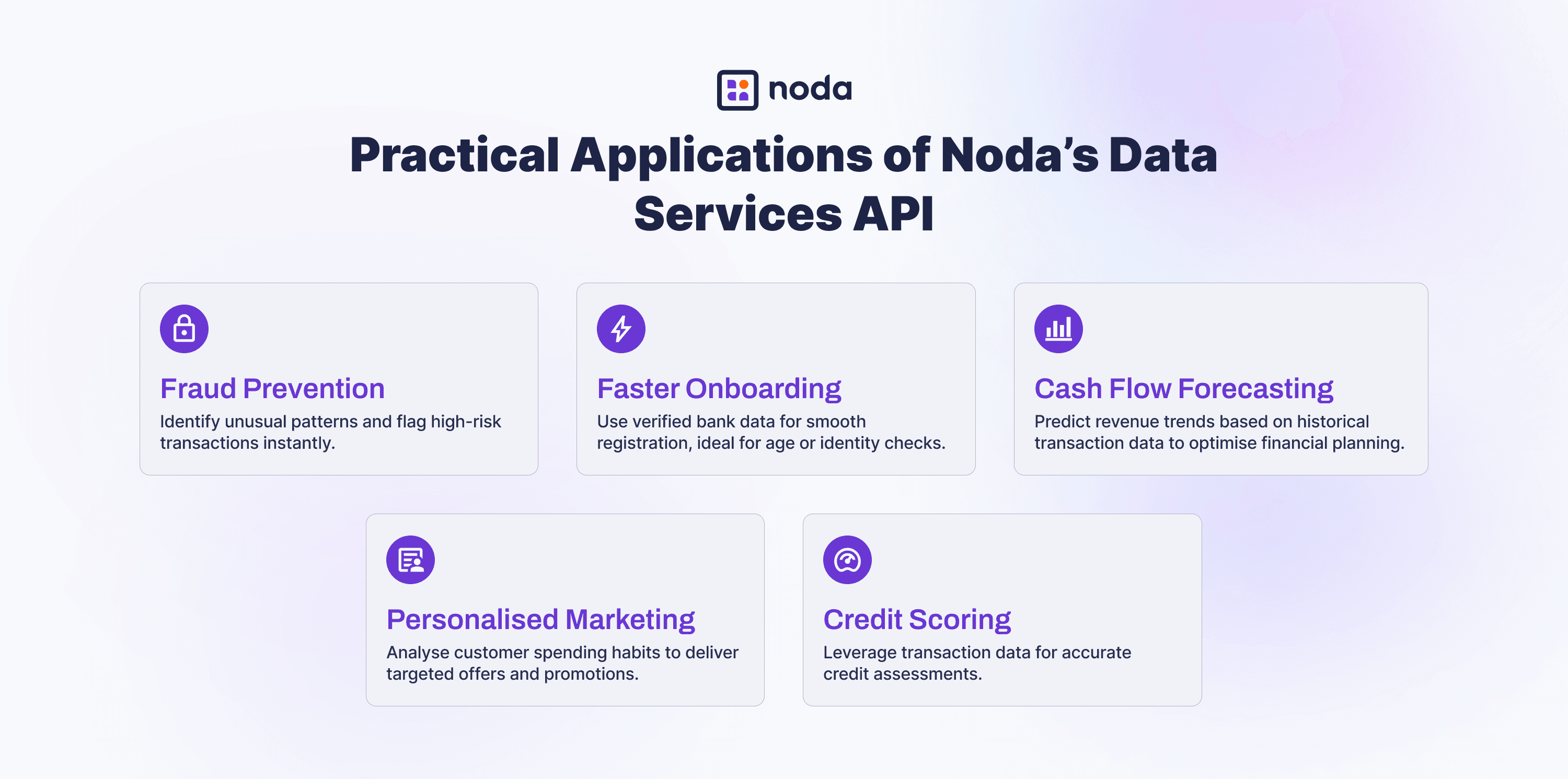

Data Services API

Noda’s Data Services API helps businesses make sense of financial data, providing a clearer picture of customer behaviour and transaction patterns. With enriched insights, businesses can improve decision-making and optimise key processes by leveraging:

- Customer Segmentation – Understand spending habits and group customers based on behaviour.

- Predictive Analytics – Forecast trends and optimise cash flow with data-driven insights.

- Risk & Credit Scoring – Use transaction data to refine risk assessments and improve financial offerings.

With Noda’s Data Services API, businesses can go beyond raw data, unlocking valuable customer insights that enhance decision-making, reduce risk and improve financial performance.

How Noda's APIs Work Across Industries

Here’s how Noda’s APIs can address specific challenges across different industries:

E-commerce

- Facilitate instant seller payouts using the Bank Transaction API.

- Simplify customer refunds by processing them through the original payment method (card or bank transfer).

- Identify and prevent fraudulent transactions by analysing purchasing patterns.

- Optimise payment routing based on transaction success rates.

- Predict cash flow for marketplace operations using historical transaction data.

Travel & Hospitality

- Support multi-currency bookings with unified payment processing.

- Offer instant refunds for cancellations, boosting customer satisfaction.

- Secure deposits with card pre-authorisation.

- Forecast payment processing volumes by analysing booking trends.

- Reconcile commissions across various travel partners efficiently.

Gaming and Entertainment

- Improve player experience with instant deposits and withdrawals.

- Allow regular players to switch payment methods seamlessly.

- Monitor transactions to enforce responsible gaming policies.

- Customise retention strategies by analysing player payment behaviours.

- Automate payouts based on player preferences and regional regulations.

Take Control of Your Financial Workflows with APIs

Financial operations shouldn't slow your business down. Modern APIs transform complex banking processes into flexible, efficient workflows tailored to your needs. From managing marketplace payouts to streamlining travel bookings or processing player transactions, the right API infrastructure allows you to:

- Deliver an exceptional customer experience without payment challenges

- Scale operations seamlessly without rebuilding integrations

- Turn financial data into actionable insights for smarter decisions

Start taking control of your financial operations. Explore Noda's API documentation to see how our solutions can support your business goals.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know