Are outdated data practices costing your business time, money, and trust? For years, screen scraping technology was the go-to method for accessing customer data, powering financial and payment tools. But its reliance on shared login credentials and vulnerability to disruptions make it risky and inefficient for today’s needs.

With open banking and APIs now leading the way, businesses have a safer, more reliable alternative. In this article, we’ll explore how screen scraping works, its cons, and why open banking APIs are the smarter choice for modern finance.

What Is Screen Scraping in Banking?

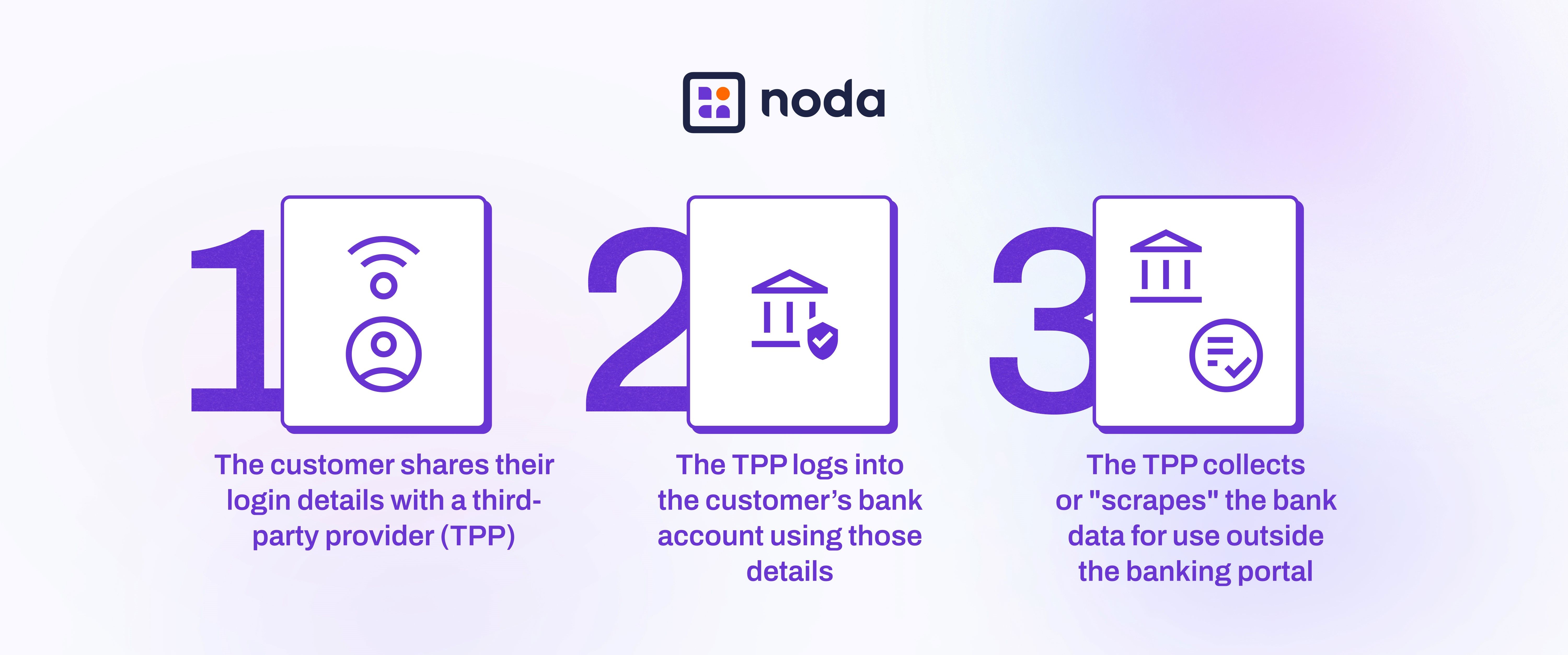

Screen scraping is a way of gathering information displayed on a screen, like a webpage, and using it for other purposes or actions that a user would typically perform. Here's how it works.

Essentially, the third-party provider acts on behalf of the user, mimicking their actions with their consent.

There are many uses of screen scraping in banking. Early personal finance apps used it to gather data from multiple accounts and loans, giving customers a simple, all-in-one view of their finances.

Other screen scraping examples include accessing and analysing account information, initiating payments, and running affordability checks via shared login details. In some cases, businesses store scraped data to build detailed financial profiles for future use.

While most screen scraping is legitimate and requires consent, cybercriminals have also used it to steal data, posing questions about the risks of screen scraping as a banking practice.

Risks of Screen Scraping

As mentioned above, screen scraping often falls short and comes with significant challenges, many of which can be resolved by using open banking.

- Security risks: Sharing login credentials with third-party providers opens the door to unauthorised access and phishing attacks. When credentials are stored outside the bank’s systems, customer information can become vulnerable.

- Limited control and responsibility: Once users hand over their credentials, they lose control over how their data is used or stored, and accountability is unclear if something goes wrong. Users also can’t easily revoke access or manage which data is shared.

- Traffic overload: Automated scraping generates heavy traffic that can slow down bank systems and disrupt services for all customers.

- Poor user experience: Screen scraping creates a frustrating experience for customers. For example, even small updates to a website can cause scrapers to fail. Plus, scrapers process large amounts of data unnecessarily, leading to slow performance.

Open Banking: Screen-Scraping Replacement

Banks spend a lot of time and resources fighting screen scraping problems. At the same time, customers want smooth, secure digital experiences. The solution is obvious – integrating open banking APIs.

Open banking, regulated under PSD2 in Europe, requires banks to share data securely with licensed providers through APIs. Customers stay in control, giving consent and revoking it whenever they want. This modern solution is replacing outdated screen scraping practices with safer and more efficient technology.

Open banking lets authorised providers, like Noda, access and utilise customer banking data securely. With open banking, they can create new payment and open banking data solutions for businesses, improving user experience and efficiency for merchants.

For example, open banking payments (pay-by-bank) are more cost-efficient, as they avoid expensive card networks with interchange and scheme fees. Plus, they eliminate chargebacks.

Integrate Open Banking with Noda

At Noda, we offer a flexible open banking payment gateway that makes transactions fast and seamless. Customers can skip lengthy payment details and pay-by-bank in just a few clicks, improving the user experience.

Get started easily with our plugins for leading e-commerce platforms or integrate effortlessly using Open Banking APIs. With connections to over 2,000 banks across 28 countries and support for multiple currencies, we help you reach global clients.

Beyond payments, Noda’s Know Your Whales (KYW) uses open banking data to deliver actionable insights. Predict customer lifetime value (LTV) and fine-tune your marketing strategies to drive better revenue results.

We also offer a secure card payment gateway, no-code payment options, authorisation tools, and more. Whatever stage your business is at, Noda provides the tools to grow and succeed.

Why Is Open Banking Better than Screen Scraping?

Open banking addresses the challenges of screen scraping in several key ways:

| Open banking | Screen scraping | |

| Security | Secure APIs | Requires sharing credentials |

| Efficiency | Retrieves only relevant data | Gathers excessive data |

| Governance | Banks control access and monitor usage | Banks have no control over third-party data handling |

| Customer consent | Customer can manage and revoke data-sharing permissions | Limited ability to control and revoke access |

| Standardisation | Follows standard API frameworks | Non-standard methods |

Security: Open banking relies on secure APIs with standardised protocols, reducing the risk of data breaches and cyber threats. These APIs ensure data encryption, authentication, and strict access controls. Plus, users keep their login credentials private.

Efficiency: APIs provide direct access to specific data, such as account balances or transaction history, without scanning entire web pages. Unlike screen scraping, which collects unnecessary data, APIs retrieve only what’s relevant. This makes data processing faster, more accurate, and less prone to errors.

Governance: APIs allow banks to control how third parties access and use customer data. Admins can define access limits and track usage to maintain compliance.

Customer control: APIs support a consent-driven model with detailed access controls. Customers can set their data-sharing preferences and revoke access anytime, ensuring their financial information is shared only with their consent.

Standardisation: APIs provide a standard framework for data exchange, ensuring all parties operate on the same system. Frameworks like NextGenPSD2 enable secure and consistent data sharing across the industry.

Open Banking Use Cases vs Screen Scraping

Open banking is steadily replacing screen scraping in financial services. Let’s look at the key case studies where open banking technology is superior to screen scraping.

- Payment initiation

Open banking streamlines payment initiation, offering pay-by-bank payment methods. It lets users make payments directly from their bank accounts without sharing credentials. The users are redirected to their trusted bank’s interface automatically. This ensures a secure and seamless process, unlike screen scraping.

- Data control

In terms of data control and privacy, open banking gives users full control over their information and transparent consent process. Customers can select what data to share and revoke access when needed.

- Account aggregation

For account aggregation, open banking APIs allow users to view all their financial accounts in one place without sharing login credentials.

According to Frollo, API approach achieves an 81% consent conversion rate compared to 50% for screen scraping, with only 0.5% of data syncs failing versus 22% for screen scraping. Open banking also provides three times more relevant data with better signal-to-noise ratios.

- Financial tools

In financial management, open banking delivers more accurate insights. Over 52% of open banking transactions include valuable details like merchant names, compared to 31% in screen-scraped data. Frollo shows. This richer dataset enables more precise analytical tools.

For example, at Noda we offer Know Your Whales (KYW), an AI-powered financial tool based on open banking data. KYW provides merchants with actionable insights and helps identify high LTV clients to tailor marketing strategies and boost revenues.

- Lending and credit scores

For lending and credit decisions, open banking allows lenders to access real-time financial data directly from banks, speeding up credit assessments while reducing fraud risk by automating data access.

FAQs

Is screen scraping legal?

Yes, screen scraping is legal in many regions, but its usage is becoming more regulated. Open banking standards like PSD2 encourage the use of secure APIs instead.

How does scraping work?

Screen scraping collects data displayed on a screen, like a web page. A third-party provider logs into a user's account with their consent and copies the data for external use.

What is scraping used for?

Screen scraping is used to gather financial data for services like account aggregation, personal finance apps, and credit assessments. It allows third parties to mimic user actions and access account information.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each