Credit card payments still represent 54% of non-cash transactions in Europe, largely due to the rewards and benefits offered by card issuers. However, this dominance is rapidly changing because customers are increasingly looking for diverse payment options that are faster, more secure, and cost-effective, creating an opportunity for alternative payment methods to thrive.

The shift is already visible: In 2023, 27% of consumers in Europe abandoned a purchase at checkout because they couldn't use their preferred alternative payment method—a figure that skyrocketed to 67% in Poland. This trend is reshaping the payment landscape, with credit cards as a direct payment tool gradually losing their share globally, even in strong card markets.

As a business owner, you face significant challenges with credit card payments:

- High fees from chargebacks, which drain businesses of $100 billion every year only in the U.S.

- Frequent transaction declines

- Risks of different types of fraud

- Processing fees that can often amount up to 3.5% or higher

This article explores the drawbacks of credit card payments and introduces alternative payment methods that can enhance your transaction approval rates while reducing costs. We'll compare major payment alternatives and examine how solutions like open banking can benefit your business.

Why Credit Cards Are Becoming a Liability for Businesses

For instance, consider a business processing a $1000 purchase daily. The total fees for this transaction can amount to 3.2%. While this may seem modest, over the long term and across high volumes of transactions, these fees can cumulatively represent substantial expenses and notable revenue losses.

According to WorldPay, high interest rates and late fees are one of the main reasons why cards are losing their position as the first payment option for shoppers. For merchants, high transaction fees also pose challenges as they considerably reduce profits.

Here's a breakdown of typical fees associated with credit card processing:

- Processing Fee: Charged by the payment provider to handle transactions

- Card Scheme Fee: Imposed by networks like Visa and Mastercard

- Acquirer Fee: Charged by the acquiring bank

- Interchange Fee: Often the largest expense, varying from 1.5% to 3.5%

Beyond high fees, businesses face three critical challenges:

Payment Failures and Lost Customers

Credit card transactions can present common issues such as incorrect entry of card details, cardholder's lack of funds, and transactions being blocked due to suspected fraud. According to PYMNTS, 67% of companies in the US said that recovering customer's trust after a failed payment is one of their biggest challenges. These failures not only result in lost sales but can permanently damage customer relationships and brand reputation.

Risk of Chargebacks

A chargeback occurs when a cardholder disputes a charge, resulting in the funds being withdrawn from the merchant's account. This process not only results in lost revenue but also incurs additional fees from payment processors, leading to significant financial losses for businesses. To illustrate the scale of this problem:

- Global chargeback transaction volumes are projected to reach 337 million in 2026, marking a 42% increase from 2023 levels

- Chargebacks drain businesses of $100 billion every year in direct losses and processing fees

Security Vulnerabilities

Credit card transactions are highly vulnerable to fraud and data breaches, significantly risking both merchant and customer information. The risk is particularly acute in online transactions:

- Card-not-present (CNP) fraud dominates fraud statistics, accounting for 63% of total card fraud losses in Europe in 2022

- By 2030, CNP fraud is projected to escalate to $49 billion globally

- Merchants often bear the financial responsibility for fraudulent transactions, adding another layer of risk to their operations

Understanding Payment Alternatives: A Comparison

According to a Mastercard report, by 2026, alternative payment methods will significantly increase their market penetration across Europe, particularly in sectors like furniture, electronics, and clothing. Credit card purchases currently dominate sectors like retail and travel due to incentives offered by issuing banks such as flyer miles and travel insurance; for instance, 23% of travel merchants in Germany receive payments via credit card. However, this landscape is rapidly evolving.

2026 Projected Transaction Volumes in Europe:

- Digital Wallet: 32%

- Credit Card: 22%

- Account-to-Account (A2A): 19%

- Debit Card: 13%

- Buy Now Pay Later (BNPL): 11%

- Other: 3%

Source: WorldPay.

This shift is driven by several factors, including economic conditions, financial responsibility, and preferences for budgeting. Despite these changes, large-ticket items, particularly in travel and retail, will likely continue to be dominated by credit card transactions as customers often look for rewards when making these purchases.

Comparing Payment Methods

| Payment Method | Fees | Processing Times | Security Features |

| Credit Cards | 1.5% - 3.5% per transaction | Settlement in 1-3 days | Fraud protection, encryption, CVV verification, two-factor authentication |

| Open Banking Payments | Typically, lower than 1%, varies by provider. With Noda, fees start from 0.1% for transaction | Instant or near-instant | Strong customer authentication (SCA), direct bank integration, tokenization |

| Digital Wallets | 1% - 3% per transaction | Instant approval, immediate access to funds | Device authentication, tokenization, biometric security |

| Local Payment Methods (such as PIX in Brazil or BLIK in Poland) | No fee or very low fees, it can vary by country and provider | Instant or near-instant | End-to-end encryption, two-factor authentication, unique transaction codes |

| Buy Now, Pay Later (BNPL) | Fees can vary from 2–8% of the purchase price, plus a fixed processing fee per transaction | Approval within minutes, immediate access to goods | Data encryption, risk assessment algorithms, some offer buyer protection |

This table demonstrates key differences between payment options:

- Traditional credit cards have the highest fees but offer widespread acceptance

- Open banking provides the lowest costs with near-instant settlement

- Digital wallets balance convenience with moderate fees

- Local payment methods vary by region but often offer the most cost-effective solution for specific markets

- BNPL services trade higher merchant fees for increased sales conversion

- A2A payments combine low fees with bank-level security

Notice that each method presents distinct trade-offs between cost, speed, security, and market penetration. These differences become particularly significant when considering specific business needs such as:

- Transaction volume and average order value

- Customer demographics and preferences

- Regional market requirements

- Industry-specific requirements

Alternative Payment Methods in Detail

Open Banking Payments: A Secure, Cost-Effective Solution

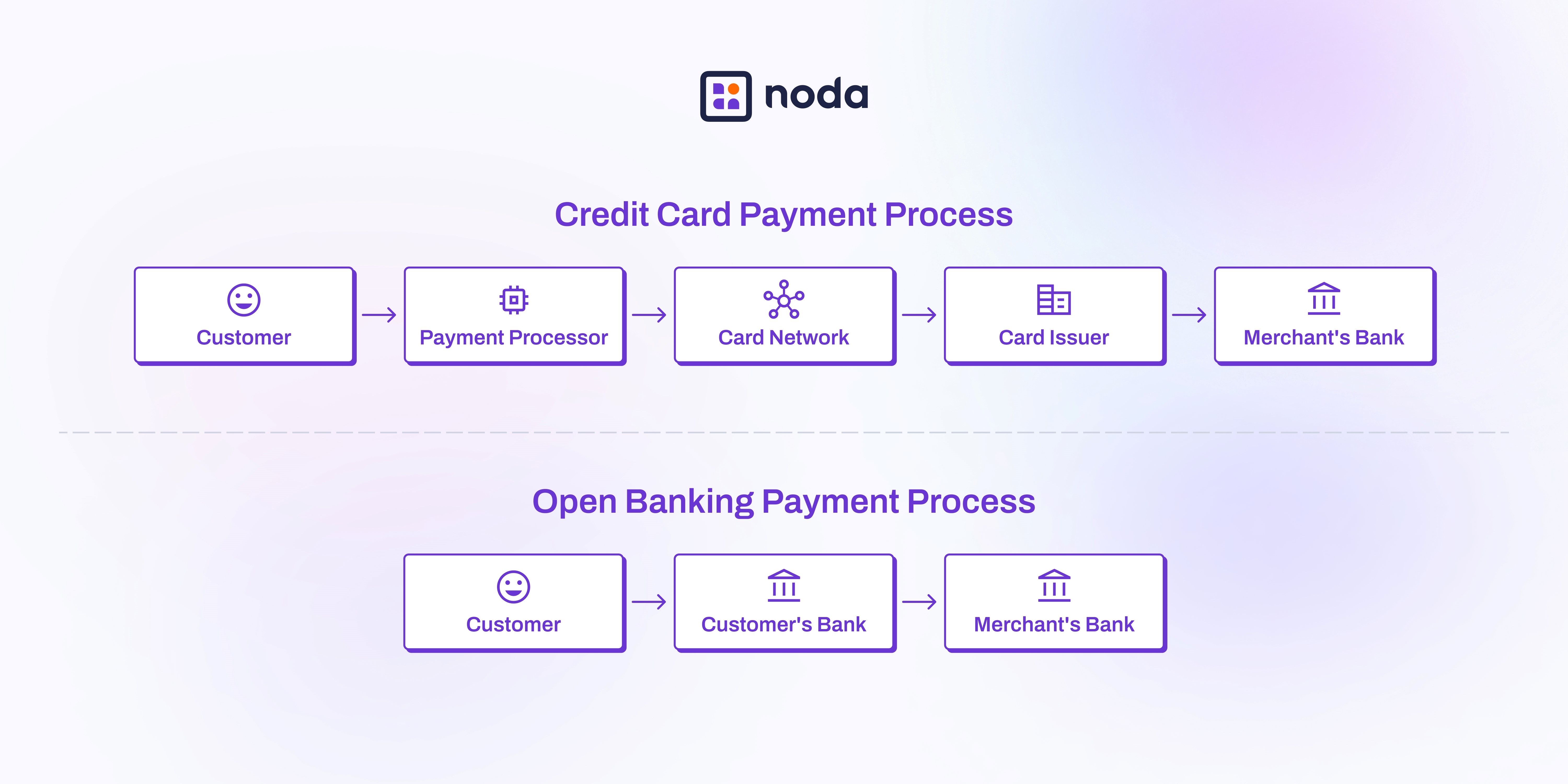

Open banking payments provide merchants with numerous benefits through direct bank integration. With this approach, customers authorise payments directly through their bank, cutting out intermediaries and reducing costs.

Key Features:

- Near-instant settlement

- Higher authorisation rates

- Direct bank-level security

- Improved security through secure APIs

- Minimised exposure of payment details

For example, a business processing €1 million annually with traditional credit cards could pay up to €32,000 in fees. With open banking payments through providers like Noda, fees could drop to as low as 0.1% — saving up to €31,000 on fees alone - representing potential savings of nearly 97%. Instead of entering credit card information, customers are redirected to their bank to authorise payments directly. This not only simplifies the payment process but ensures no payment credentials are exposed during the transaction.

Digital Wallets: Meeting Modern Consumer Habits

Digital wallets, such as Apple Pay, enable customers to make contactless and online payments directly from their mobile phones. The number of digital wallet users worldwide reached 4.3 billion in 2024 and is expected to increase to 5.8 billion by 2029.

Pros:

- Convenient for both in-store and online purchases

- Widespread acceptance globally

- Enhanced security through tokenization

- Biometric authentication options

- Immediate payment confirmation

Cons:

- Still susceptible to chargebacks

- Variable fees depending on the provider

- May require additional hardware for merchants

Buy Now, Pay Later (BNPL)

BNPL services allow consumers to split payments into installments. Services like Klarna offer customers the option to pay within 14 or 30 days without interest. According to projections, 74% of European customers use Klarna at least once a month. However, market challenges exist. In 2023, several BNPL firms including Openpay and Laterpay discontinued operations due to high interest rates and looming regulation. This highlights the importance of carefully evaluating BNPL providers' stability and regulatory compliance.

Market Impact:

- Increases average order value

- Attracts younger demographics

- Boosts conversion rates

- Helps manage cash flow for consumers

Local Payment Methods: Regional Solutions

Local payment methods cater to specific regional preferences. For instance:

- Brazil: PIX dominate local payments

- Poland: BLIK is the most popular mobile payment method in the region

- Netherlands: iDEAL holds majority market share

- Nordics: Strong adoption of bank-to-bank payments

These solutions often provide:

- Lower fees compared to international payment methods

- Faster settlement times

- Higher consumer trust in specific regions

- Better integration with local banking systems

For example, a customer can purchase items at a local market by scanning the vendor's PIX QR code with their smartphone. This illustrates how local payment methods can combine convenience with cultural preferences.

Diversify and Strengthen Your Payment Strategy

In fact, the variety of payment methods significantly influences consumers' choices of retailers - making a multi-payment strategy crucial for modern businesses. This insight becomes particularly relevant as payment preferences continue to evolve across different markets and demographics.

Key Considerations When Implementing New Payment Methods:

- Integration complexity and timeline

- Processing fees and potential savings

- Security features and compliance requirements

- Settlement times and cash flow impact

- Regional preferences and customer needs

Comprehensive Solutions with Noda

Noda's Open Banking Payments provide a complete solution for businesses looking to modernise their payment strategy:

Core Features:

- 90% acceptance rate

- Coverage across 2,000+ banks in the UK, Europe, Brazil, and Canada

- Near-instant settlement

- Fees starting from 0.1% per transaction

Beyond Basic Payment Processing:

- AI-powered financial analytics

- Identity verification tools

- Simple integration process

- Enhanced operational efficiency

Security and Compliance:

- Strong customer authentication (SCA)

- Direct bank integration

- End-to-end encryption

- Regulatory compliance across markets

By partnering with Noda, you are not merely selecting a payment provider; you are embracing a solution that adds value to both your business and your customers. Our comprehensive approach helps you:

- Reduce payment processing costs

- Improve transaction success rates

- Enhance security measures

- Streamline operations

- Meet evolving customer preferences

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each