Open banking is changing how payments work, especially in e-commerce. Instead of routing every transaction through card schemes, merchants can let customers pay directly from their bank accounts – via pay-by-bank –in a secure, fast, and lower-cost way.

For UK online merchants, that means lower fees, faster access to cash, fewer disputes, and smoother checkout experiences. In this guide, we’ll explore what benefits open banking brings to e-commerce, how it stacks up to traditional payment methods, what you can realistically expect, and how to introduce it into your checkout mix.

Key Takeaways

- Lower processing costs: Open banking bypasses card networks and their fees, allowing merchants to save 0.3–1% per transaction and improve margins.

- Faster access to funds: Payments settle instantly through the UK’s Faster Payments system, giving businesses quicker access to working capital.

- Higher checkout conversions: Customers pay directly from their trusted bank app — no card entry or extra steps – leading to smoother UX and up to 7% fewer cart drop-offs.

- Stronger security and trust: Payments are protected by bank-level encryption and Strong Customer Authentication (SCA), often verified through biometrics.

- Built for the future: Open banking sets the foundation for open finance, enabling loyalty, subscription, and data-driven growth opportunities.

What Is Open Banking?

Open banking is a regulated system that allows banks to securely share customer data with licensed fintech companies, but only with the customer’s explicit consent. It enables direct account-to-account payments (known as pay-by-bank) and gives access to financial data through APIs.

UK Regulatory Snapshot

Open banking in the UK is governed by several key laws and standards, overseen by the Financial Conduct Authority (FCA) and shaped by the Competition and Markets Authority (CMA). These frameworks ensure that financial data is shared safely, fairly, and always with customer consent.

The system rests on three main pillars:

- Payment Services Regulations 2017 (PSRs): This legislation implemented the EU’s PSD2 directive into UK law, requiring banks to provide secure APIs to authorised fintech firms.

- CMA Order: The CMA instructed the UK’s nine largest banks (the CMA9) to create open banking systems that meet strict security and interoperability standards.

- FCA Oversight: The FCA supervises both banks and third-party providers (TPPs). Only FCA-approved firms can access open banking APIs or offer data services or payment initiation.

The Open Banking Implementation Entity (OBIE) was established to define technical standards for APIs, user experience, and authentication. The UK is now moving toward a new independent body, the Future Entity, which will take over standard-setting and drive innovations such as Variable Recurring Payments (VRPs).

As part of its five-year strategy, the FCA plans to publish a roadmap within the next year, with the first Open Finance framework expected by 2027. Meanwhile, the upcoming Data (Use and Access) Act 2025 (DUAA) will extend these principles across industries, supporting a wider smart data economy by mid-2026.

Pay-by-Bank (PISP)

A leading use case for open banking is pay-by-bank – an account-to-account (A2A) payment method that allows customers to pay straight from their bank accounts via secure APIs, skipping expensive card networks. To provide pay-by-bank, providers must obtain a Payment Initiation Service Provider (PISP) license.

Pay-by-bank adoption is soaring. Back in 2018, there were only around 320,000 such payments in the UK; today, more than 15 million people use open banking services, with user numbers up 34% in the past year.

How a Pay-by-Bank Flow Works (Step by Step)

- Customer selects Pay-by-Bank at checkout

- Customer chooses their bank – at Noda, we cover 2,000+ banks in the UK and EU; full UK bank coverage.

- Multi-factor authentication via their online banking app, typically with biometric authentication

- Customer reviews details and confirms payment

- Funds are debited instantly

Data Services (AISP)

Open banking goes beyond payments – it also provides access to deeper financial data. Under PSR, there’s another regulated provider type that deals specifically with data: the Account Information Service Provider (AISP).

With a customer’s consent, an AISP-licensed provider can securely gather and combine financial information from multiple banks – think of budgeting tools and smart accounting apps. It doesn’t move money or process payments — its access is strictly read-only.

For merchants, working with an AISP opens up insights into customer finances, such as balances, spending habits, and transaction histories, to estimate customer’s lifetime value and tailor better marketing tactics.

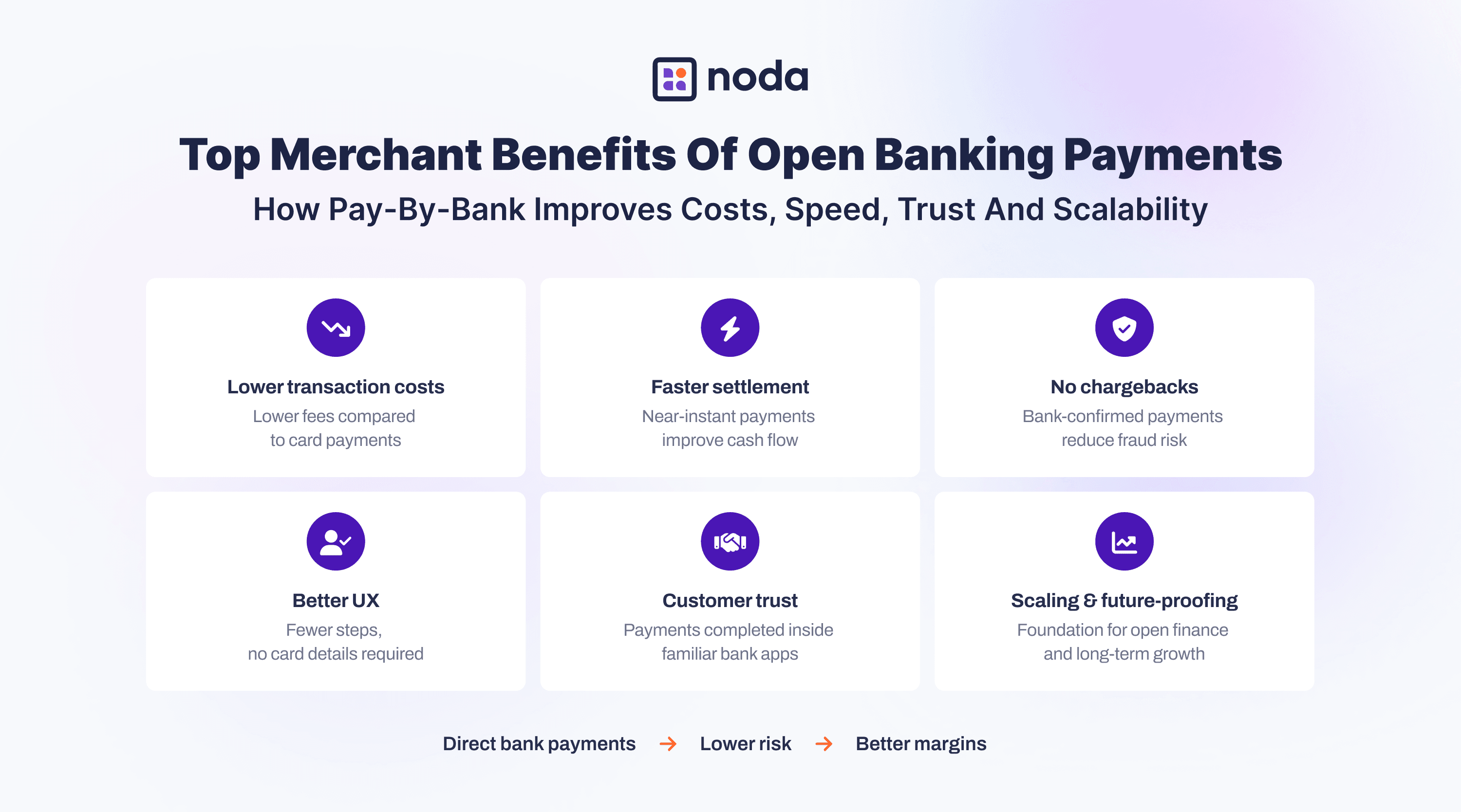

Top Merchant Benefits of Open Banking Payments

Lower Transaction Costs

Open banking cuts costly card-processing fees – for card payments, merchants typically pay 0.2 – 1.5% in interchange fees plus 0.01 – 0.04% and a few pence in scheme fees, on top of provider fees. With Noda, open banking transactions start from just 0.1%.

Faster Settlement & Better Cash Flow

Funds arrive sooner compared to delayed card billing cycles. For example, in the UK’s open banking ecosystem, funds arrive almost instantly via the UK’s Faster Payments system – improving cash flow.

Reduced Fraud & Chargeback Exposure

Payments are confirmed directly within the customer’s own bank, eliminating the risk of chargeback fraud. However, because pay-by-bank transactions aren’t protected under Section 75, merchants should set out a clear and transparent refund process to keep customers’ confidence.

Better Customer Experience & Higher Conversion

Customers complete payments straight from their trusted banking app – no need to enter card details, which helps reduce cart abandonment and boost conversion rates. Some studies indicate that offering local payment methods like open banking can boost conversion rates by around 7% and increase revenue by up to 12%.

Customer Trust & Familiarity

Open banking is already trusted by millions of users across the UK. When making a payment, customers are guided through their bank’s own familiar interface, reinforcing that sense of security. Every transaction is protected by bank-grade encryption and Strong Customer Authentication (SCA), often confirmed through biometrics like Face ID or fingerprint.

Future-proofing & Scaling Potential

As open finance develops, businesses can do far more than process payments. It creates a foundation for building long-term customer loyalty and leveraging data-driven insights to offer smarter products and services.

Open Banking vs Cards and Digital Wallets

A comparison between open banking and digital wallets like Apple Pay or Google Pay would show similar outcomes, as most digital wallets still rely on traditional card networks. Their main advantage lies in user experience – customers enjoy a faster, smoother checkout without having to enter card details manually.

When Cards or Digital Wallets Still Make Sense

While open banking offers clear advantages, cards and digital wallets still play an important role in certain scenarios. High-risk, high-value, or cross-border transactions often require traditional card networks for added protection and global coverage.

Keeping cards and wallets as a fallback option is best practice. If an open banking payment fails due to a temporary API issue or an unsupported bank, customers can seamlessly switch to another method and complete checkout without disruption.

How to Add Open Banking to Your Payment Mix

Pick a Reliable Open Banking Payments Partner

Choose a trusted, FCA-authorised provider with broad UK bank coverage, proven uptime, and responsive support. Look for built-in fallback to cards or wallets, clear reporting tools, and transparent pricing to keep payments smooth and predictable. Use these links to check providers:

- Open Banking Regulated Providers: to verify licensed companies.

- FCA Firm Checker: confirm whether a firm is authorised to provide payment services.

Integration Options (Plug-ins, Hosted Checkout, SDKs)

Here are some of the integration options offered by Noda:

- Open Banking API: Offers full flexibility to build a custom checkout experience on your site, though it takes more time and technical setup.

- E-commerce Platform Plugins: The quickest route – just connect your checkout to your e-commerce platform. At Noda, we offer integration with WooCommerce, Magento, PrestaShop, and OpenCart.

- Payment Links: Accept open banking payments online via secure, shareable links – no coding required.

- QR Payments: Take instant, in-person payments through QR codes – like payment links, it is code-free.

Pilot Launch & Testing

Before launch, test your setup in a sandbox – a secure environment that simulates real payments. Use it to verify user journeys, consent flows, and bank connections. It’s also where you check how the system handles errors, such as declined payments or cancelled consents.

Performance Monitoring & KPIs

Here’s what to monitor once open banking is live:

FAQs

What is open banking and how does it benefit e-commerce?

Open banking enables secure, direct bank payments (pay-by-bank) through regulated APIs. For merchants, this means lower fees, faster settlements, less fraud, and smoother checkouts — boosting margins, cash flow, and customer trust.

Is open banking safe for UK merchants and customers?

Yes. It’s FCA-regulated and protected by Strong Customer Authentication (SCA). Customers verify payments in their own bank app, and merchants never see credentials. Authorised providers use encrypted, consent-based connections.

What are the main financial benefits for e-commerce?

Lower fees, instant settlements, fewer fraud risks, and higher conversions. Without card scheme charges, merchants typically save 0.3–1% per transaction and see conversion lifts of up to 7%.

What if a customer’s bank doesn’t support open banking?

Most UK banks are covered, but if one isn’t, consider fallback options where the system automatically switches to a card or another payment method.

Can customers dispute or reverse open banking payments?

Open banking has no chargeback mechanism in place, but customers can request refunds directly or raise disputes for fraud. Clear refund policies help maintain trust.

Does open banking work for subscriptions?

Partly. Commercial (non-sweeping) Variable Recurring Payments (VRP) enable this, but not all banks support them yet. Most merchants still use cards or direct debits for recurring models. The full rollout of VRPs in the UK is expected to start in 2026.

How does open banking improve checkout conversion?

It removes card entry and redirects users to their trusted bank app for instant confirmation – reducing friction and drop-offs by up to 7%, especially on mobile.

How should I present open banking at checkout?

Label it clearly (“Pay by bank – secure through your bank”), show bank logos, highlight benefits, and keep cards as an alternative to build trust and adoption.

What are the downsides of open banking?

Limited chargeback rights for consumers, patchy coverage for smaller banks, low awareness among some users, and early-stage recurring payment support. Reliable providers mitigate these.

How can Noda help my business?

Noda makes open banking easy – combining pay-by-bank with cards in one solution, ensuring fast settlement, broad coverage and lower fees without complex setup.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each