While open banking won't be fully implemented in Canada until 2026, the country's financial sector is already laying the groundwork through sophisticated digital payment systems and banking innovations. With 45% of Canadians recognising the benefits of open banking and eager to embrace it, the transition is well underway, showcasing emerging payment trends in the country.

The adoption of digital payments among consumers and businesses is transforming Canada's financial interactions, turning seamless and efficient payment methods into a necessity for improving conversion rates across different types of businesses.

With open banking set to be unfolded by 2026 in Canada, this article will explore the state of this technology in the country, highlighting similarities and differences with the European and UK models, and detailing the Canadian approach to its implementation.

What Is Open Banking?

Open banking is a modern and efficient way to manage finances and make payments without additional fees. At its core, it allows individuals and businesses to securely share their banking information and initiate payments using APIs, or application programming interfaces. These APIs serve as digital bridges, enabling smooth and secure communication between banks, merchants, and financial service providers.

Platforms like Noda use open banking to help merchants with a cheaper, and quicker alternative for accepting payments. For customers, open banking brings a more intuitive payment experience. It makes it easy to try direct bank transfers, instant payments, or personalised financing options, offering more flexibility and a smoother checkout process. It also gives merchants access to customer banking data, with the customer’s consent. This helps businesses better understand spending habits, creditworthiness, and personal preferences, making it easier to offer more relevant products and services.

Payment Methods in Canada: Evolution Towards Open Banking

Daily, Canadians are growing more comfortable with a variety of digital payments, driven by their speed, security, and ease of use. This evolution is evident across all demographics - notably, in 2022, 46% of consumers aged 55 and older used mobile payments for purchases in physical stores, marking a significant shift in adoption patterns.

Online transfers have surged in popularity, with services like Interac e-Transfer and PayPal facilitating 917 million transactions in 2022, both online and in physical stores. This surge reflects a broader transition in payment preferences, with Interac's services particularly noteworthy as they mirror many aspects of open banking functionality.

Digital wallets have become increasingly prevalent, supported by a 90% smartphone penetration rate. Approximately 44% of Canadian consumers now use platforms like Apple Pay, Google Pay, and Interac Debit for their purchases. While these solutions offer significant convenience, their current limitations in terms of interoperability with other financial platforms highlight the need for a more integrated approach - precisely what open banking aims to deliver.

Open Banking Implementation in Canada

Canada has processed 1.2 billion transactions through services like Interac e-Transfer, demonstrating a robust payment infrastructure ready to support increased digital service demands. However, many current solutions operate within closed ecosystems or rely on outdated technologies like screen scraping - practices that the forthcoming open banking framework aims to phase out.

Major financial institutions in Canada are already taking action to prepare for the open banking era. Banks such as RBC, TD, Scotiabank, and BMO have begun building out their API infrastructure, experimenting with secure data feeds and consent modules, even ahead of formal regulation.

Meanwhile, fintech firms are carving out their niches in areas like payment initiation, personal finance tools, and business-to-business (B2B) transactions. Some are partnering with established banks (e.g., National Bank with Flinks; RBC with Plaid and Yodlee), while others are developing point solutions for budgeting, credit checks, and small-business payment services.

This blend of proactive bank innovation and agile fintech collaboration is driving a dynamic shift away from the old and outdated methods like screen‑scraping, laying the groundwork for a secure, API‑based system. With the Department of Finance confirming open banking regulation will be introduced by early 2026 and the Financial Consumer Agency of Canada (FCAC) preparing to oversee an accreditation system, the ecosystem is aligning swiftly, and responsibly, for a transition to efficient, secure, and user‑centric open banking in Canada.

Open Banking Adoption Roadmap in Canada

- 11 August 2017: The Department of Finance released a consultation paper expressing its intention to explore the benefits of Open Banking

- 4 August 2021: The Advisory Committee on Open Banking presented recommendations for the foundational elements of Canada's Open Banking framework

- 16 April 2024: The government introduced the Open Banking framework, renaming it to Consumer-Driven Banking

- 2 May 2024: The Consumer Banking Framework, embedded in the Budget Implementation Act, finalises an extensive analysis, setting the way for a structured Open Banking rollout

- 16 December 2024: The Canadian Federal Government has announced plans to launch the Open Banking framework in early 2026

- 17 June 2025: The federal government reaffirmed its commitment to introduce open banking legislation at the “earliest opportunity,” with the Financial Consumer Agency of Canada continuing to develop accreditation and oversight rules ahead of implementation.

Data Source: Department of Finance Canada.

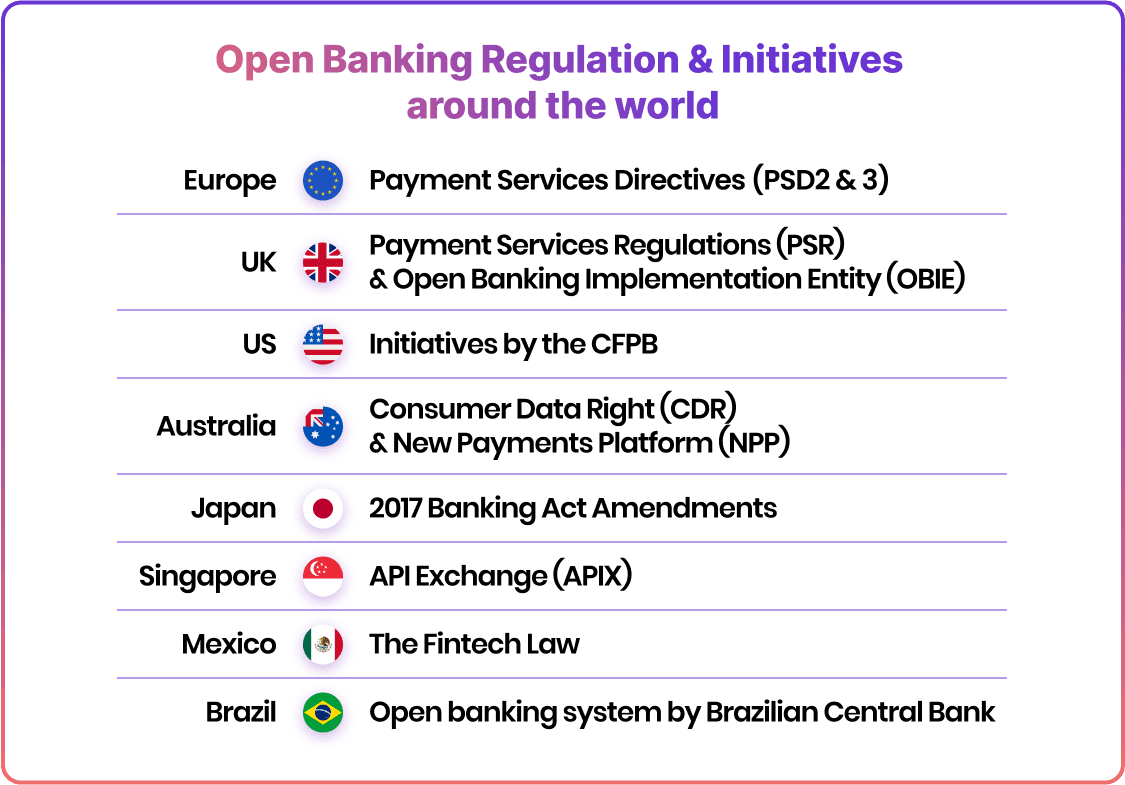

Canada vs International Open Banking Models

While the United Kingdom has led the way with 10 million users adopting open banking, Canada has opted for a more measured approach, with 40% of Canadians still familiarising themselves with the concept. This careful implementation strategy, though slower, aims to ensure robust security and system stability.

The differences between Canadian and European approaches are notable, particularly in user experience. For instance, while Interac's current process requires users to manually navigate to their bank's website for payment details, European open banking enables one-or-two-click payments, significantly streamlining the process.

Canadian consumers and businesses clearly recognise the advantages of digital payments, including speed, security, ease of use, and low cost. Additionally, 24% of all businesses in Canada see payment innovation as essential for their growth, indicating strong potential for open banking adoption once fully implemented.

Benefits for International Merchants

For merchants entering or operating in the Canadian market, open banking offers several key advantages:

- Access to a Range of Data Services: Open banking allows merchants to create personalised solutions by using open data for valuable customer insights, enabling better service customisation and risk assessment

- Customer Segmentation: Enhanced data access enables merchants to offer precise, high-value recommendations, improving customer engagement and conversion rates

- Streamlined Refund Processing: Open banking simplifies the handling of refunds, making it easier for merchants to manage transaction reversals and customer satisfaction

- Effortless Connectivity: Merchants benefit from seamless connections with leading banks across multiple regions, enhancing the financial ecosystem and enabling cross-border transactions

Final Thoughts

Canada’s journey toward open banking is steadily gaining momentum, laying a solid foundation for a future defined by smarter, faster, and more secure financial interactions. While full implementation is expected by 2026, the groundwork is already in place. Digital payment systems like Interac and the involvement of leading financial institutions signal a clear direction: one of innovation, accessibility, and improved customer experience.

For international merchants, this evolution represents both a challenge and an opportunity. Understanding the nuances of Canada’s unique, phased approach is essential for success. Unlike the rapid rollouts seen in the UK and Europe, Canada's deliberate strategy emphasises stability and long-term sustainability – making now the ideal time to prepare.

By aligning with a partner like Noda, merchants can confidently navigate this shifting landscape, ensuring compliance, enhancing payment efficiency, and unlocking new ways to engage customers. As Canada embraces open banking, those ready to adapt early will be best positioned to thrive in one of the world’s most digitally progressive economies.

Why Choose Noda for Open Banking in Canada?

- Comprehensive bank coverage

Seamlessly connect to all major Canadian banks (including BMO, Canadian Western Bank, Digital Commerce Bank, EQ Bank and others) and future participants like credit unions via a single integration. - Extremely low fees

Keep transaction costs low with competitive account-to-account pricing (from just 0.1%), so you can maximise margins and pass savings onto customers. - Instant settlement

Leverage Interac e-Transfer and soon-to-be-available open banking rails for funds that arrive in merchant accounts within seconds, entirely independent of card networks. - Effortless integration

Go live in minutes using Noda’s prebuilt integrations for WooCommerce, Magento, Prestashop, OpenCart—or use our REST API for a fully custom solution. - Multi-rail payment support

Support open banking, card networks, Apple Pay, Google Pay, all from one unified checkout platform. - No‑code payment solutions

Create payment links and QR codes instantly with Noda’s dashboard—accept bank payments easily, with zero development work. - Dedicated local support

Benefit from a personal account manager who will guide you through onboarding, compliance, and growth, ensuring seamless expansion in the market.

Contact Noda for a no-obligation demo. Our open banking experts will help tailor the solution to your unique business needs.

FAQs

Does Canada have Open Banking?

No, Canada does not yet have a fully implemented Open Banking framework. The government has been working towards it, and the full implementation is expected by 2026.

Which Canadian banks offer Open Banking?

While Canada does not yet have a formal Open Banking framework in place, several major Canadian banks have started to prepare for open banking by participating in pilot projects and by developing their own APIs. Banks like the Royal Bank of Canada (RBC), Toronto-Dominion Bank (TDB), and Scotiabank have been proactive in experimenting with Open Banking technologies and partnerships. However, these initiatives are still in their early stages, pending the formal regulatory framework.

How is Open Banking regulated in Canada?

Canada is still developing a formal regulatory framework to govern open banking practices fully and securely. However, Canada's open banking system is regulated by a hybrid model that combines government-led legislation with industry-managed implementation.

Within this framework, the Financial Data Exchange (FDX) plays a crucial role by providing industry-standard API protocols. These protocols help ensure that data sharing among financial institutions, fintech companies, and other stakeholders is secure, efficient, and consumer-centric, aligning with both government objectives and industry practices.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know