Italy's financial landscape is transforming. As Europe's third-largest economy embraces digital innovation, open banking is facilitating a shift away from its traditional cash-centric culture. With €2.2 trillion in GDP and a market of 59 million people, Italy represents a crucial frontier for financial technology – from its industrial north to its developing south.

This transformation is well-timed: 71.4% of Italian financial professionals now view open banking positively, aligning with general European sentiment and signalling readiness for change. Backed by PSD2 regulations, this shift is creating unprecedented opportunities for merchants and fintechs through faster payments and innovative financial tools.

In this article, we'll guide you through Italy's open banking landscape – from market opportunities and regulatory frameworks to practical insights – showing you how Noda can help your business navigate and thrive in one of Europe's most promising financial markets.

What is Open Banking?

Open banking is transforming financial services by enabling banks to securely connect with trusted third-party providers (TPPs) through APIs. This innovation drives faster account-to-account (A2A) payments, smarter use of financial data, and development of better financial tools for businesses and consumers alike.

For businesses, open banking reduces costs, speeds up transactions, and improves financial management – while consumers gain access to faster, smarter, and more personalised financial solutions.

Open Banking Regulation in Italy

Italy’s open banking framework is built on the EU’s Payment Services Directive 2 (PSD2) regulation, which requires banks to securely share data with authorised TPPs. This effort is overseen by the Bank of Italy – ensuring compliance, safeguarding consumer privacy, and driving innovation across the financial sector.

Italian banks are increasingly open to partnering with tech providers to build advanced open banking platforms. These collaborations set a new standard for consumer-focused banking in Italy by meeting PSD2 standards, improving transparency, enhancing user experiences, and streamlining multiple financial processes.

Adoption of Open Banking in Italy

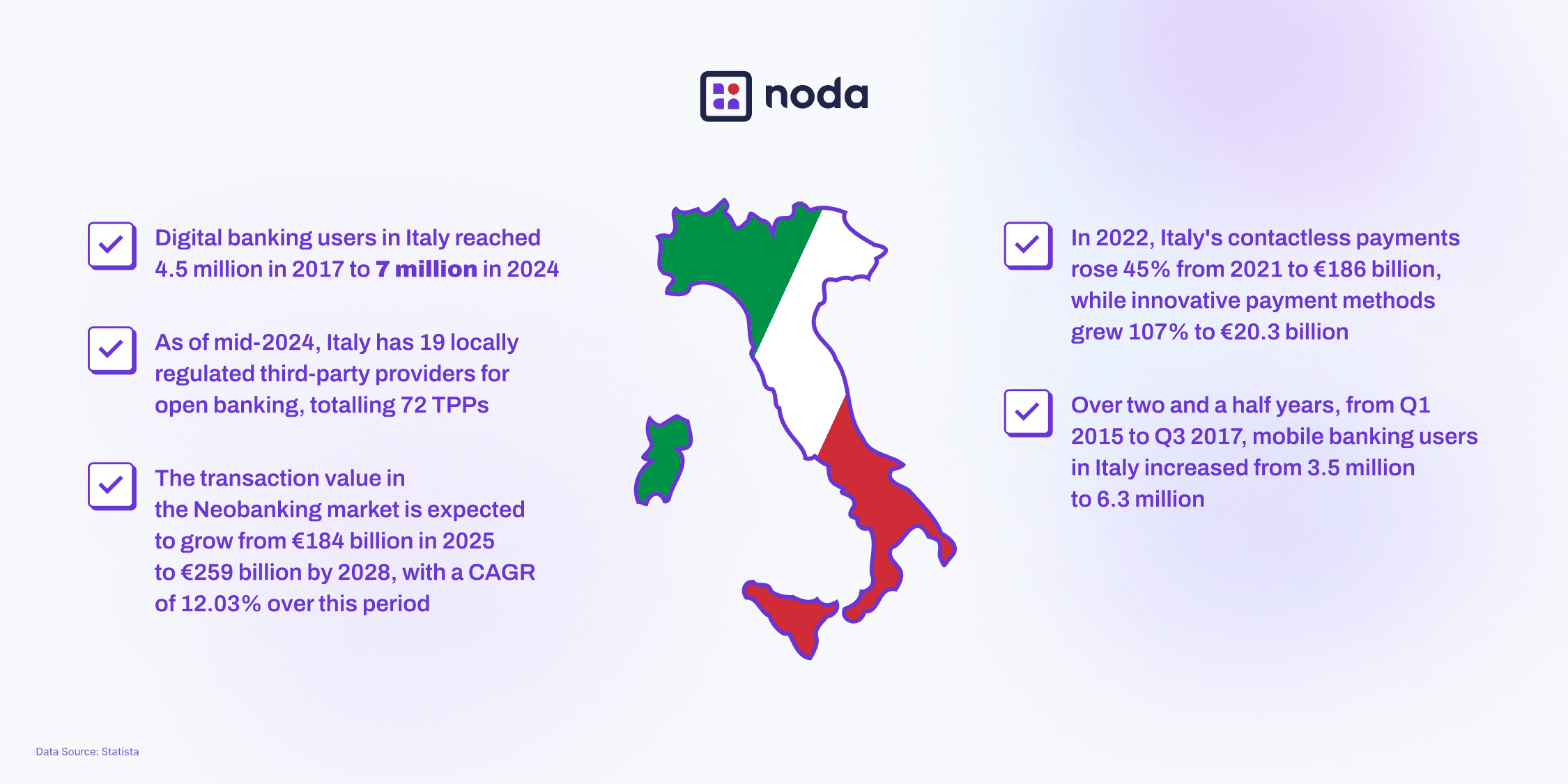

Despite a slow start, open banking in Italy is gaining traction. Online banking penetration has risen from 22% in 2013 to 51.55% by 2023, with seven million Italians using digital banking in 2024 — a number expected to reach 8.55 million by 2028.

The payment gateway market is set to grow from €4.05 billion in 2024 to €6.89 billion by 2030, a 70% increase. This growth reflects the rising importance of digital payment solutions that support features like diverse payment method availability, recurring billing, and real-time transaction processing for both merchants and consumers.

Italy’s open banking ecosystem is driven by providers like Fabrick and FlowPay. Fabrick offers open banking solutions for banks, fintechs and corporates enabling services like credit scoring and e-commerce payments. FlowPay, with its B2B focus, streamlines payment flows such as lending, invoicing, and multi-party settlements for SMEs and platforms like retail and e-commerce.

Noda's open banking platform enables international merchants to initiate secure instant bank transfers and gather financial data insights through a single API integration. This unified approach streamlines cross-border payments while maintaining compliance with regional banking regulations.

Open Banking Opportunities in Italy

Italy's embrace of open banking is catalysing a new era of payment innovation, transforming how businesses and consumers interact with financial services. It offers businesses, consumers, and third-party providers the chance to rethink financial solutions and build a more inclusive, efficient ecosystem. Here is where the opportunities lie:

Opening the Market to Innovation

A wider adoption of open banking is creating opportunities for local and international fintechs, TPPs, and non-financial companies to enter the market. Through its Enel X division, Italy's leading energy provider is transforming its traditional utility services with real-time financial data. This enables them to offer integrated payment systems and financing options for energy efficiency projects—demonstrating how utilities are evolving into comprehensive service providers.

Meeting the Demand for Digital Banking

As of April 2022, 48% of Italians were prone to switching from traditional to online banks as branches closed, highlighting a growing demand for digital-first solutions. This trend pushes banks to prioritise digital services, driving the adoption of innovative payment technologies like open banking. For merchants, this presents an opportunity to utilise smarter payment solutions that enhance customer experiences and capture a growing market.

Capitalising on A2A Payments

Research by DoubleP Consulting shows A2A payments reached 18% of Italy's e-commerce transactions by early 2024, with further growth estimated at 58% over the next year. Open banking enables businesses to capitalise on this growth through secure A2A payment solutions, which not only expand access to European markets but also boost conversion rates by reducing checkout friction and offering instant settlement confirmation.

Faster Transfers, Better Opportunities

Research shows 29% of Italian investors missed opportunities due to slow fund transfers—higher than the European average of 24%. This timing challenge is particularly acute in Italy's dynamic investment market.

Open banking's instant account-to-account transfers ensure immediate fund availability, enabling investors to seize time-sensitive opportunities both within Italy and across international markets. This capability transforms operational efficiency and investor confidence, making Italy an increasingly attractive hub for both domestic and global investment players.

Payment Gateways and Processors in Italy

While PayPal dominates online shopping and contactless payments hit €240 billion in 2023—up 30% from 2022—Italy's merchants still grapple with high card fees, particularly in e-commerce.

Open banking offers an alternative through direct account-to-account payments, allowing merchants to bypass traditional card networks. This not only reduces transaction costs but also accelerates settlement times, helping Italian businesses stay competitive in Europe's digital marketplace.

Simplifying Payments in Italy with Noda

Noda empowers international businesses in Italy and Italian merchants globally through seamless open banking integration. Whether through a single API or e-commerce plugins, businesses can initiate payments, manage transactions, and leverage customer financial data across the EU, UK, Brazil, and Canada.

The platform connects directly with Italy's leading banks—including UniCredit, Intesa Sanpaolo, Banco BPM, and BNL—while extending reach to 2,000+ partner banks across 28 countries. This extensive network enables businesses to process secure, low-cost, real-time payments as they scale both locally and internationally.

FAQs

Does Italy have Open Banking?

Yes, Italy has fully embraced open banking under the EU’s PSD2 regulation, which enables secure data sharing between banks and authorised third-party providers (TPPs).

Which Italian banks offer Open Banking?

Major banks like UniCredit, Intesa Sanpaolo, Banco BPM, and BNL support open banking, along with many others integrated into the system.

How is Open Banking regulated in Italy?

Open banking in Italy operates under the EU’s PSD2 framework, regulated by the Bank of Italy to ensure compliance, data security, and innovation in financial services.

Is Open Banking easy to integrate with existing systems in Italy?

Integration is straightforward with platforms like Noda, which provide a single API connection or e-commerce plugins. These tools allow businesses to seamlessly incorporate open banking into their operations without overhauling existing payment systems.

Can Open Banking help online merchants offer more payment options?

Absolutely, open banking allows merchants to support direct payments, giving customers a secure and convenient alternative to traditional card-based payments.

What impact does Open Banking have on cross-border transactions?

Open banking simplifies cross-border payments by providing direct and transparent transfer options, making international payments faster and more cost-efficient.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each