Open banking, the revolutionary financial model that facilitates the secure sharing of financial data, is gaining significant momentum worldwide. Latin America, renowned for its vibrant financial landscape, is also embracing this transformative trend.

Here we look at the regulatory framework of open banking in Latin America, adoption patterns, and the latest advancements within key countries.

Open banking regulation in Latin America

Latin America is currently experiencing a significant shift in its financial sector as open banking emerges. Various countries within the region are adopting different regulatory approaches at different stages.

- Brazil took the lead as its central bank, Banco Central do Brasil (BCB), introduced regulations in 2020 and implemented them in 2021, allowing the sharing of data and services among financial institutions, payment institutions and other institutions licensed by the BCB. Presently, the focus lies on open finance, a development stemming from open banking. As of 2025, Brazil remains a standout leader in open banking in Latin America.

- Mexico introduced open banking within its Fintech Law, passed in 2018. It encouraged financial institutions and other relevant companies to establish standardised application programming interfaces (APIs) to enable connectivity and access by third parties. While the country lacks full API standardisation and PIS support, it continues to evolve rapidly.

- Chile introduced open banking through its Fintech Law, enacted in January 2023. It created an Open Banking System that allows the exchange of customer information between different financial or related service providers. The country went even further and introduced open finance framework, as the law requires obligatory data sharing by credit institutions, broker-dealers, asset managers and insurance companies.

- Argentina’s central bank is introducing initiatives that promote digital transactions and ensure compatibility across different platforms. For example, the latest virtual wallet regulation enacted in May 2022, or Transfers 3.0.

- Other countries are currently in the initial stages of open banking implementation. Peru, for example, is actively evaluating the market and laying the groundwork for open finance.

Open banking in Brazil

Brazil’s open banking framework, pioneered by its central bank, remains a trailblazer in Latin America. Following the rollout of regulations during 2021, Brazil has rapidly advanced into a comprehensive open finance ecosystem that now includes insurance, investments, pensions, and foreign exchange.

In 2019, the BCB (Brazilian Central Bank) launched a public consultation to discuss the regulations of Open Finance for licensed institutions. By May 2020, the bank outlined the initial scope of Open Finance, including data sharing guidelines and participant responsibilities implemented in 2021.

As of April 2025, consumers have granted over 70 million active consents, and financial institutions handle billions of API calls weekly, with Nubank topping the list at nearly 9 billion monthly. Brazil’s open finance ecosystem now connects banks, credit unions, fintechs, insurers, and brokerages, making it one of the world’s most advanced and interoperable systems.

Despite these advances, challenges remain: globally, around 62% of banks still feel unprepared for the Open Finance transition. According to Febraran Bank Technology survey, roughly 80% of banks reported that only a small fraction, up to 10%, of their customer base has adopted open finance. Additionally, approximately 16% of Brazil's adult population remains unbanked; however, this number is gradually decreasing thanks to technological solutions such as digital accounts and the PIX payment system.

Open banking in Mexico

In Mexico, taking inspiration from Brazil, significant progress is being made in open banking. The Bank of Mexico took the lead with its Fintech Law regulations in 2020, initiating the groundwork for this transformation. Although implementation has been gradual thus far, 2023 will be a crucial year focused on establishing a comprehensive financial ecosystem that seamlessly integrates all components of open banking.

To improve process efficiency, Mexico is working on refining the technical aspects of these regulations. Looking ahead, their vision encompasses an ecosystem where banks and other financial institutions can rapidly integrate into the expansive universe of open finance. Strategic alliances are seen as instrumental in facilitating collaborative product development while also accessing previously untapped market segments.

Open Banking in Argentina

Although there is no specific regulation for open banking in Argentina yet, the country’s central bank is introducing initiatives that promote digital transactions and ensure compatibility across different platforms.

This latest regulation for virtual wallets adopted in May 2022 mandated that financial institutions, fintech, payment service entities, and digital wallet providers offer users the ability to link to other accounts. This requirement guarantees that users can easily make payments and transfers using a single digital wallet, regardless of where their funds are held. In addition, payment service entities require access to account data from banks in order to facilitate this functionality.

This new directive is a step forward for Argentina's progress in achieving open banking and interoperability. It builds upon previous initiatives like the Transfers 3.0, showcasing the country's dedication to expanding financial accessibility.

Introduced in November 2021, Transfers 3.0 is a cutting-edge digital transaction system that uses QR codes to enable instant payments. It empowers users to conveniently conduct transactions from any banking or payment account, with the goal of bridging the gap between various service providers through a unified payment framework and promoting digital transactions.

Data from the central bank revealed that Transfers 3.0 experienced robust adoption. It recorded over 2 million transactions, with a total value of approximately ARS 3.5 billion (equivalent to US$28 million), as of January 2022.

Between 2024 and 2025, Argentina expanded this digital effort with enhanced QR‑based transport payments, interoperability for credit and prepaid cards via QR codes, and scheduled DEBIN payments, further integrating instant digital payments into public infrastructure. Meanwhile, private-sector innovation continues with initiatives like Banco Industrial’s “API Bank,” signaling a gradual move toward a broader Open Finance model despite the lack of comprehensive legislation.

Open Banking in Chile

Chile's fintech landscape is currently going through a transformative phase, supported by the implementation of its new Fintech Law, officially ratified in January 2023. This legislation serves as the legal framework for open finance in the country. It not only offers legal certainty to technology-driven financial service providers but also expands the range of regulated fintech entities.

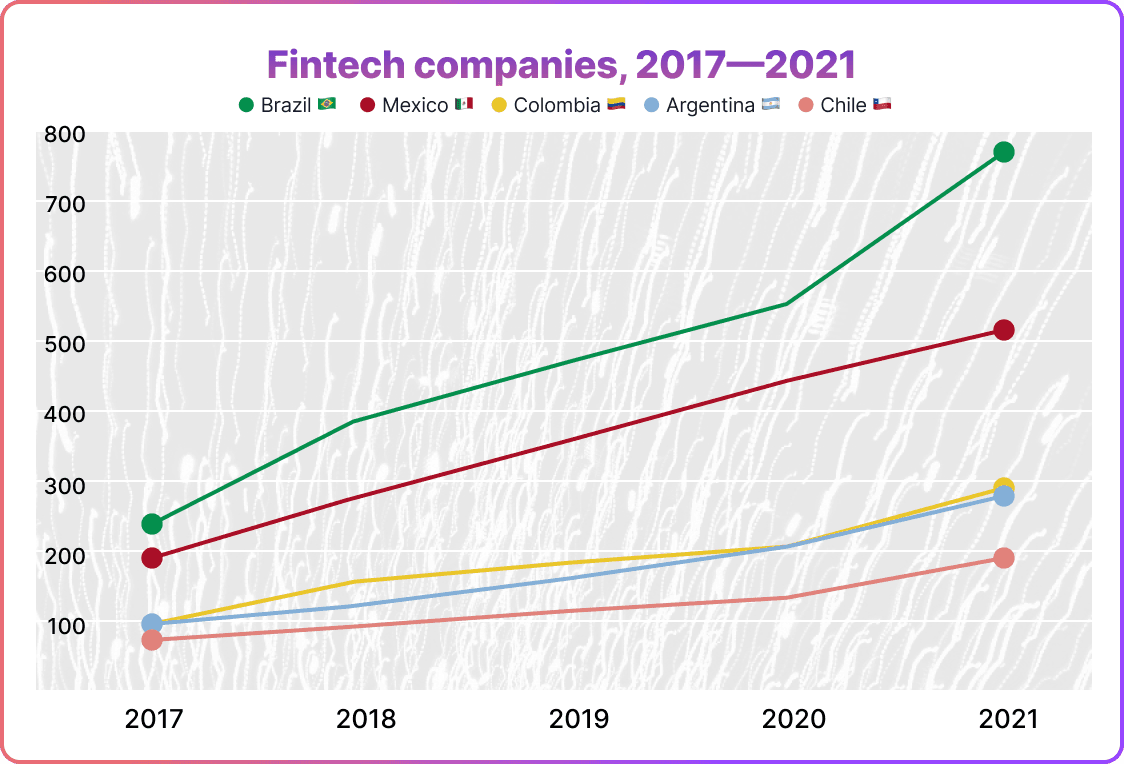

Chile's fintech ecosystem has experienced remarkable growth over the years. According to a study by the Inter-American Development Bank, in 2017, there were only 65 companies, but by 2021, this number had risen to an impressive 179. The implementation of the Fintech Law is expected to fuel further expansion, with projections indicating that the number could double in the near future.

By July 2024, the Comisión para el Mercado Financiero (CMF) issued General Standard No. 514, the regulation that governs Chile’s Open Finance System (OFS). This standard defines key aspects such as licensing, data-sharing obligations, API performance requirements, and cybersecurity protocols. According to Konsentus, the regulation also lays out a clear two-stage implementation plan: a 24-month preparation period (from July 2024), followed by a gradual rollout of functionality starting in July 2026. This includes API obligations for banks, card issuers, and other fintech entities.

With this structured and inclusive approach, drawing on global best practices and backed by a collaborative governance forum, Chile is now firmly on track to establish a robust, competitive, and future-proof open finance ecosystem.

Open Banking in Peru

In contrast to the disruptive approach often associated with new technologies, banks in Peru lean towards conservatism and wait for regulatory signals before embracing innovations.

The Peruvian banking regulator and the leader of the FinTech Group, SBS, is currently actively studying the open banking model. Recent announcements indicate a preference for an open finance approach that includes the broader financial market. This phased approach initially focuses on banking entities and addresses key challenges such as cybersecurity, interconnectivity, and data privacy.

A recent legislative proposal highlights the national interest in promoting open banking, aiming to enhance financial inclusion in the post-pandemic era. Legislative Decree No 1531, introduced in 2022, amended Peru’s banking law to allow companies authorised by the SBS to carry out digitally all the operations for which they are authorised.

In 2024, Peru advanced its open banking agenda with a phased, regulator-led approach focused on cybersecurity, data privacy, and starting with banking entities. The BCRP (Central Bank of Peru) also partnered with India’s NPCI to develop a real-time payment platform, strengthening the digital infrastructure needed for broader open finance adoption.

Although there are challenges ahead in terms of regulations and technology, the undeniable potential benefits of open banking for Peru's financial ecosystem make this journey worthwhile.

Conclusion

Open banking in Latin America is not just a passing trend; it holds the power to revolutionise the entire financial landscape. The regulatory approaches vary across nations, each reflecting its unique economic and cultural contexts. Brazil and Mexico are at the forefront, implementing comprehensive regulatory frameworks. Meanwhile, Argentina, Chile, and Peru are also making significant progress by fostering an environment that encourages fintech innovation and growth.

Despite all the benefits of open banking for Latin America, there are challenges along the journey. Overcoming hurdles like data security, customer privacy and establishing robust API infrastructure will stay crucial. Additionally, addressing the pressing concern of financial inclusion while open banking offers a promising solution.

Despite the numerous challenges it poses, open banking brings about immense potential benefits. This innovative approach not only fosters competition and promotes innovation within the financial industry but also greatly enhances customer experience and facilitates greater financial inclusion. By embracing open banking, the promise of a more inclusive and efficient financial ecosystem becomes attainable.

Looking ahead, the future of open banking in Latin America holds immense potential for businesses, financial institutions, and consumers. The ongoing evolution of this concept promises exciting opportunities in abundance for all involved.

Explore the Benefits of Open Banking with Noda

Unlock the potential of open banking in Brazil with flexible payment options, low transaction costs, and seamless integration across platforms. Whether you're a local business or scaling across borders, Noda offers easy setup, broad bank connectivity, and expert support tailored to your needs, no code required.

1. Comprehensive bank coverage

Connect to Brazilian banks as well as 2,000+ banks across Europe through a single integration.

2. Extremely low fees

Keep margins high with transaction costs starting around 0.1%, giving your company a competitive pricing edge.

3. Instant settlement

Funds hit merchant accounts in seconds via instant account-to-account rails. No card networks involved, no delays.

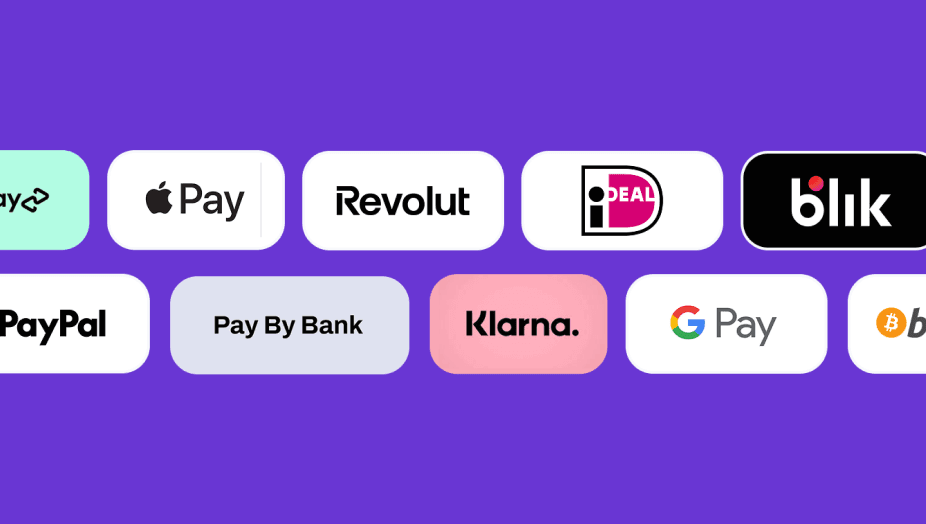

4. Multi‑rail payment support

Seamlessly combine open banking, card payments, Apple Pay, and Google Pay into one unified platform for maximum flexibility.

5. No‑code payment solutions

Generate payment links and QR codes instantly.

6. Dedicated support

Get a dedicated account manager during onboarding and beyond, ensuring smooth setup and ongoing assistance.

Contact Noda for a no-obligation demo. Our open banking experts will be happy to look into your unique business case.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants