Getting paid shouldn’t cause friction. But for a lot of businesses, it still is—whether it’s chasing invoices, dealing with card machines, or setting up clunky payment systems. That’s where payment links come in to solve these problems.

They’re simple: just send a link, and your customer clicks to pay. No complicated tech, no need for a website. Whether it’s via email, QR code, or message, payment links give you a fast, secure way to get paid—and they work for just about any business.

In this article, we’ll break down how they work, who they’re best for, and the real benefits they bring. We’ll also explain why open banking and payment links are the perfect combination.

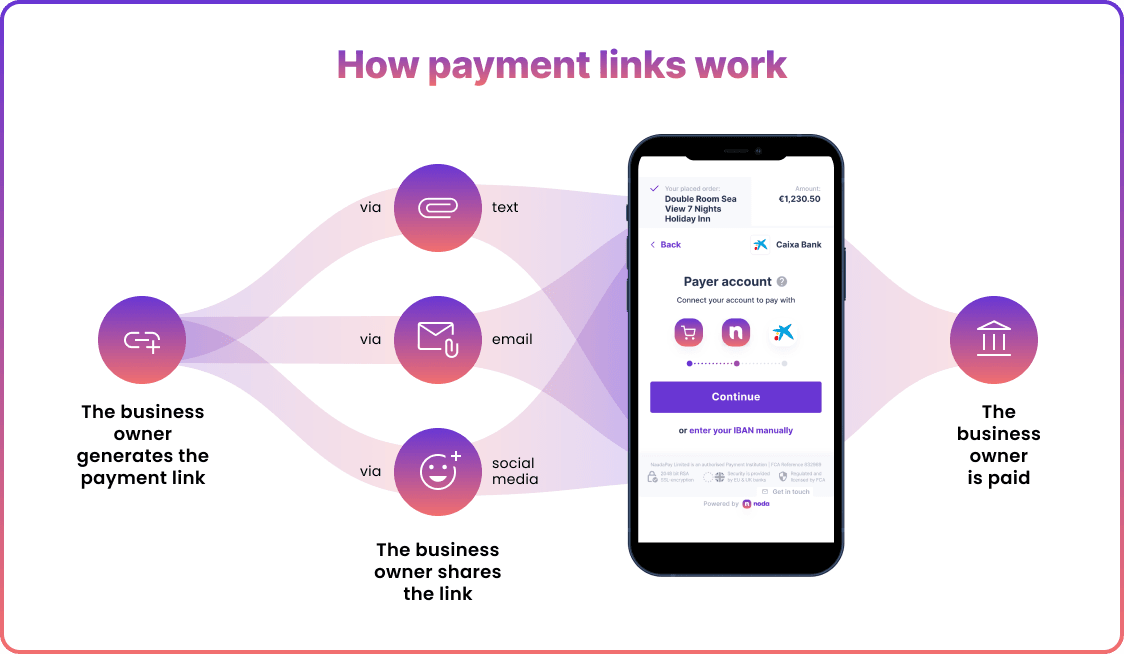

How Payment Links Work

A payment link is just what it sounds like—a unique link that you send to your customer, and when they click it, they’re taken straight to a page where they can pay. Unlike traditional point-of-sale systems or online carts, payment links are super flexible and require zero developmental effort.

To create one, you have two options:

- First, you can generate one directly from your provider’s dashboard. With Noda, it takes seconds—just log into your Hub, enter the currency, amount, and description, and your payment link is ready to go.

- Want to take it up a notch? You can also create a branded landing page for your link. It’s optional, but adds a professional touch. At Noda, our no-code payment pages let you do this with zero dev work.

After generating the link, you can send it however works best for you. You can share them in an email, text, WhatsApp message, or even on social media.

Create Instant Payment Links with Noda

With Noda’s payment links, creating and sending takes under five minutes–no coding required. Generate a payment link in seconds from Noda Hub, and send the link to your clients. You can also set up QR payments and no-code checkout pages instantly. It’s effortless to get started.

Our payment links are powered by pay-by-bank, giving your customers a simple way to pay straight from their bank account. We chose this method because it's faster, more secure, and more cost-effective than traditional card payments.

When someone clicks the link, they’re taken to their own banking app or website to approve the payment via biometric authentication. The funds go directly from their bank to yours—no intermediaries involved.

For merchants, that means lower transaction fees and zero chargebacks. For customers, it’s a trusted, secure UX with no card details or long forms. With Noda’s Open Banking, you get instant access to over 2,000 banks across 28 countries, multi-currency support, and real-time settlement.

Simplify payments, cut costs, and boost your business with Noda’s payment link generator.

Benefits of Payment Links for Businesses

- Simplicity: Streamlines the payment process, eliminating the need for complex payment gateways or merchant accounts.

- Versatility: Can be shared across various platforms, including emails, SMS, social media, and even printed materials like flyers.

- Cost-effective: Often eliminates the need for expensive point-of-sale systems or card machines, which is especially great for small businesses or startups.

- Customisation: Payment links can be tailored to specific products, services, or promotions, allowing targeted marketing campaigns.

Payment Links for Different Businesses

Payment links can be used by various businesses in different sectors, regardless of the size and operation flows. From merchants and e-commerce to hospitality and healthcare, this solution offers versatility in how companies can use it.

Freelancers and Contractors

Freelancers and contractors are the perfect case study for the benefits and ease of payment links. They can create a link with the job details and amount, then send it to their client along with or in the invoice. They get the money straight into account—and can track who’s paid and who hasn’t, all in one place.

Event Organisers

Event organisers can use payment links to sell tickets or manage bookings. They can set up a custom link for each event, add the price and details, then share it on their website, socials, or emails.

People click, pay instantly, and the merchant gets notified in real time. It’s fast, secure, and they don’t need a separate ticketing system. They also can get data to see how many tickets sold and where their audience is coming from.

Small E-Commerce

For small e-commerce businesses, payment links are a great way to skip the full website setup. Merchants can just create a link for each product and share it through Instagram DMs, email, or messages.

When the customer clicks, they go straight to the checkout or no-code branded page. They pay and the merchant gets paid instantly. It’s easy, flexible, and helps small businesses close sales faster.

You can also use payment links in e-commerce as a back-up option for when something goes wrong in your website checkout. The customer communicates to the support team, and they can send a payment link directly to the customer via live chat, email, or phone.

Offline Businesses

Payment links aren’t just for online shops—you can use them in physical stores too. Thanks to QR codes connected to the payment links, businesses can take instant payments without needing card readers.

QR codes are catching on fast. As more people use smartphones, scanning to pay is becoming second nature—especially in retail. By 2025, nearly half of in-store mobile payments will happen through QR codes. In places like China, it’s already the norm. Globally, QR payments are growing quickly and are expected to hit almost $46 billion by 2032.

How Payment Links Work Offline

Instead of using a card, customers just scan a QR code, confirm the payment on their phone, and they’re done – no extra hardware, no PINs.

Merchants can instantly generate a unique QR code linked to a checkout. Customers scan it, check the details, choose their payment method, and approve the transaction, all in a matter of seconds.

At Noda, for example, our QR payment solution enables UK merchants to generate custom QR codes for pay-by-bank transfers, offering multiple payment scenarios:

- Dynamic QR codes: Customers manually enter the amount before paying.

- Fixed-amount QR codes: Pre-set payment amounts (e.g., £10, £20, £50).

- Merchant-controlled QR codes: The business sets the amount before generating the code.

Switch to Payment Links + Open Banking

At Noda, our payment links are a no-code gateway to our open banking (referred to as pay-by-bank) payments. We believe it’s so much better than cards because it offers lower fees, instant settlement and superior user experience.

Open banking is more cost-efficient than cards

Traditional card payments can eat into your margins with non-negotiable card network fees. Pay-by-bank cuts out the middlemen—no card networks, no hidden fees. Your customer clicks a link, logs into their banking app, and sends the payment directly from their account to yours.

Open banking is more secure than card payments

Instead of relying on card numbers that can be stolen or misused, pay-by-bank uses your customer’s own bank authentication—often biometrics like Face ID or fingerprint—to authorise the payment. That means no chargebacks, no fraud disputes, and no storing sensitive info.

Open banking offers better UX, smoother operations

Finally, it makes your business run smoother. Transactions are confirmed in real time and can plug straight into your accounting tools. That means no manual reconciliations, fewer errors, and better visibility over your cash flow. You spend less time chasing payments and more time growing your business.

FAQs

Is link payment safe?

Yes, payment links are designed to be secure, offering encrypted online transaction processes without sharing card details directly.

How do I create a payment link?

To create a payment link, go to your provider’s dashboard and generate a link associated with the specific product or service you're selling. With Noda’s payment links, creating and sending takes under five minutes–no coding required. Generate a payment link via Noda Hub and send the link to your clients. You can also set up QR payments and no-code checkout pages instantly. It’s effortless to get started.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each