Merchants are grappling with a surge in chargebacks, and the numbers speak volumes. In the UK, more than 75% of customers filed a chargeback last year, setting a new record. Worldwide, chargeback transaction volumes are projected to hit 337 million by 2026, a 42% leap from 2023.

The consequences are far-reaching: lost revenue, higher fees, and strained customer relationships. While some disputes are justified, the growing issue of chargeback fraud adds another layer of challenge. But chargebacks don’t have to be a constant threat.

This guide outlines actionable strategies for reversing chargebacks and explores how open banking can redefine payment systems, helping merchants recover lost funds and safeguard their operations.

What is a Chargeback Reversal?

A chargeback reversal is when a bank reverses its original decision to refund a disputed transaction, returning the funds to the merchant. This outcome typically happens when the merchant provides compelling evidence to dispute the chargeback. The goal is to prove the transaction was valid and that the customer’s dispute was unfounded or resolved outside the chargeback process.

Can a Chargeback Be Reversed?

Yes, but the process is complex. Merchants must submit the right evidence within strict deadlines while adhering to card network policies. Success depends on preparation and a clear understanding of the rules governing chargebacks.

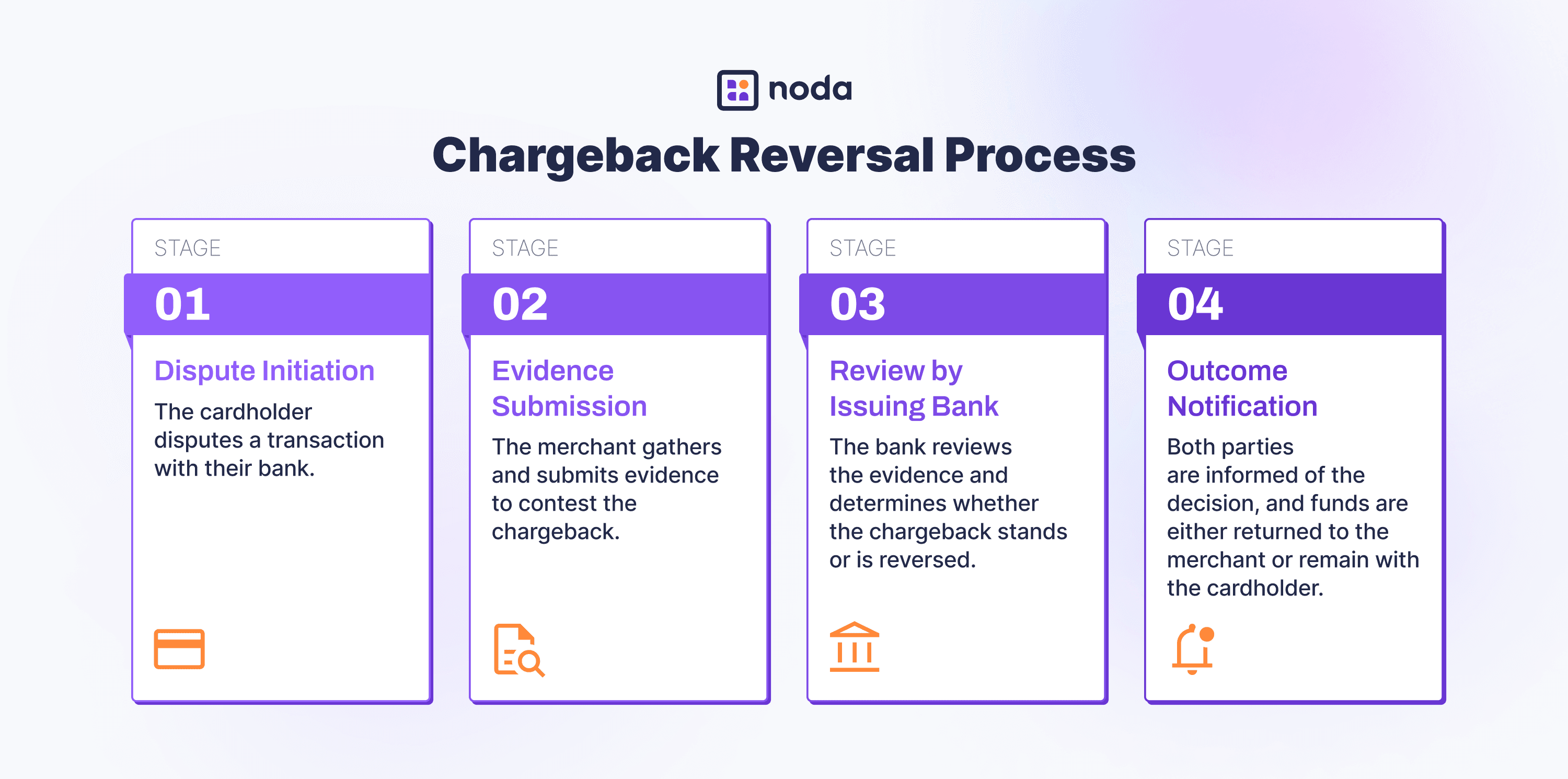

Chargeback Reversal Process

Reversing chargebacks is manageable with the right approach. Here’s a closer look at the process:

How to Reverse a Chargeback

Chargebacks drain time and money, but you can turn the odds in your favour with a clear plan. Here’s how to build a strong case and improve your chances of success:

1. Respond Within Timeframes

Cardholders generally have up to 120 days from the transaction date to file a dispute. For future-dated purchases, such as flights or concerts, the 120-day window begins on the scheduled service date rather than the purchase date.

Merchants typically have 20 days to respond to chargebacks for Visa, while Mastercard allows 45 days. However, acquiring banks often shorten this timeline to 5-10 days to ensure they have enough time to process and submit responses.

Knowing these timeframes ensures disputes are filed within the allowable period, increasing the chances of a successful resolution.

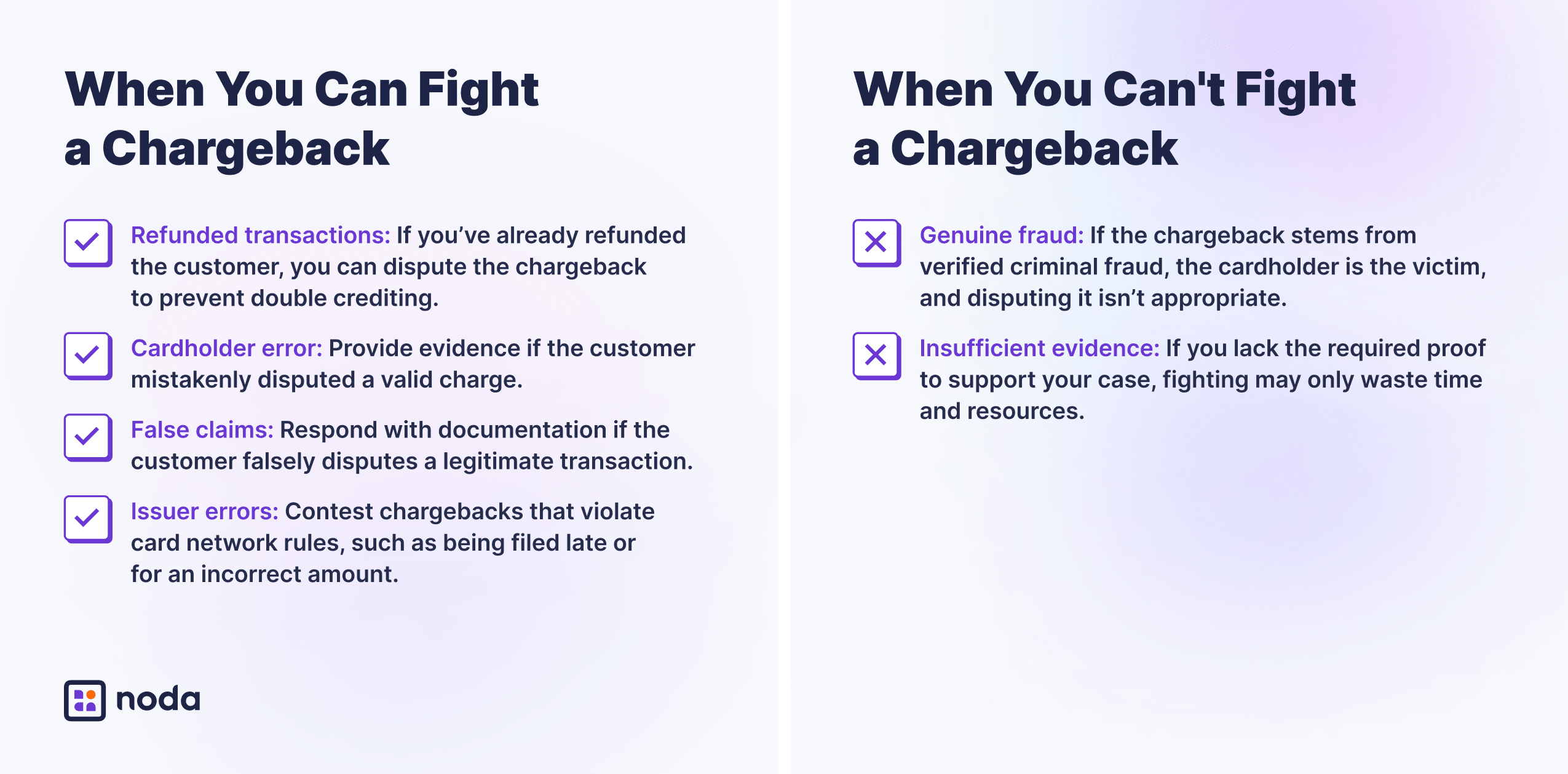

2. Be Strategic About Disputes

Chargebacks can drain your revenue, but not every dispute is worth fighting. Knowing when to respond is critical for saving time and resources while protecting your bottom line. Here’s a breakdown of when you should—and shouldn’t—challenge a chargeback.

If the chargeback is invalid, fight it with clear evidence like transaction records and delivery confirmations. Align with card network rules and respond on time to minimise losses and protect your business. Fighting back is your right—and a smart move.

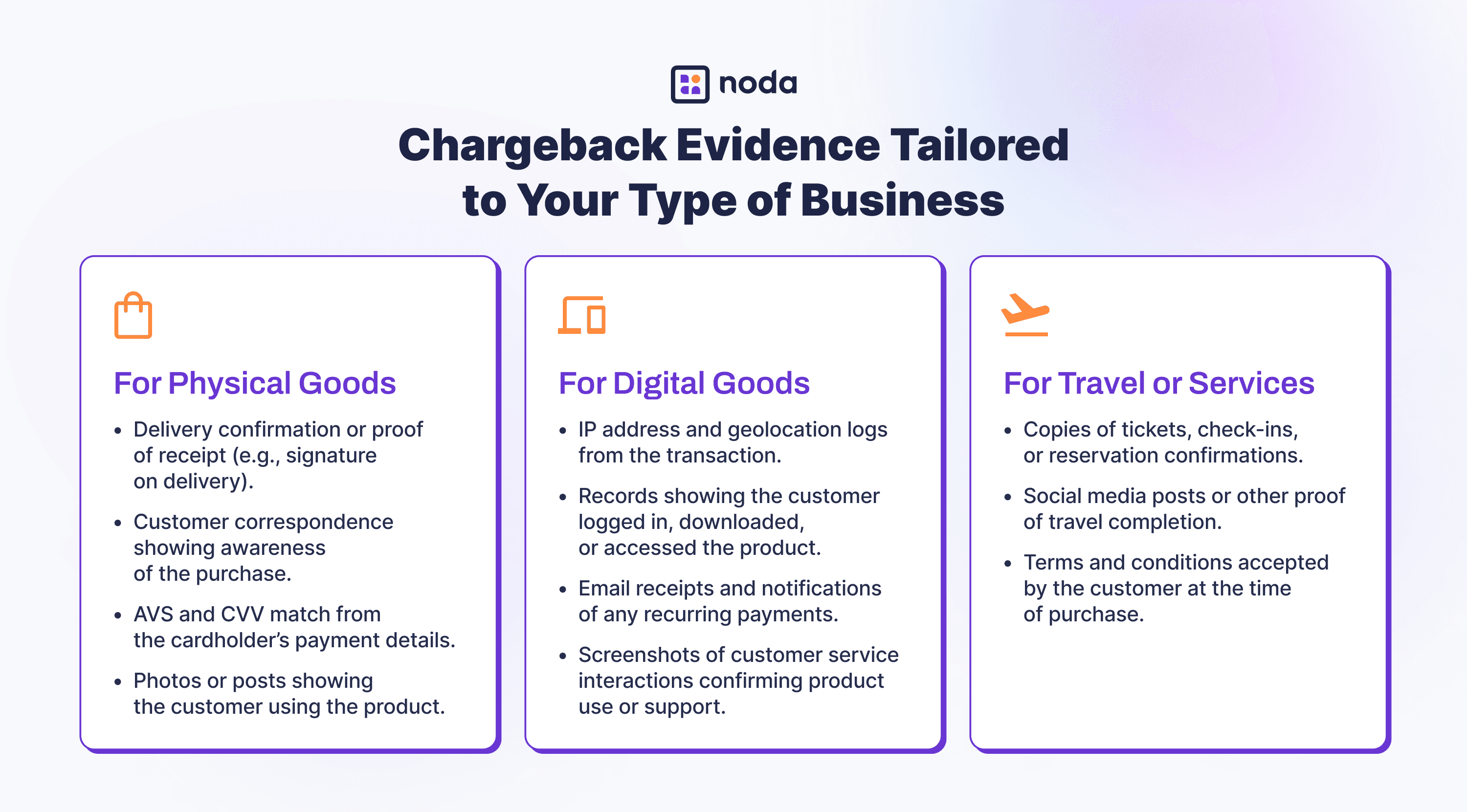

3. Get the Right Evidence

Banks favour clear and organised evidence. Avoid submitting excessive or irrelevant documents – focus on what directly disproves the cardholder’s claim. Strong cases win chargebacks. Pull together everything tied to the transaction:

- Delivery proof if the customer says the item never arrived

- Transaction history to disprove duplicate charges

- Clear product descriptions for disputes over mismatched expectations

- Authorisation codes to confirm the purchase was legitimate

4. Submit a Professional Rebuttal

Your response should be clear, factual and professional. Include all required evidence and directly address the reason for the chargeback. Avoid emotional or accusatory language – remember, your submission may also be reviewed by the customer. Clearly state the resolution you’re seeking to ensure the bank understands your position.

5. Learn from Every Case

Each chargeback offers valuable insights. Track your success rates and look for patterns. Are certain reason codes harder to overturn? Are there recurring issues you can address operationally? Use this data to refine your process and focus on cases where you have the best chance of success.

The Role and Purpose of Chargeback Reversals in Business

Chargebacks are a growing concern for businesses, particularly mid-market merchants, where 2.8% of online orders ended in disputes in 2022—higher than the 2.4% seen by smaller businesses. By 2024, nearly half of merchants reported refund abuse, while 45% faced friendly fraud, further intensifying the issue.

Reversing chargebacks allows businesses to recover lost revenue, maintain cash flow, and reduce the operational strain caused by disputes. It’s an essential strategy for fraud prevention, improving processes like customer communication and transaction security to minimise future disputes.

As fraud costs rise, with 46% of e-merchants prioritising fraud and chargeback prevention in 2023, focusing on effective chargeback reversals helps businesses protect their payment accounts, streamline operations, and safeguard their financial stability.

Why Are Chargeback Reversals So Difficult?

Chargeback reversals are challenging due to the complexity of the process, strict deadlines, and a system often skewed in favour of cardholders. Friendly fraud, responsible for up to 50% of chargebacks, complicates matters further as customers often mistake chargebacks for refunds, bypassing merchants entirely.

Merchants need clear policies, strong documentation, and proactive customer communication to navigate this process effectively.

From Managing to Preventing Chargebacks

Even with a robust reversal process in place, managing chargebacks remains resource-intensive and success is never guaranteed. For every chargeback successfully reversed, merchants still face processing fees, operational costs, and potential damage to customer relationships. This raises an important question: what if merchants could prevent chargebacks from occurring in the first place?

While traditional card payments will always carry some risk of chargebacks, modern payment technologies offer alternatives that can significantly reduce or eliminate this exposure. Among these innovations, open banking has emerged as a particularly promising solution, offering merchants a way to process payments without the traditional chargeback mechanisms that can be so costly to manage.

Open Banking: The Smart Solution to Chargebacks

Preventing chargebacks is more effective than reversing them, and open banking provides a powerful solution. By enabling direct account-to-account (A2A) payments, open banking reduces reliance on traditional card networks, addressing chargeback risks while enhancing payment efficiency. Open banking reduces chargebacks through:

- Direct A2A Payments: Transactions occur directly between bank accounts, removing intermediaries and the traditional chargeback mechanism.

- Real-Time Settlements: Payments are processed instantly, ensuring smoother cash flow and enhanced customer satisfaction.

- Secure Authorisation: Payments are authenticated through the customer’s banking app, adding a robust layer of security and reducing fraud.

A2A payments are expected to grow at a CAGR of 14% between 2023 and 2027, establishing their role as an important alternative to traditional card-based transactions. These direct payments eliminate intermediaries, offering businesses and consumers faster and more efficient payment options.

Chargeback-Free Payments Start with Noda

Noda offers advanced open banking solutions designed to eliminate chargebacks and streamline payment processes. With seamless integration across 2,000+ banks in 28 countries, Noda provides global coverage while mitigating costs by bypassing traditional card networks.

Our customisable solutions cater to one-time payments, subscriptions, and instalments, ensuring flexibility for your business needs. With bank-level security and streamlined KYC, Noda enhances payment security while improving customer experiences with a user-friendly interface that reduces cart abandonment.

Eliminate chargebacks before they happen—streamline your payments with Noda.

FAQs

Does chargeback mean a refund?

No, a chargeback is initiated by the customer’s bank to reverse a transaction, typically due to unauthorised activity or fraud. A refund, on the other hand, is issued directly by the merchant as part of resolving a customer request.

What is the difference between a chargeback reversal and a refund?

A chargeback reversal occurs when a merchant successfully disputes the chargeback and the funds are returned to their account. A refund is when the merchant voluntarily returns funds to the customer, often as part of a standard resolution process.

Why are chargebacks such a problem for merchants?

Chargebacks lead to revenue loss, increased fees, damaged reputations, and potential account termination if chargeback ratios exceed acceptable limits.

How long does a chargeback reversal take?

A chargeback reversal can take anywhere from a few weeks to several months. Cardholders have up to 120 days to file a dispute, while merchants typically have 20 days to respond for Visa and 45 days for Mastercard. Acquiring banks may shorten the merchant response window to 5-10 days. The total timeline depends on how quickly evidence is submitted and reviewed at each stage.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each