Payment strategy is a challenging aspect of building a successful business in today’s digital economy, yet payment service providers (PSPs) are there to help. Understanding PSPs and their role can boost your operational efficiency, whether you're a budding startup or an expanding company.

Here, we take a look at how PSPs work, what they offer, and how to choose a perfect PSP for your business.

What Is a Payment Service Provider (PSP)?

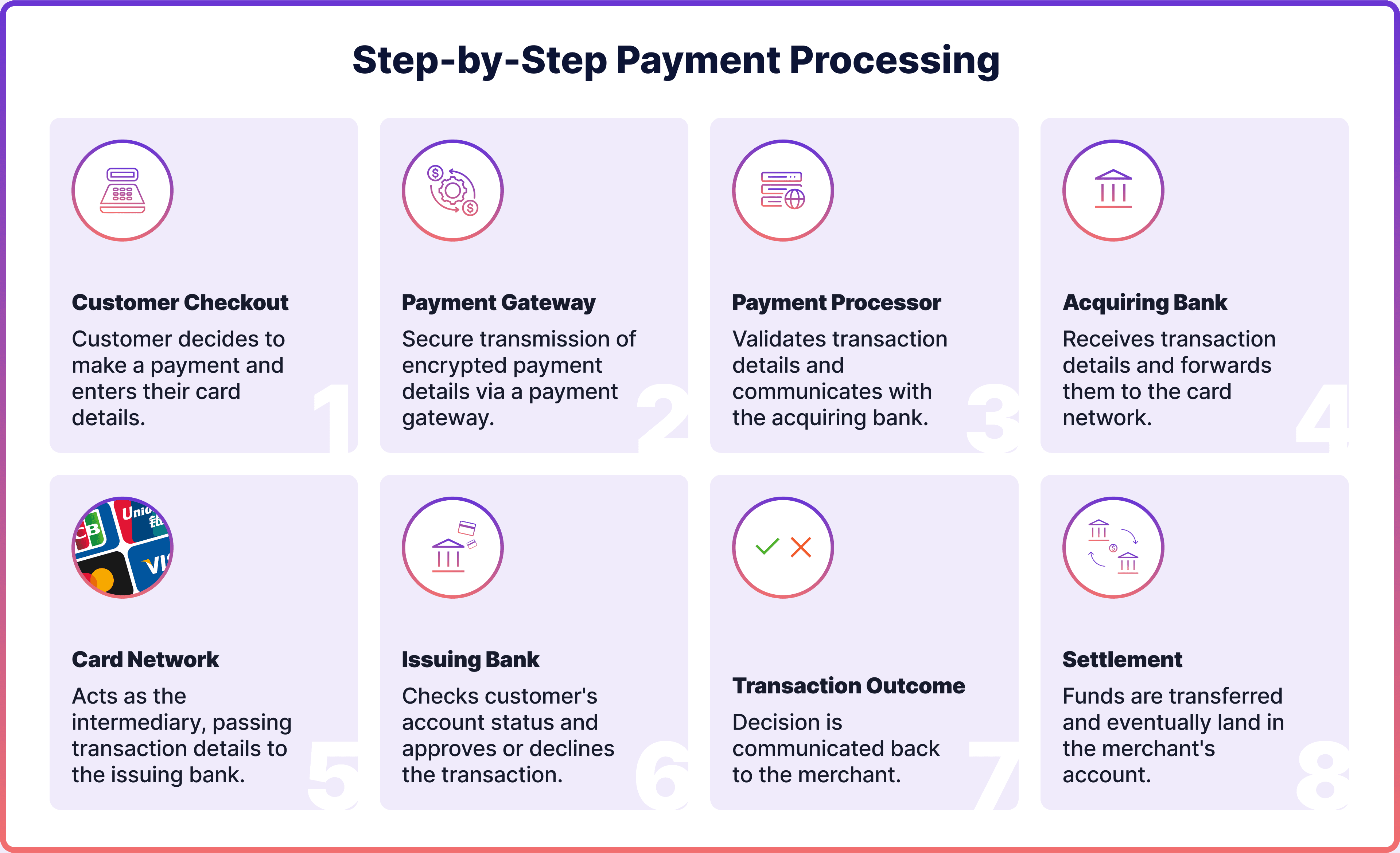

A Payment Service Provider (PSP) is a business solution that powers the transactions and handles payment processing, from when a user clicks 'buy' to when the funds settle in the merchant's account.

In essence, a PSP is like a bridge, with a customer on one end and a merchant on the other. It's invaluable in the e-commerce toolbox essential for any business looking to thrive in the digital marketplace.

What Payment Service Providers Do

PSPs aren’t just about transferring money. They also safeguard sensitive financial data with security measures, acting as a shield against potential cyber threats. They also simplify the complex world of payments, allowing businesses to accept various payment methods without having to juggle multiple systems. Below are some of the key functions and benefits of using a payment solution provider.

Providing a Payment Gateway

A payment gateway is an essential technology and is offered by PSPs. An online payment gateway acts as a middleman, collecting and encrypting payment data from the customer on the merchant’s website or app, and securely routing this information to the payment processor and appropriate financial networks for authorisation.

At Noda, for example, we offer multiple payment gateways:

- Card payment gateway

- Open banking payment gateway

- No-code payment gateway via instant payment links

To integrate a payment gateway, the PSP would typically offer multiple ways of integration. At Noda, we offer seamless APIs for cards and open banking payments. We also offer no-code open banking plugins for e-commerce platforms and no-code branded payment pages for instant payment links.

Processing Payments

A payment processing service enables the “behind the scenes” of a transaction. This includes: verifying payment information, obtaining authorisation, and facilitating communication between acquiring and issuing banks. Payment processing ensures that transactions are securely completed in line with relevant regulations and industry standards.

Some of the key features of payment processing to watch out for is smart routing, especially for card payments. It’s a way for payment systems to automatically pick the best route and banks for a payment to go through—based on factors like cost, speed, and chance of success.

At Noda, we offer AI-powered smart routing for card payments.

Payment Methods

A PSP would typically offer various payment methods to include into your payment flow. It's important to know your customers and what methods they use, to make sure your chosen PSP offers them. Here are some of the popular payment methods:

Cards

Card payments (credit and debit) are still one of the most widely used options worldwide. Even though their popularity is slowly declining with younger users, they remain a familiar and trusted method—particularly for larger purchases or in countries where alternatives aren't as developed.

Pay-by-bank

Also known as open banking, this method lets customers pay directly from their bank account, without card networks involved. It’s growing fast, especially in Europe, among digitally-native customers. For merchants, it’s a win: lower fees, no card networks, instant settlement, and fewer chargebacks. It's a modern, secure alternative to cards.

With Noda’s Open Banking payments, you can connect you to over 2,000 banks in 28 countries, accept multiple currencies, and process payments instantly—with no card fees or chargebacks.

Digital wallets

Think Apple Pay, Google Pay, or PayPal. These are fast, convenient, and especially popular for mobile shopping. Customers don’t need to type in card details—they just tap and go. Great for quick checkouts on the go.

Fraud Prevention

Cybercrime and digital financial fraud continue to escalate. In 2022 alone, payment fraud cost businesses in the EEA €4.3bn. In the UK, criminals stole over £1.17bn through fraudulent transactions in 2023.

PSPs would offer cybersecurity tools to detect and prevent payment fraud and keep your business protected. Here is a quick overview:

Encryption

Encryption scrambles sensitive data—like card numbers or bank details—so it can’t be read by hackers. Only authorised parties with the correct key can unlock it. There are two types: symmetric (same key to lock and unlock) and asymmetric (uses a public key to lock and private key to unlock for stronger security).

Encryption is used in nearly all payment types, including open banking, card payments, QR codes, and digital wallets. At Noda, we use two layers of encryption: TLS for data in transit, and AES for data at rest.

Learn more about Noda’s Security

Tokenisation

Tokenisation swaps out your real payment details with a random string of characters, called a token. That token is useless outside of a specific system, so even if it’s stolen, it can’t be used.

Tokenisation is common in digital wallets like Apple Pay and Google Pay, as well as contactless and QR code payments. It’s also used in open banking to avoid exposing bank account details during a transaction.

Multi-Factor Authentication (MFA)

MFA means you need more than just a password to approve a payment. For example, you might enter a PIN (something you know), confirm on your phone (something you have), or use your fingerprint (something you are).

This extra step makes it much harder for fraudsters to break in. Strong Customer Authentication (SCA), which is a type of MFA, is legally required in open banking under PSD2, and it’s also used in digital wallets, online card payments, and QR checkouts.

Fraud Detection Systems

These systems scan transactions in real time to spot anything unusual—like a big purchase in a new location or a different device. If something looks off, the system might block the payment or ask for extra verification.

Fraud detection is used across all types of digital payments—open banking, cards, wallets, and QR payments—to catch fraud before it happens.

Payment Service vs Payment Gateway

People often mix up payment service providers and payment gateways, but they do very different things.

- A payment gateway is like a digital cashier—it passes payment details from the customer to the bank safely and securely.

- A payment service provider (PSP) does a lot more. It includes the payment gateway, but also handles the full payment process, helps with fraud protection, security, and more. So, the gateway is just one part of what a PSP offers.

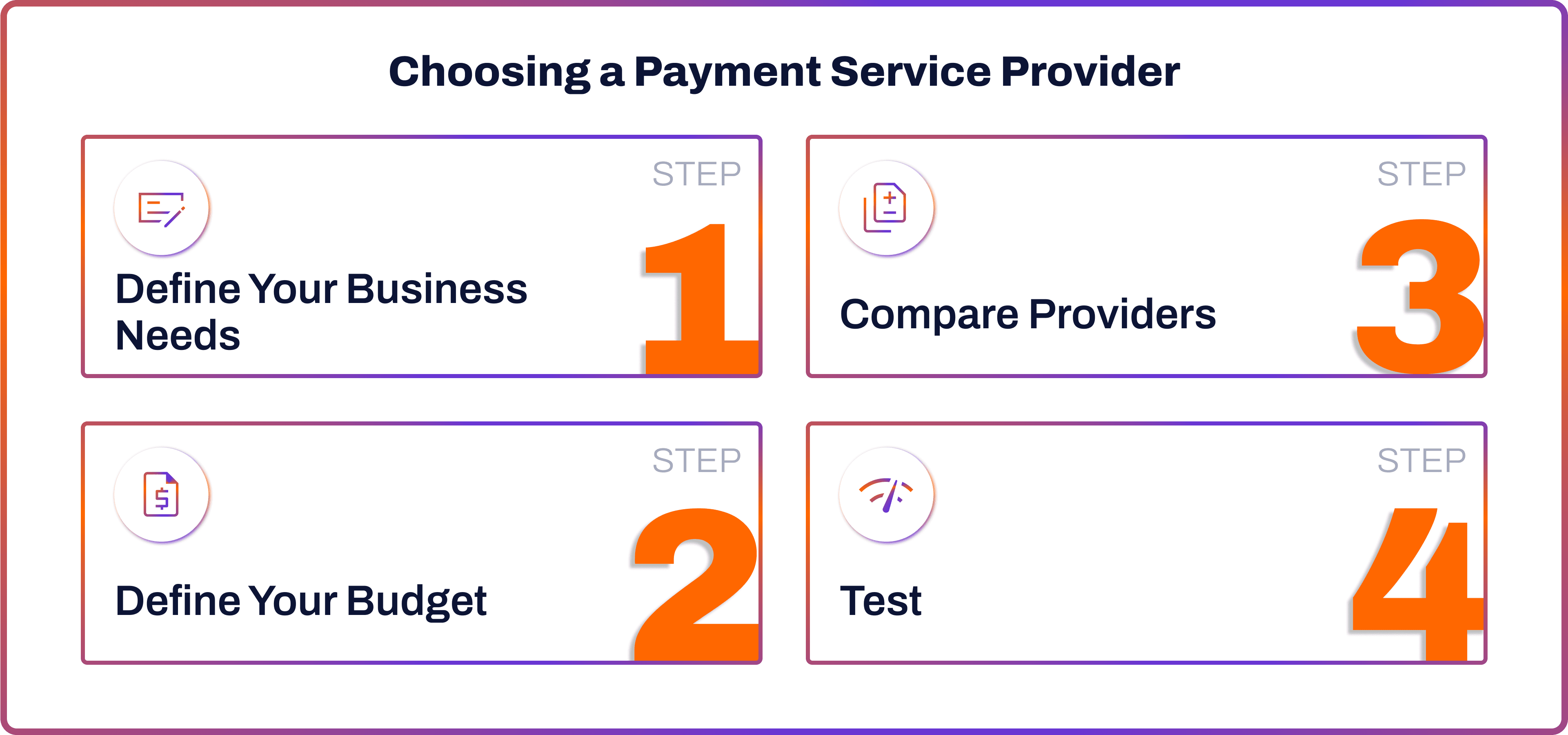

Choosing a Payment Service Provider

Define Your Payment Needs

Before picking a payment service provider, you need to know what your business really needs. Start by thinking about two key things: where your customers pay, and how they like to pay.

Identify Your Sales Channels

Figure out where your customers are making purchases. Your provider needs to support these. Remember, popular payment methods depend on your customers’ age, region, and other demographic factors.

- Online – via your website or app

- In-store – using a point-of-sale system

- Mobile – through mobile apps or on-the-go payment links

- Social media – selling via Instagram, Facebook, or TikTok

- Remote – sending invoices or payment links via email or WhatsApp

Choose the Right Payment Methods

Once you know your channels, list the payment options you want to offer your customers.

- Card payments – still widely used

- Digital wallets – like Apple Pay, Google Pay, PayPal

- Pay-by-bank (Open Banking) – fast, secure, and cheaper for merchants

- Recurring payments – for subscriptions or memberships

- QR code payments or payment links – easy for remote or in-person payments

Define Your Budget

Think about your budget and how the payment provider charges for their service. Some charge a flat fee, some take a cut of each transaction, and others work on a monthly subscription.

It’s important to understand how their pricing works—and if it suits your business. If you have lots of transactions, a subscription model might save you money. But if your volume is low, a flat fee could work out better. Make sure the pricing fits your setup and goals.

Compare Providers

Start by checking trusted sources and reading online reviews. Once you’ve got a few potential providers in mind, look into how reliable they are and whether they’ve worked with businesses like yours.

Make sure they meet strong security standards—like being PCI DSS-compliant. It’s also a good sign if they offer extra protections like tokenisation and encryption to keep your customers' data safe.

Test and Trial

Once you’ve narrowed down your list of providers, reach out and test their solutions. Most payment companies offer free trials with no upfront commitment. At Noda, for example, you can check out our demo without signing up.

Pay attention to how easy the platform is to use and how helpful their customer support is. These details make a big difference once you’re up and running.

Your Payment Needs Covered by Noda

Power your checkout with Noda’s all-in-one solution—open banking, card payments, instant payment links, and QR codes, all in one place. Connect to 2,000+ banks across 28 countries. Accept multiple currencies. Process payments instantly—with no card fees, no chargebacks, and no friction.

Plug in via our Open Banking API or get started fast with no-code plugins, branded payment pages, links, or QR codes. No dev team required.Noda also offers card payments alongside pay-by-bank—so your customers always have a way to pay, wherever they are.

Make your checkout faster, simpler, and more secure.

FAQs

What does an online payment service provider do?

An online payment service provider does more than just move money. It helps businesses accept different payment methods—like cards, pay-by-bank, or digital wallets—without needing lots of separate tools. PSPs also keep sensitive financial data safe using strong security measures.

What is the best online payment service provider?

The best online payment service provider for your business depends on your specific needs. Think about what matters most—whether it’s recurring billing, multi-currency support, or easy integration—and choose a provider that covers those essentials.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each