Payment strategy is a complex but crucial part of succeeding in today's digital economy. Payment service providers are here to help. Efficiently setting up online payments on a website can enhance your operational efficiency, which is crucial for both growing startups and expanding businesses.

Here, we take a look at how to set up a website with payment options, including different types of payment gateway and payment processing for e-commerce.

What is Payment Processing?

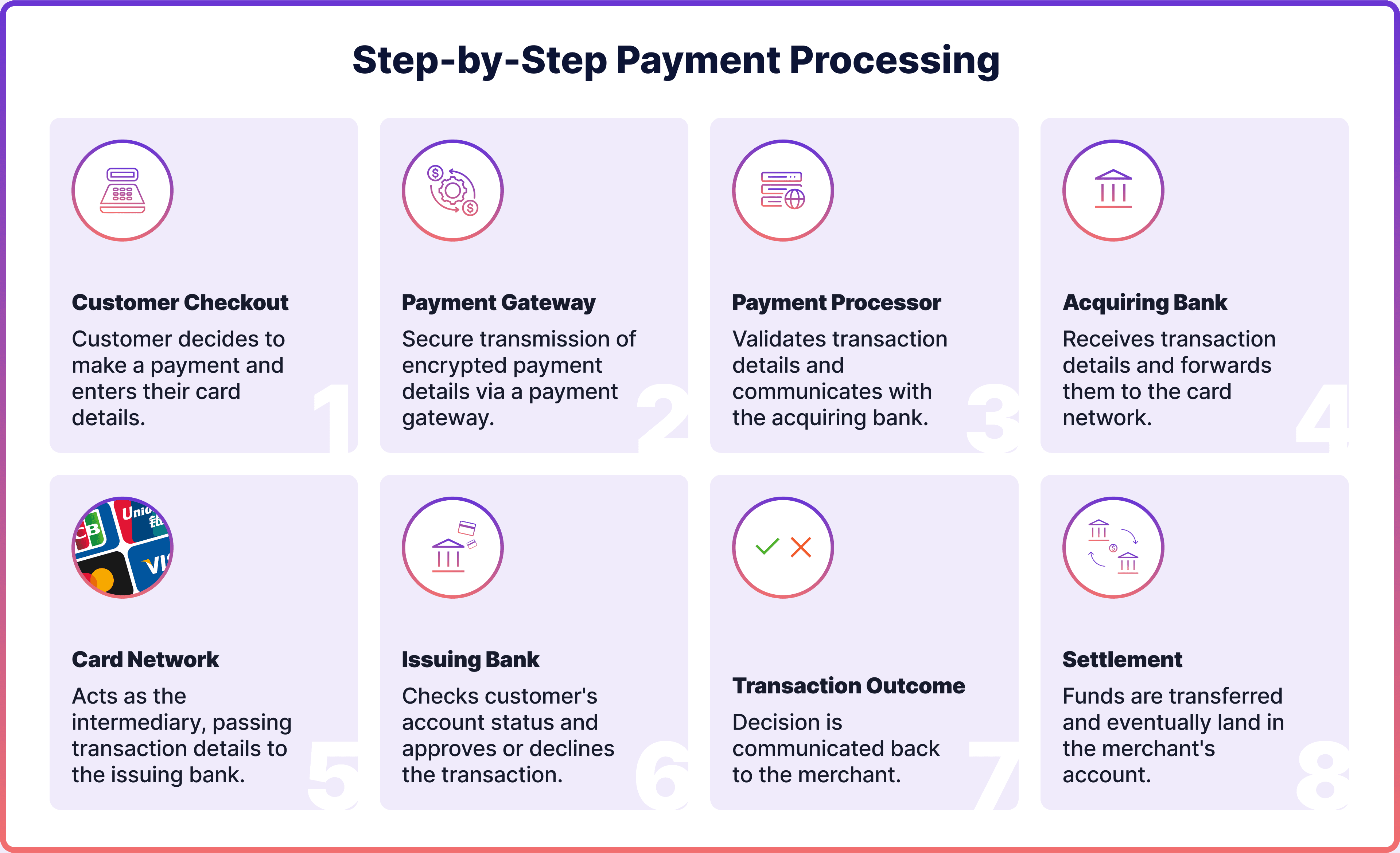

Although digital payments may seem simple from the outside, they involve a complex process. Online payment processing begins when a customer decides to pay on an e-commerce website. It involves the journey of the money from the customer’s bank to the merchant’s account.

Payment Gateway

Once the customer enters their payment details, these are securely sent to the payment gateway. This gateway is vital for encrypting and safely transmitting the transaction data, including sensitive information such as card numbers.

Payment Processor & Acquiring Bank

After the payment gateway forwards the transaction data, the payment processor receives it. They verify and confirm the transaction details before contacting the acquiring bank associated with the business or merchant.

Card Network & Issuing Bank

From there, the acquiring bank sends the transaction details to a card network like Visa or Mastercard if the payment is made with a card. The card network then communicates with the issuing bank, which checks the account status and their available balance. Note that if it’s an open banking payment, card networks are not involved as payments happen from account to account.

Settlement

Once the issuing bank reviews the transaction, it will either approve or decline it. At the end of the business day, the merchant gathers all approved transactions into a batch and sends them to the payment processor for settlement.

What is a Payment Gateway?

As mentioned above, a payment gateway is an essential step in how to accept payments on a website. A payment gateway is like a virtual card machine that collects data online. It’s the first thing to look for when you are trying to set up payments on your website. Usually, payment gateway and payment processing are offered by the same provider.

In general, there are three types of payment gateway. You’d need to first decide which type is best suited for you before you learn how to setup a payment gateway on your website.

Hosted Payment Gateway

Hosted payment gateways may also be known as redirect methods or third-party payment gateways. When customers decide to pay, they are redirected to the payment processor's platform to enter their payment details. After processing the payment, customers are redirected back to the merchant's website.

This type of payment gateway is favoured by businesses that value convenience and security, as it eliminates the need to process customer data by themselves. Integration is typically straightforward and includes built-in security features, so it’s fairly easy to implement this payment gateway on your website.

Onsite (Self-hosted) Payment Gateway

With an onsite or self-hosted payment gateway, merchants collect payment information directly on their website. The payment data is securely sent from the merchant's server to the payment gateway's server for processing.

This option, often called a direct gateway, provides a seamless and uninterrupted user experience, as customers are not redirected elsewhere. However, it may require the merchant to have higher technical expertise and resources.

Offsite (API-hosted) Payment Gateway

By using an Application Programming Interface (API), these gateways allow merchants to send payment information directly to the payment processor, ensuring no sensitive data is stored on their servers. APIs are sets of defined rules that enable different software to communicate with each other. While customer payment data is collected on the merchant's website, the actual processing is conducted offsite.

Open Banking Payments

When setting up payments on a website, merchants can adopt open banking payments for their e-commerce stores instead of just card payment processing. Under the EU's PSD2 regulation, banks are required to share customer data with authorised fintech firms, breaking the banks' previous monopoly over this information. This process is tightly regulated and requires clear customer consent to share their data.

A key aspect of open banking is account-to-account (A2A) payments, or "pay-by-bank." Providers of open banking need to have a Payment Initiation Service Provider (PISP) license to offer A2A payments under the PSD2 regulation.

With A2A payments, customers can authorise transactions directly through their bank, eliminating the need to manually input payment details. The system facilitates this by redirecting users from their online banking interface to the merchant’s site. This enhances user experience (UX) and grants sellers immediate access to funds.

How to Set up Secure Payments on a Website

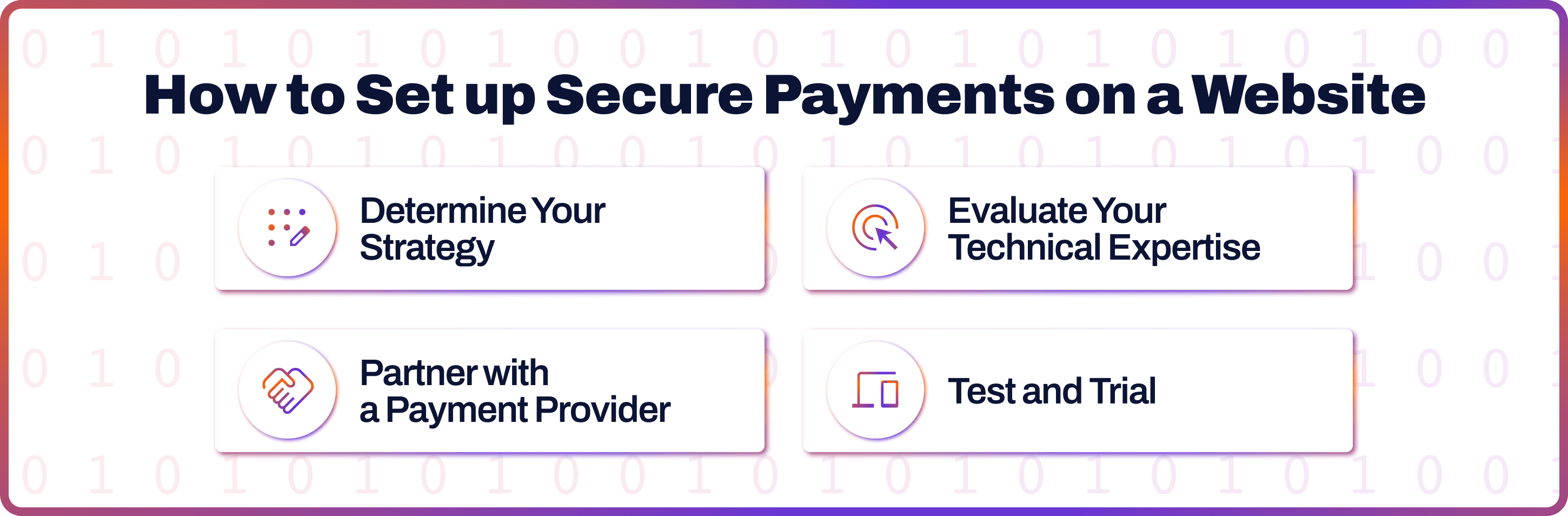

Choosing the right payment gateway is essential for ensuring seamless and secure transactions in your business. Several factors come into play when making this decision, including your business model, technical capabilities, and customer preferences.

What is Your Strategy?

First, establish your strategy. Consider your business model and the payment features you need. For instance, if you operate on a subscription model, you'll need to support recurring payments. Also, it’s essential to set up appropriate payment methods on your website, which would resonate with your target clientele. Think about your customers and the payment methods they use, such as cards, digital wallets, or alternative options like BNPL.

What Technical Expertise Do You Have?

Next, evaluate the technical expertise within your team. This is crucial as some gateway types, like self-hosted payment gateways, require more technical knowledge for integration than others.

Partner With a Payment Provider

If you opt for a hosted or API-based payment gateway, you'll need to partner with a service provider like Noda to set up a website to accept payments. Look for a payment solution that integrates easily with your current system and supports a wide variety of currencies and payment methods for a website, especially if you are serving international customers.

Consider the UX offered by the gateway, as it significantly impacts your customers' payment journey. Security is also crucial; ensure the gateway complies with industry standards like PCI DSS.

Another important factor is the cost, including transaction fees, monthly charges, and any other expenses associated with the processing. Choose one that balances cost with functionality to best meet your needs.

Test and Trial

When selecting a provider to accept online payments on a website, consider testing their services first. A demo or trial period can help you assess the platform’s functionality, ease of use, and reliability. Focus on the UX, transaction speed, and any issues that arise during the trial to ensure the service meets your needs.

FAQs

How do I set up Noda payments on my website?

First, you should be onboarded with Noda. Simply fill out the form, and our sales team will contact you shortly. We offer easy onboarding with the personalised guidance of a dedicated manager. Our processor smoothly integrates with API and front-end components, ensuring seamless merging into your website.

What are the best ways to receive payments online?

The best ways to receive payments online would depend on your strategy and business needs. Some of the methods include using hosted payment gateways, onsite or self-hosted gateways, and API-hosted gateways. Each offers different levels of security, user experience, and integration complexity. Adopting open banking payments can be beneficial as it elevates convenience.

What is the easiest way to accept payments online?

The easiest way to accept payments online is through a hosted payment gateway. This method redirects customers to a payment processor's platform to enter their payment details securely, then returns them to the merchant's site once the payment is processed. It requires minimal technical setup and ensures robust security with built-in features.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each