Renting a flat, collecting monthly rent, or securing a deposit doesn’t need to involve card fees, missed payments, or manual tracking. With open banking, property businesses can accept payments faster, reduce admin, and give tenants a smoother experience – no cards or chasing required.

Real estate payments are finally catching up. The old systems built on paperwork and delays are being replaced by more reliable, direct ways to move money.

In this article, we’ll talk about what that means for real estate, and how platforms like Noda are helping landlords and rental businesses collect property payments with open banking.

What is open banking?

Open banking is a regulatory framework that gives licensed third-party providers secure, permission-based access to a customer’s bank account – either to view financial data or initiate payments.

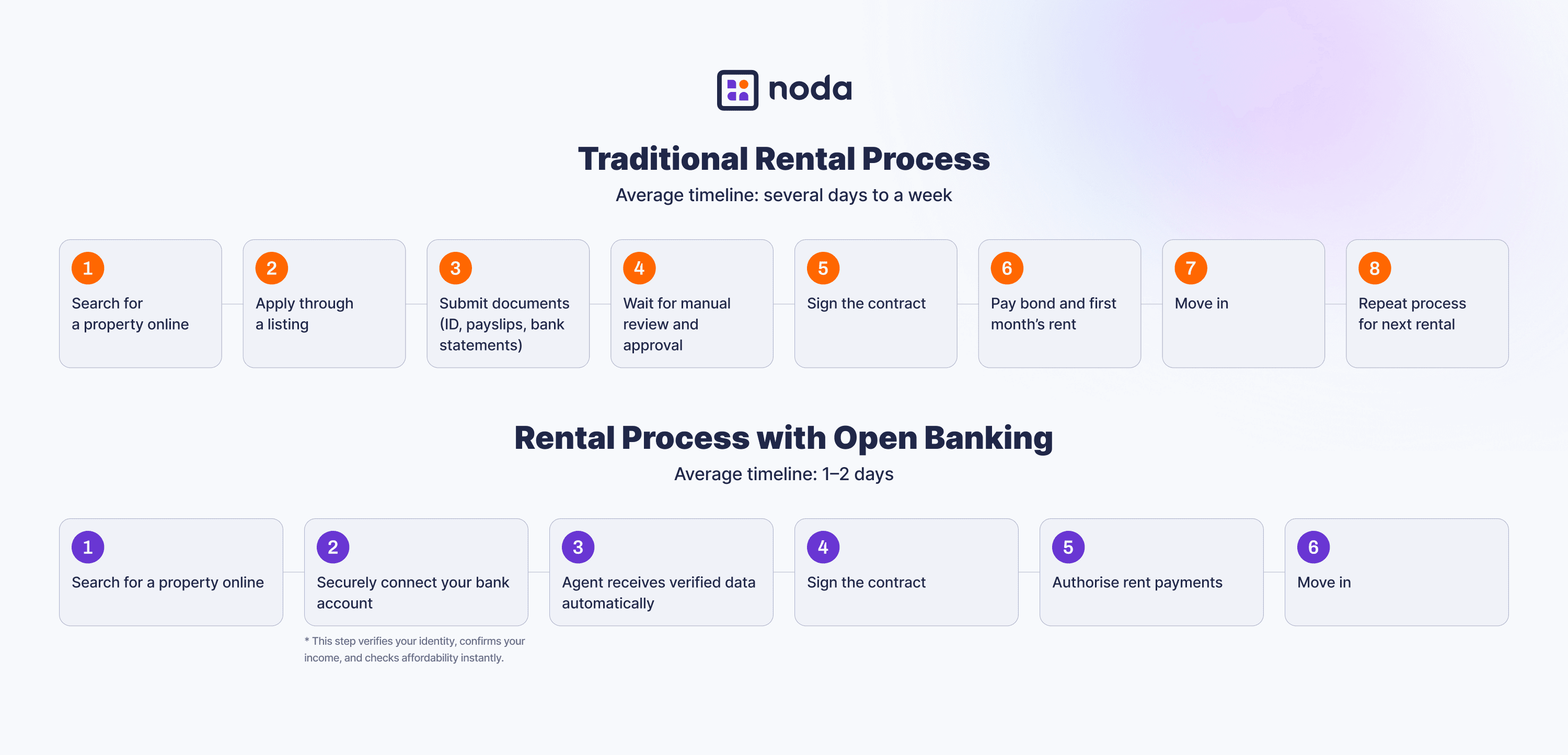

In real estate, it enables landlords, agents, and platforms to accept direct bank payments without relying on card networks or manual transfers. The result is a more efficient, cost-effective way to manage property payments, built on verified data and regulated infrastructure.

How open banking is used in real estate

For most landlords and property managers, collecting rent is a recurring task and often one filled with delays, failed payments, and reconciliation headaches. Open banking simplifies that.

With real estate open banking, renters can pay rent directly from their bank account, either through your website or by using a secure payment link. There’s no need for cards, manual transfers, or bank visits. Each transaction is authorised through the tenant’s trusted banking app, keeping the process familiar and secure.

This makes open banking ideal for:

- Monthly rent collection

- Securing deposits

- One-off payments like admin fees or holding deposits

Instead of chasing payments or dealing with declines, real estate teams can focus on what matters – filling units and keeping renters happy.

Benefits of open banking in real estate

Now let’s look at the advantages of open banking in real estate and how Noda is helping property businesses collect rent faster, lower costs, and give tenants a better way to pay, all without relying on cards:

Faster payments, less admin

With open banking, collecting rent no longer relies on slow transfers or drawn-out approval flows. Real-time payment capabilities allow property businesses to get paid faster, reduce delays, and keep everything compliant and easy to manage.

Using Noda, tenants are redirected to their trusted banking app, authorise the payment, and are brought back to your site or payment page. This reduces back-office time spent tracking payments and makes it easier for tenants to pay when it suits them.

Lower transaction costs

Card payments remain one of the most expensive ways to collect rent. Between per-transaction fees, gateway charges, and monthly minimums, the costs add up, especially for property businesses collecting recurring payments.

Noda bypasses card networks entirely. Payments move directly between bank accounts, keeping costs low (typically between 0.1% and 1%) with no hidden fees or third-party intermediaries. Landlords keep more of what they earn with every transaction.

Fewer failed transactions

Card declines are still a common issue caused by expired cards, blocked transactions, or insufficient funds. For property businesses, that means more late payments, extra admin, and occasional tenant frustration.

With Noda’s open banking infrastructure, powered by regulated Payment Initiation Services (PIS), tenants pay directly from their bank accounts in real time. There are no card details to expire and no stored credentials to manage. Because each transaction is bank-authenticated, payment failures are significantly reduced.

This means fewer support tickets, less time spent on follow-up, and steadier cash flow.

Faster settlement

Standard card payments can take 2 to 5 business days to clear. That delay affects everything, from when you can release a key to when you can move forward with accounting or issue confirmations.

With Noda, settlement is instant or near-instant, depending on the bank. Once the payment is authorised, it lands quickly without batching or reconciliation delays. This improves tenant onboarding and helps teams manage cash flow with less effort.

Smoother experience

Rent payments shouldn’t be complicated. Traditional systems often ask tenants to fill out forms, register for portals, or manually enter card details.

Noda makes the process intuitive. With a single redirect, tenants log in to their banking app, authorise the payment, and return to your page. It’s familiar, secure, and doesn’t require account creation or password management.

A smooth experience leads to better payment behaviour, fewer missed due dates, and less follow-up for your team.

Simple setup

Payment integrations are often the bottleneck. Setting up a traditional gateway can involve contracts, developer time, and long onboarding processes.

With Noda, you can start collecting payments immediately. Choose from a No-code Payment Page, QR code, or embeddable checkout – whatever fits your setup. Whether you manage five properties or five hundred, it’s fast to launch and easy to use.

Built-in compliance and bank-grade security

Open banking is built on regulated infrastructure, including PSD2 compliance and strong customer authentication. Every payment is authorised through the user’s bank, secure by design.

Noda follows this framework to help property businesses collect payments safely and meet compliance requirements without added effort. There’s no need for manual ID checks, extra layers, or paperwork. Transactions are verified in real time, with consent built into the flow.

It’s a modern, secure solution that protects your business and improves the payment experience, without slowing you down.

The future of open banking in real estate

Open banking adoption is growing steadily. In 2024, the UK surpassed 11.7 million active users, with over 22.1 million open banking payments made every month. Across Europe, adoption is expected to double by 2027 – with Sweden leading in usage per person, and the UK maintaining the largest user base overall.

Real estate, however, is still catching up. Many property businesses continue to rely on outdated systems for collecting rent and handling deposits, leaving them exposed to unnecessary costs, payment failures, and operational drag.

This makes open banking a natural consideration for businesses looking to improve how they collect payments, especially for those aiming to move away from card fees or simplify recurring transactions.

A modern way to collect rent

Still relying on cards or bank transfers to collect rent? There’s a better way. Property payments with open banking help landlords and agents move money faster, without all the baggage.

With Noda, getting started is simple. You can offer tenants Instant Payment Links, embed a checkout on your site, or send them a QR code. There’s no technical integration required, and no need to overhaul your existing system.

You get lower fees, faster settlement, and less admin. Your tenants get a simple, secure way to pay on time. It’s the kind of upgrade everyone appreciates. Try Noda today.

FAQs

What’s the impact of open banking on real estate?

It simplifies rent collection—reducing fees, failed payments, and admin. Landlords and agents can get paid faster, without relying on cards or manual transfers.

Is open banking safe for real estate?

Yes. It’s regulated, PSD2-compliant, and uses bank-level security. Your tenants approve payments through their own banking app, so it’s secure for everyone.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each